Data indicates

The BOJ intervened

Did they have no choice?

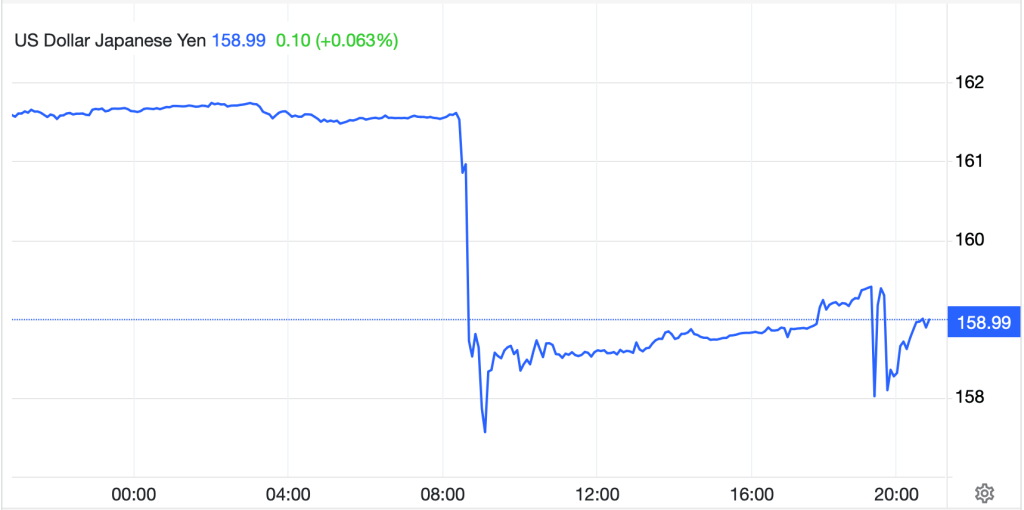

Last night, Masato Kanda, the Vice Minister of Finance for International Affairs, colloquially known as Mr Yen explained, “I have no choice but to respond appropriately if there are excessive moves caused by speculators.” He also explained, “We are communicating very closely with the authorities of each country and complying with international agreements, so there has been no criticism from other countries.” In other words, while he did not actually come out and say that the BOJ intervened on behalf of the MOF, it seems pretty clear that is the case. Certainly, a look at the price action again last night, as per the below chart, shows that is a viable reality.

Source: tradingeconomics.com

You may recall that USDJPY fell sharply in the wake of the CPI data last week and there was substantial question as to whether there was intervention at the time. My view was the BOJ would not have been able to act on a timely basis and attributed the move to an overly long dollar positioned market and some algorithmic selling. However, it appears that data from the BOJ’s accounts have since been released showing approximately ¥6 trillion (~$38.4 billion) was spent at the end of last week. Now, given the Kanda comments above, the reality is that the MOF is drawing a line in the sand at 162.

In fairness, this seems a propitious time to do so given the growing certainty that the Fed is finally going to begin its policy easing. Of course, the main reason that the yen had weakened so much is that, not only had the interest rate differential widened substantially, allowing for, and even encouraging, the growth of the ‘carry trade’ where investors were happy to simply hold long forward USDJPY positions and wait for the time to pass and the profits to roll in. But as well, there was no indication that the Fed was going to change its stance while the BOJ, though it had threatened to begin tightening policy, was doing so at a glacial pace. However, that CPI number has dramatically altered opinions, not only of the trading community, but more importantly, of the Fed. All the Fed comments we have heard since that data point have indicated a much greater willingness to consider easing policy. Talk about both the goods and labor markets coming into balance are indicators they are ready to roll.

