At this point most traders are thrilled

It’s Friday, ‘cause throughout that guild

Exhaustion is rife

From bulls’ and bears’ strife

O’er whether their dreams be fulfilled

As well, all the narrative writers

Are stuck pulling college all-nighters

With facts changing fast

Their latest forecasts

Do naught but encourage backbiters

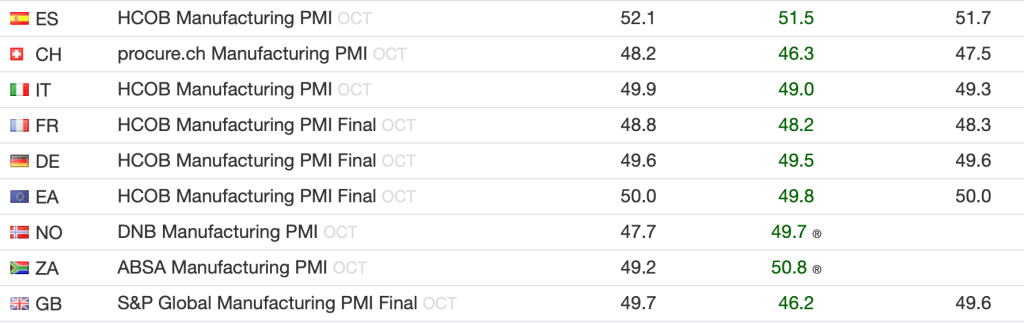

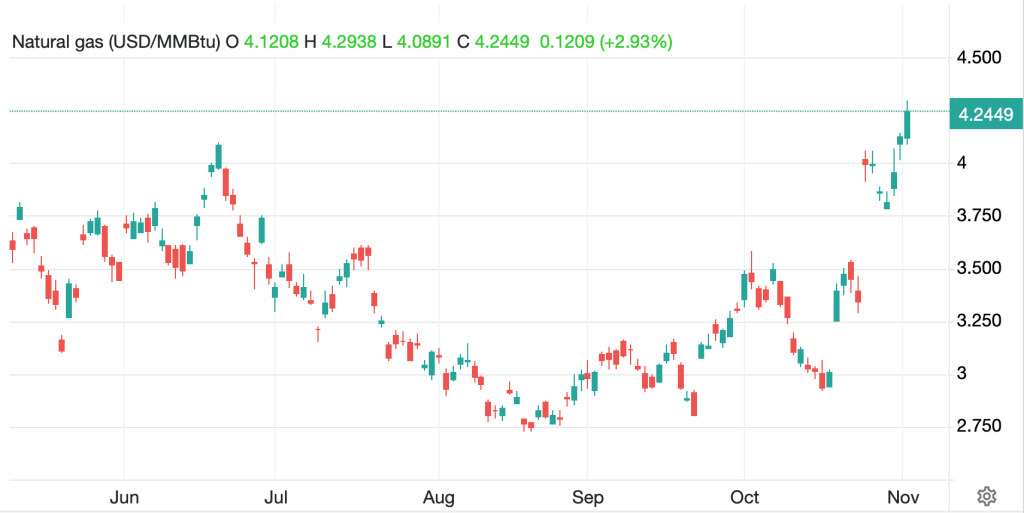

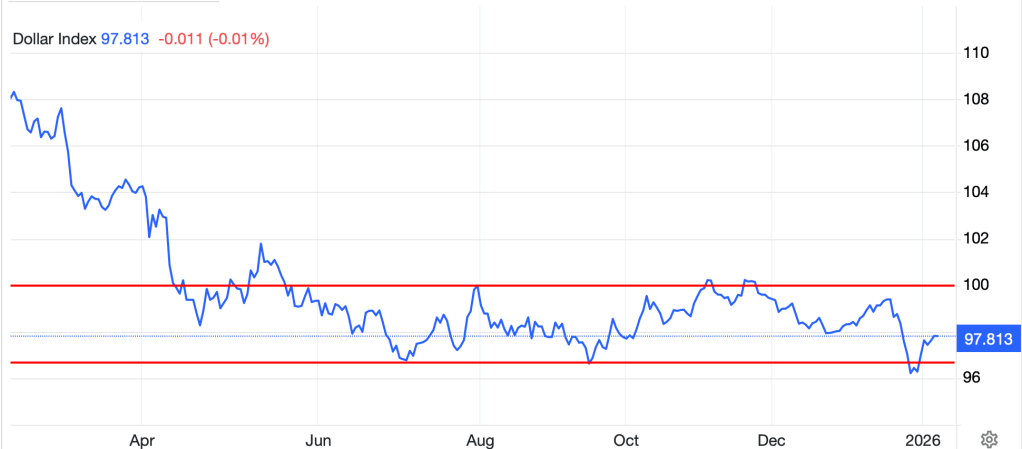

It has certainly been an interesting week in financial markets, at least most of them, with significant moves throughout the commodity, equity and cryptocurrency spaces. We even saw a jump in bond prices yesterday after a really lousy JOLTS Jobs number (6.54M compared to 7.2M expected) and a higher-than-expected Initial Claims number of 231K. Suddenly, questions about the labor market are front of mind, and prospects for a March Fed Funds cut rose to 23% for a time, although have slipped back to 17% as of this morning. But one need only look at a few charts (all from tradingeconomics.com) showing the daily movement in some popular trading vehicles to understand why traders are thankful the week is ending. For instance,

