Though there was no change

Ueda-san hinted that

The future is known

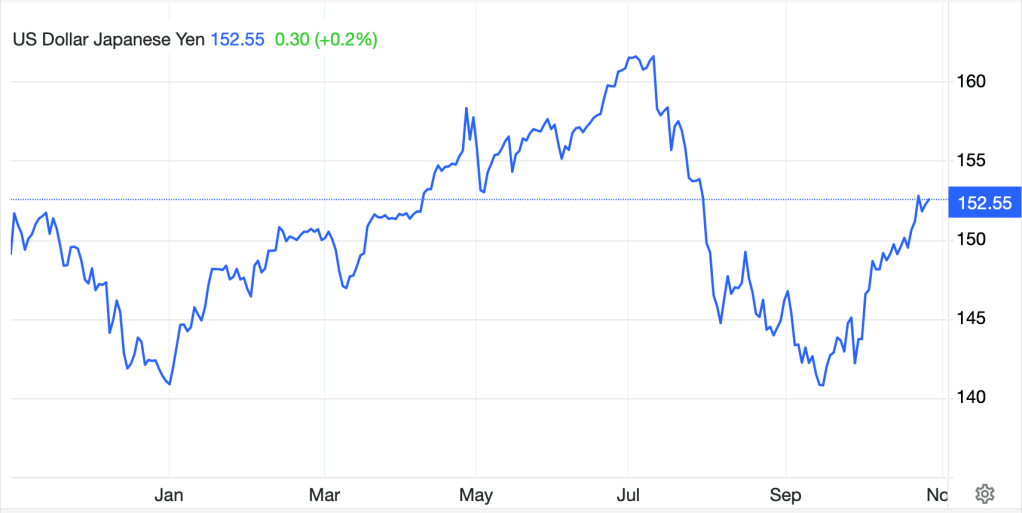

Last night, the BOJ left policy unchanged, as universally expected, but indicated that “Our basic stance is that if our economic and price outlooks are realized, we’ll respond by raising rates.” That seems pretty clear, and the market responded accordingly with the yen rallying nearly 1% in the immediate aftermath of the comments, although it has since retraced a bit and is now higher by just 0.5% on the session. As well, he explained, “We’ve been looking at the downside risks to the US and overseas economies, but that fog is clearing somewhat. Needless to say, new risks could emerge depending on the policies coming from the new US president.” The upshot is that market expectations are now for the next rate hike to take place at the January meeting (69% probability), although December cannot be ruled out.

Japanese equity markets fell modestly during the session (Nikkei -0.5%), but that could also have been more related to the US equity performance, where all three major indices fell yesterday (something that I thought had been made illegal 🤣). As to JGB’s, they rallied slightly with the 10-year yield slipping 2bps on the session.

In the current market zeitgeist, I don’t believe the happenings in Japan are that crucial. As Ueda-san said, US politics remains a key focus for every financial market around the world, as well as every economy, given the potential for a Trump victory and some very real changes to the current global trade and economic framework. However, that doesn’t mean other things of note have stopped occurring.

