For those of a certain persuasion

Wednesday was a joyous occasion

Though CPI rose

The doves did propose

That rate cuts complete their equation

They claim that the speed of its rise

Is slowing, so Jay should surmise

It’s time to cut rates

Cause everyone hates

When stocks don’t make further new highs

Yesterday’s CPI reading was, on the surface, slightly softer than markets had been expecting. The headline reading of 2.9% was the slowest increase Y/Y since March 2022. Of course, back then we were repeatedly told inflation was transitory. However, looking at the chart below, created by wolfstreet.com, it seems pretty clear that the main driver of the recent decline in the CPI readings has been Durable Goods.

I guess it’s possible that durable goods prices continue to deflate going forward, but that seems unlikely, at least based on the historical record. While the auto industry, a key segment of the durable goods data, has obviously struggled lately, with significant unsold inventories of EV’s building up and dealer incentives to sell them driving prices down, if you’ve looked for a new washer/dryer or refrigerator lately, I haven’t seen the same price action for those goods. As to the largest driver of the CPI readings, the shelter component, those numbers were higher than last month and more in line with the overall trend we have seen there for the past several years. Owners Equivalent Rent, the biggest piece of this puzzle, rose 0.4% in July, just what it has been doing for the previous two plus years prior to the June reading.

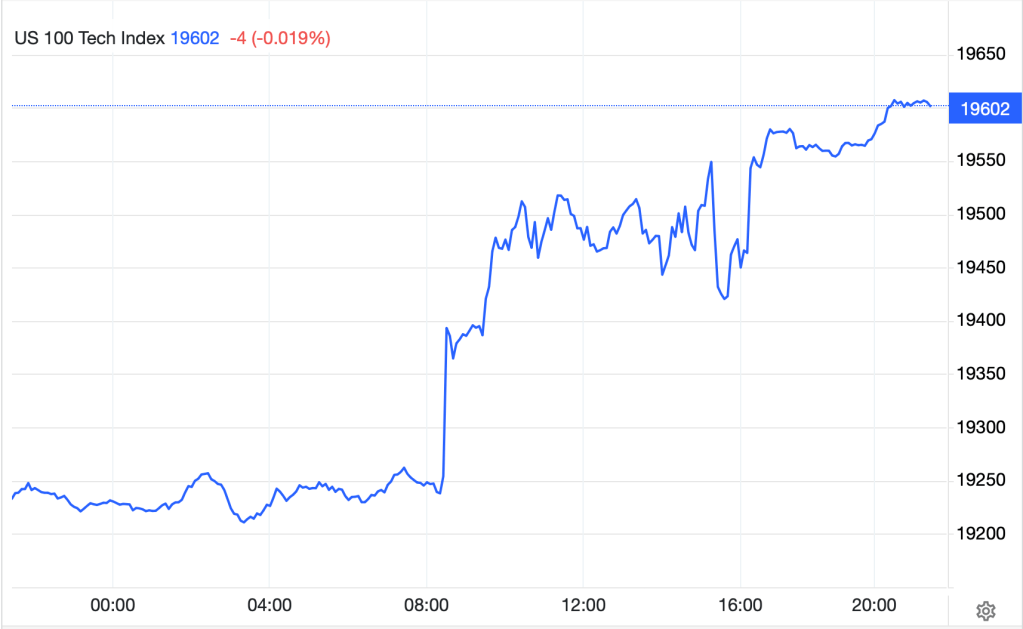

In the end, while it was nice to see a headline print below 3.0%, it is not clear to me that inflation is defeated. Other than the fact that Powell essentially promised he would be cutting rates next month, the data released since the last meeting is not screaming out for more support. Certainly, the employment report was softer than the forecasts, but it was not indicative that we are in a recession. And the CPI report, while ever so slightly softer than forecast, is also not a clear signal that things are collapsing in the economy. I’m pretty confident that Powell will cut next month, but absent some really awful August data, released in early September ahead of the next FOMC meeting, it seems like 25bps is all we should expect. Even the Fed funds futures market is slowly turning toward that view with the probability of a 50bp cut falling to 37.5% this morning.

The other news of note last night was the monthly Chinese data dump which was, on the whole, not very inspiring. The best news was that Retail Sales there rose 2.7% Y/Y in July, slightly more than expected. However, IP and Fixed Asset Investment were both weaker than forecast and weaker than last month although higher than Retail Sales. Meanwhile, Housing prices continue to decline, -4.9% Y/Y, and the Unemployment Rate ticked up to 5.2%. As yet, there has been no significant commentary from the government, but the ongoing weakness has encouraged some traders and investors to expect that President Xi will authorize some much larger stimulus in the near future. At least that’s the story behind the rally in the CSI 300 (+1.0%) last night, because there are few other highlights from the Middle Kingdom.

With this in mind, and as we await this morning’s US data releases, let’s tour the markets to see how things played out after the modest US equity rally yesterday. Aside from China, in Asia Japanese stocks did well (Nikkei +0.8%) although Hong Kong did not go along with the Chinese story. Australian employment data was released, arguably a touch better than expected but that good news reduced the chances for a rate cut so equities there only edged higher by 0.2%. As to the rest of the region, there were some gainers (Korea, New Zealand, Singapore) and some laggards (Taiwan, Indonesia).

