On Friday, the data surprised

With job growth more than advertised

So, bonds took a bath

And stocks strode a path

Where growth is what’s now emphasized

But what of the soft landing story?

Will rate cuts now be dilatory?

If Jay just stands pat

Will stocks all go splat?

Or is this the new allegory?

Well, this poet was clearly wrong-footed by Friday’s employment report where not only were non-farm payrolls stronger than anticipated at 199K, but hours worked rose and the Unemployment Rate fell 2 ticks to 3.7%. While revisions to previous reports were lower, as they have been all year, the report did not point to an imminent slowing of the economy nor a recession in the near-term. Arguably, the soft-landing crowd made out best, as equity markets, which initially plunged on the report following Treasury prices, rebounded as investors decided that growth is a better outcome than not. Yields jumped higher, as would be expected, rising 8bps in the US with larger gains throughout Europe before they went home for the weekend. And finally, the dollar flexed its muscles again, rallying universally with gains against 9 of the G10 currencies, averaging 0.4% (only CAD (+0.1%) managed to hold its own) and against most of the EMG bloc with a notable decline by ZAR (-1.1%), although MXN (+0.6%) bucked the trend.

Does this mean the soft landing is coming? As we start the last real data intensive week of 2023, it remains the favored narrative, but is by no means assured. After all, before the end of this week we will have seen the latest CPI reading in the US (exp 3.1% headline, 4.0% core) and we will have heard from the FOMC, ECB and BOE as well as several smaller central banks like the Norgesbank and the SNB. And let us not forget that the BOJ meets next Monday. So, there is plenty of new, important information that is coming soon and will almost certainly drive potential narrative changes.

Perhaps an important part of the discussion is to define what we mean by a soft landing, or at least what the ‘market’ means by the concept. My best understanding is as follows: GDP slides to 1% or so, but never goes negative. Unemployment may edge higher than 4.0%, but only just, with a cap at the 4.2% or 4.3% area, and inflation, as measured by Core PCE finds a home between 2.0% and 2.5%. This result, measured inflation falling back close to target while the growth and employment story just wobbled a bit, would be nirvana for Powell and friends.

How likely is this outcome? Ultimately, history is not on their side as arguably the only time the Fed ‘engineered’ a soft landing was in 1995, and on an analogous basis they had already started cutting rates by this time in the cycle. The fact that we are still discussing higher for longer implies that there is much more pain likely to come than the optimists believe. We have already seen the first signs of trouble as the number of bankruptcies soar and stories about non-investment grade companies needing to refinance their debt at much higher interest rates than the previous round fill the news. Certainly, Friday’s employment data is encouraging for the economic situation, but the chink in the armor was the wage data which showed more resilience (+0.4%) than expected. Given the Fed’s focus on wages and their impact on inflation, the fact that wage growth remains well above the levels the Fed deems appropriate to meet their inflation target is not a sign that policy ease is coming soon.

And ultimately, I believe that is the critical feature here. The economy has held in remarkably well considering the pace and size of the interest rate changes we have already seen. The big unknown is how much of that interest rate change has really been felt by the economy. Obviously, the housing market has felt the impact, and to some extent the auto industry, but otherwise, it is not as clear. Do not be surprised if this period of slow economic activity extends for a much longer time than in the past as the drip of companies that find themselves unable to refinance at affordable rates slowly grows. By 2025, about $1 trillion of corporate debt that was issued at much lower interest rates will need to be refinanced. I’m not worried about Apple refinancing their debt, but all the high-yield debt that was snapped up with a 4% or 5% handle during the period of ZIRP will now be at 10% or so and it is an open question if those business models will be functional with financing that expensive.

So, perhaps, the story will be as follows: economic activity is going to muddle along at low rates for an extended period, another 2 or 3 quarters, until such time as the debt ‘time-bomb’ explodes with refinancing rates high enough to force many more bankruptcies and start a more aggressive recessionary cycle with layoffs leading to rapidly rising Unemployment rates and economic activity falling more sharply. In this timeline, we are talking about the recession becoming clear in Q3 of 2024, a time when most of that $1 trillion of corporate debt will be current. While interest rates will certainly be slashed at some point, this does not bode well for risk assets in the second half of 2024. For now, though, it certainly seems like the current narrative is going to continue.

