The CPI data was smokin’

So, Jay and the doves are now chokin’

He’s lost the debates

And they can’t cut rates

Without, higher prices, provokin’

As such, it should be no surprise

That traders, risk assets, despise

So, bond yields exploded

While stocks all eroded

And dollars made new five-month highs

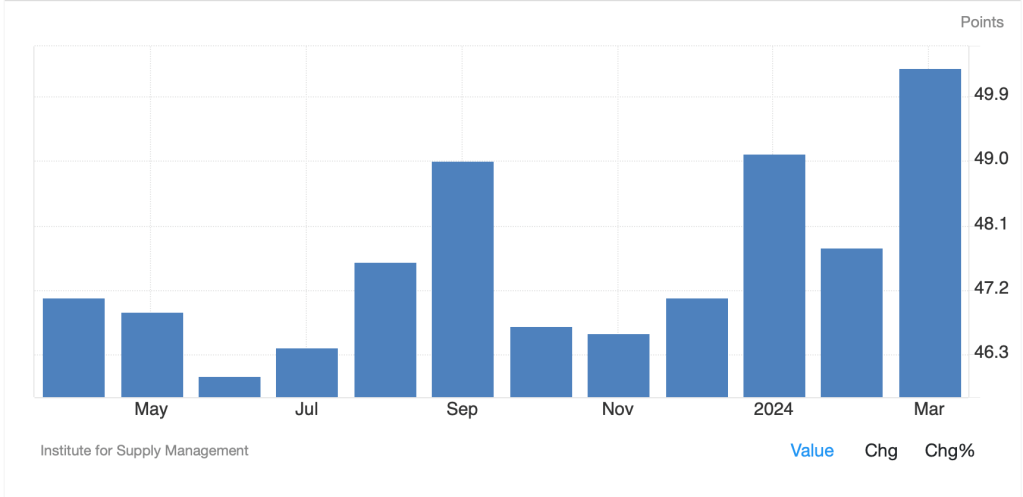

Welp, the inflation data was not merely a little hot, it was a lot hot. Measured prices rose 0.4% on both the headline and ex food & energy readings for the month of March with the annual rises ticking higher to 3.5% and 3.8% respectively. Too, you will not likely hear the inflation doves and those who had been concerned with deflation talking about the trend for the past 3 months or 6 months, as both of those are now running well above 4%.

In truth, if the Fed was both data dependent and actually still fighting inflation, rate hikes would be on the table again as there is absolutely no indication that either wages or rental/housing prices are heading back to the levels necessary to see an overall inflation rate of 2.0%. Alas, it is also clear that politics is a part of the decision process and the concept of fiscal dominance, where fiscal policy overwhelms monetary policy, remains the order of the day.

Fed funds futures adjusted their probabilities instantly with the idea of a June cut now down to just 16% while there are less than 40bps of cuts now priced in for the rest of 2024. Given this price action, it is no surprise that bond yields rose dramatically, with the 10-year closing the session at 4.54%, up 18bps and the highest close since November 2023. My sense is it has further to go. Meanwhile, 2-year yields rose back to 4.97%, a more than 21bp rise to levels also last seen in November 2023. One other aspect of the bond market was the worst 10-year auction in more than a year as the tail was 3.1bps, the third largest tail in history, with a lousy bid-to-cover ratio (2.33) and much less foreign interest (61.4%) than we have been seeing lately. The last 5bps of the yield rally came after the auction result.

Adding to the general gloom, equity prices fell about -1.0% across the board, but closed above their session lows. It is the dollar, though that really saw a big move with a greater than 1% move against most of its major counterparts. USDJPY blasted through the 152.00 level that many had thought was a line in the sand for the MOF/BOJ and is a full big figure higher. Meanwhile, European currencies all declined by more than -1.0% and Aussie (-1.8%) was the absolute laggard across both G10 and EMG blocs.

With this as backdrop, the ECB sits down this morning and must decide if it is too early to cut interest rates. The economic data continues to underwhelm, and the inflation data is actually trending lower, rather than the situation in the US where it has turned back higher. But the sharp decline in the euro yesterday has got to be a warning to Lagarde and her minions as a cut, especially since it is not priced at all, would likely see another sharp euro decline, something they are certainly keen to avoid.

One other thing, the Minutes of the March FOMC meeting were released in the afternoon, and it seems the committee is coming to an agreement that they are going to slow the roll-off of Treasury securities, likely cutting it in half to $30 billion/month although they are not going to touch the mortgage-backed part of the balance sheet since that is barely declining at all. It appears that this may take place at the June or July meeting, but clearly before too long.

Enough about yesterday. Overnight saw Chinese CPI data fall back to -1.0% M/M, reversing the previous month’s rise, as it becomes ever clearer that China will never be able to consume as much as it is able to produce. That is the very crux of the trade issues that are becoming more heated as China ultimately dumps all its excess production overseas, or at least tries to. This is an issue that is not going to disappear anytime soon, and one that will have major political and economic ramifications going forward. I suspect that the tariff situation will only get worse, and I would not be surprised to see further absolute restrictions on Chinese trade regardless of who wins the US election in November. As to the market impacts of this story, for now, I believe Xi is more fearful of a capital flight if he allows the yuan to weaken substantially, than he is of annoying the US and the rest of the world because the yuan is too weak. But, given the clear difference in the trajectories of the US and Chinese economies and inflation stories, pressure for yuan weakness is going to continue.

