While waiting for Jay and the Fed

And CPI data on Wed

This week’s 3-year note

Was less than the GOAT

Though risk assets still moved ahead

But talk from some sources of late

Exhibit concern ‘bout the fate

Of how the US

Will deal with excess

Supply of bonds as they inflate

Since we observe market activities daily, though we remain subject to surprising outcomes (see Friday’s NFP results), there are more consistent features that offer a hint of how the mechanics of financial markets are working, and whether those mechanics are running smoothly or a bit creakier.

Arguably, the thing getting the most press is Nvidia’s stock price, as its continued rapid rise has resulted in the company now representing ~6.5% of the market capitalization of the S&P 500. Along with Apple and Microsoft, all currently having market caps > $3 trillion, we are looking at three companies representing nearly 20% of the S&P 500. This is unprecedented and many (including this poet) believe that it is unsustainable in the long run, and probably the medium run.

But another key market, arguably the most important when discussing the financial markets and the Fed, is the US Treasury market. Countless hours are devoted to dissecting each tick and how movements in the yields of various maturity bonds may impact the economy and overall market sentiment. With this in mind, when new securities are auctioned, it is always worth a look. So, yesterday, the Treasury issued $53 billion of 3-year notes at a yield of 4.659%. The underlying characteristics of this auction were not particularly encouraging for a Treasury that will be issuing 10-year and 30-year bonds as the week progresses, as well as another $trillion this year.

The numbers that are most closely watched are the tail (the difference between the market estimate of the final yield prior to the auction and the actual results) which was at 1.1bps, a full basis point above the average tail of the past 6 months, an indication that demand was lacking. As well, the bid to cover ratio (how many $ of bids were received vs. the $53 billion offered) fell to 2.43X, well below the average over the past 6-months of auctions. Dealers were saddled with nearly 20% of the paper and overall, domestic demand was not very robust.

This gets highlighted because these little data points are often harbingers of bigger problems to come. After all, if there is a dearth of demand for US Treasury paper, even short-dated paper like 3-year notes, that bodes quite ill for the US government, as well as for global financial markets. Remember, US Treasury paper is the baseline for virtually all debt issuance around the world. If it fails here, it will be GFC 2.0 or worse.

Why, you may ask, is this becoming an issue? Well, one answer would be that the US’s current financial profligacy is starting to be discussed in quite negative terms at key institutions around the world. For instance, the IMF’s managing director, Kristalina Georgieva, has expressed concern recently that the US is essentially hogging all the borrowing capacity around the world. As well, Banque de France governor, Francois Villeroy de Galhau, explained, “U.S. fiscal policy is the elephant in the room: it is not in the hands of the Fed, and could significantly affect the level of long-term interest rates. A large U.S. fiscal deficit tightens financial conditions and fuels inflation.”

The point is that while Secretary Yellen, and Chair Powell, will not even discuss the potential ramifications of excess US government borrowing, it is being noticed in the halls of power elsewhere in the world, as well as on trading floors and in investment meetings at major asset managers. This is not to say that anything dramatic is going to happen anytime soon, but death by a thousand cuts is still death. Remember this, whatever the Fed’s mandate may say about price stability and maximum employment, I assure you, their number one priority, by miles and miles, is a smoothly working Treasury bond market. A 1 basis point tail may not seem to be much, but like the little boy in Holland with his finger in the dike, it may foretell bigger problems to come.

The reason I can focus on minutiae like the details of a Treasury auction is that there is so little else ongoing from a macro perspective right now. With US CPI to be released tomorrow and the FOMC meeting, statement and subsequent Powell press conference coming later tomorrow afternoon, most market participants are effectively holding their collective breath waiting for new information.

So, let’s review the overnight activity, which was not that exciting. After modest gains in the US yesterday, Asia couldn’t seem to follow except for Japan (+0.25%) with most of the rest of the region selling off, notably the Hang Seng (-1.0%) and Australia (-1.3%). European bourses, too, are under pressure across the board this morning with Spain (-1.4%) leading the way, but all the other large markets lower by at least -0.7%. There is a rumor that French President Macron may resign if the RN wins the election at the end of the month and the first polling shows that Marine Le Pen’s group will win a plurality of votes, but not necessarily a working majority. This will obviously be a major focus of markets going forward as regardless of who is in charge, it would be reasonable to expect many of the key issues that have driven this political shift (immigration, inflation, Ukraine) to become policies going forward. As to US futures, at this hour (6:45) they are lower by about -0.25%.

