The news of the day is that gold

Is actively bought, never sold

The Four Thousand level

Led some folks to revel

And drew many more to the fold

But weirdly, the dollar keeps rising

Which based on the past is surprising

The problems in France

And Sanae’s stance

Have been, for the buck, energizing

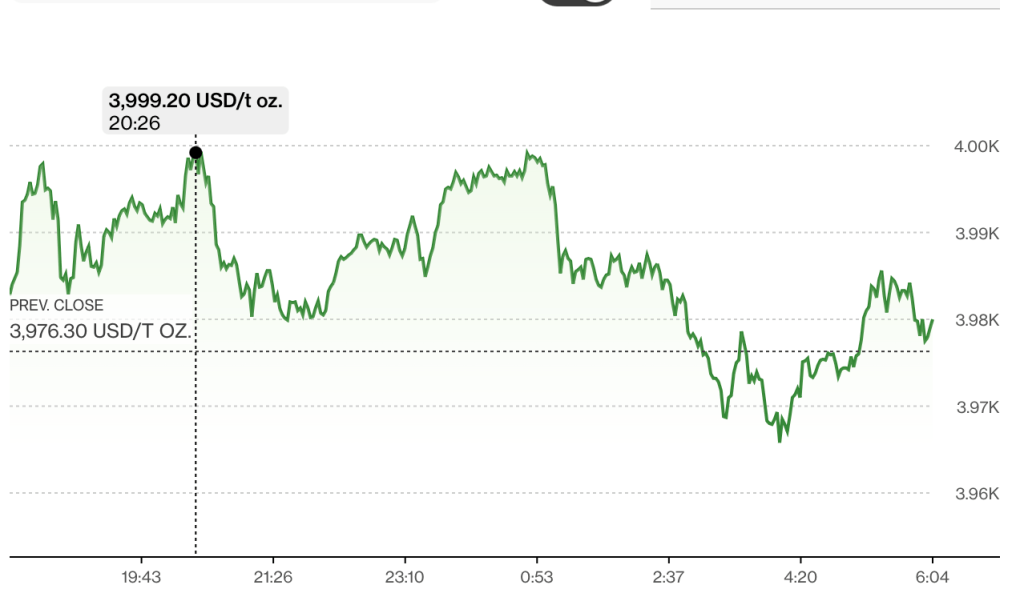

A month ago, many Wall Street analysts came out with forecasts that gold could trade as high as $4000/oz by mid 2026 as they reluctantly jumped on the bandwagon. But, by many accounts, although my charts don’t show it, the barbarous relic’s futures contract traded a bit more than 120 lots at $4000.10 last night, nine months earlier than those forecasts.