In Europe this morning, the story is one of a seeming lack of interest with no major market having moved more than 0.2%, whether higher or lower, on the session. On the data front there, the UK GDP data was just a touch softer than the forecast, and the Y/Y output of 0.7% shows that problems remain in the economy. It will be interesting to see if the new government there can adopt policies that help rejuvenate the nation. As to the FTSE 100, it is basically unchanged on the day, arguably tension between weaker growth prospects clashing with hopes for rate cuts to support things. Meanwhile, on the continent there was nothing of note and no major movement. And lastly, US futures, at this hour (7:00), are little changed awaiting the US data.

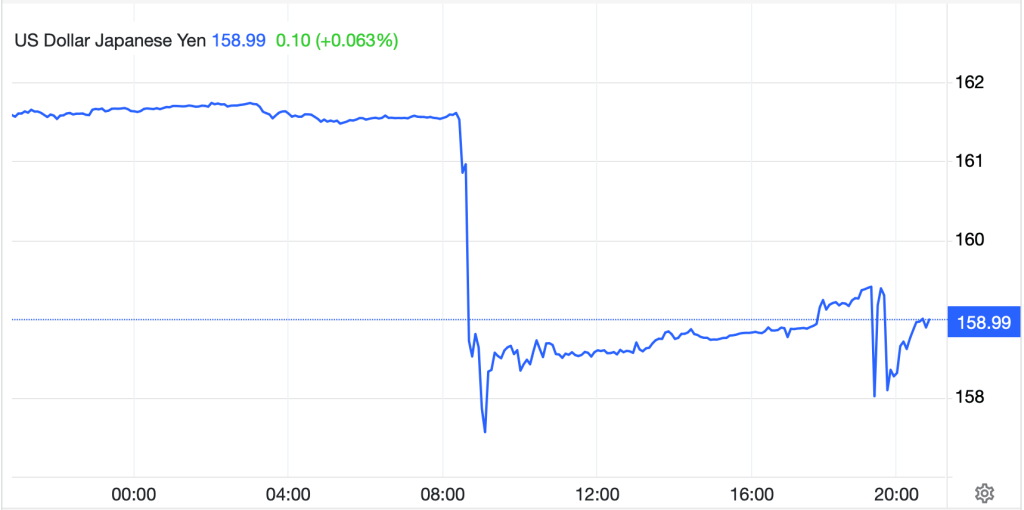

In the bond market, Treasury yields, after a little early gyration following the CPI release, basically closed the day unchanged and remain at those levels this morning. the yield curve remains mildly inverted, just -11bps this morning, but it seems it will require the Fed to actually cut rates, or much worse economic data, to get that process complete and normalize the curve. In Europe, sovereign yields are largely unchanged, or perhaps higher by 1bp this morning amid very little activity. Also, a quick look at JGBs shows that while the yield edged up 1bp overnight, the level is still just 0.82%. I would contend that any ideas of a quick normalization of interest rates in Japan are fading away.

In the commodity space, oil (+0.85%) is rebounding after data showed net draws across all products yesterday. Obviously, the Iran/Israel situation remains live, but it feels like markets are losing interest in that story. As to the metals, gold (0.4%) is recouping yesterday’s losses and both silver and copper are firmer this morning, not so much on the demand story, but more on the supply story with potential strikes at key mines in Chile and Peru.

As to the dollar, it is little changed, net, on the day, although it is no surprise to see the commodity bloc performing well (AUD +0.5%, ZAR +0.5%, NOK +0.4%). But away from those currencies, the euro is unchanged, though the pound (+0.3%) seems to be benefitting from the GDP data. The yen, too, is unchanged on the day while CNY (-0.2%) is under pressure from the weak data there. Again, I will note that CNY’s volatility has definitely increased over the course of the past several months. Partly this is because all currency volatility has moved higher, but I believe there is some real China specific aspect to this change. Beware as this could continue going forward.

On the data front, this morning brings a bunch here at home:

| Initial Claims | 235K |

| Continuing Claims | 1880K |

| Retail Sales | 0.3% |

| -ex autos | 0.1% |

| Empire State Manufacturing | -6.0 |

| Philly Fed | 7.0 |

| IP | -0.3% |

| Capacity Utilization | 78.5% |

Source: tradingeconomics.com

You may recall that last week’s Initial Claims number was seen as a savior when it printed a bit lower than forecasts. However, if the Unemployment Rate is truly heading higher, it would seem that we should see this number resume its climb. Right now, it is not clear to me if good news is good or bad and vice versa. Generically, the narrative still wants to push for as many rate cuts as quickly as possible, I think, but if the data starts to collapse, that will not be a positive either. I suspect that Retail Sales is today’s key release. A strong number there will further reduce the probability of a 50bp cut in September and may weigh on equity markets.

We also hear from St Louis Fed President Alberto Musalem this morning, one of the newer members of the FOMC who has not spoken much. However, he appears to be more on the hawkish side thus far. In my view, markets are looking for reasons to continue to push equities higher but are not getting all the love they need. The problem is that it is not clear what the right medicine for that is right now. Strong data may support the economy but reduces the probability of rate cuts, or at least the amount of rate cutting that will come. As to the dollar, it has been under some pressure of late and I think it will be very clear that weak data will encourage dollar selling and vice versa.

Good luck

Adf