The world is ending

At least, that’s the way it feels

Owning equities

The narrative writers are caught

‘Cause stories those writers had wrought

No longer apply

And folks now decry

The idea that dips should be bought

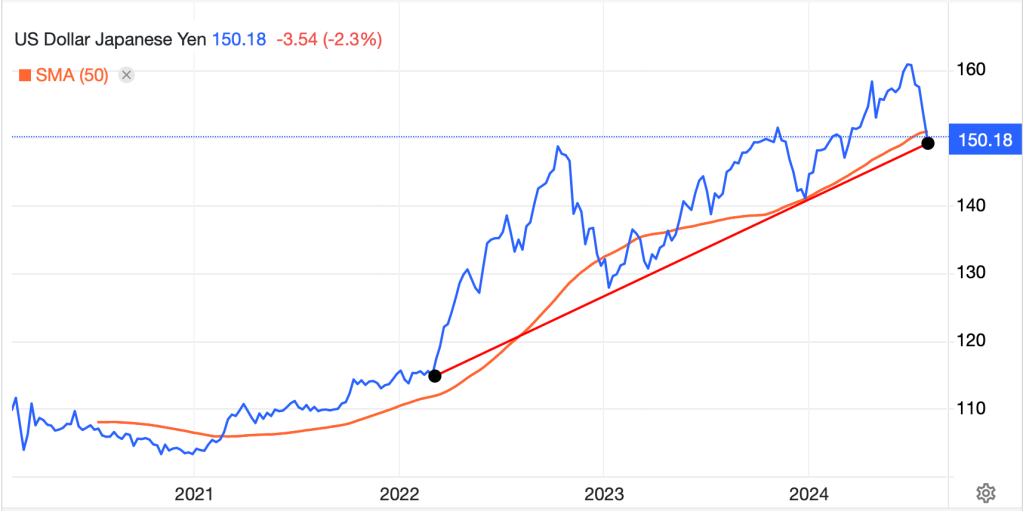

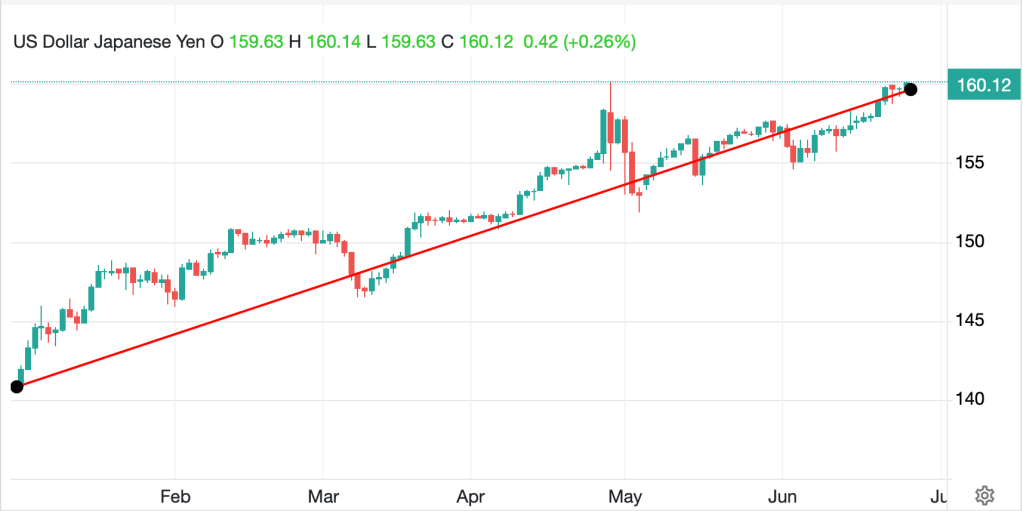

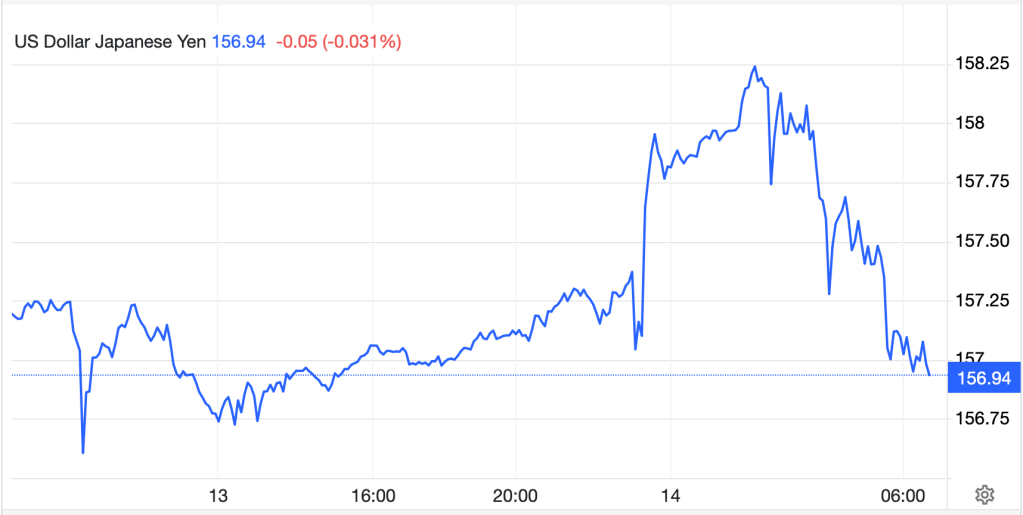

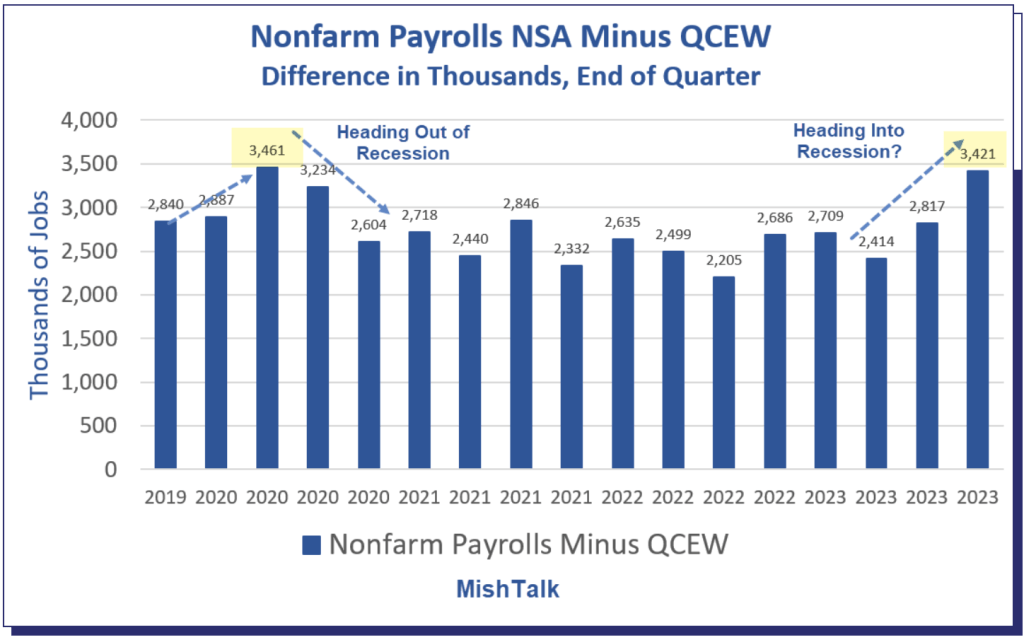

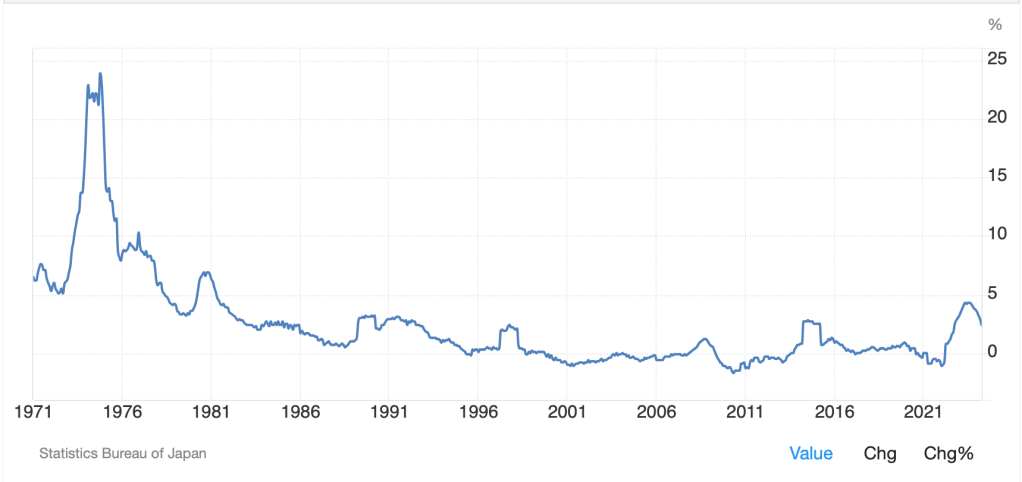

Remember the idea of the summer doldrums where everybody is on vacation, so markets move very little? Yeah, neither do I! Here’s a different idea though, when risk is under pressure, all correlations go to 1.0. Look at the following three charts (source: tradingeconomics.com) and explain to me how they behave independently:

There is rioting in the streets today, perhaps not in your neighborhood directly, but in many places around the world (the UK, Bangladesh, Kenya, others), as the global order that we have known for the past X years gets tested. How big is X? There will be many different answers to that question, but in this poet’s mind, what we are witnessing in its full glory today is the beginning of the unwinding of the market excesses that began when global interest rates headed to 0.00% in the wake of the GFC in 2009, so X=15 years.

It is easy to wax philosophical on this subject, discussing the merits of moderating the business cycle and why interest rate policy is a net benefit, and you can be sure that before this week is over, we will get policy interventions. But ultimately, markets need to clear to function effectively, and I would argue that the last time markets actually cleared was in 1974. The next big opportunity to allow markets to clear was in October 1987 and the Maestro, although he had not yet earned that moniker, stepped in after that Black Monday and promised unlimited liquidity to prevent too much damage.

