There once was a policy view

That tariffs, we all should eschew

But President Trump

Explained on the stump

To this idea, he wouldn’t hew

And so, as the clock struck midnight

Trump’s tariffs once more saw the light

Most analysts say

The tariffs will weigh

On growth, with recession in sight

By now you are all aware that as of 12:01 EST this morning, 25% tariffs have been imposed on all imports from both Canada and Mexico except energy products, which have seen 10% tariffs imposed. As well, all Chinese imports have been hit with an additional 10% tariff. Once again, President Trump has proven to be a man of his word, promising these tariffs during his election campaign and imposing them now.

The mainstream view is that these tariffs are a disaster and will send the economy into a recession. In fact, the International Chamber of Commerce said a depression was likely. As well, there is much concern that inflation will rise during the recession, which for Keynesians must be a very difficult concept to grasp given their strongly held belief that a recession will result in declining inflation.

Now remember, I am just a poet, so please take that into account when I offer my views here. First, we have no idea how things will play out. The one thing about which I am extremely confident is that there will be numerous behavioral changes by everyone because of these tariffs. The first question is who will absorb the cost of the tariffs. Remember, essentially the definition of a recession is that demand is declining. Will companies be able to pass through the higher costs? In some instances, they likely will, but in others probably not. Anecdotally, there was a story in the WSJ that Chipotle will see its costs rise because of the tariff on avocados from Mexico but will not change their prices to account for that. I’m confident they are not the only company who will absorb those costs.

However, there will certainly be companies that believe they can raise prices and maintain their sales and will try to do that. My point is each company will evaluate the environment under which they operate and respond in the profit-maximizing manner, but each company’s scenario will be different.

Second, let’s consider the reason that President Trump is such a strong believer in tariffs. He sees them as the stick to achieve his goals. I would argue there are two goals in sight. With Canada and Mexico, he is still unsatisfied with their efforts on the border and with fentanyl smuggling and is very keen to push that to completion. However, the broader goal is to return manufacturing to America from its decampment overseas, mostly to Southeast Asia, during the past forty years. And remember, he is seeking to implement a carrot as well, looking to cut corporate taxes to 15% going forward, which would put the US in the lowest quartile of corporate tax rates in the world. While this morning the headlines are all about the tariffs and their potential destruction, just yesterday, Taiwan Semiconductor announced they would be investing $100 billion to build new fabrication plants in Arizona. That is exactly the response Trump is seeking.

We all recognize that the world today is very different than it was even two months ago as President Trump has taken an extraordinary number of steps to implement the ideas upon which he was elected. Interestingly, a large majority of the public remains strongly in his camp with approval ratings for many of his policies well above 60% and as high as 80%. While markets are clearly unhappy as they have no idea how things will play out, and companies are now faced with far more uncertainty as they attempt to plan for their future, there is no reason to believe this process is going to change anytime soon.

