The jury is no longer out

And Jay may be losing his doubt

That ‘flation is slowing

So, bulls are now crowing

Let’s end, soon, this rate-cutting drought!

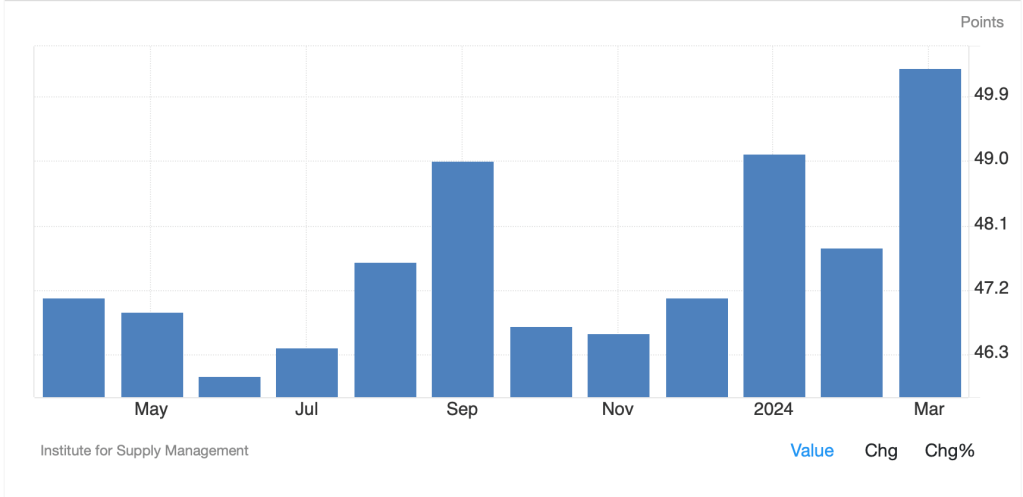

I am old enough to remember when Chairman Powell explained that he did not have confidence inflation was falling back to the target level and so maintaining the current, somewhat restrictive, policy stance would be appropriate for longer than had been originally anticipated. In other words, higher for longer was still the operating thesis. That is soooo two days ago! Apparently, when CPI prints at 0.3% M/M for both headline and core with the Y/Y readings at 3.4% and 3.6% respectively, that means the inflation fight is won. Now, I will grant that the headline monthly number was 0.1% below expectations, but everything else was right on the money. On the surface, it is not clear to me that this signaled the all-clear for the end of inflation. As my good friend Mike Ashton (@inflation_guy) said in his write-up yesterday, “the sticky stuff is not yet unstuck.” But the market saw this news and combined with a clearly weaker than expected Retail Sales print (0.0%) and weaker than expected Empire State Manufacturing print (-15.6) and was off to the races.

So, risk is back in vogue and bond yields are tumbling. Hooray! This is the perfect encapsulation of how the actual data may not mean very much per se, but the framework of how investors and traders were positioned and anticipating the data is the key driving force. So, not only did equity markets in the US rally 1% or more, but Treasury yields fell 10bps in the 10yr and 8bps in the 2yr. Meanwhile, September is now the odds-on favorite for the first interest rate cut, politics be damned.

At this point, the question becomes will the Fed respond to this small sample of data in the same way the market has? The first comments from Fed speakers seemed more circumspect than the market opinions. Chicago Fed president Goolsbee, who was not on the calendar, said the following in an interview, “[inflation showed] some improvement from last time, pretty much what we expected, but still higher than we were running for the second half of last year, so there’s still room for improvement.” Meanwhile, Minneapolis Fed president Kashkari explained, “The biggest uncertainty in my mind is how much downward pressure is monetary policy putting on the economy? That’s an unknown. And that tells me we probably need to sit here for a while longer until we figure out where underlying inflation is headed before we jump to any conclusions.”

To my eye, there is no indication that the Fed has changed their tune, at least not yet. If we continue to see data that indicates the long-awaited recession is actually closing in, I expect that we will begin to hear more of a consensus view regarding the initial rate cuts other than the current higher for longer stance. Of course, if a recession is making an appearance, my sense is that will not be a huge benefit for risk assets either, but what do I know, I’m just a poet. Ok, I don’t think we need to spend any more time on that subject for today so let’s see what is happening elsewhere.

