At this point, investors don’t care

‘Bout tariffs and if they are there

The hype train is rolling

With pundits extolling

Nvidia’s four trillion share

So, Canada’s out in the cold

As Loonies, this morning, are sold

But energy’s boring

When folks are adoring

AI or, if bankers, then gold

The tariff machine has been switched back on with yesterday’s announcement that the US will now apply 35% tariffs to all imports from Canada that do not comply with the USMCA. These tariffs are due to go into effect on August 1st. It appears this is an effort by Mr Trump to push the progress of trade talks forward as they are not moving at a pace with which he is satisfied. The Canadian response, by PM Carney, was to indicate they will redouble their efforts to get things done on a timely basis.

I understand that there are many who dislike the President’s bullying tactics as they are completely different than any previous president (or world leader really) and fall far afield from what had been previously accepted and expected in “polite” society. Diplomats are horrified that he is forcing decisions to be made, something that has been anathema to the diplomatic community since the beginning of time. But Mr Trump has his agenda firmly in mind and is very keen to use all the power he can to achieve it. It turns out, the US has a great deal of power beyond its military might.

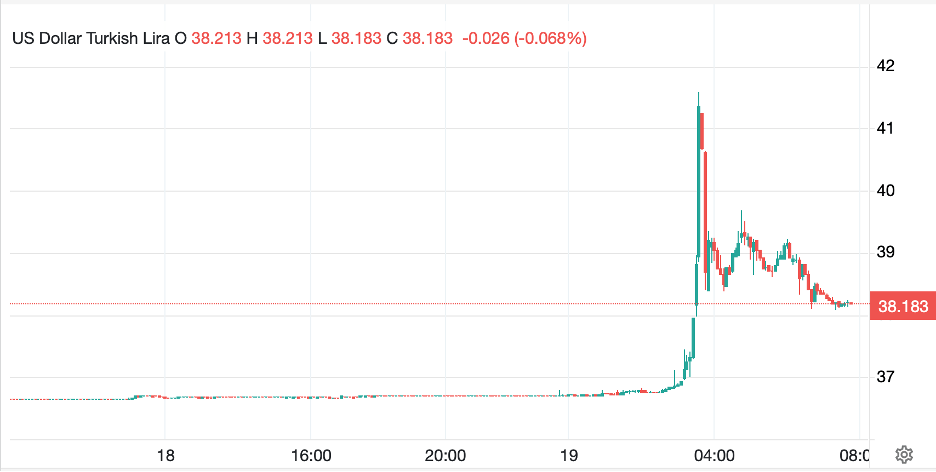

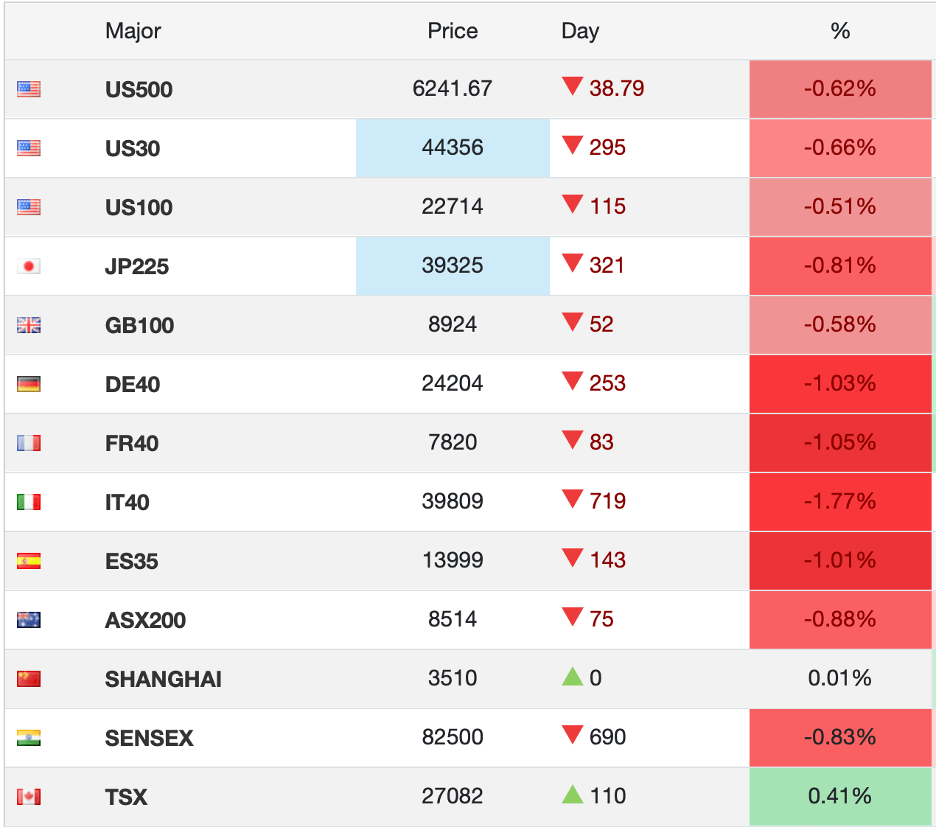

