It used to be data was seen

As noncontroversial and clean

But politics, lately

Has damaged it greatly

With both D’s and R’s venting spleen

So, it ought not be a surprise

That yesterday’s NFP rise

Was claimed by the left

To lack any heft

While R’s crowed out loud to the skies

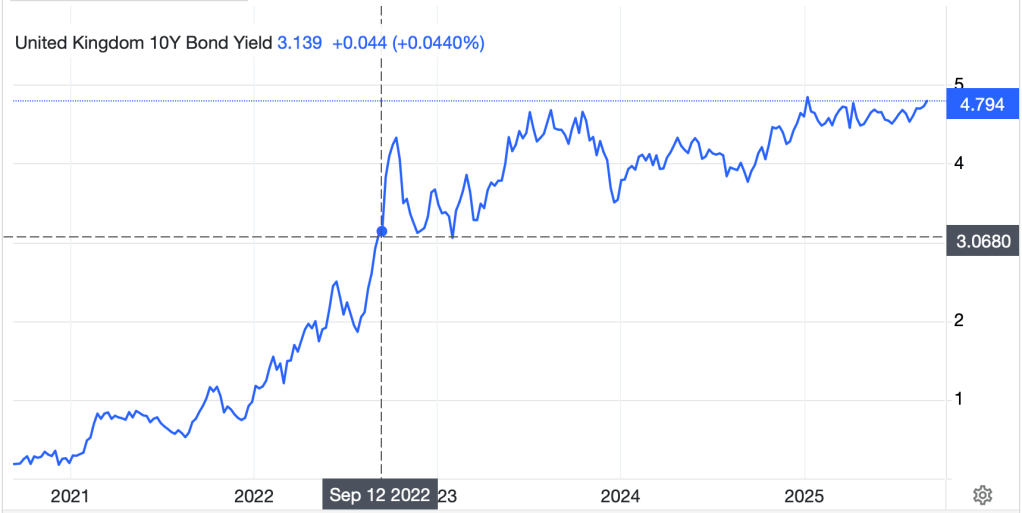

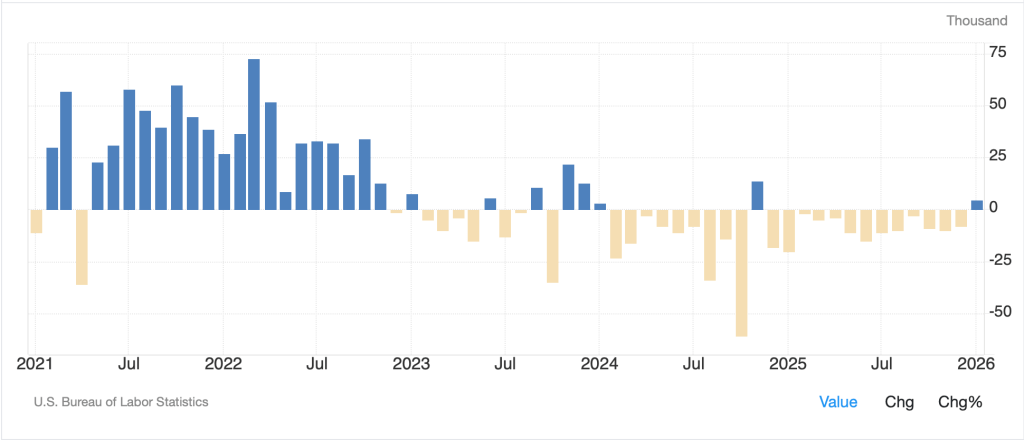

To me, the big news was that private sector jobs rose 172K, while government jobs declined by 42K. In fact, the Federal civilian workforce is back to its smallest count since 1966! That is an unalloyed positive in my view. Too, manufacturing jobs increased by 5K, which is the first time we have seen a rise since November 2024. In fact, if you look at the chart below of manufacturing jobs for the past 5 years, it is easy to see what President Trump is trying to achieve. One month does not indicate success, but it’s a start.

