It has been two weeks

Since she rolled the dice. Sunday

It came up hard eight!

Leaders round the world

Would sell their soul to obtain

The Sanae lightning

Source: asia.nikkei.com

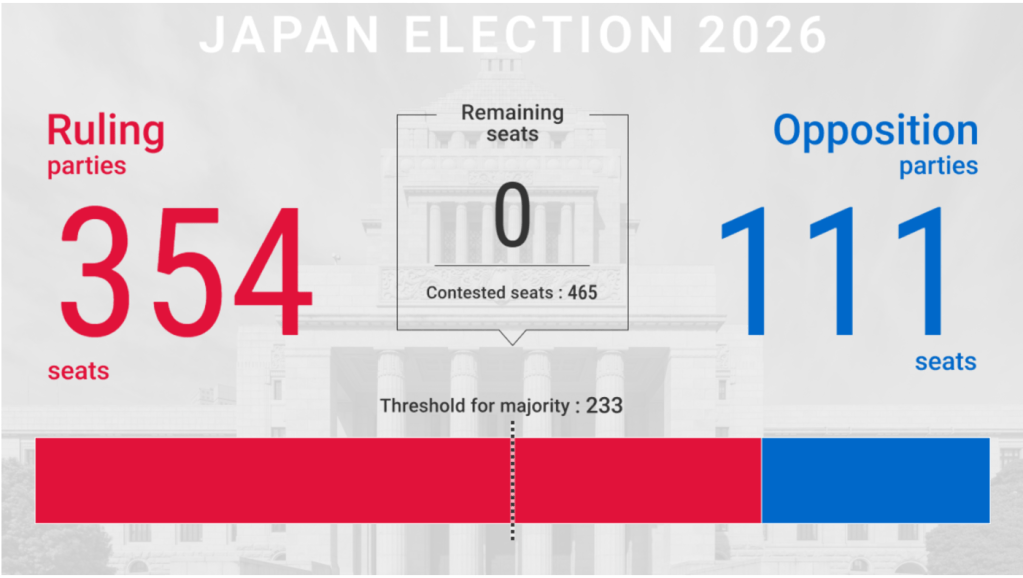

Japanese PM Takaichi scored a resounding victory yesterday, capturing more than 76% of the seats with her coalition partners, and she now commands a super-majority, enabling her to control the dialog completely, pass any legislation and even change the constitution. As I said, every other elected leader in the world pines for that type of power and approval, even Xi!

The immediate market response was a 5.0% rally in the Nikkei as expectations for an aggressive fiscal policy expansion to the economy gets priced in. Add to this more defense spending and the mooted tax cuts on food, and it is easy to understand the response.

Interestingly, the yen, which had been under pressure from fears of unfunded spending, after declining at first, reversed course and strengthened nearly 1% from its worst levels early in the Tokyo session as per the below chart. It certainly seems logical that yen weakness would be coming on this basis, but perhaps, what we are going to see is the Japanese use some of their FX reserves, which total about $1.3 trillion, to help fund the ¥5 trillion (~$32 billion) that the tax cuts will cost. That would mean selling Treasuries to sell USD and buy JPY, helping to support the yen while allowing the BOJ to leave rates on hold. In truth, it makes a lot of sense. We shall have to see how things progress from here.

Source: tradingeconomics.com

Some pundits, when looking ahead

Are worried that Warsh at the Fed

With Bessent, will try,

To Treasury, tie

Their efforts, some assets to shed

The other big story this morning is a growing concern about a potential accord between the Fed and the Treasury once Kevin Warsh is confirmed and takes his seat as Fed chair. Bloomberg has a big article on the subject, but it is around all over. When combined with another article on China recommending its banks to reduce their Treasury holdings, it has helped create a narrative that the US is going to have major fiscal problems going forward which will result in massive money printing and much higher inflation.