Source: Bloomberg.com

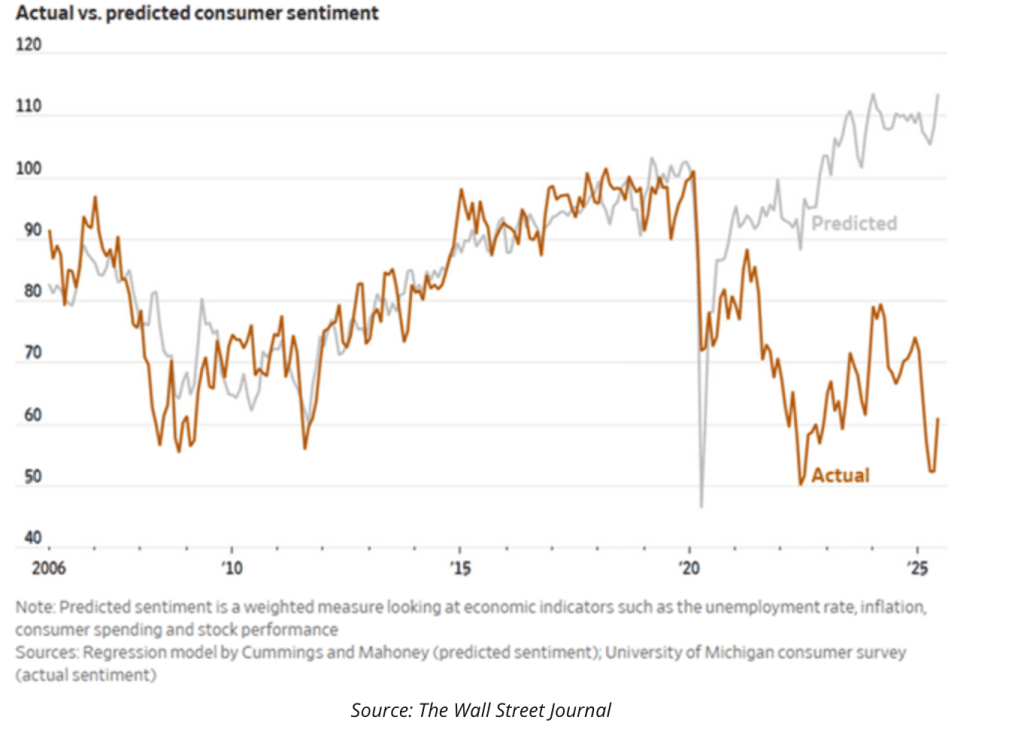

Right now (6:20), the cash market is trading at $3957 (-0.1%) but there is absolutely no indication that the top is in. Rather, I have been reading about the new GenZ BOLD investment strategy, which is buying a combination of Bitcoin and gold. Mohammed El-Arian nicknamed this the debasement trade, which is a fair assessment and a number of banks have been jumping on this theme.

