My sight is clearing

I now see the price target

Closer than you think

“With monetary easing continuing, I believe we have reached a point where attainment of the 2% price stability target is finally in sight, despite uncertainty over the Japanese economy. It is necessary to consider shifting gears from extremely powerful monetary easing … and how we should respond nimbly and flexibly toward an exit.” So said BOJ member Hajime Takata last night at a meeting with business leaders in western Japan. These are the strongest words we have heard, I would argue, and the market did respond with the yen strengthening (+0.5%) and now right on the 150.00 level, while 2yr JGB yields rose another basis point, up to 0.18%, and its highest level since 2011. I always find the BOJ wording to be odd as they try to be nimble and flexible in something that doesn’t appear to offer opportunities to behave in that manner.

Regardless, this has encouraged a more hawkish take on Japan with the probability of their first rate hike occurring in March rising to 26% from a previous level in single digits. But despite these comments, we must remember this is from a single BOJ speaker. Unless and until we hear this tone from multiple BOJ board members, I maintain that while an April move to 0.00% is possible, movement much beyond that seems very premature. After all, last night saw IP in Japan fall -7.5% in January which takes the Y/Y number to -1.5%. Recall, too, that Japan is in the midst of a technical recession. It just doesn’t seem like tightening monetary policy is the prescription for what ails that nation.

However, the Japanese story is for the future as we have already seen the initial knee-jerk reaction. And that means that all eyes are going to be on the US data at 8:30.

So, what if Core PCE’s smoking?

It seems that might be thought-provoking

If that is the case

We’d all best embrace

The idea the bulls will start choking

The flipside’s a cool PCE

Which winds up at zero point three

If that’s the result

The stock-buying cult

Will take every offer they see

As the market awaits this morning’s PCE data, a quick recap of yesterday seems in order. I think you can argue that the data indicated economic activity remains at quite a high pace. While the second look at Q4 GDP was revised down a tick, it is still at 3.2%. The sub-indices showed that prices rose a bit more than expected and that Real Consumer spending rose a better than expected 3.0%. The other data point was the Goods Trade Balance which showed a larger than expected deficit, a sign that imports are growing faster than exports. This is typically a growth scenario, not a recessionary one, so nothing about the data hinted at a slowdown in things.

As well, we heard from three different Fed speakers and to a (wo)man they all explained that they remain data dependent and that the total economic situation was what they were following, not simply the inflation rate. My point is that there is no indication that they are anywhere near ready to cut rates.

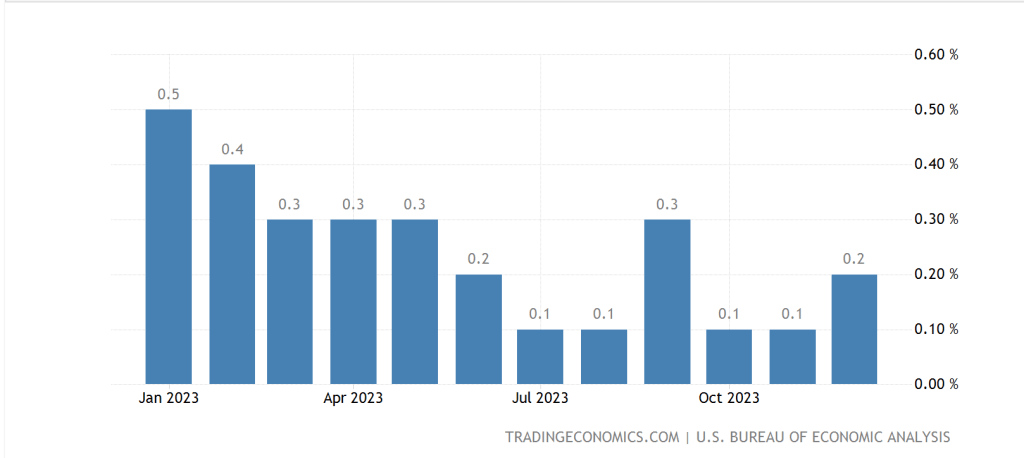

Turning to this morning’s release, expectations are as follows: Headline (0.3%, 2.4% Y/Y) and Core (0.4%, 2.8% Y/Y). As well, we do see some other important data with Personal Income (exp 0.4%), Personal Spending (0.2%), Initial Claims (210K), Continuing Claims (1874K) and Chicago PMI (48.0). But really, it is all about PCE.

My take is things are quite binary for a miss from expectations. A hot print, 0.5% or more, will result in a sharp risk-off session as market participants will reduce the probability of future rate cuts. This should see both stocks and bonds sell off, while the dollar rallies. In contrast, a 0.3% or lower print for Core PCE will see the opposite outcome with a massive equity rally along with a huge bond rally, especially the front of the curve, and I suspect that futures markets will juice the odds of a May cut again (March is off the table no matter what.)

Of course, the last choice is a release right at the consensus view. In that case, both sides of this argument will continue to argue their points, but my take is, based on yesterday’s price action, that equities may have a bit further to correct on the downside absent some other news that encourages the idea of stronger real growth, or an increased probability of a Fed cut. One other thing to remember is we get four more Fed speeches today and this evening, so regardless of the outcome, there will be a lot of opportunity to reinforce their views.

Heading into the data release, a quick look at the overnight session shows us that the Asian market was quite mixed with Japan very little changed, a small decline in Hong Kong, but mainland Chinese shares rose sharply (CS! 300 +1.9%) as traders are looking for the government to announce a new fiscal stimulus package after they meet next week and roll out their growth targets for the coming year. it strikes me there is ample opportunity for disappointment here given how unwilling Xi has been to do just that. The European picture is equally mixed with some gainers (UK and Germany) and some laggards (France and Spain) although not a huge amount of movement in either direction. There was a lot of Eurozone data released this morning with weak German Retail Sales, slowing growth in Scandinavia, and inflation throughout the continent coming in just a touch hotter than forecasts, although still trending lower. And, after a lackluster day yesterday, US futures are softer by -0.2% at this hour (7:00).

In the bond market, yields are rising this morning with Treasuries (+4bps) back above 4.30% and all European sovereigns rising by at least that much. In fact, UK Gilts (+7bps) are leading the way after some slightly better than expected housing data. 10-year JGB yields also edged up by 1bp after the Takata comments, but remain far below the 1.00% level that is still seen as a YCC cap.

Oil prices are a touch softer this morning, -0.4%, after a modest gain yesterday. The big story remains the rumors of OPEC+ continuing to restrict their production. In the metals markets, precious metals are under modest pressure this morning, but base metals are holding their own, with aluminum leading the way higher by 0.6%.

Finally, the dollar, away from the yen, has really done very little overall. Looking at my screen, the only currency that has moved more than 0.2% in either direction is NZD (-0.25%) which seems to be continuing yesterday’s price action after the less hawkish RBNZ meeting outcome. Otherwise, nada.

As we await the PCE data, and the Fedspeak later in the day, the one thing to remember is that if we see a soft number and the equity market cannot hold its early gains, that would be quite a negative signal for risk assets in the near term. There are many who believe we are in a bubble market, especially the tech sector, and certainly there are many frothy valuations there. It would not be hard to imagine a correction happening just because. But if a market falls on ostensibly bullish news, that correction could have a little more oomph than most would like to see. I’m not saying this is my expectation, just that it is something to keep in mind. As to the dollar, that remains beholden to the monetary policy choices and so far, they haven’t changed.

Good luck

Adf