When gold was the talk of the town

Most governments just played it down

But now that its oil

That’s gone on the boil

The issue is much more profound

Twas Nixon who made sure that gold

Fell out of the government fold

But oil’s essential

In truth, existential

Without it, the world’s dark and cold

The past several days have seen some substantial moves in the commodity markets, notably the metals markets as I discussed all week. Precious metals had been on an extraordinary run, with YTD gains in gold (+60%), silver (+80%) and Platinum (+85%) prior to the dramatic declines that began last Friday. Using gold as our proxy, the chart below shows the nature of the recent price action, something which I believe was driven by liquidity issues as much as anything else. (As I wrote yesterday, when margin calls come, and in a highly levered market like we currently have, they do come, people sell what they can, not what they want, and they could sell gold.)

Source: tradingeconomics.com

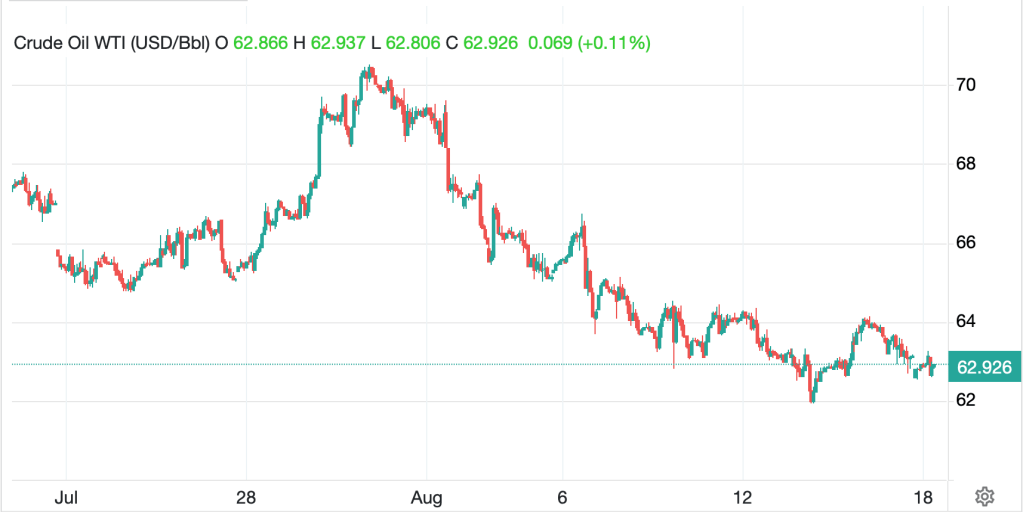

However, missing from that price action, both YTD and in the recent session volatility, was oil, which had been fairly benign, drifting lower on a growing belief that there was a huge glut of the stuff around the market. But, yesterday afternoon, President Trump announced new sanctions on the Russian oil majors Rosneft and Lukoil to increase pressure on President Putin to come to the table in a serious manner and end the Russia/Ukraine war. Too, Europe imposed sanctions on the same firms, although clearly it was the US ones that made the difference.

Remember, earlier in the week the Trump administration put out bids to begin refilling the Strategic Petroleum Reserve when the price of WTI fell to ~$55/bbl. Now, add on the sanctions and we cannot be surprised that oil has rallied sharply, up 5.5% today and more than 9% since Monday as per the below chart from tradingeconomics.com

Aiding the rally here was the EIA data yesterday that showed a net draw of inventories of nearly 4mm barrels vs. an expectation of an inventory build as per the glut narrative. Now, if I take the story of the US refilling the SPR and add it to the inventory draw, that is probably enough to see a rally ahead of the sanction news. However, there are several rumors/stories around that there was inside information with some institutions buying oil ahead of the sanctions announcement. Of course, anytime there is a news story that drives market price action, it is common for there to be complaints of insider trading activity. And maybe there was some. But I don’t think you have to stretch your imagination to believe that a combination of short covering and the SPR news got things going without the benefit of inside scoop.

At any rate, financial market attention remains on the commodity space with stocks and bonds garnering a lot less excitement. While equity markets did fall in the US yesterday, none of the declines were dramatic, with the three major indices slipping between -0.5% and -0.9%. Compare that movement to what we have seen in commodities and you can see why equities have slipped from the headlines. But let’s see how things played out overnight.

The Nikkei (-1.35%) had a rocky session, caught between concerns over unfunded fiscal stimulus from the new Takaichi government and the dramatic jump in oil prices on the one hand, and a Trump comment that he will be meeting President Xi next week on the other. I guess it was the latter story that helped Chinese (+0.3%) and HK (+0.7%) shares. Elsewhere in the region, Korean and Taiwanese stocks slipped while Indonesia and Thailand saw gains of more than 1% and the rest was little changed. in Europe, under the guise of bad news is good, UK stocks (+0.6%) have rallied after a weaker than expected CBI Industrial Trends release of -38. As you can see from the below chart, while this is not the lowest level seen in the past 5 years, it certainly paints a picture of a struggling economy. Of course, that means the market is increasing its bets the BOE will cut rates next week, hence the lift in the stock market!