The message from Madame Lagarde

Is further rate cuts aren’t barred

She just doesn’t know

How fast she should go

Though colleagues, more cuts, have pushed hard

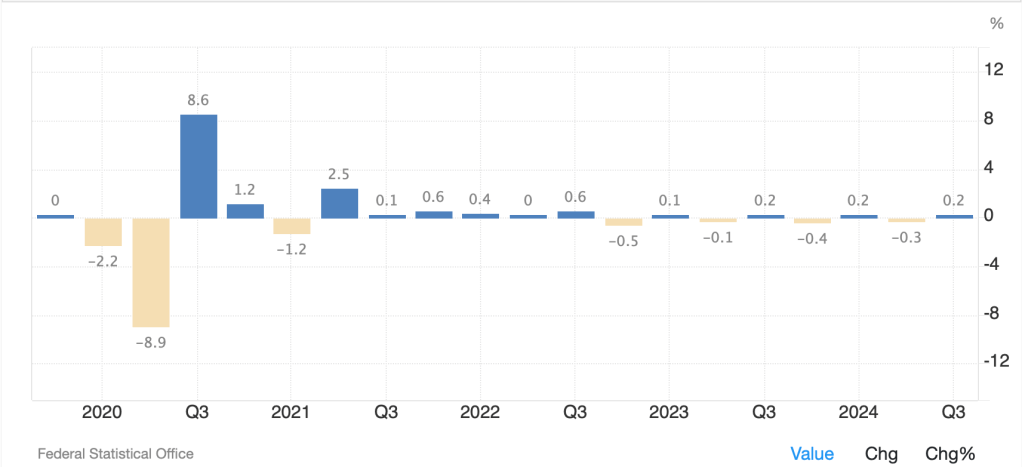

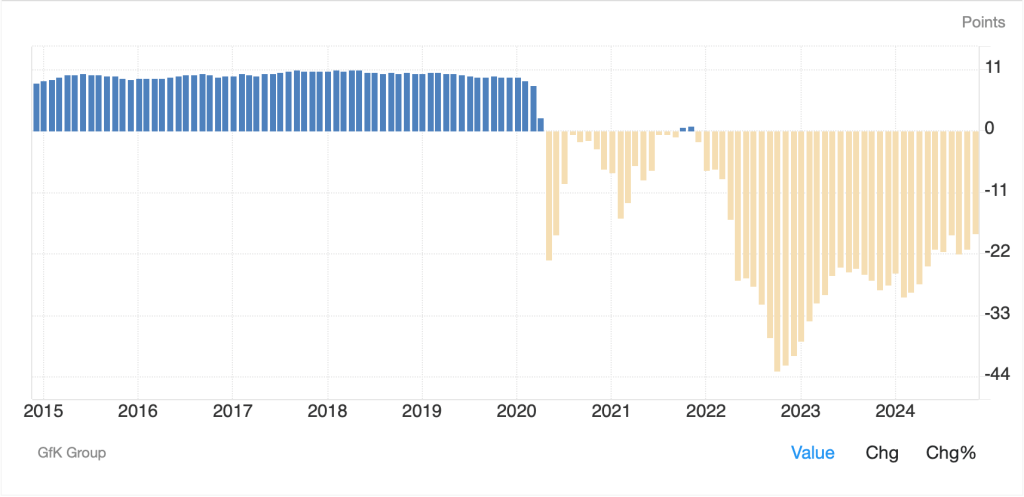

The other story this morning, in the wake of some Eurozone data showing inflation ticked higher in October (headline 2.0%, core 2.7%), is the commentary from several ECB members. Notably, Madame Lagarde explained “The objective is in sight, but I am not going to tell you that inflation is under control. We also know that inflation will rise in the coming months, simply because of base effects.” The punditry sees this as a middle ground between the more hawkish ECB members, like Nagel and Schnabel, who are calling for a “gradual approach” and that the ECB “mustn’t rush further steps,” and the doves, led by Panetta, who are concerned, “Monetary conditions are still tight and new cuts will be necessary.”

The ECB is finding itself in a difficult position as they refuse to accept the idea that a recession is coming despite the lackluster economic data and the ongoing anecdotal evidence of trouble as evidenced by VW’s closing of factories and seeking wage cuts. Meanwhile, they understand that inflation, at least optically, is due to rebound somewhat, and cutting rates while that is occurring may be more difficult to explain.