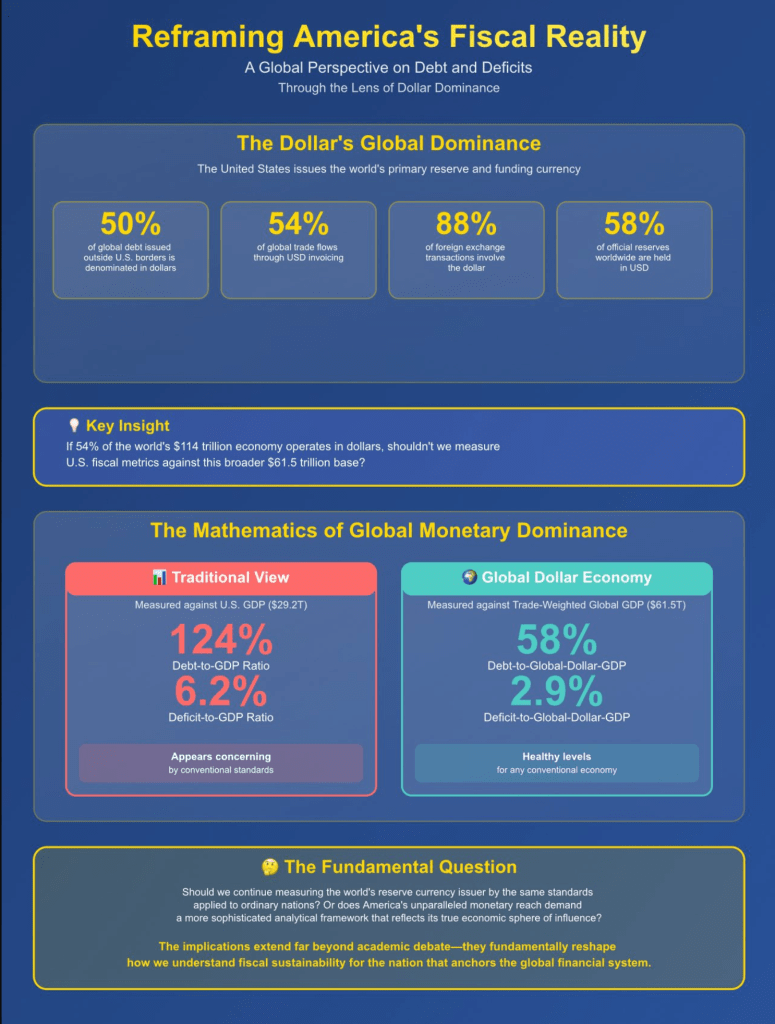

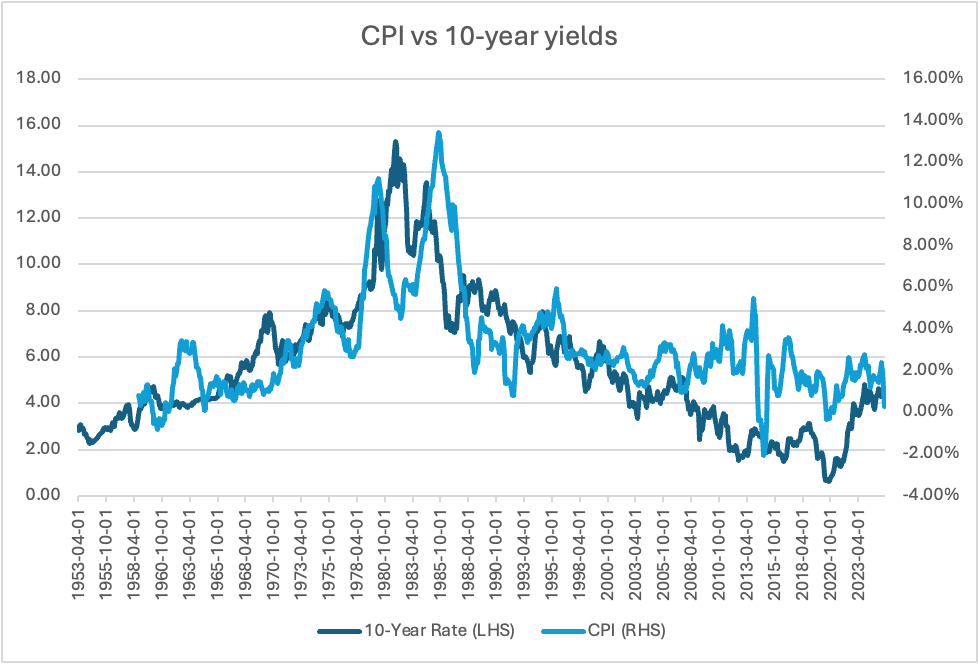

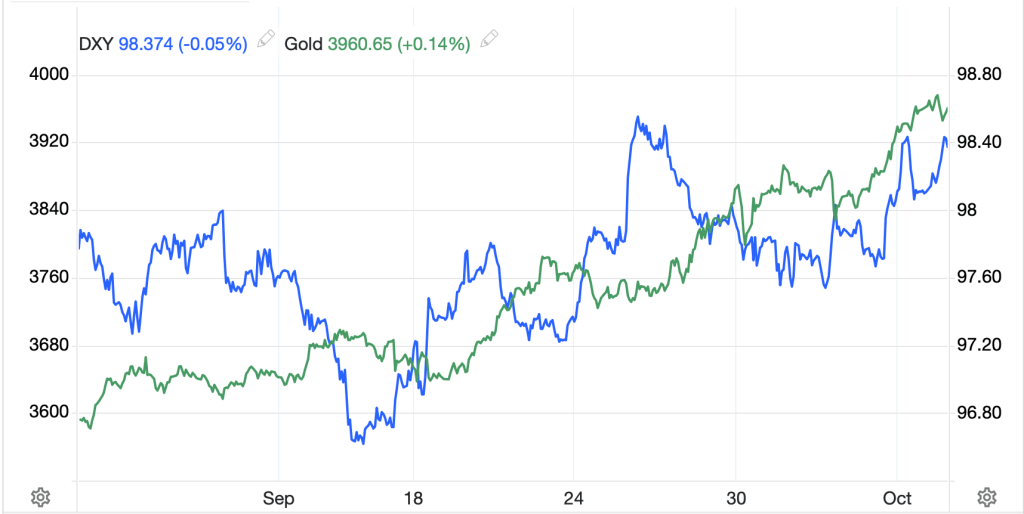

Perhaps more interesting than this story, which after all is simply rehashing the fact that gold is seen as a long-term hedge against inflation, is the fact that the dollar is trading higher alongside gold, which is typically not the case. In fact, for the bulk of my career, gold was effectively just another currency to trade against the dollar, and when the dollar was weak, foreign currencies and gold would rise and vice versa. But look at these next two charts from tradingeconomics.com, the first a longer term view of the relationship between gold and DXY and the second a much shorter-term view.

