No doubt it was President Xi

Who leaned on the PBOC

To cut rates at last

And try to recast

The tone of its cash policy

So, mortgage rates will be reduced

While bank reserves, too, will be juiced

But will cutting rates

Be what motivates

The people and give growth a boost?

It’s almost as though Pan Gongsheng, head of the PBOC, read my note yesterday morning and decided that it was time to really do something big! While obviously, we know that is not the case (at least I don’t see his name on my subscriber list), the PBOC definitely painted the tape last night with their actions. Fortunately, Bloomberg listed them for us as per the below:

- The seven-day reverse repurchase rate will be lowered to 1.5% from 1.7%

- RRR lowered by 0.5 percentage points, unleashing 1 trillion yuan in liquidity

- PBOC didn’t specify when RRR cut takes effect

- MLF expected to be cut by 0.3 percentage points

- Minimum down-payment ratio cut to 15% for second-home buyers, from 25%

- China may cut the RRR further this year by another 0.25 to 0.5 percentage points

- RRR cut won’t apply to small banks

- LPR and deposit rates to fall by 0.2 to 0.25 percentage points

- The PBOC to cover 100% of loans for local governments buying unsold homes with cheap funding, up from 60%

A glossary of terms is as follows:

- RRR is the reserve ratio requirement which describes how much leverage banks may take, with the lower the number equating to more leverage (need to hold fewer reserves).

- MLF is the medium-term lending facility which is the program that the PBOC uses to lend money to banks in China, and the rate had been the key interest rate for policy.

- LPR is the loan prime rate, the rate at which banks lend to their best clients

- Seven-day reverse repurchase rate is a relatively new rate that the PBOC uses for its monetary policy efforts, similar to the Fed funds rate, and is now deemed the PBOC’s key interest rate.

Now, that’s a lot of activity for a central bank in one day. Consider how long it takes the Fed to decide to raise or cut the Fed funds rate and compare that to just how much was done.

And that’s just the rate moves. In addition, they indicated they would lend up to CNY 500 billion for funds, brokers and insurers to buy Chinese shares and another CNY 300 billion for companies to buy back their own shares. Again, I find the irony of a strictly communist nation worrying about their stock market unbelievably delicious. So, the government is willing to roll out significant monetary stimulus, but as yet, has not been willing to inject fiscal stimulus. Arguably the biggest economic problem in China right now is that sentiment is weak as people are concerned over both their jobs and the value of their property, hence consumption remains weak overall. It is not clear what Xi can do to fix that problem, but cheap money is only effective if people and companies want to borrow and spend it. That remains to be seen, although the odds of China achieving its 5.0% GDP growth target for 2024 have improved now.

One other thought is that this likely would not have been possible for the Chinese had the Fed not cut 50bps last week. As I have consistently explained, once the Fed gets going, central banks everywhere will feel more comfortable cutting their own rates and easing policy further. At least in China, inflation is not a problem, so they have plenty of room to cut. However, elsewhere inflation has proven stickier than most central bankers would like to see. Nothing is yet carved in stone as to just how many rate cuts are in the offing.

As this was the only noteworthy story, let’s look at how it impacted markets everywhere. It can be no surprise that shares in China exploded higher given the explicit PBOC support with both the CSI 300 and Hang Seng rallying more than 4.1% on the session. As well, Chinese yields backed up a bit, off the lows I described yesterday, but only by a few basis points. As seen below, CNY (+0.4%) rallied nicely, trading to its strongest level since May 2023 and commodities rallied across the board with oil (+2.1%) and copper (+2.4%) the leaders although precious metals (Au +0.3%, Ag +0.8%) are also rising.

