Most pundits assure us the world

Will end, because Trump has unfurled

A tariff barrage

Which will sabotage

World trade, which is now oh so knurled

But so far, the data have shown

The ‘conomy, widely, has grown

Just wait, they all say

There will come a day

When our forecasts will set the tone!

Market activity remains quite dull lately and yesterday was no exception. Equity markets are generally creeping higher, but ever so slowly. Meanwhile, all the forecasts of President Trump’s tariff policy creating imminent economic destruction have yet to prove true. In fact, the WSJ this morning even published an article complaining explaining that things seem to be working out so far despite the tariffs as the global economy is more resilient than most economists’ models had assumed. (I know we are all shocked that economists’ models have proven unworthy). While this doesn’t suit the narrative they have been pushing, or that, in fact pretty much every mainstream media outlet has been pushing, at least they have been willing to recognize that the world has not yet collapsed.

Of course, the great question is can this continue or are the doomsayers correct, and we just have not yet felt the impacts of all these (terrible) policy choices that have been made? My experience tells me that Trump’s designs for his best-case scenario will not be achieved, but neither will the worst-case scenarios painted by the punditry. In fact, history has shown that it takes a remarkable amount of effort to completely destroy an economy and that usually takes many years of incredibly stupid policies.

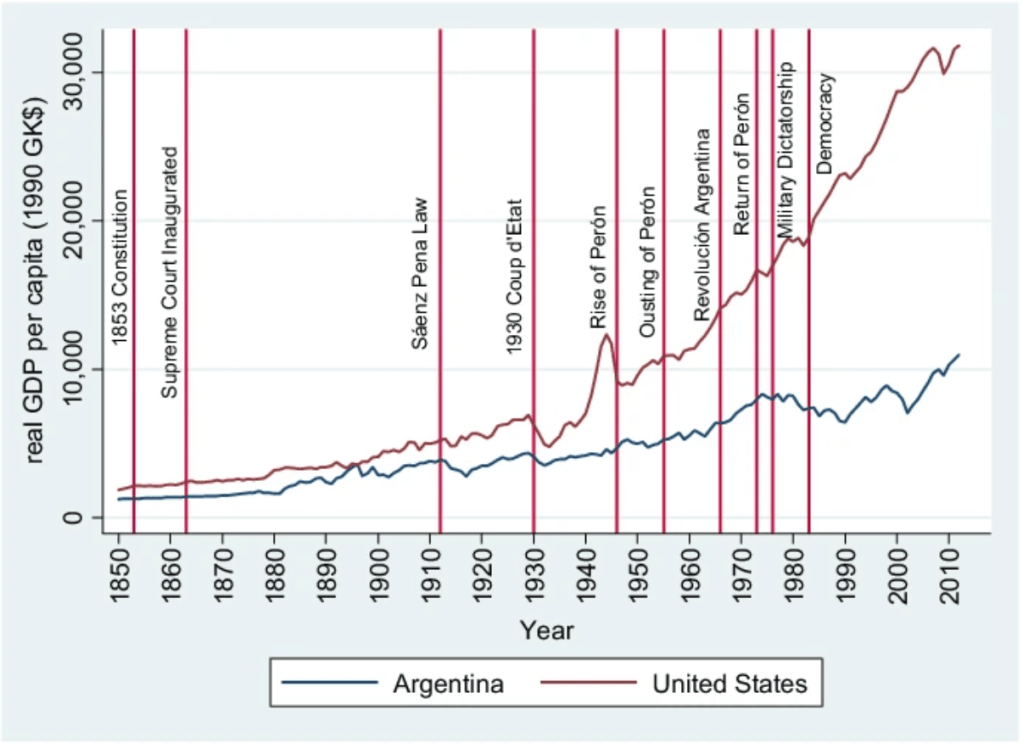

After all, it took nearly 60 years for Argentina to destroy itself with socialist policies (see chart below from latinaer.springeropen.com), and the same was true for Venezuela.