Source: tradingeconomics.com

The last positive was that the Unemployment Rate fell to 4.3%, so overall, this seems like a pretty good report. But as with everything these days, it depends on the lens through which you view it. As with most national data in an economy as large and varied as the US, there were real and perceived negatives. The BLS made their annual benchmark revisions to the data which removed 403K jobs from 2025’s numbers. These revisions come as they adjust their birth-death model as well as get updated population statistics. But for those who seek bad news for this administration, that reduction of 403K jobs is proof that the president’s policies are failing. Another complaint has been that the bulk of the increase in NFP was in the health care sector, although given the ongoing aging of the population, that cannot be very surprising.

Nonetheless, just like every other piece of data these days, NFP was a Rorschach test of your underlying political beliefs and not so much a description of the economy. My question is, if the employed population is ~159 million, is an adjustment of 400K really meaningful? After all. It’s about 0.25% of the working population in a measurement of a dynamic statistic amid people changing jobs and the economy growing. Perhaps the politics are the signal, and the data is the noise.

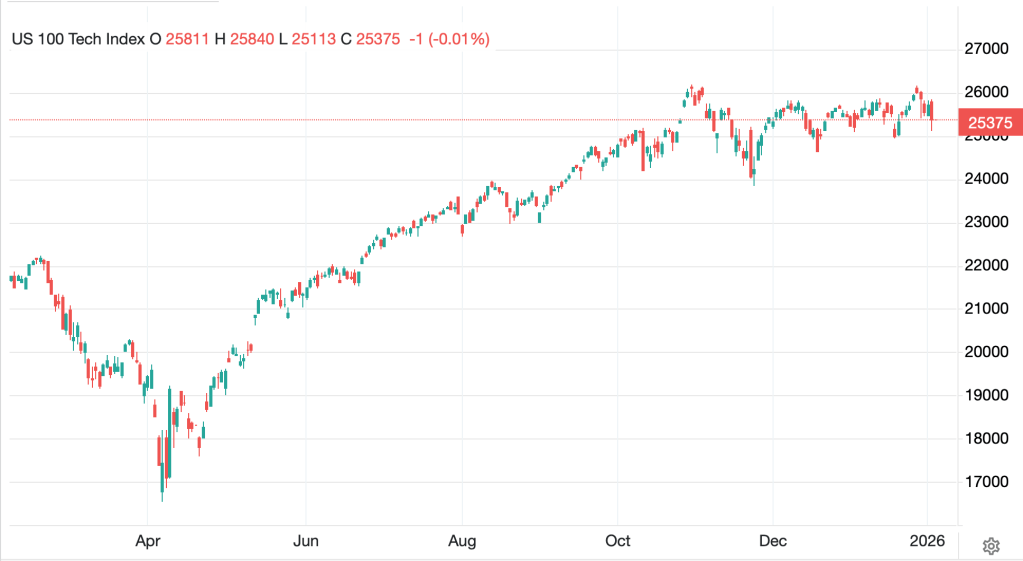

Given that there were two very different takes on the data, it ought be no surprise that the S&P 500 finished the day exactly unchanged which is a pretty rare occurrence, happening less than 2% of the time in the past 10 years. In fact, that lack of movement was the norm with both the NASDAQ and DJIA slipping -0.1%. Net, I don’t think we learned much new and now markets and the algorithms will focus on tomorrow’s CPI data.

However, the narrative writers had their work cut out for them. All those who were seeking to pan the government had to change their tune and now they are focused on the fact that there don’t need to be rate cuts if the employment situation is better. Again, through a political lens this is good if you are anti-Trump because it prevents him getting the rate cuts he has been demanding. I guess we cannot be surprised that Stephen Miran, in comments yesterday, continues to explain rate cuts make sense, which simply confirms the view that everything is political these days.