Turning to this morning’s session, Madame Lagarde and her crew meet, and the market is not pricing in any movement. June remains the odds-on favorite for the first rate cut, and given the fact that the Eurozone, as a whole, is stagnant from an economic growth perspective, and that price pressures there have been ebbing more quickly, that certainly makes sense. Of course, after yesterday’s CPI, June is off the table in the US so the ECB will have to act without the ‘protection’ of the Fed. As mentioned above, the euro declined by more than -1.0% yesterday and is edging lower this morning as well, down -0.1%. Lagarde’s risk is she follows the path of lower rates, the euro declines more sharply, perhaps to parity or beyond, and that invites a resurgence in imported inflation. Remember, energy is still priced in USD, so that a weak euro would raise the price of oil products across the continent. Alas for Madame Lagarde, it’s not clear her political nous will allow her to solve this problem.

Recapping markets overnight, following the US declines yesterday, the Nikkei (-0.35%) also fell, but I think the yen weakness helped mitigate the declines. Chinese shares were lackluster, slipping slightly both in HK and on the mainland and the rest of the time zone saw a mix of modest gains and losses. Meanwhile, European bourses are all in the red this morning, with Spain (-0.9%) the laggard, but the average decline probably around -0.5%. US futures, too, are softer at this hour (7:00), down about -0.3% across the board. Clearly, there is grave concern that the Fed is not going to help ease global monetary policies.

As further proof that US yields drive global bond markets, yesterday’s CPI data pushed European sovereign yields higher by about 10bps across the board! This despite the fact that inflation is going in the other direction in Europe. This morning, those yields are continuing to grind higher, up between 2bps and 4bps across the board. However, Treasury yields have stalled after yesterday’s dramatic rise. Let me say that if the PPI data released this morning is hot, I fear things could move much further.

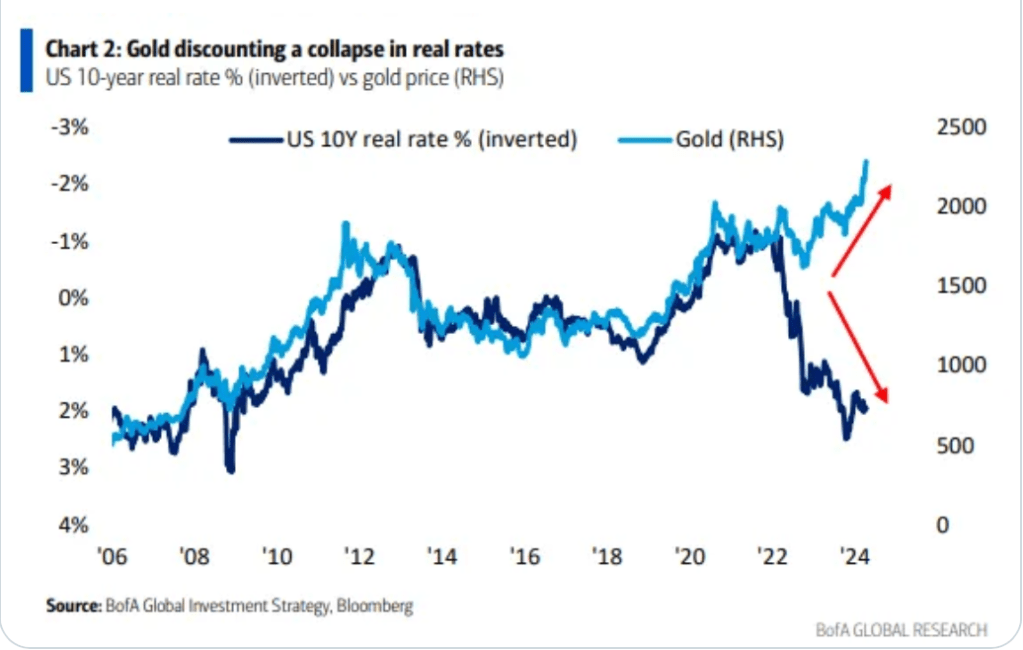

In the commodity space, oil rallied yesterday on stories that Iran was preparing for a more substantial retaliation against Israel and despite the fact that EIA inventory data showed surprising builds in crude and products. However, this morning it is edging lower, -0.5%. Perhaps more interesting is gold (+0.2%) which is a touch higher this morning but was able to rebound off its worst levels of the session after the CPI print to close nearly unchanged on the day. In the end, the market remains quite concerned about inflation regardless of the Fed’s response, and gold continues to get love on that basis. As to the base metals, yesterday’s rate induced declines were cut in half, but this morning both Cu and Al are drifting lower by about -0.2%.

It is the dollar, though that had the most impressive movement yesterday and this morning, it is holding onto most of those gains. Absent a hawkish message from the ECB this morning, something which I believe is highly unlikely, the euro feels like it has further to decline. The BOC left policy on hold and sounded fairly non-committal regarding its first rate cut there. The Loonie suffered yesterday and has seen no rebound at all. In fact, the only currencies showing any life this morning are AUD and NZD, both higher by 0.25%, which seems much more of a trading reaction after their dramatic declines yesterday, than a fundamental story. As long as the Fed remains the most hawkish, the dollar should hold its bid.

Turning to the data today, PPI (exp 0.3% M/M, 2.2% Y/Y) and core PPI (0.2%, 2.3%) lead alongside Initial (215K) and Continuing (1792K) Claims. Those numbers will arrive 15 minutes after the ECB policy decision is announced with no movement expected there. Madame Lagarde has her press conference at 8:45 this morning. We hear from Williams, Collins and Bostic over the course of the day, so it will be quite interesting to find out how far their thinking has changed. I would be particularly concerned if there is further talk of rate hikes again. Remember, Bowman intimated that might occur when she spoke last week, and Bostic has been in the one-cut camp so could turn as well. Let me just say the market is not pricing in that eventuality at all!

At the beginning of the year, I opined that there would be at most one rate cut and rates would be higher by Christmas. As of this morning, I see no cuts and a very real chance of hikes. Keep that in mind for its impact on all asset classes going forward.

Good luck

Adf