Twas just about two months ago

When President Trump was laid low

As bullets were flying

With somebody trying

To end his campaign in one blow

And now, yesterday, once again

A shooter used more than a pen

To try to rewrite

The vote that’s so tight

Enthused to act by CNN

By now, you are all aware of the second assassination attempt on former president Donald Trump’s life, this time while he was playing golf at his course in Palm Beach. The difference, this time, is the alleged shooter was caught alive, so it will be very interesting to hear what he says under questioning and as this situation progresses. While this is obviously newsworthy, it did not have a major market impact as investors are far more focused on the Fed coming Wednesday and then the BOJ on Friday. As such, as I write (6:20) US equity futures are mixed with modest movements of +/-0.2%.

In China, poor President Xi

Is finding that his ‘conomy

Is not really growing

In fact, it is slowing

Much faster than he’d like to see

While last night there were different holidays in China, Japan and South Korea, causing all three markets to be closed, Saturday morning, the Chinese released their monthly data drop regarding IP (4.5%), Retail Sales (2.1%) and Fixed Asset Investment (3.4%) along with the Unemployment Rate (5.3%). Then on Saturday evening here, they released their Foreign Direct Investment (-31.5%) with every one of those figures worse than the previous reading and worse than forecasts. The evidence continues to show that the Chinese economy is slowing and seems to be slowing more quickly than previously anticipated. In truth, from my perspective, the biggest concern Xi has is the FDI decline, which as can be seen below, has been falling (net, foreign investors are exiting China) for the past 15 months, and at an accelerating rate.

Source: tradingeconomics.com

This bodes ill for President Xi’s 5.0% GDP growth target for 2024 and the working assumption amongst the market punditry is that he will soon announce fiscal stimulus in order to get things back on track. Of course, one of the key problems is that not only are economies elsewhere in the world slowing down, thus reducing demand for Chinese exports, but as well, the expansion of tariffs on Chinese goods by the West continues apace, slowing that data even further. I saw an estimate this morning that Chinese families have seen $18 trillion of wealth evaporate as the property market in China continues to decline which undoubtedly weighs on consumer sentiment and activity. But Xi is going to have to do something to prevent a revolution, because remember, the basic Chinese Communist Party contract with the people is we will bring you economic betterment and you let us rule. If they don’t achieve better economic growth, the population, especially the millions of unemployed young men, may get restless. While I am not forecasting a revolution, this is typically a precursor to the process.

On Wednesday, the time will arrive

When Jay and his minions contrive

To try to explain

Their easing campaign

And hope stocks don’t take a swan dive

Now to the most important market story this week, will the Fed cut rates by 25bps or 50bps? It’s funny, if you read independent economic analysis, both sides make their case, and not surprisingly, given the mixed data we have received over the past several months, each case makes some sense. But…that is not the information you get when reading the press. The WSJ, inparticular, is really banging the drum for a 50bp cut and many more to follow. You will recall that Friday, the Fed whisperer was out with his latest piece discussing the merits of a 50bp cut. Well, this morning there are two more articles, one by pundit Greg Ip basically begging for a 50bp cut, and one by a trio of authors laying out the case and coming down strongly on the side of 50bps.

All this has helped push Fed funds futures to a 59% probability of a 50bp cut as of this morning. As some have pointed out on X(fka Twitter), in the past, when there was uncertainty about a Fed move, they managed to get the word out as to what they wanted to do during the quiet period via articles like the ones above and sway markets to their preferred outcome. As such, at this point I assume we are going to see a 50bp cut on Wednesday.

I guess the real question is what will the impact on markets be? This morning, we are already seeing the impact in the FX market, with the dollar under pressure across the board. Versus its G10 counterparts, it has declined by between 0.4% and 0.6% against all except CAD, which remains very tightly linked to the dollar and has gained just 0.1% this morning. But this movement seems entirely a result of the belief that 50bps is coming. In the EMG bloc, though, the picture is more mixed with some significant gainers (KRW +0.8%, CE4 +0.5%, ZAR +0.6%) but most other currencies little changed overall. Nevertheless, the market is clearly pricing for 50bps across the board now and I expect that by Wednesday morning, the Fed funds futures market will reflect that as well.