Ever since then, central bankers around the world, led by the Federal Reserve, but do not forget actions like Mario Draghi’s “whatever it takes” moment, have decided that they need to manage the global economy, and market responses, and that markets were only effective if they were going higher. (It’s ironic that TradFi people scoffed at the crypto maxim ‘number go up’, yet they believed exactly the same thing, only in a different wrapper.) As well, we all know that the concept of political will does not exist anymore, at least not in the West, as no elected politician will ever choose to fight for a policy that has short-term pain and long-term gain. The result of this constant intervention and guidance from policymakers is that things get overdone, and bubbles inflate. And it is much easier to inflate a bubble when you maintain policy rates at 0.00% (or negative rates in some cases).

At this point, you will read many stories about which particular catalyst drove this market reaction, whether it was last week’s BOJ meeting where Ueda-san surprised the market and hiked rates as well as promised to reduce QQE, or whether it was the fact that Chairman Powell did not cut rates, or if it was the weak payroll report. Others will point to the escalation in hostilities in Ukraine and the Middle East as flashpoints getting people to exit risk positions. But in the end, the catalyst is not important. As I wrote on Friday, and is so well explained in Mark Buchanan’s book, Ubiquity, the market was rife with ‘fingers of instability’ and an avalanche has begun.

To this poet’s eye, there needs to be more excess wrung from the market. After all, given the underlying trade of virtually the entire bull market has been the JPY carry trade, where traders and investors borrowed JPY at 0.00%, converted it to another currency and either held that currency to earn the interest rate differential, or for the truly aggressive, used the currency to buy other risky assets (NVDA anyone?), and that trade has been building for years. Deutsche Bank has estimated that it grew to $20 trillion in size. I assure you it is not completely unwound!

However, as I mentioned above, I am confident that central bankers are already getting intense pressure from their respective governments to ‘do something’ to stop the rout. But central bankers are already (save Japan) in cutting mode. And the Fed just passed on cutting rates last week. If they were to cut today, no matter what they said, it would remove any doubt that the only thing they care about is the stock market. It would destroy whatever credibility they still retain. But do not count out that response, at this stage, it’s probably 50:50 they cut this week if things continue. After all, the Fed funds futures market is now pricing in a 95% probability of a 50bp cut in September and a total of 125bps of cuts by December!

I will be the first to say I have no idea where things are going to head from here because while market internals point to further unwinding of risky assets, policy responses have not yet been seen. So, the best advice I can offer if you are not leveraged is do not panic. If you are, you have probably been stopped out already anyway. In the meantime, let’s take a look at the damage overnight.