But for our purposes, the market response is the place we need to look. First, it can be no surprise that the Canadian dollar quickly declined -0.5% on the announcement as that is the textbook response to tariffs, the country affected sees their currency weaken. As to equity markets, as there are no TSX futures, we cannot tell exactly how stocks in Canada will be impacted but based on the fact that virtually every market is lower this morning, I expect to see weakness there as well. in fact, a look at this listing of equity futures markets from 6:30 this morning shows exactly what is happening. You will note that the Toronto market still reflects yesterday, but pretty much every other nation is feeling the heat of a new potential wave of tariffs from the US.

Source: tradingeconomics.com

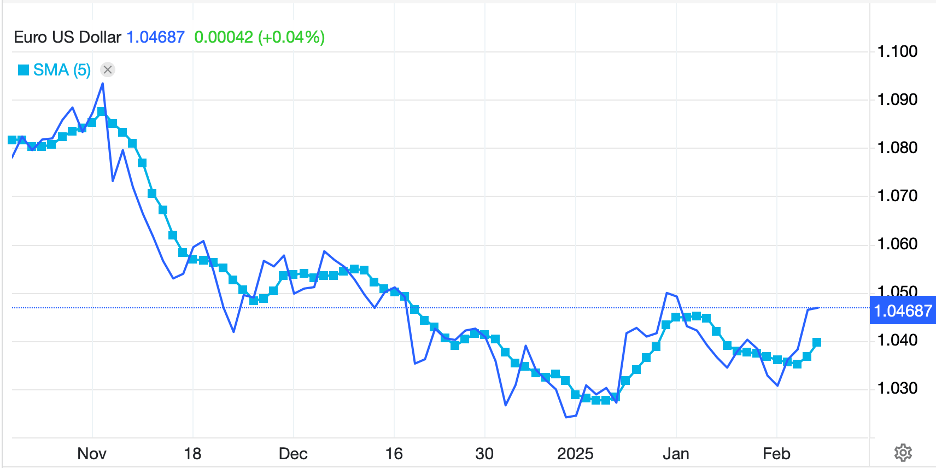

I continue to read that European nations are getting closer to agreeing a deal with the US, something that has never occurred before and I suspect that there are a number of leaders in the EU that are growing nervous about the situation. Again, the world was not anticipating the US to wield its power in such a brash and open manner, and many governing theories still need to be rewritten to address the new reality.

But yesterday’s story was all about Nvidia becoming the first $4 trillion market cap company, a remarkable achievement. It seems Nvidia’s market cap is greater than the entire German stock market.

For the longest time, I was convinced that the market concentration of the Mag7, which now account for just over 34% of the S&P 500, would ultimately lead to their demise and a major correction. However, it is becoming harder to make the case that concentration alone is going to be the problem.