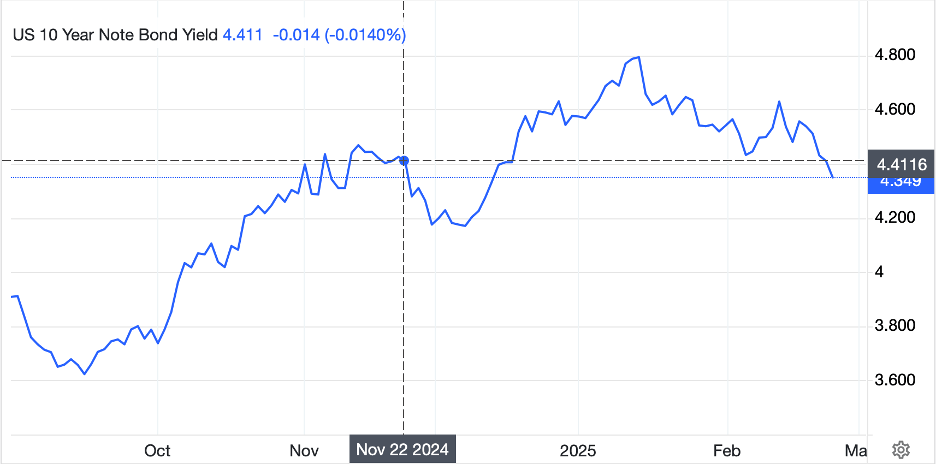

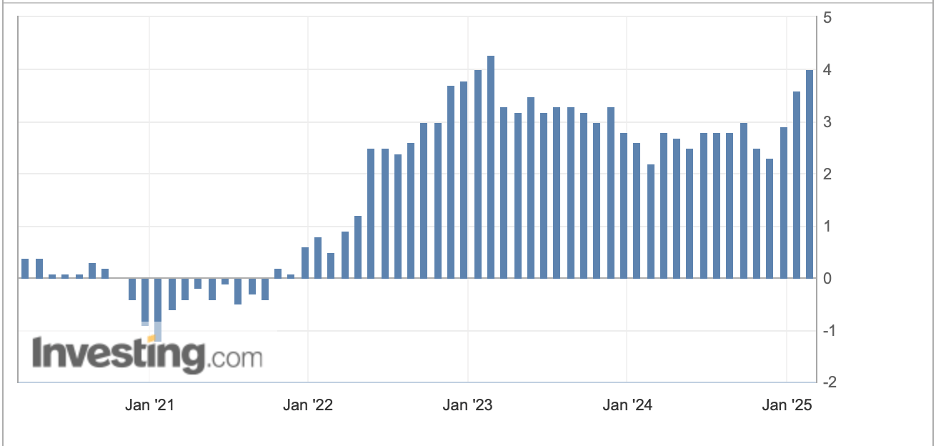

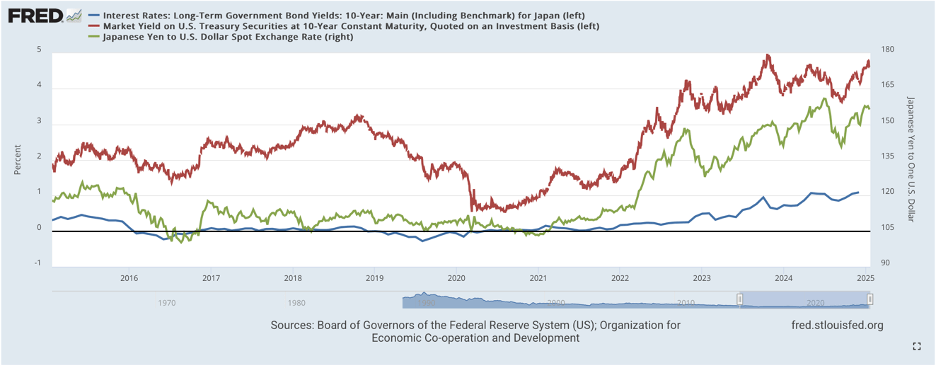

Keep one other thing in mind, unlike Trump’s first term in office, where he was constantly touting the strength of the stock market as a vote of confidence, this time around he and Treasury Secretary Bessent have been entirely focused on the 10-year yield and getting that rate down. After a 7bp decline yesterday, he has been successful there. (see chart below) I would be surprised if Trump speaks about the stock market much at all for a while.

Source: tradingeconomics.com

With that in mind, let’s see how markets have been handling the tariff imposition. After yesterday’s rout in the US, where a higher open morphed into a sharply lower close on the day, we saw red throughout Asia (Nikkei -1.2%, Hang Seng -0.3%, CSI 300 -0.1%) and Europe (DAX -2.1%, CAC -1.2%, IBEX -2.3%). In fact, it is far harder to find a market that has rallied at all, although US futures at this hour (6:40) are pointing slightly higher. However, after the sharp declines, an early bounce is not uncommon though not necessarily a harbinger of activity for the day. All of this makes sense as public companies are likely going to see impacts on their profitability either because of reduced sales or reduced margins, or both, with tariffs now in place. (Well, private companies are going to feel the same pressures, but there are no markets for them to worry about.). The worry for investors is given the extremely high price multiples that currently exist across so many companies, margin pressures can be problematic for stock prices. For the near term, it is easy to make the case that equities have further to fall.

In the bond market, after yesterday’s Treasury yield decline, there has been a modest 1bp bounce, although as per the above chart, the trend remains lower. In Europe, the news just hit the tape that the Eurozone is creating a plan to rearm the continent allowing for European countries to exceed debt restrictions to enable them to borrow and spend the money on this task. The mooted amount is €800 billion, meaning that markets can expect that much new debt issuance across the continent in the coming months and years. However, it appears investors are viewing the situation overall and are far more concerned with potential slowing growth than on increased issuance as yields have slipped one or two basis points across all nations in Europe. Perhaps that is a signal that there is little belief in the likelihood of this new plan coming to fruition.