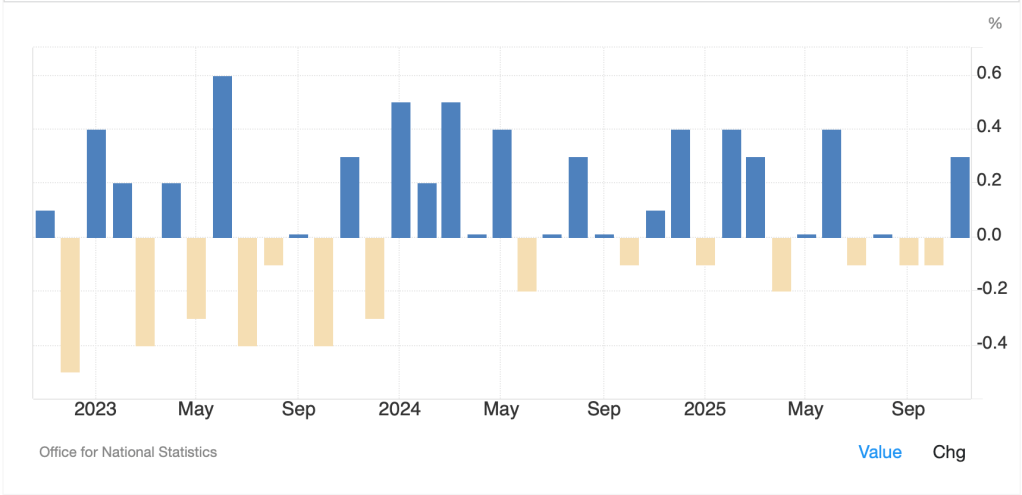

So, do we know anything new this morning? Alas, I don’t think we learned anything to change the big picture yesterday, so let’s see how the data was received around the world. Tokyo followed the S&P’s lead and was unchanged overnight with China (+0.1%) also doing little. HK (-0.9%) lagged as traders prepare for the Chinese New Year holiday that runs all next week and took profits. Korea (+3.1%) continues to perform well while India (-0.7%) continues to waver as the trade deal with the US impacts different parts of the economy very differently there. Net, a mixed session. In Europe, Germany (+1.3%) is the leader this morning on the strength of solid earnings reports by key companies as there has been no data released. France (+0.75%) too is having a good day on earnings although Spain (-0.2%) is lagging. The UK (+0.1%) is the only place where data made an appearance and it showed that GDP growth has fallen to 1.0% Y/Y there, another problem for the embattled PM Starmer. It appears his time in office will be ending soon as literally every policy decision he has made has had a negative outcome. As to US futures, at this hour (7:30) they are firmer by about 0.3%.