Source: tradingeconomics.com

I don’t know about you, but it is hard to look at that chart and feel positive about the UK economy going forward, whether or not the BOE acts! As to the continent, the DAX (-0.25%) is lagging while the CAC (+0.5%) is rallying with both responding to corporate earnings news rather than macro signals. US futures are little changed at this hour (7:15).

In the bond market, yields are bouncing off their recent lows with Treasuries adding 4bps, although still just below the 4.00% level. European sovereign yields have edged higher by 2bps across the board, and we saw JGB yields rise 3bps overnight. It is difficult to get too excited about this market right now. All eyes will be on the CPI release tomorrow morning with expectations of a rise of 0.3% M/M, but the general tone of what I continue to read is that the US economy is slowing down which, theoretically, will reduce inflation pressures and encourage bond buying. Maybe.

We’ve already discussed commodities, although I have to say that the liquidation phase of the metals markets appears to be ending as all three precious metals are higher this morning (Au +0.4%, Ag +1.4%, Pt +2.6%) and copper (+1.8%) is joining in the fun. It strikes me that copper’s recent performance is at odds with the slowing growth narrative, but then I am just an FX poet, so probably don’t understand.

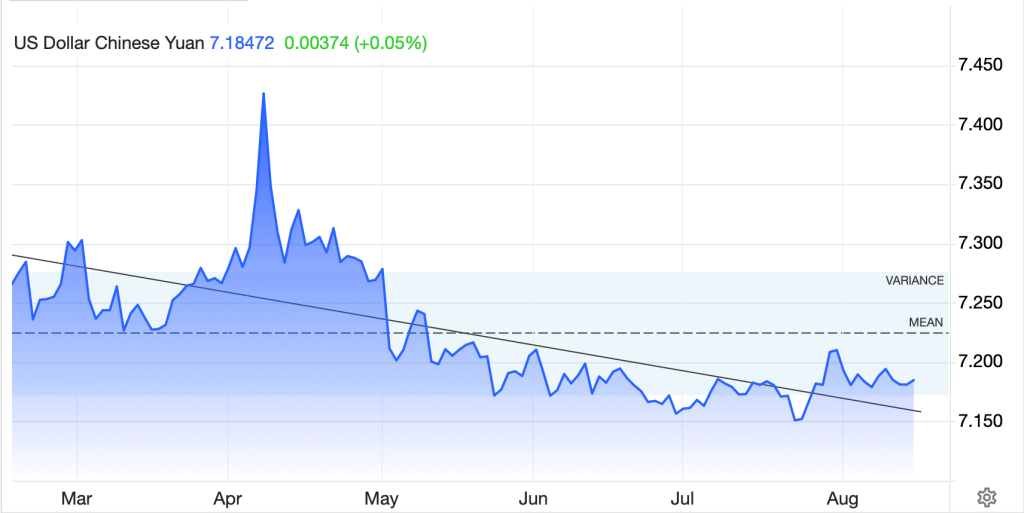

Finally, the dollar is…still there, but the least interesting part of markets lately. It is a bit firmer this morning with the yen (-0.5%) the laggard in the G10 space as it appears FX traders are concerned over Takaichi’s plans, even if JGB traders are not. The outlier in G10 is NOK (+0.4%) which is clearly benefitting from the oil rebound. In the EMG bloc, KRW (-0.6%) is the worst of the bunch, slipping after the BOK hinted that a rate cut might be in the offing soon. On the flip side, ZAR (+0.2%) is benefitting from the bounce in metals, but I want to give a shout out here to the rand, which despite the dramatic decline in gold and platinum earlier this week, held in remarkably well and is basically unchanged on the week.

There are actually two data points this morning, the Chicago Fed National Activity Index (exp -.40) and Existing Home Sales (4.1M), as the Fed is not shut down and the existing home data is privately sourced. Speaking of private data, there is a WSJ story this morning about how ADP has stopped giving the Fed access to anonymized data that they had previously enjoyed. There are many conspiracy theories as to why this is the case, but I can only report it is the case.

The government has been shut down for more than three weeks, and the story does not have much traction anymore. I’m no political pundit but it seems to me that this is going to end sooner rather than later, perhaps early next week, as it is very clear President Trump is going to continue his policies and unclear to a growing proportion of the population that the shutdown is helping them.

One final thought. You know I am involved in a cryptocurrency project called USDi, the only fully backed truly inflation tracking currency that exists. I strongly believe that we are going to continue to see cryptocurrencies, notably stablecoins expand their usage throughout the economy. But I couldn’t help but laugh at the following post regarding the jewel heist from the Louvre.

My mildly informed take is that financial assets are a perfect place for blockchain technology and cryptocurrency products, but maybe the real world is different.

Good luck

Adf