In Washington, Cook feels the heat

As Trump wants a change in her seat

In Paris, the sitch

For Macron’s a bitch

As confidence there’s in retreat

These two stories plus so much more

Explain that we’re in, Turning, Four

So, all that we knew

Seems no longer true

Instead, there’s political war

The dichotomy between the general lack of price volatility in markets and the increase in political volatility over policy choices and requirements around the world is truly remarkable. However, just like so much else that many have assumed as a baseline process for so long, this relationship appears to be changing as well. These changes have historical precedence, as documented by Neil Howe and William Strauss back in 1997 in their seminal book, The Fourth Turning.

Perhaps this is the best definition of what the Fourth Turning is all about [emphaisis added]:

“In the recurring loop of modern history, a final, perilous era arrives once each lifetime. It is marked by civic upheaval and national mobilization, both traumatic and transformative. That era, reshaping the social and political landscape, is unfolding now.”

Now, read that and tell me it is not a perfect description of what we are seeing daily, not just in the US, but around the world. If you wondered why all the models that had been built about many things, whether financial, economic or governmental are no longer offering accurate forecasts, I would point to this as the underlying premises are going through the throes of change.

For instance, consider President Trump and his relationship with the Fed. We already know that he and Chairman Powell are at odds and have been so for months over Powell’s reluctance to cut rates. But his attacks on the Fed are unceasing, and last night he ‘fired’ Governor Lisa Cook for cause. That cause being the allegations that she committed mortgage fraud, which if true is certainly a concern for a Federal Reserve Board Governor. But this has never been attempted before so will involve legal wrangling which we will watch over the next many months.

Now, some of you may remember the last time there was a scandal at the FOMC, where two different regional Fed presidents, Dallas’s Robert Kaplan and Boston’s Eric Rosengren, were trading S&P 500 futures in their personal accounts prior to FOMC announcements of which they had inside knowledge. Both did step down and allegedly the Fed has tightened its controls on that issue as they tried to sweep it under the rug, but let’s face it, Fed members are no angels.

I have no idea how this will play out, although I suspect that Governor Cook will eventually resign as the one thing at which President Trump excels is applying public pressure. While Powell is an experienced public figure, Ms Cook was a professor at Michigan State, not exactly a spot where you feel the withering heat of a Trumpian attack on a regular basis. Of course, if she did lie on her mortgage applications, that is a tough look for someone charged with overseeing the financial system.

But that is just the latest issue in the US, at least involving financial markets. This Fourth Turning is coming alive all around the Western World, perhaps no place more than Paris this morning. There, PM Bayrou has called for a confidence vote in order to gain the power to pass an austerity budget that cuts €44 billion from spending. While at this point, it seems long ago, his predecessor PM, Michel Barnier, lasted just 99 days with his minority government and was ousted last December. While Bayrou has made it for 9 months, it appears his odds of making it for a full year are greatly diminished now as all the opposition parties have promised to vote against him. Recall, he leads a minority government and if he loses the vote, there will be yet another set of elections in France.

Again, this is emblematic of a Fourth Turning, where systems and institutions that have been operating for decades are suddenly coming apart. From our perspective, the impact is more direct here with French equity markets (CAC -1.5%) falling sharply (see below) while French government bond yields soar.

Source: tradingeconomics.com

In fact, French 10-year yields now trade above almost all other EU nations including Greece and Spain, although Italian yields are still a touch higher. Consider that during the European bond crisis of 2011-12, France was considered one of the stronger nations. Oh, how the mighty have fallen!

Source: tradingeconomics.com

Again, my point is that much of what we thought we understood about how markets behave on both an absolute and relative basis is changing because the institutions underlying the Western economy are undergoing massive changes. This is not merely a US phenomenon with President Trump, but we are seeing a growing nationalist fervor throughout the West as populations throughout Europe, and even Japan, increasingly reject the culmination of what has been described as the globalist agenda. As John Steinbeck has been widely quoted, things can change gradually…and then suddenly.

