The punditry fears that the bond

Is starting to move far beyond

A level at which

The US can stitch

Together a plan to respond

Meanwhile, though yields broadly are rising

The dollar, it’s somewhat surprising

Continues to sink

Which makes some folks think

Their models now need some revising

Perspective is an important thing to maintain when looking at markets as it is far too easy to get wrapped up in the short-term blips within a trend and accord them more importance than they’re due. It is with that in mind that I offer the below chart of the 10-year US Treasury yield for the past 40 years.

Source: finance.yahoo.com

Lately, much has been made of the fact that 10-year yields have risen all the way back to where they were on…January 1st of this year. But the long history of the bond market is that yields at 4.5% or so, which is their current level, is the norm, not the exception. As you can see, in fact they were far higher for a long time. Now, I grant that the amount of debt outstanding is an important piece of the puzzle when analyzing the risk in bonds, and the current situation is significant. After all, even Moody’s finally figured out that the US’s debt metrics were lousy. And under no circumstances am I suggesting that the fiscal situation in the US is optimal.

But I also know that, as I wrote yesterday, the Fed is not going to allow the bond market to collapse no matter their view of President Trump. Neither is the US going to default on its debt (beyond the slow pain of higher inflation) during any of our lifetimes. I continue to read that the just-passed ‘Big, Beautiful Bill’ is going to result in deficits of 7% or more for the next decade, at least according to the CBO. Alas, predicting the future is hard, and no one knows that better than the CBO. Their track record is less than stellar on both sides of the equation, revenues and expenditures. This is not to blame them, I’m sure they are doing their best, it is just an impossible task to create an accurate forecast of something with so many moving parts that additionally relies on human responses.

My point is that one needs to look at these forecasts with at least a few grains of salt. While the current narrative is convinced that deficits are going to blow out and the nation’s finances are going to fall over the edge of the abyss, while the trend is in the wrong direction, my take is the end is a long way off. In fact, the most likely outcome will be debt monetization around the world, as every government has borrowed more than they are capable of repaying without monetizing the debt. The real question we need to answer is which nations will be able to do the best job of managing the situation on a relative basis. And that, my friends, despite everything you read and hear about, is still likely to be the US. This is not to say that US assets will not fall out of favor for a while relative to their recent behaviors, just that in the long run, no other nation has the resources and capabilities to thrive regardless of the future state of the world.

I guess the one caveat here would be that the entire global framework changes as the fourth turning evolves and old institutions die while new ones are formed. So, the end of the IMF and World Bank, the end of SDR’s and even organizations like the UN cannot be ruled out. And I have no idea what will replace them. Regional accords may become the norm, CBDC’s may become the new money, and AI may run large swaths of both governments and the economy. But in the end, at least nominally, government debt will be repaid in every G10 nation, of that I am confident.

One of the reasons I have waxed philosophical again is that market activity, despite all the chattering of the punditry, remains pretty dull. For instance, in the bond market, despite all the talk, Treasury yields, after slipping a few bps yesterday, are unchanged today. The same is true across Europe, with no sovereign bond having seen yields move by more than 1 basis point in either direction. JGB’s overnight, despite CPI coming in a tick hotter than forecast, saw yields slip -4bps, following the US market from yesterday. If the end is nigh, the bond market doesn’t see it yet.

In equities, yesterday’s lackluster session in the US was followed by a lackluster session in Asia (Nikkei +0.5%, CSI 300 -0.8%, Hang Seng +0.25%) with no overall direction and this morning in Europe, the movement has been even less interesting (CAC -0.5%, DAX +0.2%, FTSE 100 0.0%). Too, US futures are little changed at this hour (7:00).

In the commodity markets, gold (+0.9%) continues to chop around within a range that it entered back in early April.

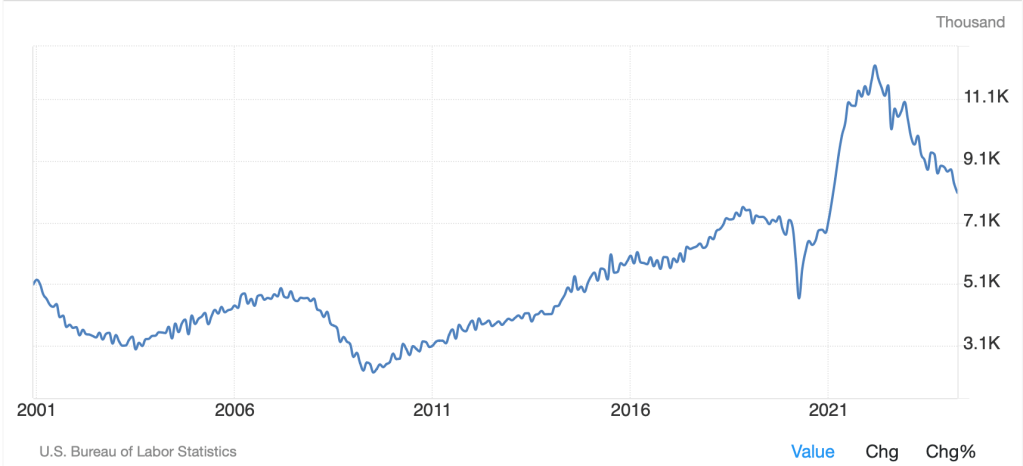

Source: tradingeconomics.com

To me, this is the perfect encapsulation of all markets, hovering near recent highs, but unable to find a catalyst to either reject those highs, or leave them behind in a new paradigm. You won’t be surprised that other metals are also a touch higher this morning (Ag +0.2%, Cu +0.7%), nor that oil (+0.3%) is also edging higher. It strikes me that today’s commodity profile may be attributed to the dollar’s weakness.

So lastly, turning to the dollar, it is softer against virtually all its major counterparts this morning, with the euro (+0.6%) and pound (+0.6%) both having a good day. In fact, the pound has touched 1.35 for the first time in three years. But the dollar’s softness is widespread in both blocks; G10 (AUD +0.85%, NZD +1.0%, SEK +1.0%. NOK +1.0%, JPY +0.5% and even CAD +0.35%), and EMG (ZAR +0.7%, PLN +0.6%, KRW +1.0%, SGD +0.5% and CNY +0.35%). The fact that SGD moved 0.5% is remarkable given its inherently low volatility. But I assure you, Secretary Bessent is not upset with this outcome.

The only data this morning is New Home Sales (exp 692K) and we hear from yet another Fed speaker this afternoon, Governor Cook. Chairman Powell will be speaking on Sunday afternoon, so that may set things up for next week, although with the holiday weekend, whatever he says is likely to be diluted by the time US markets get back to their desks on Tuesday.

In the end, the message is the end is not nigh, markets are adjusting to the changing realities of trade and fiscal policies, and monetary policies remain on a steady state. The ECB is going to cut again, as will the BOE. The BOJ is likely to hike again, and the Fed is going to sit on its hands for as long as possible. The futures market is still pricing in two rate cuts this year, but I still don’t see that happening. In fact, if the tax bill is enacted, I suspect that it will have a significantly positive impact on the economy, as well as on expectations for the economy, and interest rates are unlikely to fall much at all. As well, absent a concerted international effort to weaken the dollar (those pesky Mar-a-Lago accords again), while the short-term direction of the dollar is lower, I’m not sure how long that will continue.

Good luck and have a great holiday weekend

Adf