It seems bond investors are learning

That government spending’s concerning

As yields ‘cross the board

Have all really soared

While buyers become more discerning

Meanwhile, o’er the weekend we learned

That Tariff Man’s truly returned

More letters were sent

Designed to foment

Responses as well as heartburn

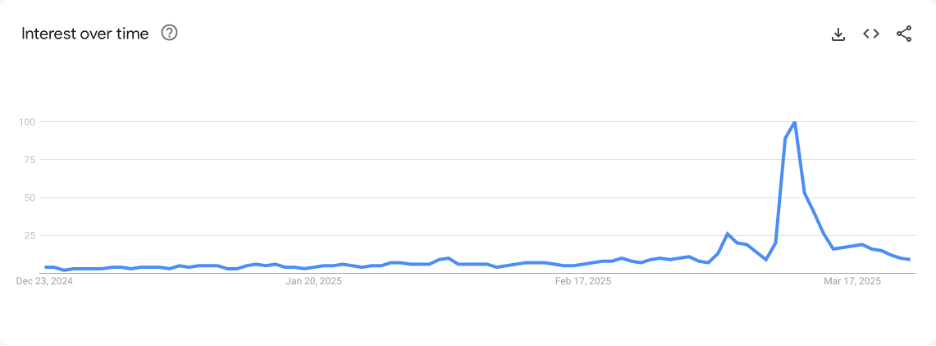

As we approach the middle of the summer, two things are becoming increasingly clear; the world today is very different from just a few years ago and it is getting harder and harder to pay for all the things that the world seems to want. Taking the second point first, market headlines today have pointed to German 30-year yields which have traded to their highest level since October 2023, and appear set to breech that point and move to levels not seen since prior to the Eurozone bond crisis in 2011 (see MarketWatch chart below)

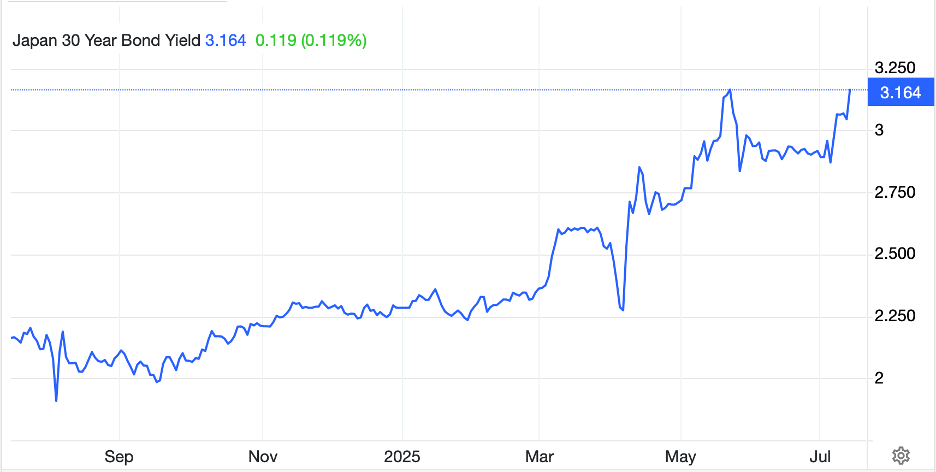

Similarly, we have seen 30-year yields rise in Japan, a story that gained legs back in late May, and yields overnight returned to those all-time highs from then.

Source: tradingeconomics.com

Not surprisingly, given the debt dynamics globally, US 30-year yields are also pushing back to the levels seen back in May, although have not quite reached those lofty levels and as I type this morning, are trading just below the 5.00% level.

Source: tradingeconomics.com

As Austin Powers might say, “What does it all mean, Basil?” While I’m just a poet, so take it for what it’s worth, it seems pretty clear that the level of government borrowing is pushing the limits of what private sector investors are willing to absorb. The below chart, created from FRED data tells an interesting tale. Up through the GFC, government and private sector debt grew pretty much in step with each other, although after Black Monday in October 1987, government debt started to grow a bit more rapidly. But the GFC completely changed the conversation and government debt took on a life of its own. Essentially, the GFC took private losses and nationalized them and put them on the government’s balance sheet. (As an aside, this is why there is still so much anger at the fact that nobody was held accountable for that event, with the perpetrators getting larger bonuses after their banks were bailed out.). But in today’s context, the rise in yields is telling us, or me at least, that the market is losing its appetite for more government debt.