The one-year history:

Compared to the one-month history:

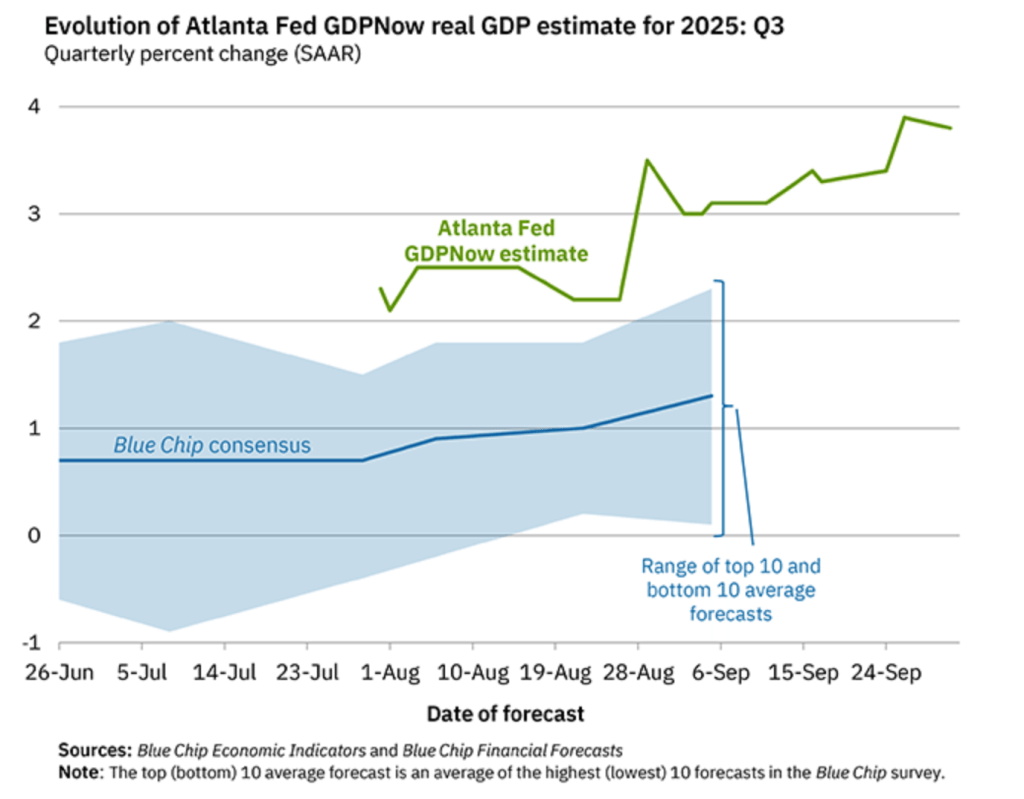

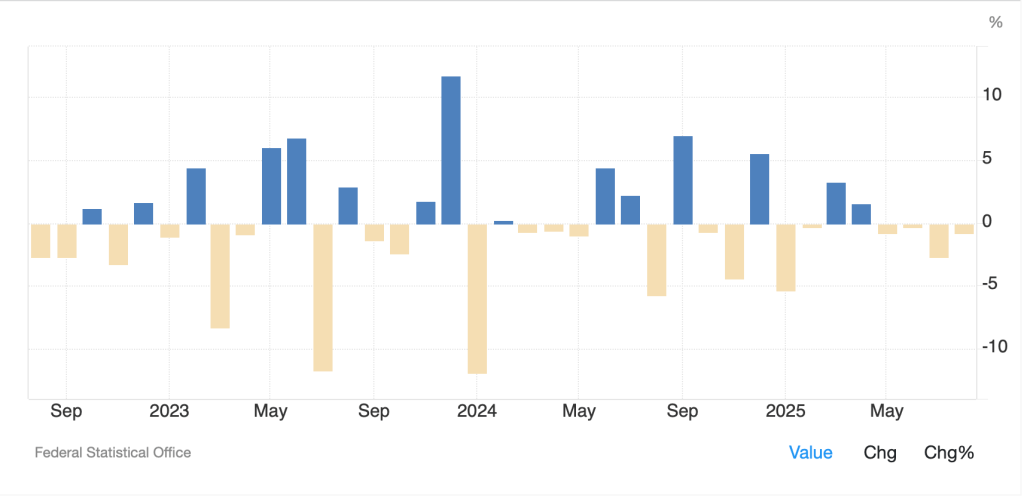

I believe it is fair to say that while there is a clear concern about, and flight from, fiat currencies, hence the strength of precious metals as well as bitcoin, in the fiat universe, the dollar remains the best of a bad lot. Yesterday I described the problems in France and how the second largest nation in the Eurozone was leaderless while trying to cope with a significant spending problem amid broad-based political turmoil. We have discussed the problems in Germany in the past, and early this morning, the fruits of their insane energy policies were shown by another decline in Factory Orders, this time -0.8%, far less than the 1.7% gain anticipated by economists. I don’t know about you, but it is difficult for me to look at the below chart of the last three years of Germany’s Factory Orders and see a positive future. Twenty-two of the thirty-six months were negative, arguably the driving force behind the fact that Germany’s economy has seen zero growth in that period.

Source: tradingeconomics.com

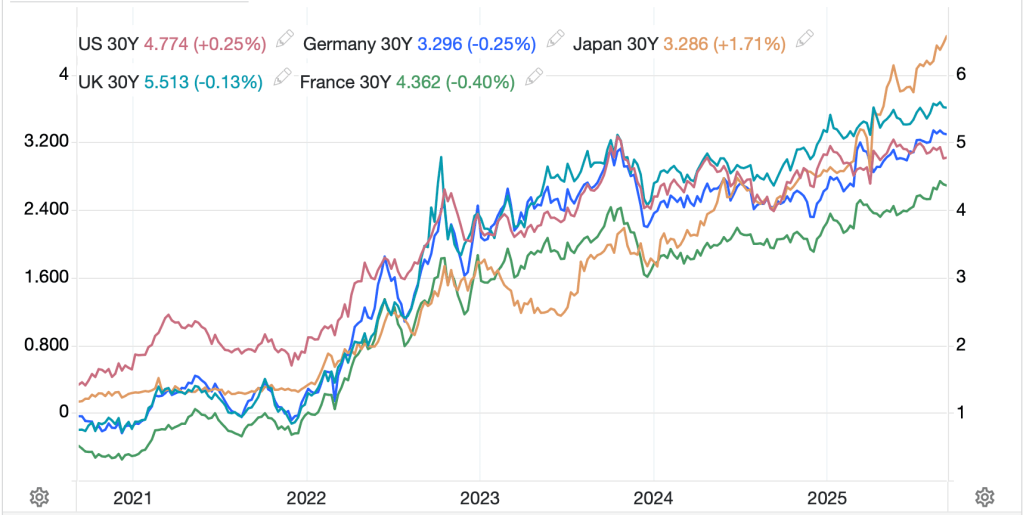

Meanwhile, the yen continues to weaken, pushing toward 151 now and quite frankly, showing limited reason to rebound anytime soon. Takaichi-san appears to be on board with the “run it hot” thesis, looking for both monetary and fiscal stimulus to help Japan grow itself out of its problems. The JGB market has sussed out there will be plenty more unfunded spending coming down the pike if she has her way as evidenced by the ongoing rise in the long end of the curve there. While the 30-year bond did touch slight new highs yesterday, the 40-year is still a few basis points below its worst level (highest yield) seen back in mid-May as you can see in the chart below. Regardless, the chart of JGB yields looks decidedly like the chart of gold!

Source: tradingeconomics.com

In a nutshell, there is no indication the fiscal/financial problems around the world have been addressed in any meaningful manner and the upshot is that more and more investors are seeking safety in assets that are not the responsibility of governments, but either private companies or have inherent intrinsic value. This is the story we are going to see play out for a while yet in my view.