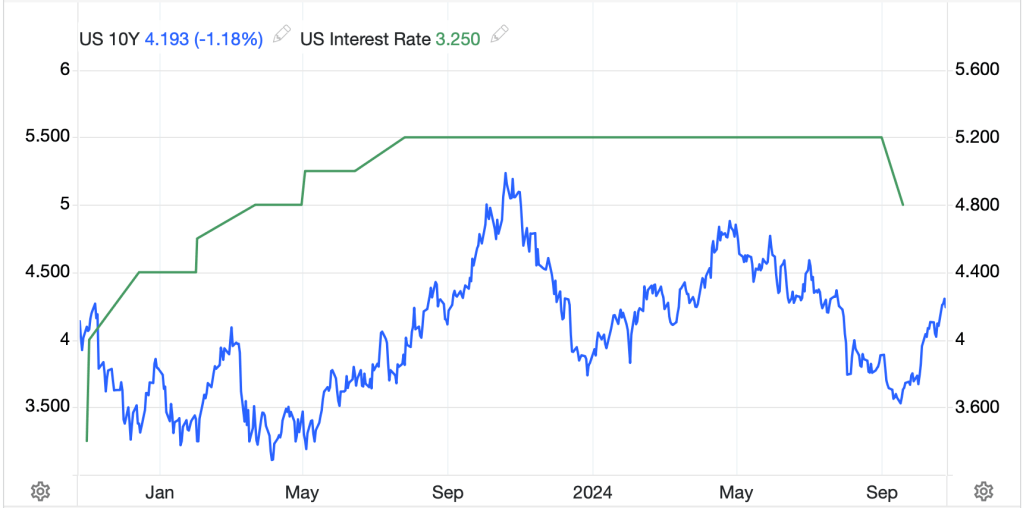

Ultimately, as we have seen repeatedly across all markets and nations, the biggest driver of almost everything is the combination of US economic activity and monetary policy. However, that is not to say that other nations or blocs cannot demonstrate some independence for their own idiosyncratic reasons. Regarding the euro, I find it interesting that I have seen more comments this morning about how the currency has found a bottom and is set to rebound. However, I cannot help but look at the bigger picture (see chart below) and think nothing at all has changed.

Source: tradingeconomics.com

I continue to believe that in order for there to be any changes of substance, we will need to see the US policy change substantially. That could take the form of an acknowledgement by the Fed that the economy remains strong and further cuts are not necessary (see yesterday’s ADP Employment number of 233K, twice expectations) or a decision by Chairman Jay that there are enough structural issues in the banking and financial system that further rate cuts are necessary despite what appears to be solid growth and still-high inflation. If the former were to occur, I would look for the dollar to take another strong step higher and the euro to test parity along with other currencies declining commensurately. If the opposite were to occur, the dollar would weaken substantially in my view, with the euro rising toward 1.15 or so. However, I don’t see either of those scenarios playing out, so I believe the reality is we remain in the range we have traded in for the past two years as seen above.

And those were really the only stories to discuss away from the US election cacophony. So, let’s see how markets behaved broadly overnight. As mentioned above, US equities had a down day after some disappointing earnings results added to some overly long positioning. Beyond Japanese shares, the rest of Asia was broadly negative as well, with Korea (-1.5%) and India (-0.7%) leading the way lower, but almost every market in the red. We are seeing similar price action in Europe this morning as it appears Lagarde’s comments did not soothe any frazzled nerves, and the data was unhelpful as well. As such, the CAC (-0.85%) is the lagging performer although the DAX (-0.5%) and FTSE 100 (-0.8%) are also under pressure. Now, regarding the FTSE 100, that is also a product of the UK budget announcement yesterday which has been widely panned by most analysts. It appears they have actually managed to create a situation where they increase spending and taxes but reduce growth substantially. The upshot here is that there seems to be a little buyers’ remorse with the July election results. Meanwhile, US futures are all pointing lower as well this morning, at least -0.5%.

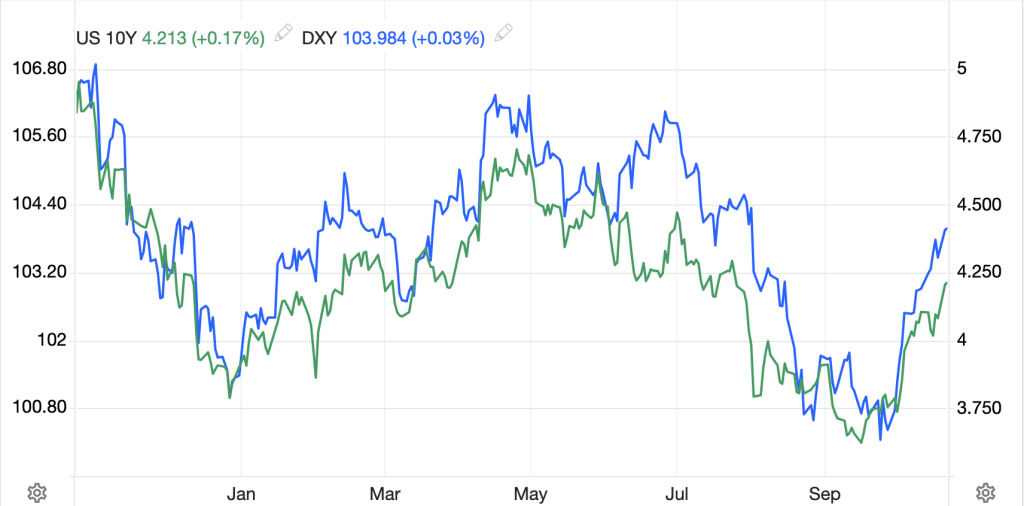

In the bond market, yesterday saw Treasury yields rebound to their recent highs at 4.30% but this morning they have slipped back lower by -2bps. European sovereigns, however, are higher by those same 2bps as the market responds to the combination of yesterday’s Treasury movement and the higher than forecast Eurozone inflation report. The outlier here is the UK, which after the budget has seen yields rise dramatically, a sign that markets are distinctly unimpressed with the proposals. This is a case where a picture is truly worth 1000 words.