While this is the US graph, the situation is similar around the developed world. This is why we are hearing more about Secretary Bessent’s sudden love of stablecoins as they will be a source of significant demand for Treasury paper that he needs to sell. But in the end, do not be surprised if we see more than simply QE, whatever they call it, going forward, but outright financial repression and yield curve control. While the US may be in the vanguard of this situation, the yields in Germany and Japan tell us that the same is happening there as well.

As to the first point above, back in the day, it seemed that weekends were observed by one and all around the world with policy statements a weekday affair. But no longer. Over the weekend, President Trump sent letters to Mexico and the EU that 30% tariffs were on the way if they did not reach an agreement by August 1st. For 80 years, most of the Western world operated on a genteel basis, with decorum more important than results. It is not clear to me if this was because negotiations were more effective, or because most leaders didn’t have the stomach for confrontation. But it is abundantly clear that President Trump is quite willing to be confrontational with other leaders in order to get his way. The problem for other leaders is they are not used to dealing in this manner and find themselves uncertain as to how to proceed. Thus far, whether they have been combative or conciliatory, it doesn’t seem to matter. Remarkably, it is still just 6 months into this presidency, so things are going to continue to change, but the one thing that is unequivocally true is the world is a different place today than ever before.

Ok, let’s see how other markets are handling the latest tariff storms. Equity markets are mostly unhappy with this new process as after Friday’s modest declines in the US, we saw more losers (Japan, India, Taiwan, Australia) than winners (Hong Kong, China, Korea) in Asia. The salient news there was that the Chinese trade surplus grew to $114.8B, slightly more than expected as exports rose sharply while imports underperformed. However, Chinese bank and lending data did show an increase in M2 and Loan Growth, so at least they are trying to add some monetary stimulus. As to Europe, other than the UK (+0.4%) the continent is under pressure with Germany (-1.0%) the laggard of the bunch. The UK story seems to be a single stock, AstraZeneca, which released strong trial results for a new drug. But otherwise, the tariff story is weighing on the continent. US futures are also softer at this hour (7:30), down around -0.3% across the board.