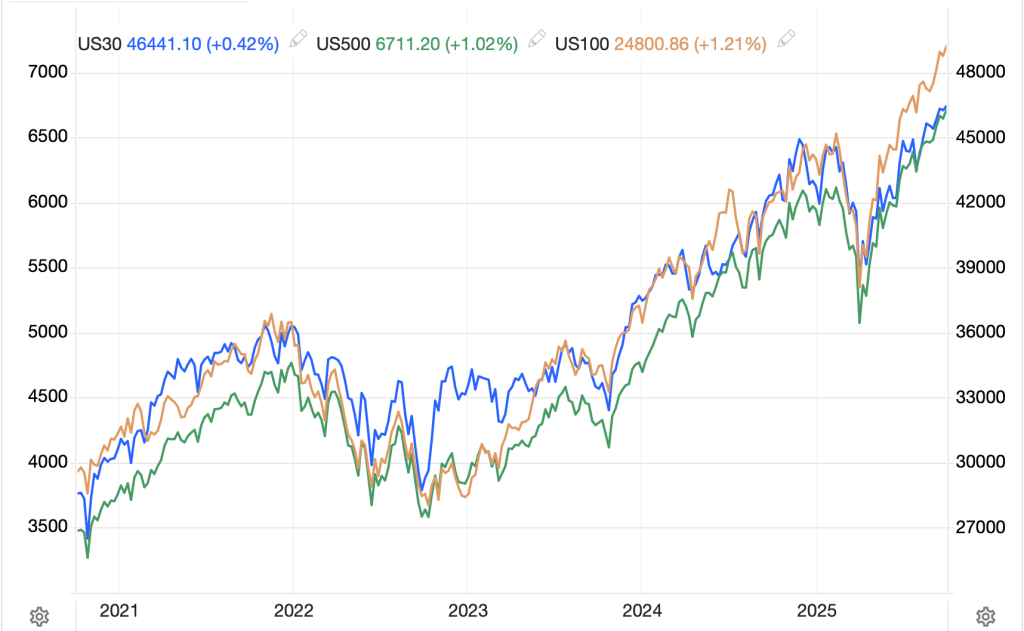

Ok, so, let’s look at how markets overall behaved in the overnight session. China remains on holiday, but it will be interesting to see how things open there on Thursday morning local time. Japan, was unchanged overnight, holding onto its extraordinary post-election gains. As to the other bourses there, holidays abound with both Hong Kong and Korea closed last night and the rest of the region net doing very little. Clearly the holiday spirit has infected all of Asia! In Europe, though, we are seeing very modest gains across the board despite the weak German data. The DAX (+0.2%) has managed a gain and we are seeing slightly better performance in France (+0.4%) and Spain (+0.4%) with the UK (+0.1%) lagging slightly. On the one hand, these are pretty benign moves so probably don’t mean much, but it is surprising there are rallies here given the ongoing lousy data coming from Europe. As to US futures, at this hour (7:20), they are all pointing higher by just 0.1%.