There’s no urgency

To change policy quite yet

But…some day we will

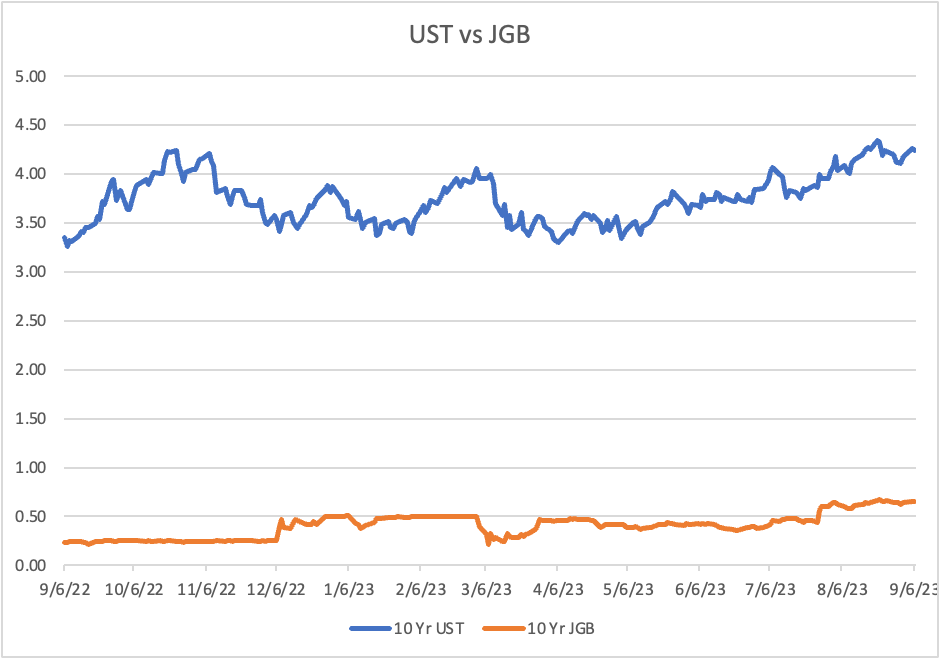

A quick story about the BOJ which last night pushed back firmly against the growing narrative that they were about to start normalizing interest rate policy with a rate hike in either December or January. Instead, several stories were released that described the recent decline in both GDP and inflation as critical and the fact that they still don’t have enough information with respect to wages in Japan, given the big spring wage negotiation has not yet happened, to make a decision. In other words, the BOJ was successful at convincing markets to behave as the BOJ wants, not as the rest of the world wants. The upshot was that the yen weakened sharply (-0.9%) while the Nikkei rose 1.5% and JGB yields were unchanged. The BOJ pivot remains one of the biggest themes in the macro community, mostly because it is seen as the place where the largest profits can be made by traders. But my experience (4 years working for a Japanese bank) helps inform my view that whatever they do will take MUCH longer to happen than the optimists believe.

Ok, let’s try a quick trip around markets here for today. Aside from Japan, most of Asia had a good equity session with Hong Kong (-0.8%) the only real laggard. Remember, a key story there remains the Chinese property sector as many of those firms are listed in HK. Meanwhile, European bourses are mixed although movements haven’t been very large in either direction. The worst situation is the UK (FTSE 100 -0.5%), while we are seeing some gains in the CAC and DAX, albeit small gains. Finally, US futures are pointing a bit lower, -0.2%, at this hour (7:45).

In the bond market, after Friday’s dramatic price action, Treasury yields are continuing to rise, up 5bps this morning, although European sovereign yields are little changed on the day, with the bulk of them slipping about 1bp. Given most saw quite large moves on Friday, and given the imminent policy decisions by the big 3 central banks, I suspect traders are going to be quiet for now.

Oil prices (-0.3%) are slipping slightly this morning but are mostly consolidating Friday’s gains. On the metals front, though, everything is red with gold, silver, copper and aluminum all under pressure. Again, this is the one market that has been pricing a recession consistently for the past several months while certainly equity markets have a completely different view.

Finally, the dollar is continuing to rebound on the strength of rising Treasury yields. While the euro is little changed on the day, the yen is driving price action in Asia with weakness also seen in CNY, KRW and TWD. As well, ZAR (-0.8%) continues to suffer on weaker commodity pricing and both MXN and BRL are under pressure leading the LATAM bloc lower. At this point, I would say the FX market has more faith in Powell’s higher for longer mantra than some other markets.

As mentioned, there is a lot of data this week:

| Today | NY Fed Inflation Expectations | 3.8% |

| Tuesday | NFIB Small Biz Optimism | 90.9 |

| CPI | 0.0% (3.1% Y/Y) | |

| -ex food & energy | 0.3% (4.0% Y/Y) | |

| Wednesday | PPI | 0.1% (1.0% Y/Y) |

| -ex food & energy | 0.2% (2.3% Y/Y) | |

| FOMC Rate Decision | 5.5% (unchanged) | |

| Thursday | ECB Rate Decision | 4.5% (unchanged) |

| BOE Rate Decision | 5.25% (unchanged) | |

| Retail Sales | -0.1% | |

| -ex autos | -0.1% | |

| Initial Claims | 221K | |

| Continuing Claims | 1891K | |

| Friday | Empire State Manufacturing | 2.0 |

| IP | 0.3% | |

| Capacity Utilization | 79.2% | |

| Flash PMI Manufacturing | 49.1 | |

| Flash PMI Services | 50.5 |

Source tradingeconomics.com

Thursday also has the Norges Bank and SNB, both of whom are expected to leave rates on hold. For today, it strikes me that the discussion will continue as pundits try to anticipate what the FOMC statement will say and how Powell sounds in the press conference. As such, it is hard to get excited that there is going to be a big move in either direction. With all that in mind, my overall read on the economy is that while we may muddle along in the US for a while yet, it will be better than many other places in the world, notably the EU, the UK and China, and so the dollar is likely to hold up far better than most expect…at least until Powell changes his tune.

Good luck

Adf