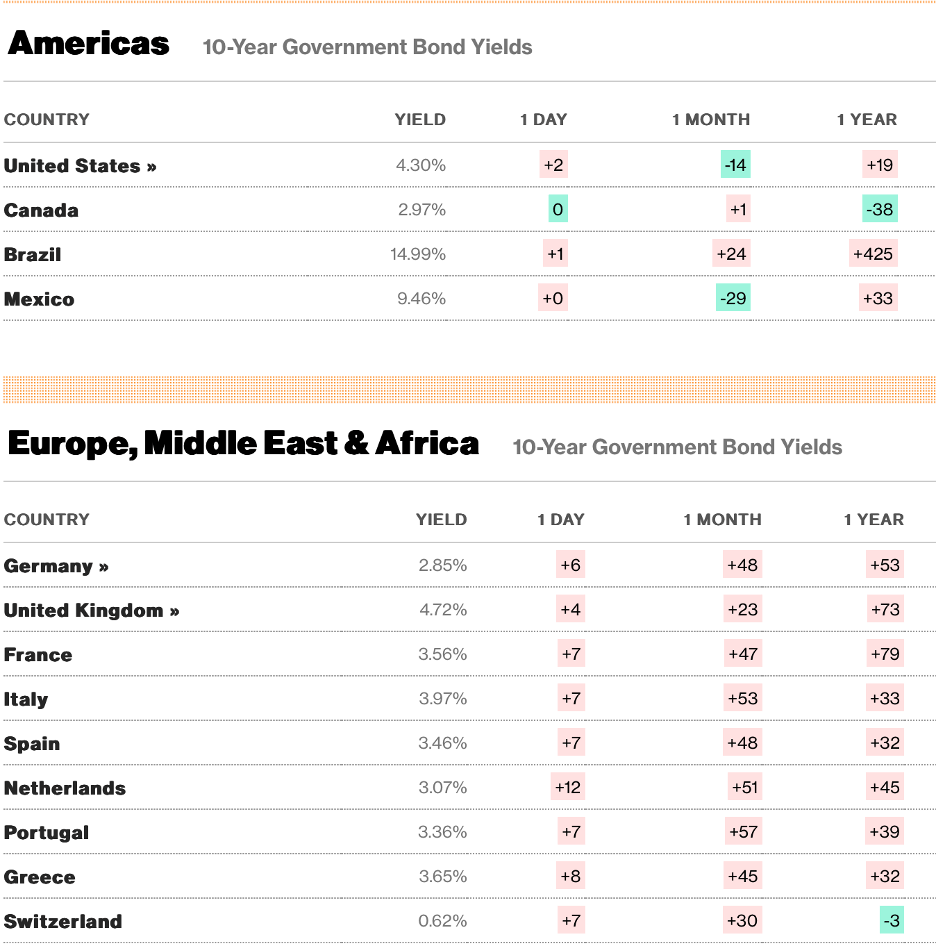

While my bond conversation was on the 30-year space, 10-year yields are only marginally higher, about 1bp, in the US and Europe although JGB yields did jump 6bps ahead of their Upper House elections this week.

In commodities, oil (+1.2%) continues to find support despite the ongoing theme that the economy is soft and supply is growing significantly with OPEC increasing production and set to return even more to the market by the end of the summer. As it happens, NatGas (+4.75%) is also higher this morning and continues to find substantial support as on a per BTU basis, it is desperately cheap vs. oil, something like one-seventh the price. In the metals markets, while gold (+0.4%) continues to see support, the real action is in silver (+1.4%) which has rallied very consistently, gapping higher as you can see in the chart below, and has been the subject of much discussion as to how far it can rise. Historically, silver lags the timing of gold rallies but far outperforms the gains in percentage terms.

Source: finance.yahoo.com

Finally, the dollar is little changed to a touch stronger this morning as traders cannot decide if tariffs are going to be a problem, or if deals are going to be struck. However, in the dollar’s favor right now is the fact that most other countries are in a clear easing cycle while the Fed remains firmly on hold. Fed funds futures are pricing less than a 7% chance of a cut this month and only a 61% chance of a September cut. If US rates continue to run higher than the rest of the world, and there is limited belief they are going to fall, the dollar will find support. However, given the pressure that President Trump continues to heap on Chairman Powell (there was a story this weekend that Powell is close to resigning, although my take is that is wishful thinking), it is hard to get excited about the dollar’s prospects. Remember this, all the economists who tell us that an independent central bank is critical work for central banks.

On the data front, after virtually nothing last week, we do get some important numbers this week.

| Tuesday | CPI | 0.3% (2.7% Y/Y) |

| -ex food & energy | 0.3% (3.0% Y/Y) | |

| Empire State Manufacturing | -8.0 | |

| Wednesday | PPI | 0.2% (2.5% Y/Y) |

| -ex food & energy | 0.2% (2.7% Y/Y) | |

| IP | 0.1% | |

| Capacity Utilization | 77.4% | |

| Fed’s Beige Book | ||

| Thursday | Initial Claims | 234K |

| Continuing Claims | 1970K | |

| Retail Sales | 0.1% | |

| -ex autos | 0.3% | |

| Friday | Housing Starts | 1.30M |

| Building Permits | 1.39M | |

| Michigan Sentiment | 61.4 |

Source: tradingeconomics.com

In addition to this, we hear from eight FOMC members, so it will be interesting to see if the erstwhile doves are willing to join Waller and Bowman in their call for a July rate cut. If we start to see momentum build for a July cut, something which is not currently evident, look for the dollar to suffer substantially. But absent that, I have a feeling we are going to range trade for the rest of the summer.

Good luck

Adf