In Japan, the economic news remains less positive than the Kishida administration would like to see. Last night, Q1 GDP was released at a worse than expected -0.5%, its second negative print in the past three quarters with Q4 a ‘robust’ 0.0% in between. While not technically a recession, the situation there certainly does not have a positive feel. Making things even worse, of course, is the fact that inflation remains higher than their target of 2%, although it has been slowly drifting lower over the past year.

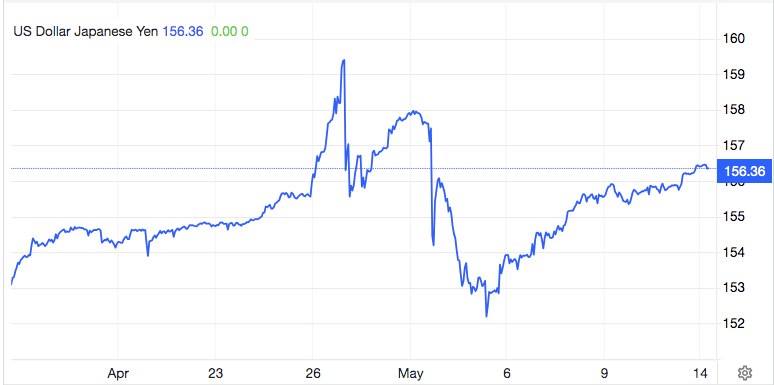

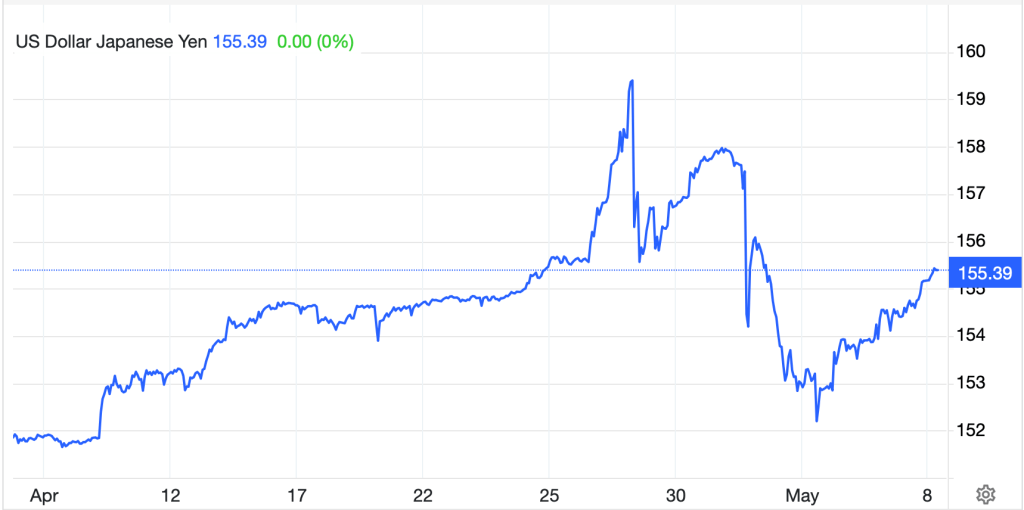

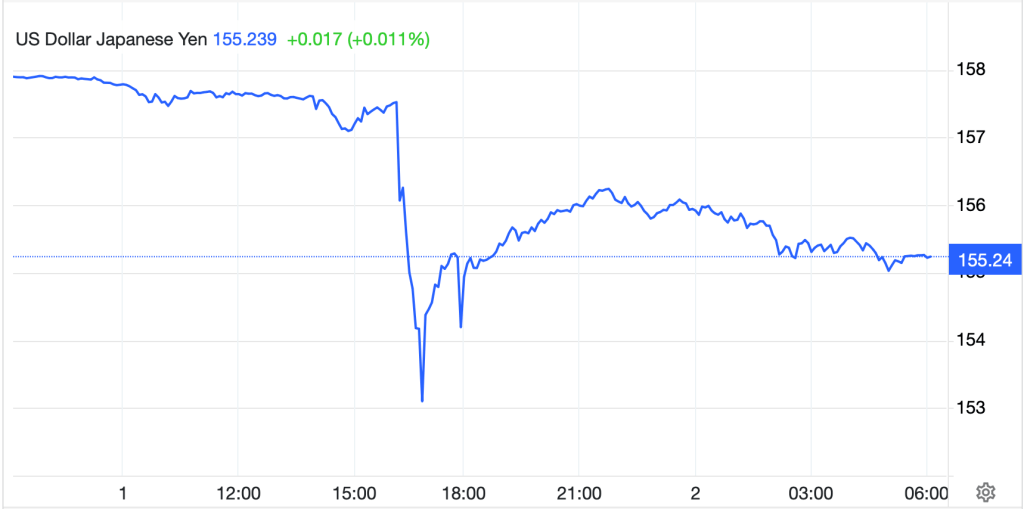

The interesting thing about this situation is that the BOJ does not have a dual mandate regarding prices and employment; but is focused only on price stability. However, if economic activity continues to slow there, can Ueda-san really tighten policy further? And what of the yen? It has drifted higher (dollar lower) alongside the dollar’s broad down move on the back of the recent decline in US yields. However, it feels to me like Ueda’s path to tighter policy just got a lot narrower if economic activity in Japan is going to remain so lackluster. Many pundits have decided that the yen’s weakness reached its peak ahead of the recent bout of intervention two weeks ago. I am not so sure. Absent a significant slowdown in the US, I’m sensing that the policy divergence may even widen going forward, not narrow, and the yen would not respond well to that outcome.

With all that in mind, let’s survey the overnight session to see what else is happening. Asian equity markets followed the US rally with solid gains across the board. Clearly, the prospect of lower US rates was seen as a positive. However, the same is not true in Europe, where bourses are all lower this morning albeit not dramatically so. Declines of between -0.25% and -0.5% are universal. My take is that this is a bout of profit-taking as to much less fanfare than US markets, many European bourses have just touched all-time high levels, so a little pullback should be no surprise. This is especially true given there was neither data nor commentary that would indicate something in Europe has changed. The situation remains slow growth, slowing inflation and rate cuts next month. Lastly, US futures are essentially unchanged at this hour (6:45) as traders await more data and, perhaps more importantly, 4 more Fed speakers. I think the trading community is looking for Fed confirmation of their response to the CPI data yesterday which, as mentioned above, was not forthcoming.

Bond markets, which all rallied yesterday following the Treasury move, are little changed this morning with virtually no movement in the US or Europe. Overnight, JGB yields slipped 3bps in the wake of the US data, but this market is entirely focused on the US economy and the Treasury marker for its lead.