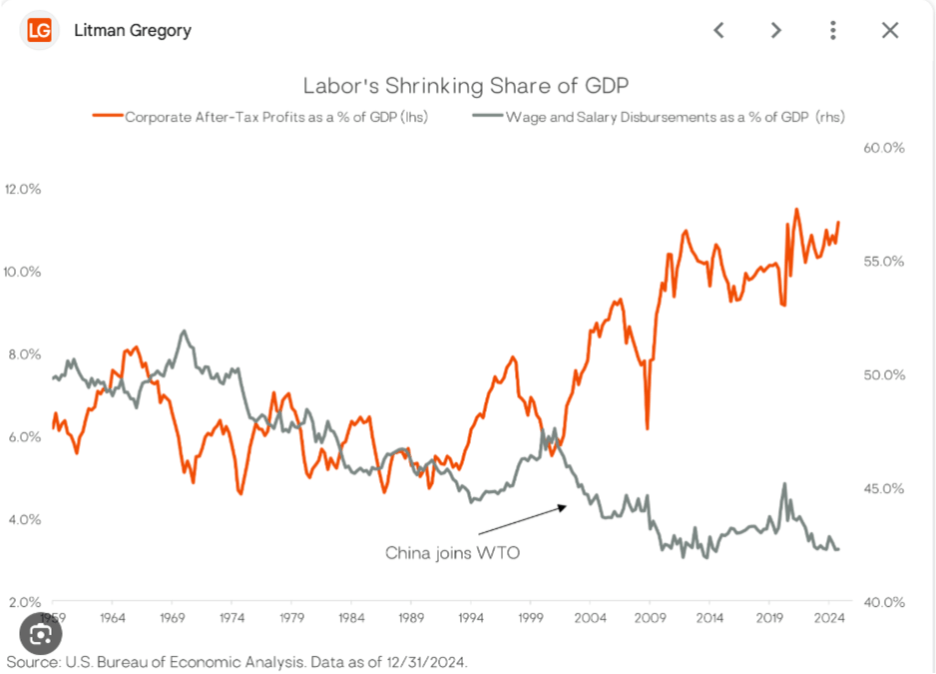

Rather, I believe any correction will now come from a broader economic result, arguably the long forecast recession when it finally arrives. If you recall, on Sunday I wrote about how the relative gain in corporate profits vs. labor has been a key driver in the bifurcation in the country. I also strongly believe that President Trump is very serious about changing that situation. The obvious solution is to reduce corporate profits. One way to do that is to impose tariffs where companies wind up reducing their margins to maintain sales volumes. If inflation does not rise (and it has not done so yet) that is a step in the President’s direction of choice. I have no idea whether this will work, and arguably neither does anybody else. Virtually, every economic model is no longer viable as Mr Trump has changed the rules so completely that the underlying assumptions are almost certainly incorrect. But remember this chart, if by the end of his term in 2028, the two lines have begun to converge more clearly, he will have changed a multi-decade trend and likely to the detriment of equity markets.

