The ECB hiked twenty-five But Madame Lagarde tried to drive The idea they’d hike Again was dreamlike And so, euro-dollar did dive Then last night some Chinese reports Showed there was some growth there, of sorts The PBOC’s Continuous squeeze Of rates, too, has hammered yuan shorts

Starting with a quick recap of the ECB meeting, as I had believed, they hiked rates by 25bps which takes the Deposit rate to 4.00%, the highest level since the euro was created in 1999. It seems Madame Lagarde’s rationale was similar to my own, which was essentially, this was the last chance to raise rates before the recession in Europe really gets going at which point further rate hikes will be incredibly difficult politically. However, by essentially explaining they were done, with inflation running well above both the current interest rate structure as well as their 2.0% target, Lagarde undermined any support for the single currency which fell sharply yesterday after the announcement and has been unable to show any signs of life since then. Current market pricing shows a 38% probability of another hike this year before an eventual reduction in the rate structure by the middle of 2024. However, my take is that if the recession spreads further, the ECB will be quick to cut rates. Ultimately, I continue to believe the euro is going to have a very difficult time going forward.

Turning our attention east, the Chinese monthly data dump was released last night and virtually every single measure beat expectations, even the property investment. None of the beats were very large, but I guess the question has become are analysts and investors overly bearish on China (or perhaps the question is can we trust Chinese data)? For instance, IP rose 4.5% Y/Y, vs. 3.9% expected; Retail Sales rose 4.6% Y/Y vs. 3.0% expected; Property Investment fell -8.8% Y/Y vs. -8.9% expected and the Unemployment Rate fell to 5.2% rather than remaining unchanged at 5.3%. The only outlier was Fixed Asset Investments which rose 3.2% rather than the 3.3% expected. The market response to this was quite interesting. The yuan was little changed, although it remains well above its recent lows with USDCNY hovering around 7.2800. The CFETS fixing continues to be pushed toward a lower dollar, although the spread between the fixing and the onshore market has narrowed slightly to 1.4% from its recent levels above 1.9%.

As I mentioned yesterday, the Chinese cut their RRR by 0.25% trying to inject more liquidity into the economy and they have also been pushing up offshore CNY interest rates which are now equal to USD interest rates so there is no carry benefit in shorting the CNY offshore. This, too, will help eliminate some of the downward pressure on the yuan. In fact, it appears that much of the recent policy focus has been to prevent the yuan from weakening much further. I guess if you are trying to convince other countries that they can use the yuan for payments and holding it is safe, it really cannot be seen falling sharply. I suspect that the PBOC will be doing everything they can to support the currency going forward. In a bit of a surprise, Chinese shares were the worst performers overnight, with all the main indices there in the red while markets elsewhere in Asia (Nikkei +1.1%, Hang Seng +0.75%, ASX 200 +1.3%) and Europe (DAX +1.0%, CAC +1.6%, FTSE 100 +0.8%) are all higher. As it happens, US futures are little changed this morning after a strong equity performance yesterday. So, all in all, I would say risk is in favor today.

This risk attitude is evident in bond yields as well as they are rising with investors moving from bonds to stocks. Treasury yields are higher by 3.5bps, while in Europe, yields are all higher at least 6bps with Italian BTPs seeing the most selling and a rise of 7.5bps. Arguably, if the ECB has finished its tightening cycle, which it seems to have done, and inflation remains as high as it is, the value of bonds should decline. This movement is logical based on what appears to be the new narrative.