Equity Markets in Asia:

- Nikkei 225 -12.4%

- Hang Seng -1.5%

- CSI 300 -1.2%

- ASX 300 -3.7%

- KOSPI -8.8%

- TAIEX -8.3%

- Nifty 50 -2.7%

In other words, it was quite the rout, with tech shares getting hammered everywhere. Perhaps the most surprising thing to me as that the CSI 300 didn’t fall further, although I suspect that there was significant intervention by the government to prevent that from happening. (After all, you don’t need to be a western government to want the number to go up!)

Equity Markets in Europe:

- DAX -2.6%

- CAC -2.4%

- FTSE 100 -2.4%

- IBEX -2.8%’

- FTSE MIB -3.0%

This tells me that these markets were not nearly as leveraged as Asian markets, likely because prospects throughout Europe have been relatively less interesting to many investors. After all, if you are leveraging up via borrowing yen, you want to buy growth, not value, stocks, and there aren’t that many growth names in Europe.

Finally, US futures, at this hour (7:00) are lower by:

- S&P 500 -3.0%

- NASDQ -4.5%

- DJIA -2.1%

Bond markets are also seeing very significant movement, in the opposite direction as they are performing their safe haven role brilliantly today. While the movements today are solid, with Treasury and European sovereign yields all lower by between 5bps and 7bps, to see the real story, you need to see the move since Friday’s opening (these are all 10-year yields).

- US -20bps

- Germany -10bps

- UK -9bps

- Japan -20bps

- Australia -17bps

The US yield curve, at least the 2yr-10yr measurement, is virtually flat today and 30yr yields are now higher than both of those maturities. Also, look at JGB yields, down to 0.77%, as Japanese investors take their toys and go home. The thing about this move, and the reason I don’t believe the unwinding is over yet, is that once the Japanese investment community starts to move, it takes a long time for them to get to be where they want given the amount of the assets involved. And despite all the clutching of pearls about the US ability to sell the amount of debt they need to fund themselves; it won’t be a problem for right now. Many people around the world will be all too happy to buy Treasury bonds regardless of some political foibles in the US.

Commodity markets are under pressure this morning, but not seeing the same type of pain as equity markets. The story here is that commodities are not directly impacted by the current movements (if anything declining interest rates should help them) but when margin calls come, people sell whatever they can that is liquid. So, gold (-1.6%) is being liquidated to cover margin calls, not because people don’t want it. Oil (-1.6%) is likely feeling pressure because these equity moves presage potential economic weakness and a reduction in demand, and we are seeing the same response from the industrial metals. My take is gold is the one thing, besides bonds, that people are going to be willing to hold, and will rebound first.

Finally, the dollar is under pressure, net, but we are seeing massive movements in both directions.

- JPY +2.5%

- EUR +0.4%

- GBP -0.3%

- AUD -0.9%

- MXN -3.3%

- NOK -1.0%

- ZAR -2.0%

- CNY +0.8%

- CHF +0.8%

- KRW -0.5%

See if you can determine which were the favorite currencies to hold long against short JPY (AUD, MXN, ZAR). Meanwhile, the renminbi is able to gain as it continues to weaken, net against the yen, its most important competitor. Remember, currencies are the outlet valves for economies when other markets cannot move enough. The thing to keep in mind, especially as a hedger, is that volatility is going to be very high for a while yet. This will not all quiet down and go away in a week’s time.

At this point, it’s fair to ask, does data matter anymore? Probably not today, but it will be key for the central banks if for no other reason than to cloak their actions in some fundamental story. Alas for the Fed, there is virtually nothing to be released this week. All we see is:

| Today | ISM Services | 51.0 |

| Tuesday | Trade Balance | -$72.4B |

| Thursday | Initial Claims | 250K |

| Continuing Claims | 1880K |

Source: tradingeconomics.com

As well, and perhaps remarkably, so far on the calendar we only have three Fed speakers, Goolsbee, Daly and Barkin. However, it seems almost certain we will hear from others, especially if the rout continues.

Right now, fundamentals do not matter. My sense is we will see a bounce of some sort after the first wave ends, perhaps as soon as tomorrow, but the narrative of the soft landing has been discarded. Look for more political pressure on the Fed to act, and to act soon. Also, do not be surprised if the rest of the week ultimately sees a slower, but steady, decline in risk assets as those who haven’t panicked react to the situation and reevaluate just how much they love their positions. Consider, Warren Buffet sold some of his favorite positions last week and is loaded with cash to act. But there is nobody who is more patient than he.

Good luck

Adf