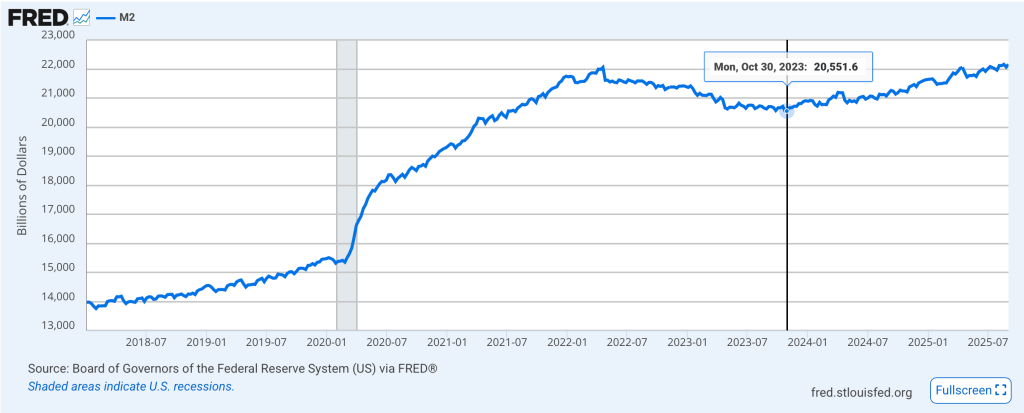

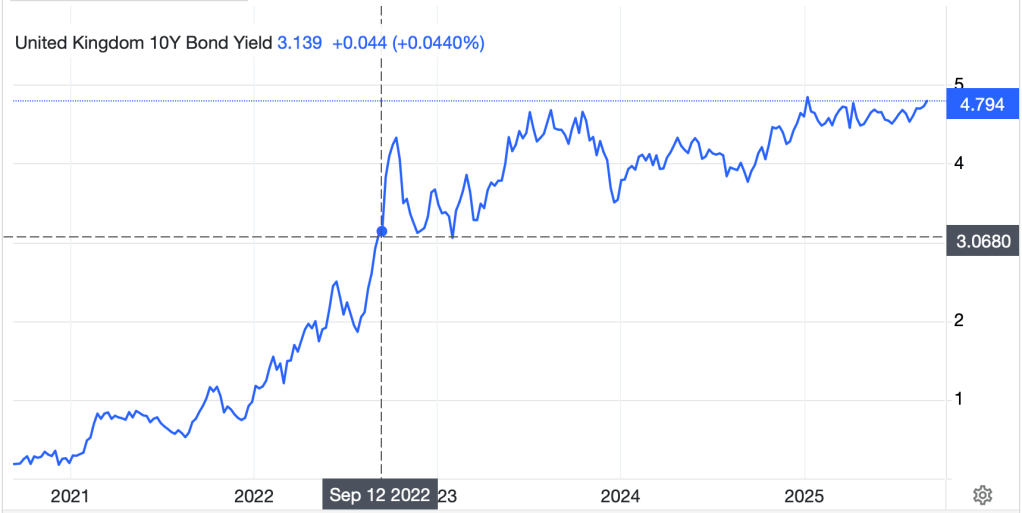

In the bond market, yields are continuing to edge higher with Treasuries (+2bps) leading the way and European sovereigns following along with yield there higher by between 2bps and 3bps. There continues to be a disconnect between what appear to be government policies of “run it hot” and bond investors, at least at the 10-year maturity. Either that or there is some surreptitious yield curve control ongoing to prevent some potentially really bad optics.

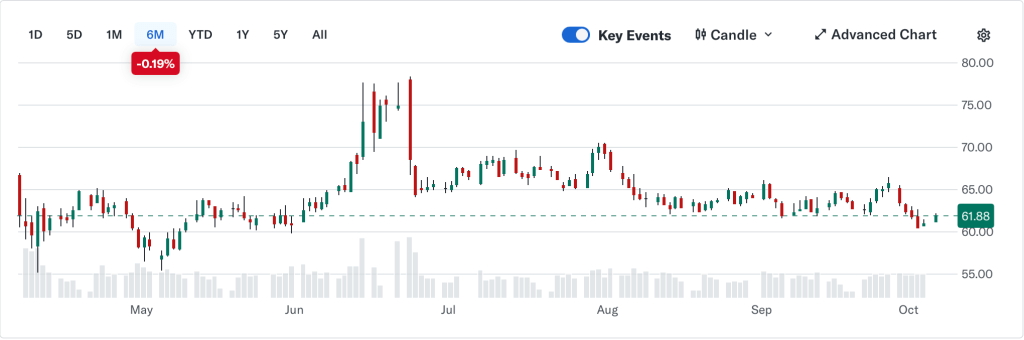

In the commodity markets, oil (+0.1%) is still firmly ensconced in its recent range with no signs of a breakout. I read a remarkably interesting article from Doomberg (if you do not already get this, it is incredibly worthwhile) this morning describing the methods that the Mexican drug cartels have been heavily involved in the oil business in Mexico, siphoning billions of dollars from Pemex and funding themselves, and more importantly, how the US was now addressing this situation. This is all of a piece with the administration’s view that the Americas are its key allies and its playground, and it will not tolerate the lawlessness that has heretofore been rampant. It also implies that if successful, much more oil will be coming to market from Mexico, and you know what that means for prices. As to the metals markets, they are taking a breather this morning with gold (-0.1%) and sliver (-0.3%) consolidating after yesterday’s rally. We discussed gold above, but silver is about $1.50 from the big round number of $50/oz, something that I am confident will trade sooner rather than later.