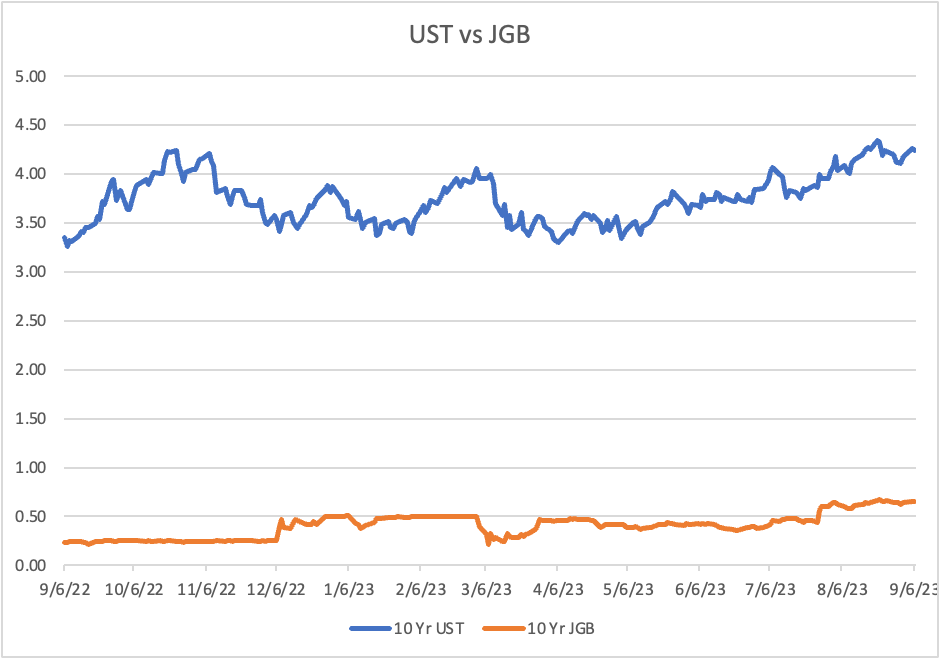

A quick aside on Japan, where you may recall that on Monday, the yen strengthened and JGB yields rose after comments from BOJ Governor Ueda regarding the possibility that they would have enough information to potentially end ZIRP there. It turns out that was not Ueda-san’s intention, and rather he thought his comments were benign. It seems there is no intention to adjust policy anytime soon. The market response was seen in FX where the yen fell -0.3% and is now pressing to 148. I suspect 150 is coming soon, although further intervention at that level cannot be ruled out.

Turning to commodities, oil (+0.5%) continues to rally and is now solidly above $90/bbl. The other gainer today is gold (+0.4%) but base metals are softer. A possible train of thought here is that rising oil prices will both force interest rates higher through the inflation channel as well as undermine economic growth, so the industrial sector is getting double-whammied in the short-term. As with energy, the long-term prospects remain quite positive for base metals as production is just not going to be able to keep up with demand given the lack of investment in the sector since the ESG movement began a decade ago. Even if it is recognized that this must change, it will take years before new production can come online which should continue to be supportive of the sector overall.

Finally, the dollar is mixed this morning, with the EMG bloc seeing half gainers and half laggards although the largest movement is less than 0.2%. In other words, nothing is going on here. Similarly, in the G10, other than the yen mentioned above, movement has been mixed with no real substance in either direction. Given the FOMC meeting next week, it appears that traders are unwilling to position themselves too much in either direction. Net, this week, the dollar did fall a bit, but remains well above its recent lows.

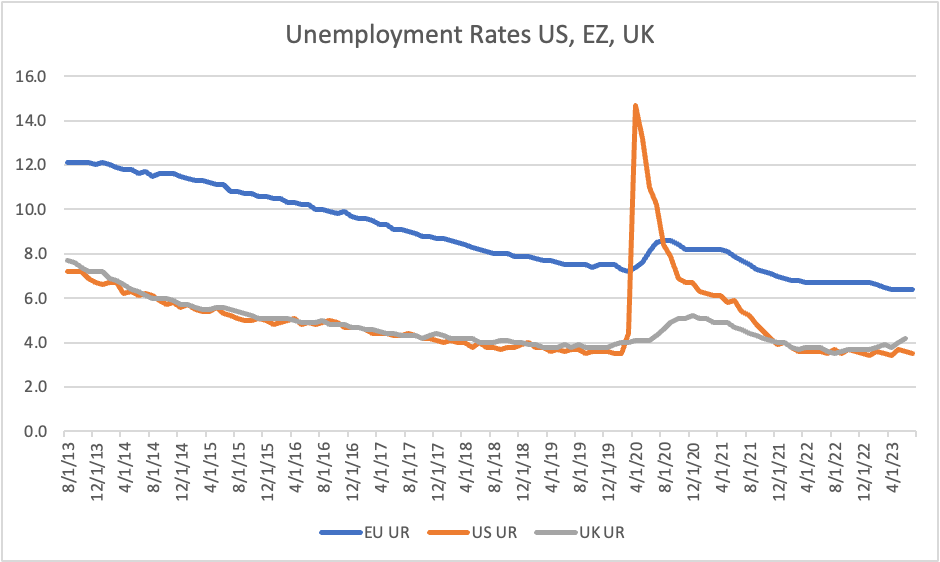

Yesterday’s Retail Sales data was once again quite hot, rising 0.6% for headline and ex-autos, which just goes to show that there is a lot of money still sloshing around the system. As well, the Claims data was solid again with 220K Initial Claims, less than forecast and certainly not showing any weakness in the labor market. Today brings a bunch of secondary data with Empire Manufacturing (exp -10.0), IP (0.1%), Capacity Utilization (79.3%) and Michigan Sentiment (69.0). The Citi Surprise Index continues to push higher which continues to indicate that economic activity in the US remains solid. While a recession is clearly going to arrive at some point, for now, it remains a distant prospect. With that in mind, do not think that the Fed is going to go soft anytime soon and that ongoing higher for longer is very likely to help support the dollar overall.

Good luck and good weekend

Adf