Source: tradingeconomics.com

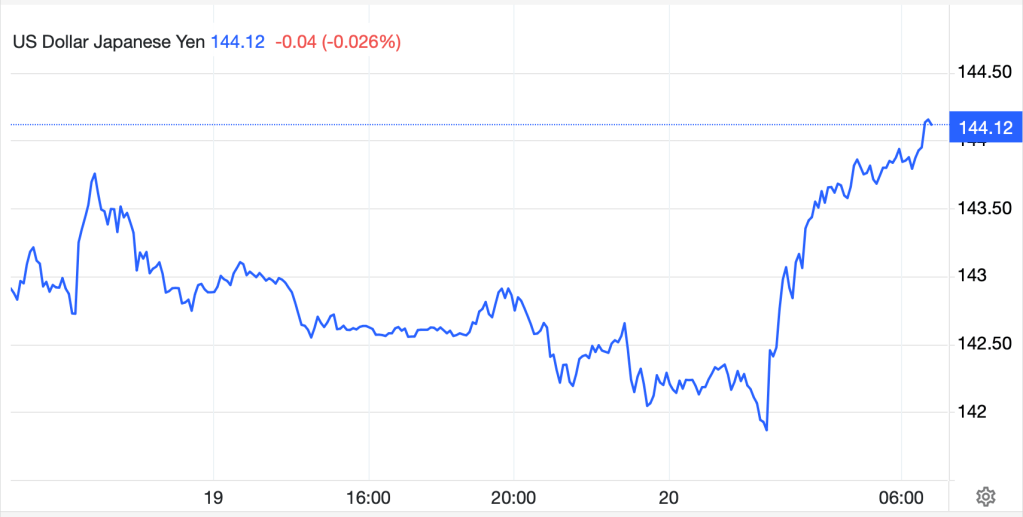

Perhaps the most interesting thing about this story is just how little it impacted non-Chinese markets. Japanese shares (Nikkei +0.6%) rallied but given the yen’s decline (-0.3%) overnight, that likely had a bigger impact on those shares. And the rest of Asia saw a mix of modest gains and losses, with Taiwan (+0.6%) and Korea (+1.1%) the next best performers although India, Australia and Singapore saw no benefit whatsoever. It appears they are awaiting the fiscal boost.

In Europe, though, shares are definitely feeling the love led by the CAC (+1.6%) although even the DAX (+0.75%) is rallying despite another series of lousy data, this time the Ifo surveys all printing weaker than last month and weaker than expectations. I guess given the importance of China as an export market for Germany, the PBOC news trumps the Ifo surveys from earlier this month. As to US futures, after very modest gains yesterday, although some more record highs, they are essentially unchanged at this hour (7:00).

In the bond market, Treasury yields continue to back up, higher by 3bps this morning and now 15bps off the lows pre-FOMC meeting. European sovereign yields are higher by 1bp across the board except for UK gilts (+4bps) as concerns grow that the fiscal situation in the UK may deteriorate more rapidly given the apparent confusion in the Starmer government about what to do to pay its bills. It is also worth noting that JGB yields have slipped 3bps this morning and are now back to levels last seen back in April before the BOJ’s policy tightening got somewhat serious.

As to the dollar, overall, it is on its back foot this morning although other than the renminbi, most of the moves have been 0.2% or less. Today’s story is CNY for sure.

On the data front, this morning brings Case-Shiller Home Prices (exp 5.8%) and Consumer Confidence (103.8). While there are no Fed speakers today, yesterday we heard from three (Goolsbee, Bostic and Kashkari) all of whom agreed with the 50bp cut last week and were mostly pushing for another one before the end of the year. It seems Goolsbee has taken the mantle of chief dove on the committee, explaining there are “hundreds” of basis points left to cut before they achieve the neutral rate, however neither of the other two indicated any hesitation to cut further. As of this morning, it is basically a 50:50 proposition as to 25bps or 50bps at the November 7th meeting according to the Fed funds futures market.

And that’s where we stand this morning. China has opened their coffers and are adding yet more liquidity to the global system. This should continue to help risk assets everywhere, and ultimately feed into inflation readings, although in China that is not a problem. But what about elsewhere? For now, it feels like the dollar is more likely to suffer given the dovish enthusiasm from the Fed speakers, but Thursday will bring 4 more speakers, including Chairman Powell, so perhaps we need to hear that before getting too excited.

Good luck

Adf