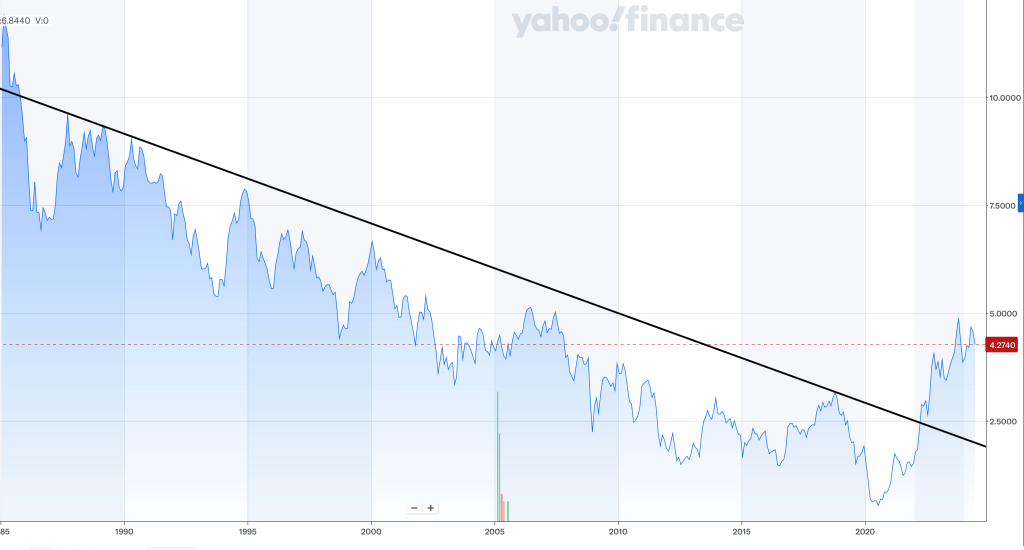

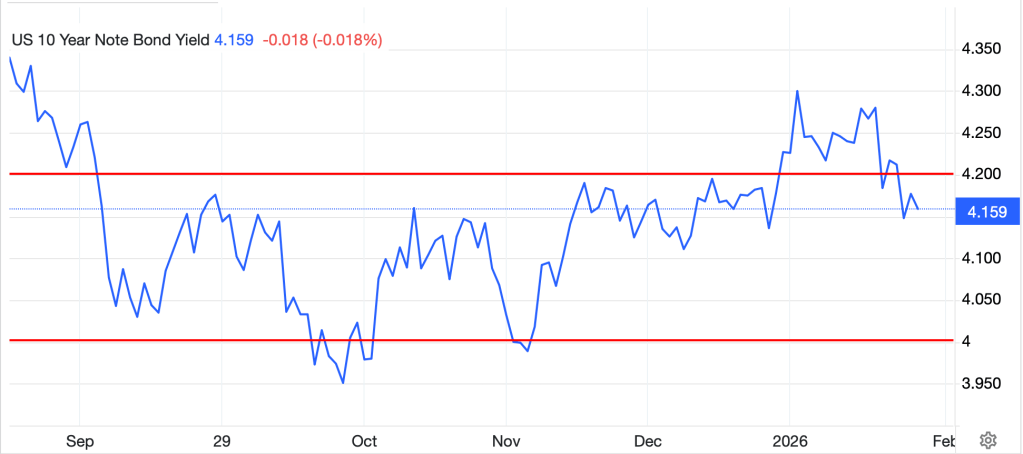

Bond markets saw the biggest move yesterday, with Treasury yields rising 4bps, although they have slipped back -1bp this morning and continue to trade in their range of 4.0% – 4.2%. while we did spend some time above that range, it appears that fears of a bond market meltdown, or that China was going to sell their bonds or something else have faded somewhat. In fact, globally, 10-year yields this morning are essentially unchanged.