In fact, some might say that Europe is well on its way to destroying its economy as they implement more and more central control, but it will take decades to completely collapse things. My point is that it would be a mistake to assume that because you do, or don’t, like a political regime, that they will change the nature of an economy so quickly that it will impact your life. Perhaps the exception to that rule is the current situation in Argentina where in one year’s time, President Milei’s free market policies have reversed decades of stagnation. But going the other direction takes a long time to affect.

Turning back to the developed world, we are in the midst of the summer doldrums with a limited amount of data to be released and the headlines in the US focused on either Coldplay concerts or questions about the actions of the Obama government in the last days of his administration. None of them are financial or market related (the Powell firing story has taken a breather) and while the tariff deadline looms next week, we continue to hear that more deals are on the way.

So, let’s take a quick look at what happened overnight (not much) and how things are setting up for the US session. Yesterday’s mixed US performance, with not much movement in either direction was followed by a lack of movement in Tokyo (-0.1%) and Australia (+0.1%) although both Hong Kong (+0.5%) and Chinese (+08%) shares managed to continue their recent rally. But arguably, things were generally worse in Asia as Korea (-1.3%), Taiwan (-1.5%) and New Zealand (-1.0%) all lagged badly with the other regional bourses showing no life whatsoever. This feels tariffy to me. In Europe, the DAX (-1.0%) and CAC (-0.75%) are both under pressure this morning with tariffs the clear concern. As of now, while Commerce Secretary Lutnick has expressed confidence a deal with Europe will be done, if not, tariffs on European goods will rise to 30% next week. I guess that has focused the minds of investors on the continent. As to the UK, stocks there are unchanged this morning as, recall, they have already struck a deal. Of course, the UK has many problems on its own to prevent its economy from growing. Meanwhile, at this hour (7:10), US futures are essentially unchanged.

In the bond market, yesterday saw yields slide across the board, with Treasury yields slipping 5bps. This morning, though, there is a little bounce in yields with Treasuries and most European sovereigns seeing yields rise 2bps. JGB yields, though, fell -2bps last night, as the response to the LDP losing the Upper House election was quite benign. It seems that so far, investors are not that worried about major changes in Japan

That Japan story is confirmed by the fact that the yen is essentially unchanged today. In fact, looking at the chart of USDJPY over the past 6 months, it is hard to get excited about much.

Source: tradingeconomics.com

Remember the talk about the carry trade being unwound? Yeah, me neither. Arguably, there are two potential drivers of a substantial move in USDJPY, either the Fed will have to start cutting rates, and more aggressively than the 2 cuts currently priced in for the rest of the year, or the BOJ will need to start hiking rates, and quite frankly, neither seems likely anytime soon. As to the rest of the currency market, sleepy overstates the amount of movement we are seeing this morning. In fact, it is hard to find a currency that has moved 0.2% in either direction. FX traders are on summer holiday.

Finally, commodity markets are a bit softer this morning on the open with oil (-0.85%) leading the way after a slide yesterday. While the narrative discusses concerns over trade and a reduction in demand, market insiders (notably Alyosha) continue to describe the evolution of the crack spread and the fact that the futures contract is rolling over today as being far more impactful to the price right now. Perhaps the narrative will matter again soon, but that is not the discussion in the marketplace. As to metals, they had a very strong day yesterday and are consolidating this morning with gold (-0.3%) and silver (-0.15%) slipping slightly, although both metals are closing in on highs. The big picture in the precious metals space remains that there is more demand and insufficient supply.

On the data front, arguably, Chairman Powell’s speech this morning is the most widely anticipated feature of the day. However, he is merely making opening remarks at a conference on capital framework for large banks, which while important seems unlikely to touch on monetary policy.

And that’s really it for the day. There is no reason to believe that anything remarkable will happen but in this age of White House Bingo, we can never rule out some unforeseen event. The talk in the FX market is that the dollar’s recent countertrend rally is failing and folks are starting to put on bearish bets. Maybe, but it is hard to get excited in either direction right now.

Good luck

Adf