Silver (+4.75%), which had a 34% range last Friday and has fallen 39% since its high 8 days ago:

Gold (+2.1%), which showed the same pattern, albeit not quite as dramatically:

Natural Gas (+3.4%), which rose $2.65 and reversed $2.00 on a $3.00 base over the past two weeks:

And Bitcoin (+5.8%), which has fallen nearly 50% since its highs in early October and 22% in the past week:

Now, it must be remembered that Bitcoin has a long history of massive drawdowns, with a 50% drawdown in spring of 2021 and a 75% drawdown from November 2021 through October 2022. We shouldn’t be surprised as Bitcoin is essentially a pure risk asset, so is completely narrative driven. And as the narrative writers try to keep up with the facts on the ground, they are trying to figure out how to sell the story that Bitcoin, which was ostensibly designed to be an alternative to the fiat currency system, has become so tightly linked to the fiat financial system.

In the end, though, the commodity markets are beholden to the marginal demand/supply of the last molecule available. I have not seen anything change with respect to demand for power to drive the economy, the demand for silver to build out electronics or the demand for gold by central banks. To me, while prices for these commodities can whipsaw aggressively as the global regime changes, ultimately, I remain confident demand will continue to be the story. (Bitcoin is an entirely different beast and one I will not discuss in depth other than to highlight its volatility along with the rest of these markets.)

Anyway, you can understand why traders are exhausted. In fact, my forecast for next week is that we are highly unlikely to see the same size movements, although choppiness will still be the rule.

You may have noticed I missed oil (-0.4%) which has also seen some volatility as per the below chart, but not quite at the same level as the others. Part of that is the oil market is much larger and more liquid and part of that is that the whole Iran/US discussions question has provided fodder for both bulls and bears in short intervals resulting in no net movement over the past week.

From what I can piece together, the situation in Iran is coming to a head regarding the regime there. The talks today are ongoing, but there is other information that appears to indicate preparations are being made for a transitional government, and the State Department just warned all US citizens to leave Iran. Something is up which will certainly drive more oil volatility.

If we look at bonds, Treasury yields fell -8bps yesterday and have rebounded by 2bps this morning. That was the largest single day move we’ve seen since October, and basically took the market right back to that 4.20% level that had been home for weeks.

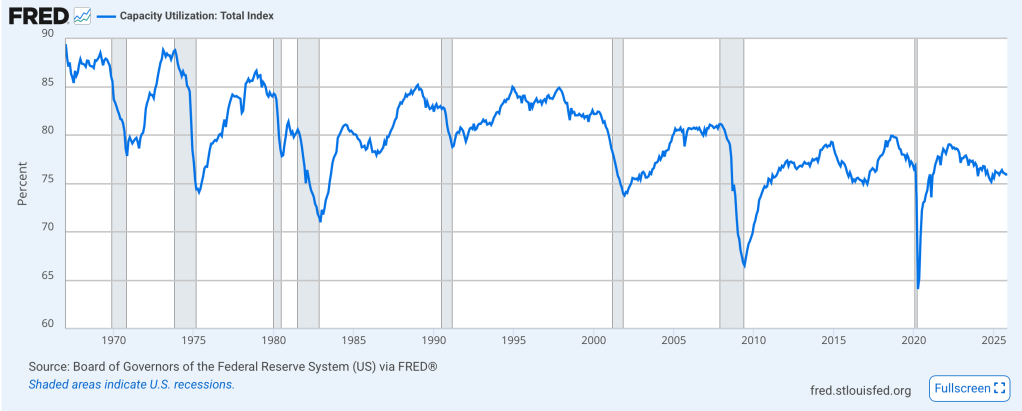

There continues to be a lot of confusing data and information regarding the economy as yesterday’s weak jobs data conflict with the broader idea that the hyperscalers are spending 2% of GDP on capex this year and forecasts for the budget deficit continue to run around 2%. It seems like it will be difficult for a recession to come about with that much new spending in the economy, but as we have seen over the past decades, the beneficiaries of that spending are not necessarily the population cohort that is currently upset. I guess the question is, is economic growth real if the population doesn’t feel it? That will certainly be the political question come November.