Source: tradingeconomics.com

I’ll let you determine when the budget was released, but one must be impressed with the more than 20bp response!

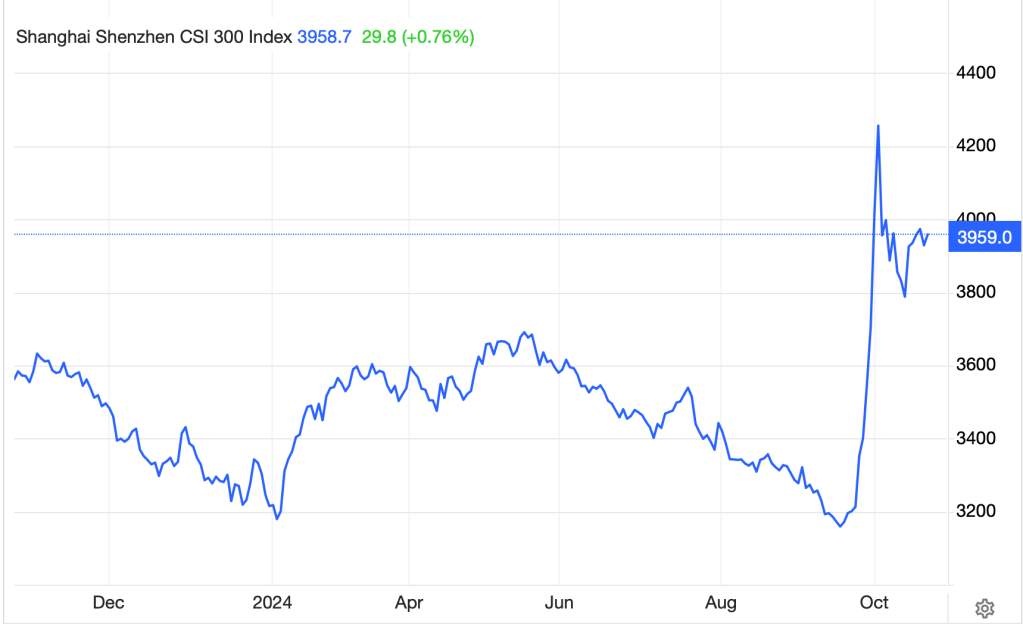

In the commodity space, oil (+0.5%) is continuing its rebound from its worst levels at the end of last week after EIA inventory saw surprising draws rather than modest builds. As well, Chinese PMI data overnight was slightly better than expected and there are those now calling for a more robust Chinese economic rebound and increase in demand. As to the metals markets, though, weakness is the order of the day with both precious and industrial metals slightly softer, although remember, these have rallied sharply over the course of the past month, so some trading movement lower is no surprise.

Finally, the dollar is mixed to slightly higher with only the MXN (+0.3%) showing any gains of note beyond the yen’s moves while there is more breadth in the decliners (NOK (-0.3%, ZAR -0.2%, AUD -0.2%) with almost no movement in Asian currencies overnight.

On the data front, this morning brings the weekly Initial (exp 230K) and Continuing (1890K) Claims data as well as Personal Income (0.3%), Personal Spending (0.4%) and PCE (0.2%/2.1%) and core PCE (0.3%/2.6%). Already we are hearing that the impact of the recent hurricanes is likely to confuse the employment data, which makes sense, but I think much more attention will be paid to the Income/Spending data. Certainly, Retail Sales have held up well, and if Personal Income continues to do well, it will call into question the need for that many more rate cuts by the Fed. As of this morning, the futures market is pricing in a 94% probability of a cut next week and a 70% probability of another one in December. Perhaps more interestingly, and where things could really change, is the fact the market is pricing in a total of 135bps of cuts by the end of next year. We will need to keep an eye on how that changes for clues to the dollar’s future.

For now, the dollar appears on its back foot, but absent some much weaker than forecast data, it is hard for me to see a sharp decline. Rather, I continue to see more reason for the dollar to maintain its broad strength going forward.

Good luck

Adf