Source: tradingeconomics.com

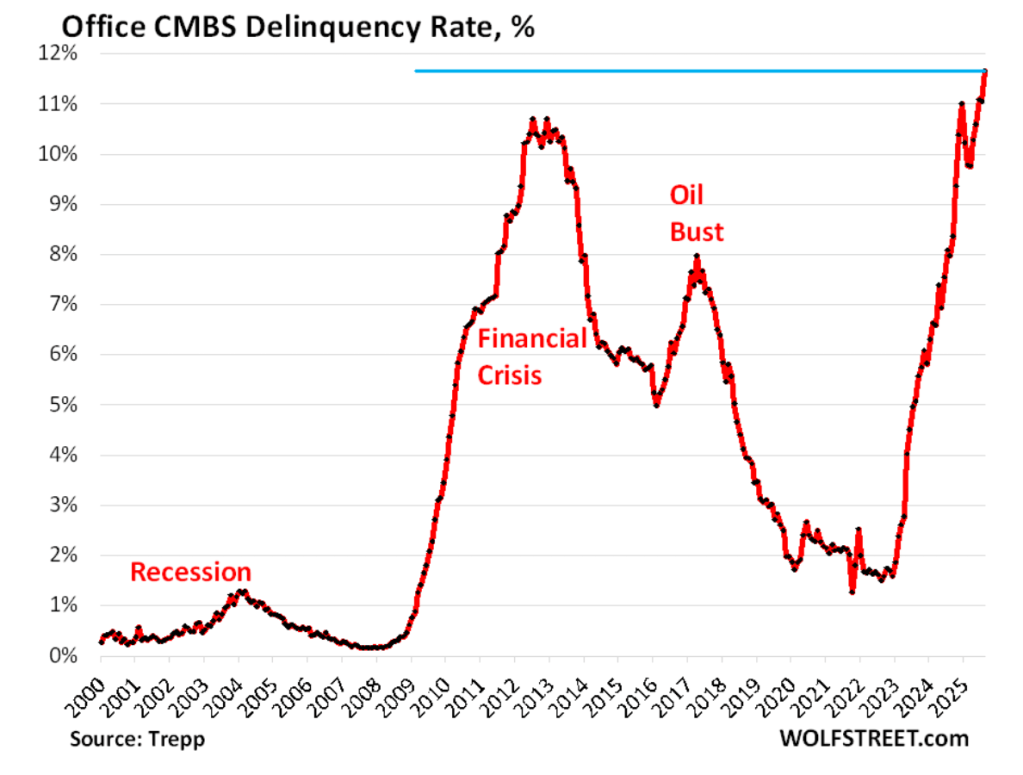

In the commodity space, the Iran situation continues to be top of mind for oil traders although WTI (-0.3%) is not really moving much this morning. There was no announcement from the White House regarding the meeting between President Trump and Israeli PM Netanyahu which indicates, to me at least, that nothing was decided. While a second US aircraft carrier steams toward the Persian Gulf, we are all on tenterhooks as to how this plays out. Right now, it doesn’t appear that discussions between the US and Iran are leading anywhere. Meanwhile, metals (Au -0.4%, Ag -1.6%, Pt -1.3%) are giving back some of yesterday’s strong gains with gold firmly back above the $5000/oz level again. There is much talk of a major shortage on the COMEX for deliveries for March, but we shall see how that plays out. Certainly, there has been no change in the demand structure for silver, but we just don’t know how much silverware has been sold for scrap to help alleviate the shortage at this point.

Finally, the dollar is little changed vs most major counterparts with the two outliers KRW (+0.6%) on the back of strong equity market inflows and CHF (+0.4%) which appears to be the one haven that is behaving like one this morning. JPY (-0.2%) has strengthened several percent over the past week, and comments from the latest Mr Yen, Atsushi Mimura, make clear they continue to watch the market closely, but for right now, there seems little concern, or likelihood, that intervention is coming soon.

One thing the NFP data did achieve was to alter the Fed funds futures market which now is pricing just a 6% probability of a rate cut at the March meeting with two cuts priced for the year. I have to say that based on the comments from Logan and Hammack, as well as the NFP data, it certainly doesn’t appear likely that the Fed is going to cut again soon. Tomorrow’s CPI data may change some opinions there, but we will have to wait to find out.

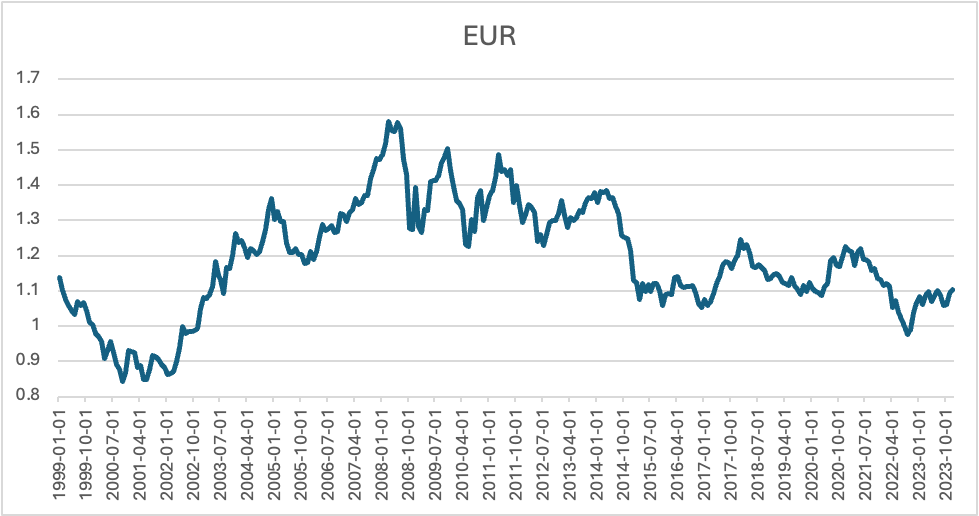

But riddle me this, if the Fed has finished its loosening cycle, and Kevin Warsh is seen as someone who is keen to reduce the size of the Fed’s balance sheet, why would we think the dollar is going to decline sharply from here? For now, the buck remains rangebound, but as I watch what is going on elsewhere around the world regarding economic activity, the US continues to lead the way. I still don’t see the dollar collapse theory making sense, although frankly, I think the administration would be fine with it. Let me leave you with the entire history of the EURUSD exchange rate since its inception in 1999 and you tell me if you think the dollar is exceptionally weak or strong here. Remember, a weak dollar is a strong euro, so higher numbers. Frankly, it feels like we are close to the middle of the range, or if anything, stronger rather than weaker.

Source: data FRED, graph @fx_poet

Good luck

Adf