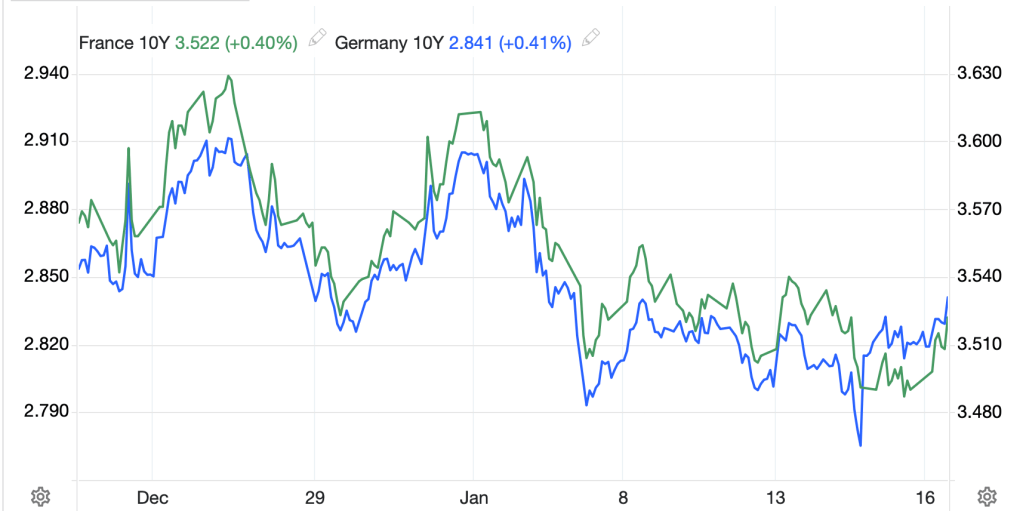

As to European yields, they all followed Treasuries lower, especially after the BOE 5-4 vote to leave rates on hold offered a much more dovish signal than anticipated, and the ECB harped on the strength of the euro and how that could bring down their inflation forecasts, hinting at lower rates going forward.

In the equity markets, yesterday saw a tough day in the US as the tech/AI story continues to get beaten up right now, and that was more than enough to offset strength in things like defensives and staples. But this morning, US futures are higher by about 0.5% as I type (8:00). In Asia, Japan (+0.8%) bucked the US trend on the back of excitement about the upcoming election where Takaichi-san is expected to gain a mandate. However, China (-0.6%), HK (-1.2%), Korea (-1.4%) and Australia (-2.0%) all had the same fate as the US. Given the weight of technology companies in Asian indices, I suspect we are going to see more volatility here as different narratives come about on AI and investment and the social/political impacts. As to Europe, modest gains are the story with the DAX (+0.5%) and IBEX (+0.9%) leading the way higher with the former benefitting from yesterday’s surge in Factory orders as well as a better-than-expected trade balance today. As to Spain, it has been trending higher and nothing has come out to change that view for now.