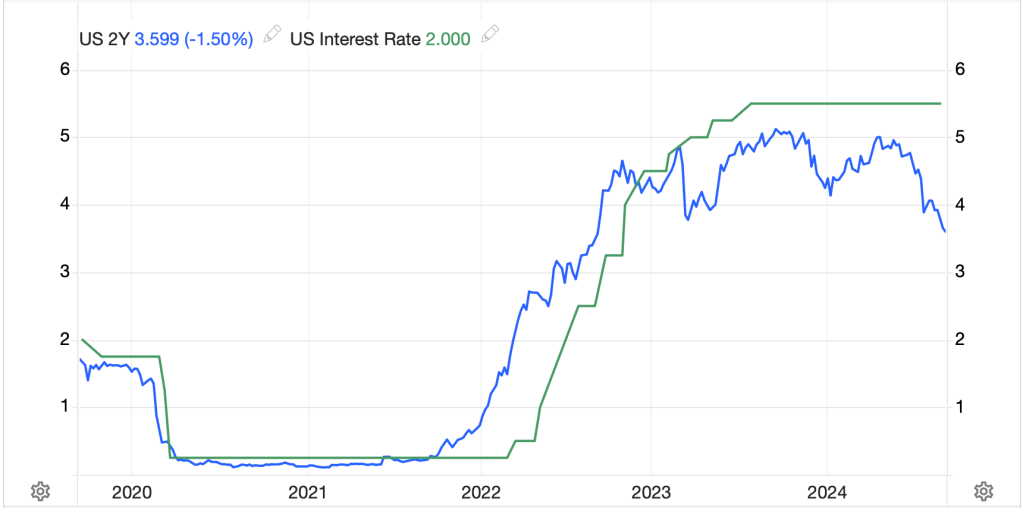

But a weaker dollar is probably not the Fed’s goal. After all, dollar weakness can help reignite inflation, so they will be wary. Of more interest to them is the bond market which also appears to be in agreement as the 2yr yield has now fallen to 3.56%, 10bps below the 10yr yield and a clearer sign that the two plus year inversion is behind us. Of course, as I pointed out Friday, with 2yr yields nearly 200bps below Fed funds, it can be interpreted that the market is anticipating a recession, something I’m pretty sure the Fed wants to avoid if it can. Perhaps you can see in the chart below how the 2yr yield (in green) fell sharply this morning, almost exactly when those WSJ articles were published. Go figure!

Source: tradingeconomics.com

At any rate, that is the current zeitgeist, the Fed has leaked they want 50bps and are pushing the levers so when they cut 50bps on Wednesday afternoon, nobody is surprised. The Fed hates surprises. It will, however, be very interesting to hear Chairman Powell’s comments given that economic data remains pretty strong overall.

As to the other markets beyond bonds and FX, equity markets, after Friday’s US strength, were generally positive in those countries in Asia not celebrating a holiday (Hong Kong +0.3%, Australia +0.3%, Taiwan +0.4%). In Europe, though, the picture is more mixed with the DAX (-0.3%) lagging while Spain’s IBEX (+0.3%) is higher although other major markets are virtually unchanged on the session.

Finally, in the commodity markets, oil prices (+0.4%) are edging higher this morning as Libya’s production has been completely shut in due to ongoing internal military conflict. In the metals markets, gold (+0.2%) remains the biggest beneficiary of the global central bank rate cutting theme as it continues to trade at new all-time highs virtually every day. Silver (+0.7%) is getting dragged along for the ride with many pundits calling for a much more substantial rally there and copper (+0.4%) is responding to a combination of lower rates and lower inventories in exchange warehouses raising the specter of supply shortages.

On the data front, this week is mostly about central banks, but we do get some other important numbers.

| Today | Empire State Manufacturing | -3.9 |

| Tuesday | Retail Sales | 0.2% |

| -ex autos | 0.3% | |

| IP | 0.0% | |

| Capacity Utilization | 77.9% | |

| Wednesday | Housing Starts | 1.25M |

| Building Permits | 1.41M | |

| FOMC rate decision | 5.25% (-0.25% still median) | |

| Brazil interest rate decision | 10.75% (+0.25%!) | |

| Thursday | BOE rate decision | 5.0% (no change) |

| Initial Claims | 230K | |

| Continuing Claims | 1851K | |

| Philly Fed | 2.4 | |

| Existing Home Sales | 3.85M | |

| Friday | BOJ rate decision | 0.25% (unchanged) |

Source: tradingeconomics.com

Clearly Retail Sales will be closely scrutinized as evidence that the economy is still growing. I would estimate that a weak number there would insure a 50bp cut, while a strong number may give some pause to those on the fence. The other very interesting aspect of this week will be the BOJ’s communication in the wake of their meeting Friday. They went from tough talk to just kidding in less than a week back in August. What will Ueda-san try this time? Japanese inflation data is released just hours before their announcement, and it remains well above the 2% target. My sense here is they want to raise rates, they just need to prepare the market more effectively before doing so.

The dollar is already pricing a bunch of cuts as is the bond market. If the Fed truly gets aggressive, I believe it can fall further, but if the Fed gets aggressive, you can be certain that so will the BOE, ECB and BOC at the very least. When they start to catch up, the dollar’s decline will slow to a crawl at most.

Good luck

Adf