So, let’s look at how other markets behaved overnight following the weakness in US equity markets yesterday. Asian markets followed suit lower (Tokyo -1.0%, Hong Kong -1.2%, China -0.4%, Korea -1.0%, India -1.0%) with essentially the entire region in the red. Europe, too, is under pressure this morning and while France leads the way, Germany (-0.4%), Spain (-0.8%) and the UK (-0.6%) are all declining in sync. However, at this hour (7:10) US futures are essentially unchanged, so perhaps things will stabilize.

Those yields I picture above represent modest declines from yesterday’s levels, although that is only because European yields yesterday mostly climbed between 5bps and 7bps across the board. As to Treasury yields, they are higher by 2bps this morning, but remain below 4.30%, so are showing no signs of a problem.

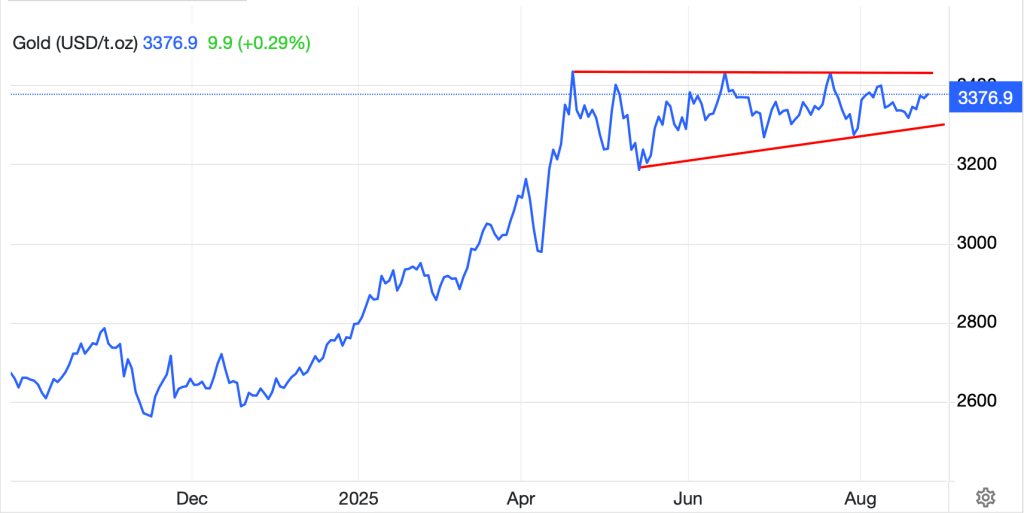

In the commodity markets, oil (-1.8%) is giving back all its gains from yesterday and a little bit more, but in the broad scheme of things, continues to trade in its recent range. The one thing to watch here is Ukraine’s increasing ability to interrupt Russian production and shipment of oil via long-range drone strikes, as if they continue to be successful, it may well start to push prices above their recent cap at $70/bbl. That is, however, a big if. It is getting pretty boring describing metals markets as gold (+0.3%) has been trading in an increasingly narrow range as per the below chart. This has been ongoing since April and feels like it could last another 5 months without a problem. Silver’s chart is similar, albeit not quite as narrow a range.

Source: tradingeconomics.com

Finally, the dollar is a touch softer this morning, slipping against the euro (+0.3%), pound (+0.2%), and yen (+0.2%) with most of the rest of the G10 having moved less than that. NOK (-0.3%) is the outlier following oil lower. In the EMG bloc, +/- 0.3% is the range for the entire bloc today, so it appears that traders like other G10 currencies today for some reason I cannot fathom.

On the data front, we see Durable Goods (exp -4.0%, +0.2% ex Transport) as well as Case Shiller Home Prices (2.1%) and then Consumer Confidence (96.2). Speaking of Consumer Confidence, in France this morning the latest reading was released at 87.0, three points lower than forecast and clearly trending down. Perhaps the government’s problems are feeding into the national psyche.

Source: tradingeconomics.com

It is difficult to get excited by markets during the last week of August, and if we add the time of year, when vacations are rife, to the ongoing White House bingo outcomes, the best position seems to be no position at all. As to the dollar, if the Fed does start to ease policy at this time, with inflation still sticky, I do foresee a decline. However, it is very difficult to look around the world and think, damn, I want to own THAT currency, whatever currency that might be. Perhaps the one exception would be the Swiss franc, where they really do work to have sane monetary policies.

Good luck

Adf