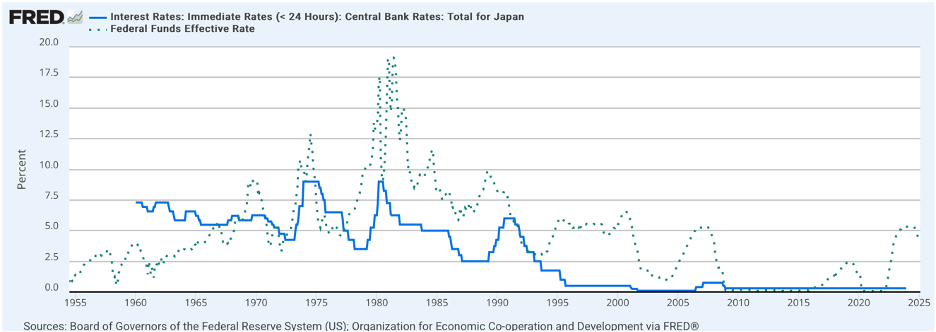

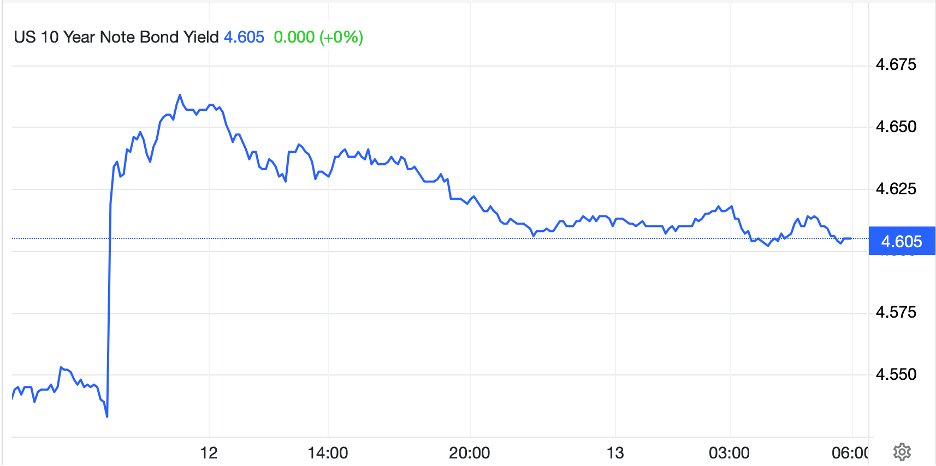

Ok, enough philosophizing, let’s see how other markets beyond equities have behaved overnight. Bond markets have been under modest pressure with Treasury yields ticking higher by 3bps and all European sovereign yields higher by 1bp this morning. We heard from Bundesbank, and ECB, member Isabel Schnabel that it was unlikely there would be further rate cuts from the ECB absent a major decline in Eurozone growth. Inflation has returned to their target, and she indicated her belief that current rates there were modestly accommodative, i.e. below neutral. JGB yields have returned to 1.5% after having spent the past month below that level.

Recall back in March and April when yields in Japan moved higher quite quickly with the 10yr touching 1.6% and the longer bonds trading above 3.0% to new all-time highs. That panic subsided but it appears that yields are on the move again as the BOJ discusses selling its equity ETF’s in an effort to reduce their balance sheet further. Interestingly, the yen (-0.4%) is under pressure this morning and trading back above 147 for the first time in two months. Here’s what we know about the yen; the carry trade is still in place in significant amounts, inflation is running hot, and the BOJ clearly is uncomfortable raising rates further to address that situation. My sense is that the yen could have further to weaken, especially if tariffs on Japanese exports are increased as per the recent letter from Mr Trump.

Continuing with currencies, the dollar is having a good day all around, with only CNY (+0.15%) bucking the trend. The pound (-0.45%) is under pressure after weaker than expected May GDP figures were released this morning (-0.1% vs. +0.1% expected). We’re also seeing weakness in MXN (-0.5%) and ZAR (-0.7%) even though precious metals prices are rising this morning. Here, too, we must keep in mind that many of the old relationships have broken down.

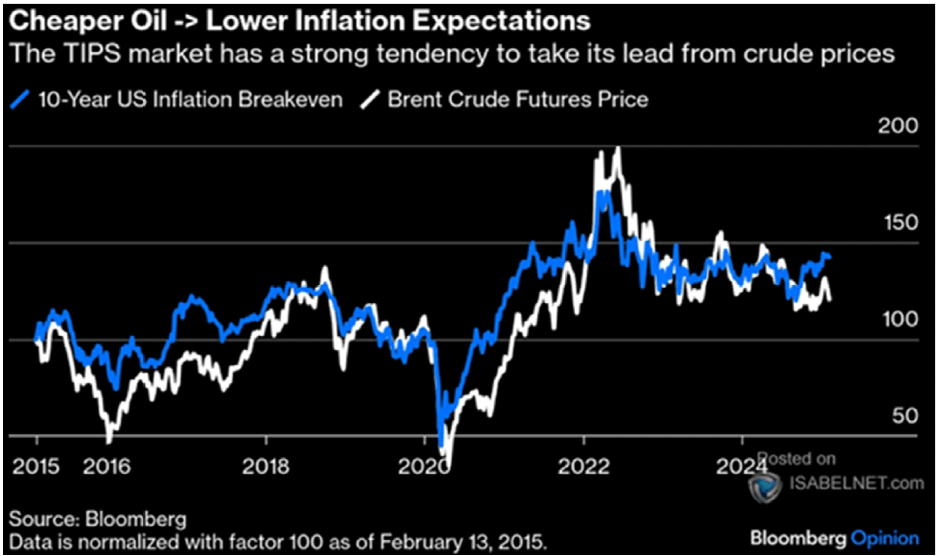

Finally, in the commodity space, gold (+0.65%) is back at its pivot level, taking silver (+1.4%) and platinum (+1.9%) along for the ride although copper (-2.2%) remains subject to the vagaries of exactly what those mooted 50% tariffs are going to cover. Oil (+1.0%) which sold off yesterday after news that Saudi Arabia had been producing more than its OPEC quota, is rebounding this morning with all eyes on President Trump’s upcoming announcement regarding potential sanctions on Russia given President Putin’s unwillingness to talk peace.

And that’s all there is. There is neither data nor scheduled Fed speakers on the calendar today, so we all await the next pronouncement from the White House. Word is that Presidents Trump and Xi will soon be sitting down for a discussion with the opportunity to get more clarity on that situation a potential outcome. However, White House bingo remains the game of the day, and my card has not been a winner lately. How about yours?

Good luck and good weekend

Adf