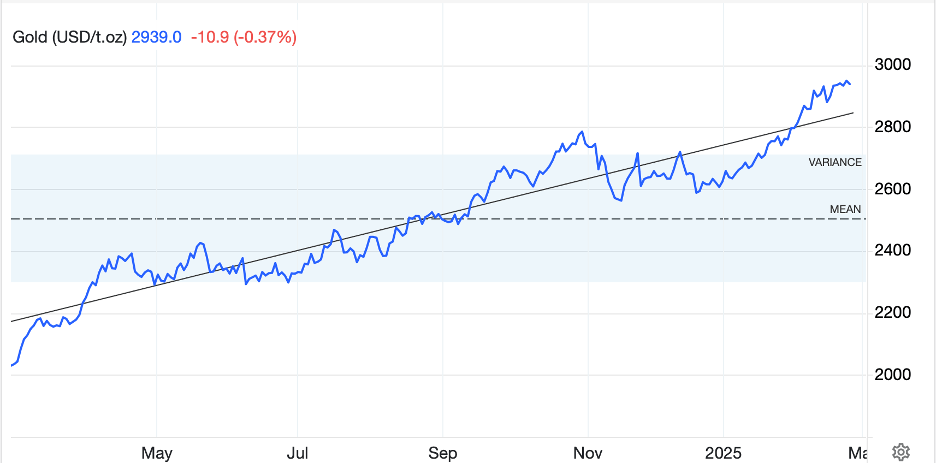

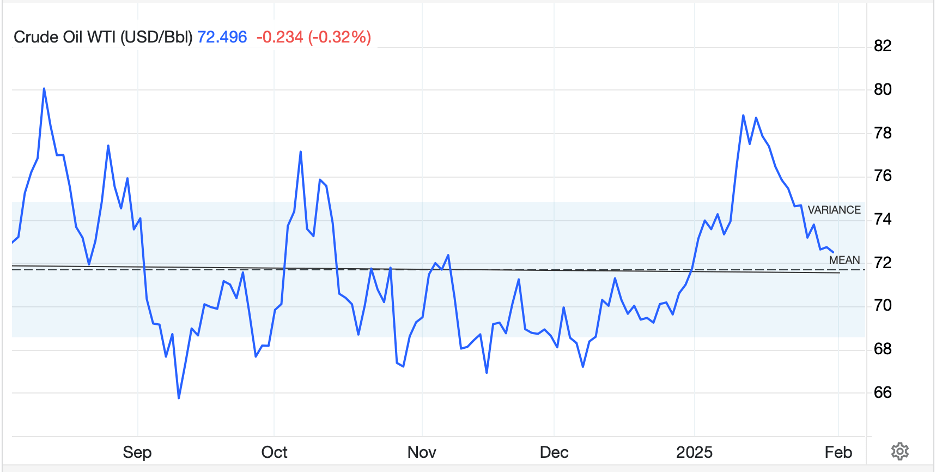

In the commodity markets, oil (-1.4%) continues its slide as a combination of worries over future growth due to the US tariffs and the OPEC+ announcement that they would start to bring production back online beginning in April (just 138K bbl/day, but the signal is quite clear that more is on the way) has traders unnerved. Certainly, this is part of what President Trump is seeking, lower oil prices to help keep a lid on inflation, and there is no doubt he has pressured OPEC+ on the issue. Remember, too, that if gasoline prices fall at the pump, that is a key driver of inflation perceptions for everyone. As to the metals markets, we are seeing a split this morning with precious (Au +1.0%, Ag +0.65%) rallying on uncertainty and fear while copper (-1.2%) seems to be suffering on recession fears.