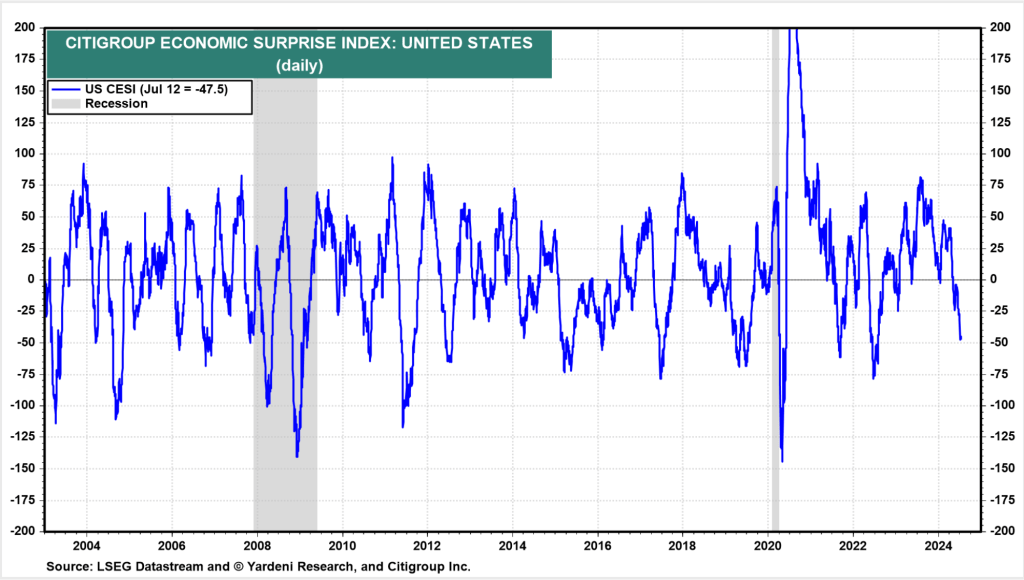

We still have seven more Fed speakers this week ahead of the quiet period and I would wager that to a (wo)man, they will all say their confidence is growing that price pressures are receding, and they are watching the employment situation carefully. As I wrote yesterday, the CME Fed funds futures market is pricing a 100% probability of a 25bp cut in September with some folks looking for 50bps. Given the totality of the recent data where the probability of a recession seems to be growing, I agree a September cut looks likely. This is not to say every data point is going to be pointing to weaker economic activity (e.g., yesterday’s Retail Sales data was much stronger below the headline number), just that will be the broad trend.

In this situation, with the market starting to believe that higher for longer is truly dead, the initial reaction will be for further dollar weakness. Of course, once it is clear the Fed has begun to ease policy, we will see other central banks increase their pace of policy ease at which point the dollar’s decline will likely slow or stop. Remember, FX is a relative game, so if everybody is easing policy at the same time, those interest rate differentials are not going to change very much at all. However, commodity prices, especially precious metals prices, are likely to be the biggest beneficiaries. As to stocks and bonds, the former have a much less certain path given the impact of declining inflation on profits, especially for the mega cap names, but bonds should perform well (yields declining) at least as long as inflation remains tame. Just beware of a slow reversal of the inflation story. Nothing has changed my view that 3.0% is the new 2.0%.

Aside from the yen news, last night was decidedly lacking in new information. We saw UK inflation data print at the expected levels showing it has fallen back close to their target of 2%. We saw final Eurozone inflation also confirming a 2.5% inflation rate. While the ECB has essentially ruled out a rate cut tomorrow, a September cut seems highly likely at this time, especially if they have confidence the Fed is going to cut then as well.

So, let’s look at the overnight session. After more record highs in the US, with the DJIA approaching 41K, the tone in Asia was more mixed. Japanese shares (Nikkei -0.4%) fell as the yen’s strength continues to hamper profit expectations for the many exporters in the index. Chinese shares, both in Hong Kong and on the mainland, edged higher by less than 0.1% as investors continue to wait to hear the results of the Third Plenum. As to the rest of the region, gains in Australia and New Zealand were offset by losses in South Korea with most other markets little changed. however, in Europe this morning, the screens remain red with losses across the board, albeit not as significant as we have seen in the past several sessions. The DAX (-0.4%) is the laggard although all the major markets are lower. Finally, at this hour (7:20), US futures are suffering led by the NASDAQ (-1.5%) although they are all under pressure. It seems that the story about increased tariffs on Chinese goods as well as a ban on selling additional semiconductors to China doesn’t help the prospects of semiconductor companies that rely on China for their sales.

Interestingly, the bond market has seen yields edge higher this morning with Treasuries higher by 2bps and most of Europe up by 1bp. Given the small size of the movement, I wouldn’t attribute much fundamental thought to today’s price action, and after all, 10-year Treasury yields have fallen 30bps since the first of the month, so a lack of continuation is not that surprising.

In the commodity markets, oil (+0.5%) is rebounding after a rough couple of days. The weakening economy story is weighing on perceived demand and there is ample supply around. Gold (+0.1%) is continuing to rally after closing at another all-time high yesterday while silver (-0.9%), which followed gold yesterday, is giving back a bit this morning. Industrial metals are little changed this morning as they await further confirmation of the economic situation.

Finally, the dollar is under pressure this morning, falling substantially against almost all of its major counterparts, both G10 and EMG. Aside from the yen (+1.1%) which we discussed above, the pound (+0.5%) is leading the way along with SEK (+0.6%) although the euro (+0.35%) is also firm. In fact, the pound has risen above 1.30 for the first time in a year while the euro pushes the top of its 1.0650/1.0950 2024 trading range. The laggard in the G10 space is CAD, which is unchanged on the day as market participants tie its performance directly to the dollar and anticipate the BOC to match the Fed going forward. In the EMG bloc, though, there are two outliers which have suffered today, despite the dollar’s broad weakness, MXN (-0.6%) and ZAR (-0.7%). The peso seems to be feeling the effects of weaker than expected economic data lately which has put Banxico into a difficult position as inflation remains above their target. Will they cut to support the economy and undermine the currency? That is the question. As to the rand, aside from its status as the most volatile currency, the market seems to be reacting to a sharp decline in Retail Sales last month, -0.7%.

On the data front, this morning brings Housing Starts (exp 1.3M), Building Permits (1.4M), IP (0.3%) and Capacity Utilization (78.4%) along with the EIA oil inventories. In addition, we will hear from Richmond’s Thomas Barkin and Governor Waller and then at 2:00 the Fed’s Beige Book will be released. The current market narrative has quickly shifted to rate cuts, and more tariffs. The upshot is the dollar is likely to remain under pressure while equities will have a more difficult time going forward. If inflation remains quiescent, then bonds can do well, but the big winner through it all should be commodities.

Good luck

Adf