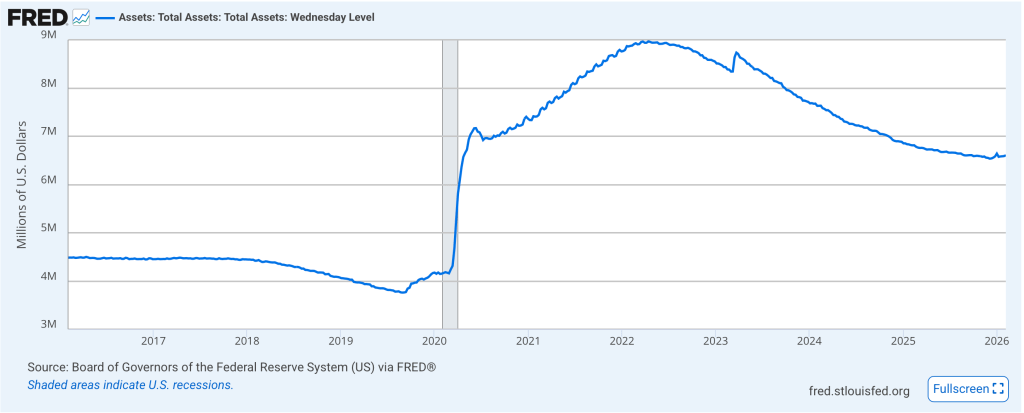

Of course, the thing about this that I don’t understand is that Warsh is on record, repeatedly, for saying he wants the Fed’s balance sheet to shrink, and that its expansion has been one of the major economic issues in the US since QE2 back in 2012. I also find it interesting that Warsh’s apparent desire to see the Fed’s balance sheet hold almost exclusively short-dated Treasuries, 3-years and under, is seen as a concern given that has been the Fed’s stated goal since they started shrinking the balance sheet back in April 2022.

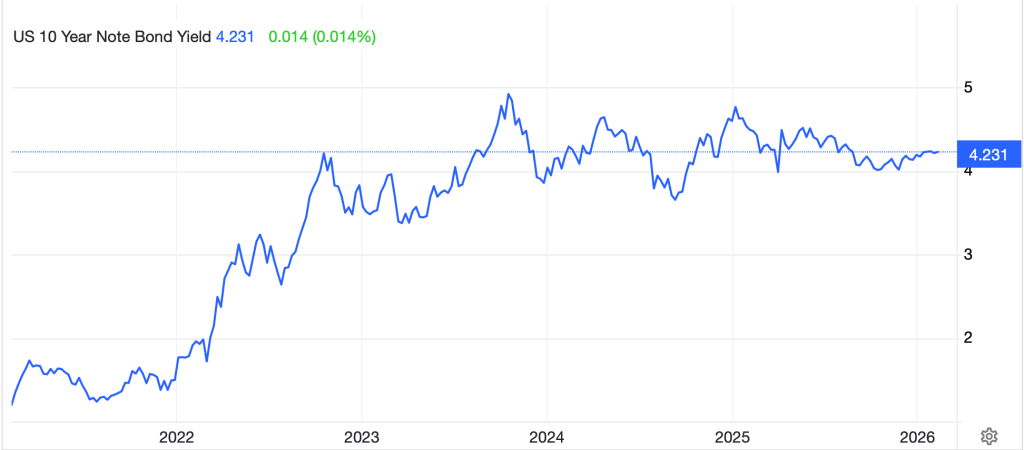

Recall, Chairman Powell explained that in order to maintain the ample reserves framework they are currently using, the balance sheet needs to grow alongside the economy. However, this is completely at odds with Warsh’s stated beliefs that the ample reserves framework is no longer effective and needs to be replaced eventually. Of course, if I look at 10-year Treasury yields (+2bps today) over the past 5 years, as per the below chart, it is hard to get overly excited that things have changed much since the end of the Covid adjustments.

Source: tradingeconomics.com

Perhaps Chinese selling will drive yields higher, or perhaps others will sell because they are concerned that the Fed and Treasury working together is inherently bad for the economy and will lead to higher inflation but so far, that is not the case. As to inflation, while CPI and PCE remain higher than the Fed’s target, it does not appear to be galloping away at this stage. In fact, there is much discussion on X that Truflation is now running at 0.68% and that the Fed will soon need to cut rates aggressively! Of course, if inflation is running at 0.68%, can someone please explain the ‘affordability’ crisis that has gotten so much press? PS, I don’t see Truflation as being an accurate representation of the world, but it sure is good for narrative writers sometimes!

And that is how we have started the week. The Super Bowl was pretty dull overall, with defensive excellence, but nothing spectacular. Someone made the point that this was the AI Super Bowl for advertising and the last two times we saw something dominate the advertising (dot.com in 2000 and crypto in 2022), within a year, both sectors had been decimated in the equity markets. In the meantime, a quick tour of the overnight session shows the following:

Stocks – Asia was strong across the board with Japan (+3.9%) giving back some of the early gains but still rocketing to new highs. The rest of the region was similarly strong, especially Korea (+4.1%) but gains of between 1.5% and 2.0% were the norm. I guess everybody is positive on Takaichi-san! Europe, however, has not been as robust although there are mostly gains there led by Spain (+0.6%) and Germany (+0.3%). The laggard here is the UK (-0.1%) which is struggling as PM Starmer appears to be coming to the end of his disastrous term. His appointment of Ambassador to the US looks to be the final straw as Peter Mandelson is widely mentioned in the Epstein files and now Starmer has lost his chief of staff because of that. The UK will be better off, I believe, if Starmer is pushed out, although if they put in Ed Miliband, it could actually get worse given his personal insanity regarding energy. But I would buy a Starmer removal. As to US futures, at this hour (7:20), they are modestly lower, -0.15% or so.