In the bond market, the big news is really in Europe where the spread between German bunds and French OATs has widened by a further 8bps as concerns over the future government of France creep into investors’ minds. Historically, Madame Le Pen has been quite anti-Europe so there seem to be some worries that if the RN wins an outright majority, there will be significant ructions in the European Union with France seeking more independence. In the end, uncertainty breeds investor concern so I would not be surprised to see this spread widen further leading up to the election. As to the Treasury market, yields have backed off 4bps this morning in what appears to be position inspired trading rather than being caused by new information.

Commodities, which had a very nice rebound yesterday with both energy and metals markets performing well, are back under pressure this morning with oil (-0.3%) and gold (-0.1%) the least impacted but the rest of the metals complex feeling the heat again. However, NatGas continues its strong rally, up another 5% this morning and looking for all the world like it is going to continue rising until it tests the November 2023 highs of $3.80/MMBtu which is still $.75 higher.

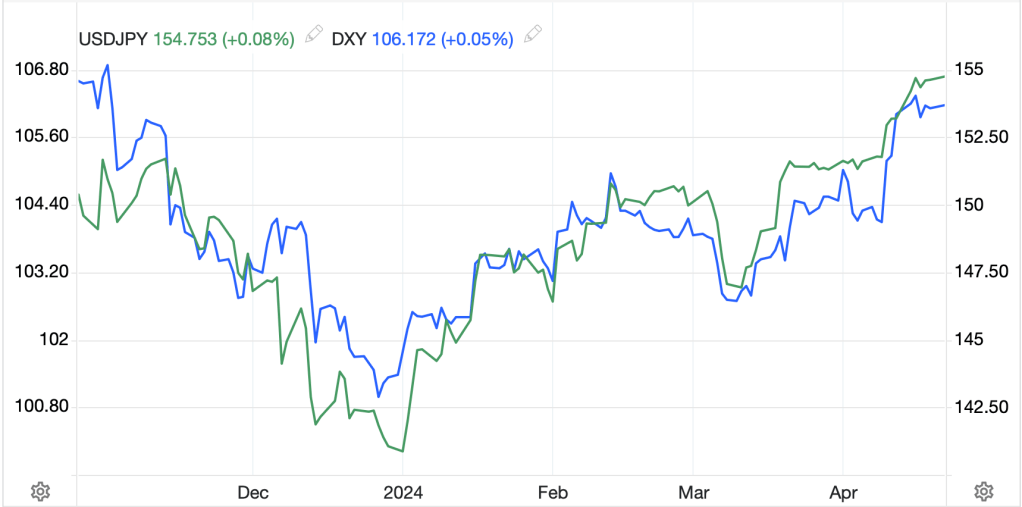

Finally, the dollar continues to gain at the margins with the euro (-0.2%) slipping further on the French political news, although the pound is bucking the trend with a very modest rise. The other currency that is having a good day is MXN (+0.8%) which continues its slow rebound from its post-election collapse last week. Otherwise, EEMEA currencies are all under pressure as is the CNY (-0.1%). Now, 0.1% may not seem like a lot, but the PBOC has been walking the value of the renminbi lower (dollar higher) ever so slightly every day for the past three months and the fix last night was at its highest level since January. It appears clear that the pressure for a devaluation is strong in China and that the PBOC is working very hard to maintain a sense of stability. My sense is this gradual weakness will continue for quite a while, at least until the Fed makes a change.

And that’s what we have today. The NFIB Small Business Optimism Index was just released at 90.5, a bit firmer than forecast, but that is not a market-moving data point. And there are no other data points to await today, nor any Fedspeak so the FX markets will take its cues from bonds and stocks. Given that CPI and the Fed are both tomorrow, I anticipate another very quiet session overall in the US as investors (and algorithms) will want new news to drive their next trades. Broadly, I think we are in a ‘good data is bad’ for risk assets as the mindset is it will delay any Fed rate cuts even further. Of course, if Treasury auctions continue to see shrinking demand (today there is a 10-year auction for $39 billion) that will certainly have an impact on the bond market, the Fed’s response, and by extension risk assets and the dollar. So, arguably, that auction is the biggest news of the day this afternoon.

Good luck

Adf