In the commodity markets, oil is a touch softer this morning, but remains firmly toward the middle of its recent trading range as conflicting reports regarding expected demand continue to confuse practitioners. FWIW any report that indicates demand for oil is going to decrease makes no sense to me given how many people on this earth are energy poor and will do as much as they can to get hold of energy. But that’s just my view. The IEA continues to forecast reductions in demand because they are desperately pushing their transition thesis because their models are old and unreliable. As to metals markets, yesterday saw a major rally in gold and silver, with the latter making a push for $30/oz for the first time since 2013. Copper, however, may have seen a blow-off top yesterday as it has fallen back sharply from its peak and is now back below $5.00/lb. In truth, the demand story here remains attractive, but the price action did seem to get out of hand there.

Finally, the dollar, which sold off hard yesterday on the CPI and Retail Sales news is bouncing slightly this morning. Those sharply lower yields in the US, even though they were matched by Europe, were a signal to sell dollars across the board. Thus, this morning’s 0.2% ish bounce should not be that surprising. It is in this segment of the market that I believe the opportunity for the biggest structural changes exist. After all, the dollar’s strength over the past 3 ½ years has been built on the Fed being the most hawkish central bank around as they belatedly fought inflation. While they have made clear they want to start to cut interest rates, the data has not been supportive of that move. If yesterday’s data is the beginning of a more consistent slowdown in the US, those rate cuts may be coming sooner than currently priced and regardless of what happens to risk assets, the dollar would suffer. We shall see.

On the calendar today we have a bunch more data and four more Fed speakers (Barr, Harker, Mester and Bostic). The data brings the weekly Initial (exp 220K) and Continuing (1780K) Claims, Housing Starts (1.42M), Building Permits (1.48M) and Philly Fed (8.0) all at 8:30 then IP (0.1%) and Capacity Utilization (78.4%) at 9:15. As Chairman Powell has repeatedly explained, he and his colleagues look at the totality of the data, so another wave of soft numbers here would likely get risk asset markets excited. However, listening to what they have all continued to say informs me that the Fed is not nearly ready to cut rates. September remains the odds-on favorite for the first cut, but I still suspect that they could be here all year long. If I am right about that, the dollar will retain its bid overall.

Good luck

Adf