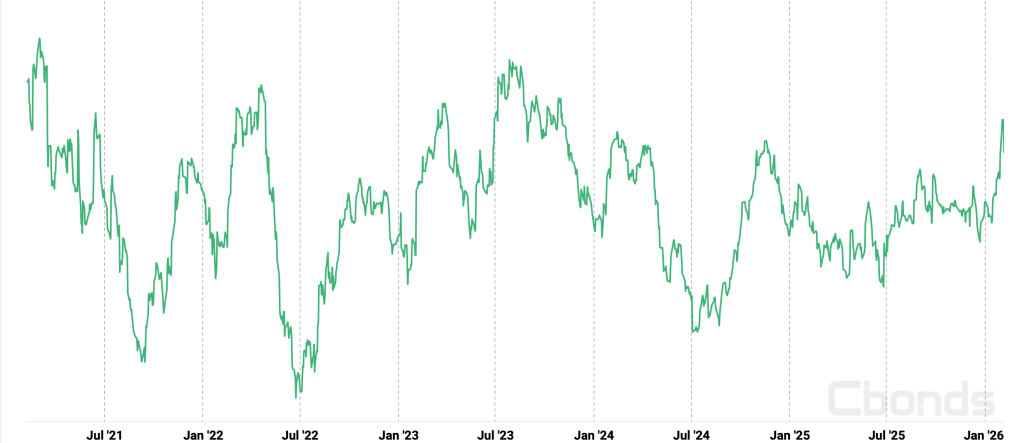

Bonds – European sovereign yields are edging higher this morning, around 1bp across the board as there has been no data to change opinions and the bond markets, worldwide (Japan excepted) remain the dullest of places to play. Japan (+6bps) did see a response to the Takaichi victory, which is what one would have expected. We will have to watch this yield closely as if it truly does start to break out, there will be ramifications worldwide. However, if we look at the chart below of 10-year and 30-year JGBs, they remain below the peak seen several weeks ago and, surprisingly, the overnight move was more pronounced in the 10-year than the 30-year. Watch this space.

Source: tradingeconomics.com

Commodities – oil (+0.3%) has been chopping around either side of unchanged all evening as questions about Iran remain unanswered. There was a story in the WSJ about the US holding back on any military action because Iran has so many medium range ballistic missiles and any reprisal could be devastating to the Middle East overall. But if I have learned anything from observing President Trump and his negotiating style, it is impossible to know what the next move will be. I would not rule out either a successful deal or a military strike at this point, with the former resulting in lower oil prices while the latter would see a sharp rally. In the metals, gold (+0.9%) and silver (+2.7%) are both continuing their volatile rebound from last week’s sharp selloff, while copper is unchanged this morning. As I have said, nothing has changed this supply demand balance in physical metals, although the paper, futures market, can still do many remarkable things that don’t necessarily make sense.

FX – the dollar is softer across the board this morning, slipping against both G10 (EUR +0.5%, GBP +0.3%, JPY +0.4%, CHF +0.7%) and EMG (MXN and BRL +0.25%, PLN +0.65%, ZAR +0.25%, CNY +0.15%) with little in the way of data as a driver anywhere. While I have not specifically seen a reboot of the dollar is collapsing narrative, I presume the concerns over a potential Fed-Treasury accord are an underlying thesis today.

On the data front, we see both NFP and CPI this week as they come a few days late due to the short government shutdown.

| Tuesday | NFIB Small Biz Optimism | 99.9 |

| Retail Sales | 0.4% | |

| -ex autos | 0.3% | |

| Employment Cost Index | 0.8% | |

| Wednesday | Nonfarm Payrolls | 70K |

| Private Payrolls | 70K | |

| Manufacturing Payrolls | -5K | |

| Unemployment Rate | 4.4% | |

| Average Hourly Earnings | 0.3% (3.6% Y/Y) | |

| Average Weekly Hours | 34.2 | |

| Participation Rate | 62.3% | |

| Thursday | Initial Claims | 218K |

| Continuing Claims | 1850K | |

| Existing Home Sales | 4.15M | |

| Friday | CPI | 0.3% (2.5% Y/Y) |

| Ex food & energy | 0.3% (2.5% Y/Y) |

Source: tradingeconomics.com

In addition, we hear from seven more Fed speakers, with Governor Miran making three appearances as he seeks to make his case for cutting rates.

Nothing has changed my view that Warsh and Bessent are the two most important voices now, with the rest of the Fed relegated to biding their time until Warsh shows up. As to the data, the Citi surprise index continues to show that data is better than most forecasts which speaks well of the economic situation.

Source: cbonds.com

I am not a proponent of the world ending, the Treasury market collapsing or the dollar dying despite a lot of doom porn that this is the near future. I would contend the dollar remains rangebound for now, and we need a definitive policy adjustment to see that situation change. Until then…choppy is the way.

Good luck

Adf