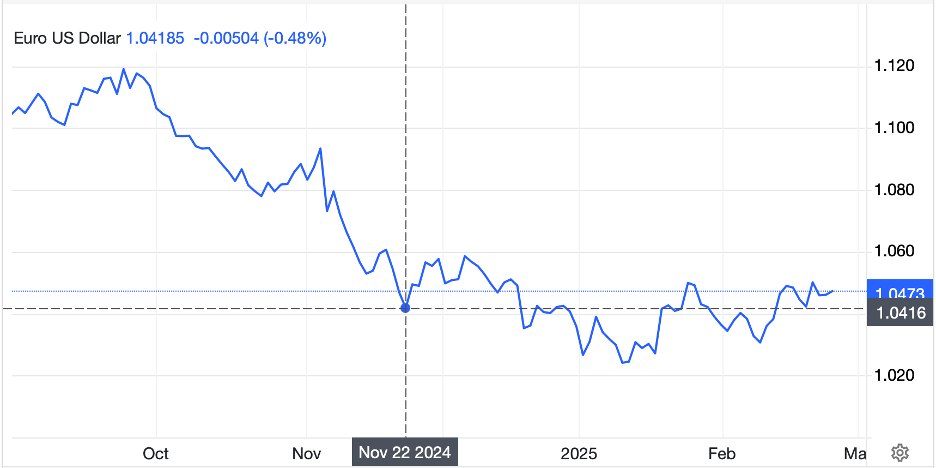

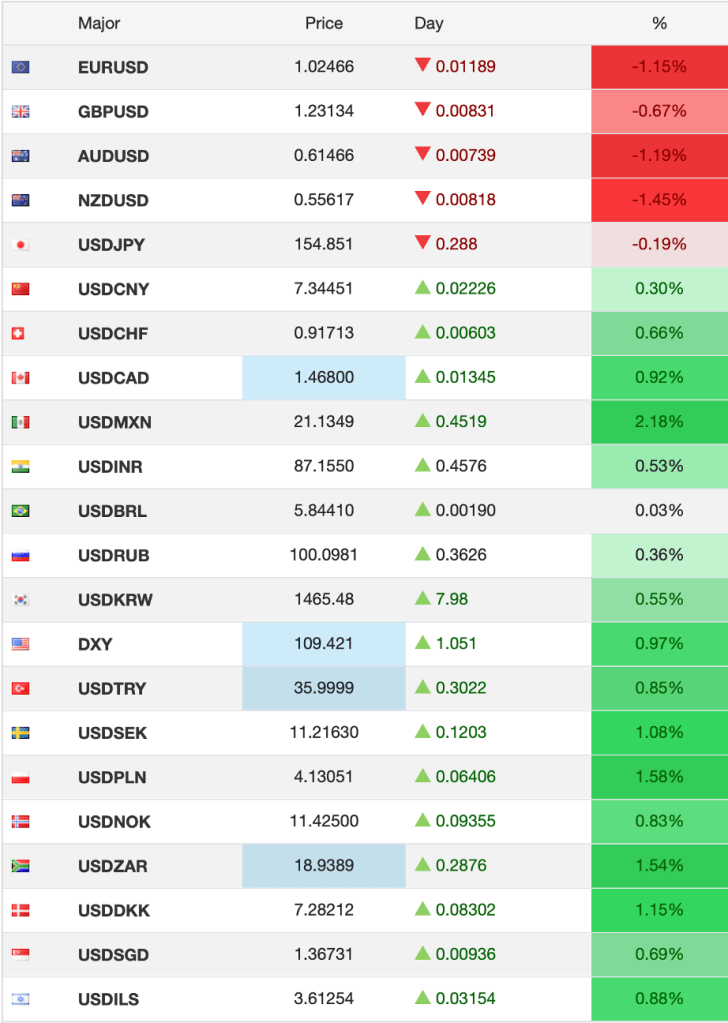

Finally, the dollar is lower again this morning with the DXY breaking back below 106 for the first time since early December as a signal of the broad trend. This is interesting as the textbooks claim that if the US imposes tariffs, the dollar will strengthen, or more accurately other currencies will weaken, to offset those tariffs, and yet this morning CNY (+0.55%) and CAD (+0.45%) are bucking that trend although MXN (-0.2%) is behaving as most would expect. But the dollar’s weakness is broad based, and my take is given the movement in interest rates, which are suddenly declining far more rapidly than anticipated just a week ago (Fed funds futures are now pricing in 75bps of cuts this year with a 11% probability of a cut in March, up from 2% last week) the dollar bull case is under real pressure. I have maintained all along that if the Fed reignited their easing policy, the dollar would suffer. Funnily enough, despite any angst between Chairman Powell (remember him?) and President Trump, they both may see lower rates as their preferred outcome. In that case, the dollar has further to fall.

There is no hard data set to be released today although we do hear from NY Fed President Williams this afternoon. This could be the first hint that the Fed’s caution is abating, and further rate cuts are in store. Of course, with Powell on the calendar for Friday, if there is a change in tone, most market participants will be waiting to hear it from him.

The watchword has shifted from caution to uncertainty. The tariffs have thrown sand into the gears of the economy and markets. It remains to be seen how much impact they will have, but for now, fear is rising although the dollar is not following suit. I think Trump must be happy, but I’m not sure how many in the markets are.

Good luck

Adf