Finally, the dollar is rallying again with the euro (-0.5%) and pound (-0.6%) both under pressure and dragging the rest of the G10 with them. If the DXY is your favorite proxy, as you can see from the chart below, this is the 4th time since the failed breakout in late July that the index is testing 98.50 from below. It seems there is some underlying demand, and I would not be surprised to see another test of 100 in the coming days.

Source: tradingeconomics.com

It should be no surprise that the CE4 currencies are all under pressure this morning and we have also seen weakness in MXN (-0.3%) and ZAR (-0.3%) although given the holidays in Asia, it is hard to make a claim there other than that INR (-0.1%) continues to steadily weaken and make new historic lows on a regular basis.

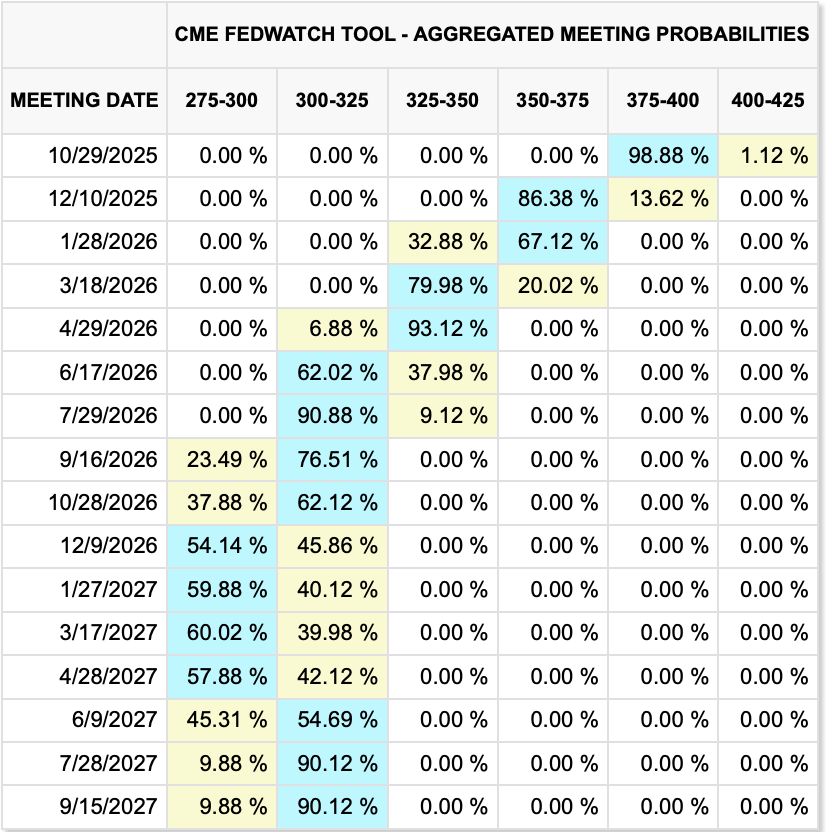

With the government shutdown continuing, there is still no official data although there is a story that President Trump is willing to have more talks with the Democrats. We shall see. I think the biggest problem for the Democrats in this situation is that according to many polls, nobody really cares about the shutdown, with only 6% registering any concern. It is a Washington problem, not a national problem. Of course, FOMC members will continue to speak regardless of the shutdown and today we hear from four more. Interestingly, nothing any of them said yesterday was worthy of a headline in either the WSJ or Bloomberg which tells me that there is nothing coming from the Fed that matters.

Running it hot means that we will continue to see asset prices rise, bond prices suffer, and the dollar likely maintain its current level if not rally a bit. We need a policy change somewhere to change that, and I don’t see any nation willing to make the changes necessary. I have no idea how long this can continue, but as Keynes said, markets can remain irrational longer than you can remain solvent. Be careful betting against this.

Good luck

Adf