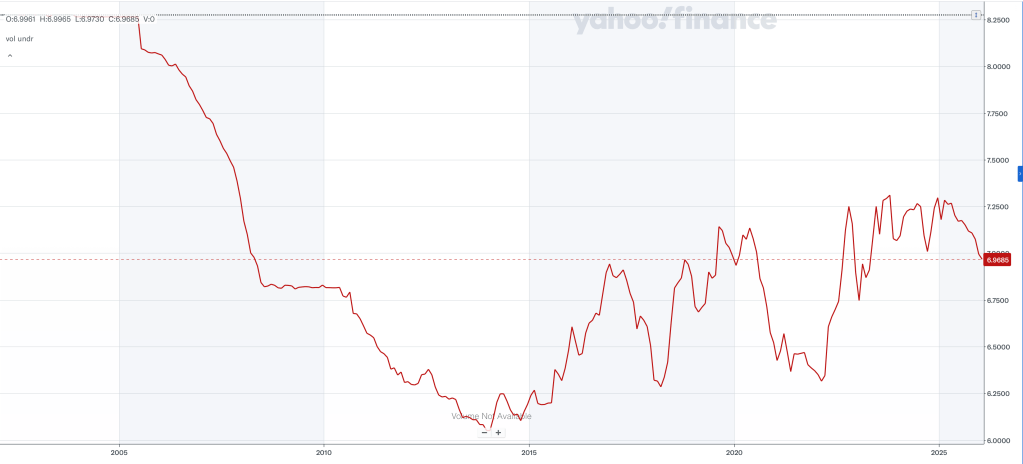

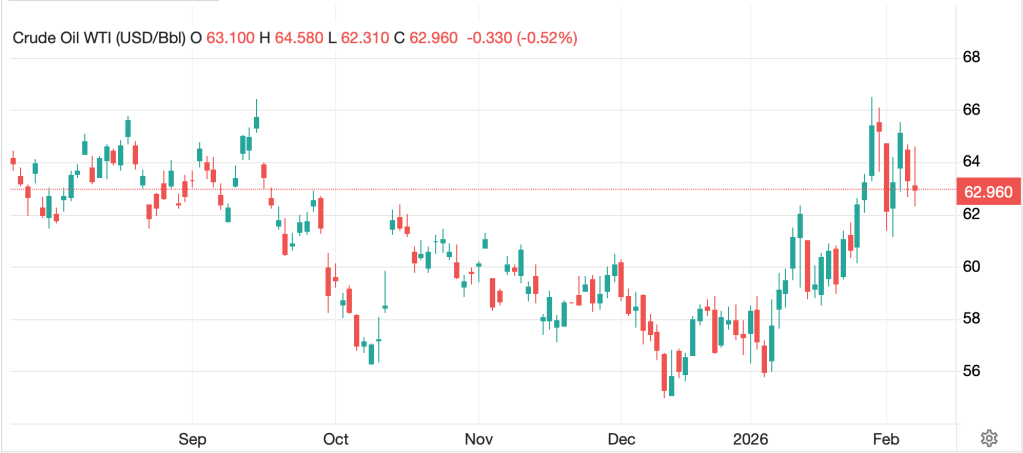

Finally, the dollar is giving back some of yesterday’s gains but remains within that longer term trading range. Using the dollar index (DXY) as our proxy, you can see just how little things have changed. All the talk last week of the breakdown in the dollar has been forgotten for now, although I continue to read about China building a digital currency backed by gold. I discussed that earlier this week and why I continue to believe that is unrealistic at this time.

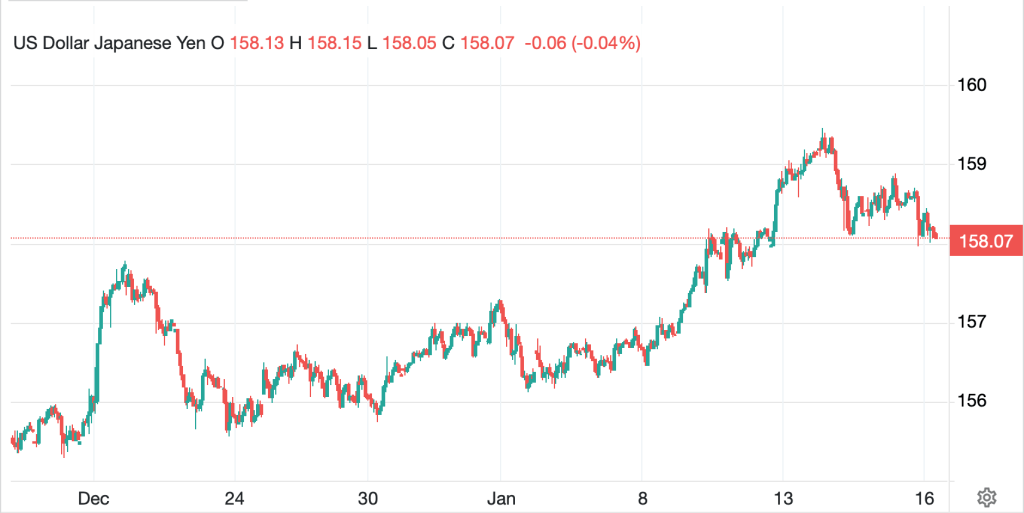

But the weird thing about the DXY is it doesn’t seem to reflect what is happening in individual currencies. For instance, AUD (+0.85%), GBP (+0.45%) and NOK (+0.9%) are all much stronger although the euro (+0.15%) and JPY (0.0%) not so much. In the EMG bloc, MXN (+0.8%), ZAR (+1.1%), HUF (+0.8%) and KRW (+0.3%) are all having a very good session despite no specific news that would seem to drive that. Historically, I never paid attention to the DXY because nobody who actually trades FX pays it any mind. However, as a trading vehicle, it has gained many adherents which is why I mention it. So, as we look across the currency universe, the dollar is having a tough day.

On the data front, we only see Michigan Sentiment (exp 55.0) and Consumer Credit ($8.0B). We also hear from Governor Jefferson, but nobody seems to be listening to any Fed speakers right now, Secretary Bessent is a far more important voice for the markets.

We have seen massive moves across many markets lately, with excessive moves correcting, but I remain stubbornly of the view that while things got ahead of themselves, the underlying trends are still in place, at least in commodities. As to the dollar, it’s not dead yet, but its future will depend on the administration’s ability to achieve their goals regarding the economic adjustments and inward investment.

Good luck and good weekend

Adf