For all of those pundits that claimed

inflation had died and been maimed

The data did show

What now we all know

Inflation is still quite inflamed

The upshot is all those who said

That real rates would soon force the Fed

To quickly cut rates

Are in dire straits

And stanching their bleeding instead

Wow! Not much else you can say after yesterday’s market activities following the hotter than expected CPI data released in the morning. As I wrote on Monday, a 0.1% difference in a monthly print is not really substantive in the broad scheme of things, but when the narrative is so strong and so many are convinced that the Fed is itching to cut rates because they don’t want to overtighten as inflation continues to fall, that 0.1% in the wrong direction means a lot. Hence, yesterday’s price action (which I did presage in the last line of my note yesterday morning before the release.)

Of course, you are all aware that stocks got crushed, with the major indices falling -1.35% to -1.80% while the Russell 2000 small cap index fell -4.0%! But it wasn’t just stocks, bonds joined the fun with the 10-year yield soaring 15bps to 4.30%, its highest yield since early December. Gold got crushed, falling $30/oz and back below $2000/oz for the first time in two months, while the dollar exploded higher, rising about 1% against most currencies and almost 1.8% against the yen.

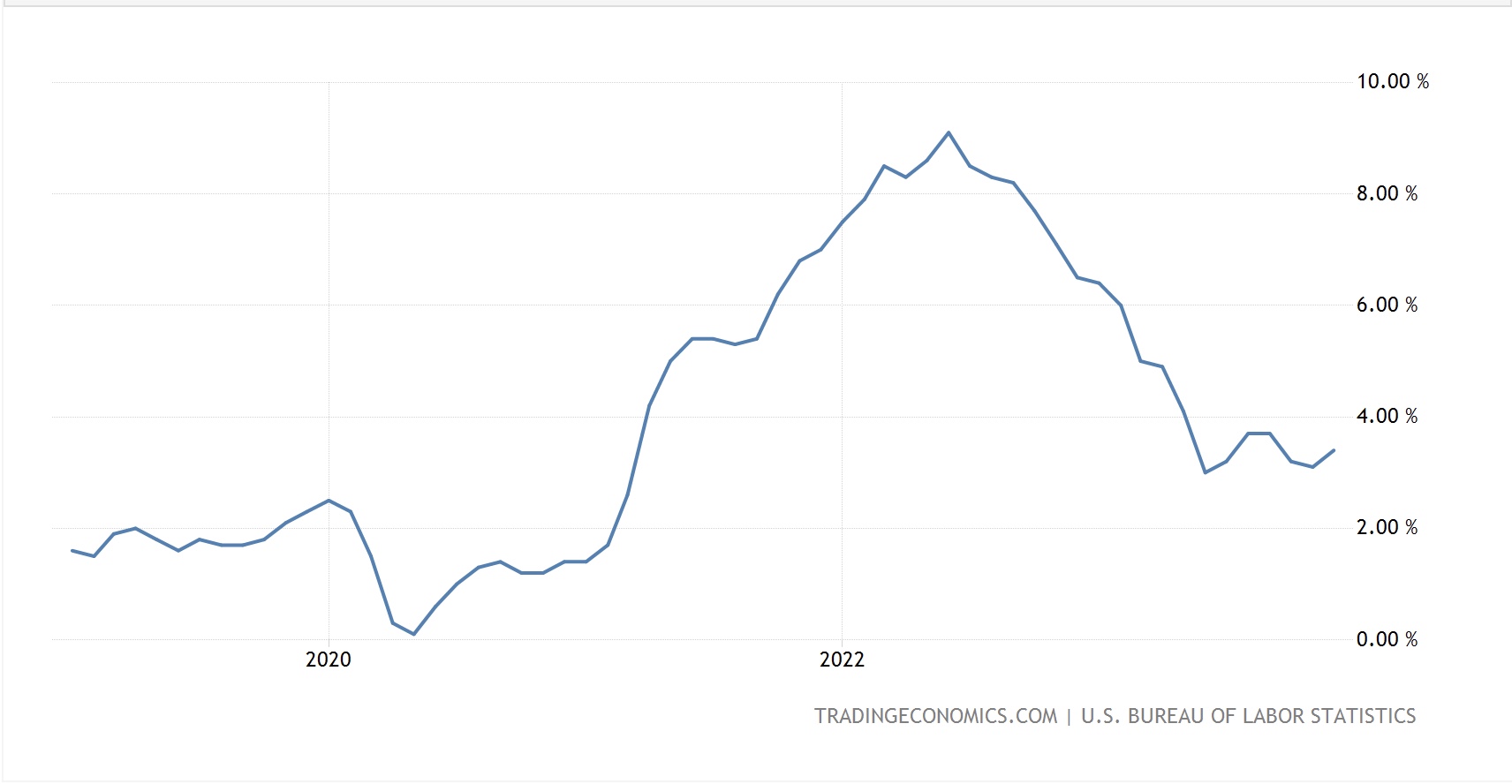

A quick analysis of the CPI data shows that the shelter component was the big surprise on the high side, although airfares also were higher than expected. As well, wages remain much stickier than the Fed would like to see as they continue to support price increases in the services component of the data. Forgetting the headline for a moment, a look at Median CPI, as calculated by the Cleveland Fed, shows that last month’s rise was 0.5% and the Y/Y number is +4.85%. That feels to me like a much better estimate of what is happening than the newest darling of the bullish set, Truflation, which claims that inflation is “really” rising at only 1.39% as of yesterday. One final thing, hopefully, all of those who claimed that the ‘real’ trend of inflation was sub 2% because the 3-month average had fallen there (please look at Monday’s note, What If?) will finally shut up for a while.

The new Mr. Yen

Said “we are closely watching”

So you don’t have to

Do not cross this line!

As mentioned above, the yen was the worst performer yesterday after the data which, not surprisingly, triggered a response from the Japanese government. Now that USDJPY is back above 150.00, there are many who believe the MOF/BOJ will be intervening soon. There is a terrific website called Harkster.com which aggregates all sorts of commentary and research from around the web as well as adding their own commentary. I highly recommend it as a source for information. At any rate, they have a very nice description of the historical actions that lead to intervention by the Japanese which I show here:

1. Language such as “monitoring developments in currency markets”.

2. “Sudden/abrupt/rapid” movements in currency markets are “undesirable”. In addition, markets are “not reflecting fundamentals”.

3. “Excessive” is introduced next to describe the price movements alongside “clearly” in addition to referring to FX moves as “speculative”.

4. Readying for action is normally reflected with the phrase “we are ready to take decisive action” which would suggest some action is imminent.

5. Price checking is the step prior to actual intervention whereby the BoJ will call round selected Japanese banks and ask for a level of USDJPY. Even though they do not deal the act of them asking normally makes the banks, who have been contacted, sell USDJPY in anticipation of intervention and they will also spread the news around the market to encourage more selling.

6. Same as 5 but this time the BoJ actually do sell USDJPY. This may happen in waves.

7. Finally, coordinated intervention with other major central banks involved. This would generally happen early NY hours to include the US. This obviously has the most effect on the markets.

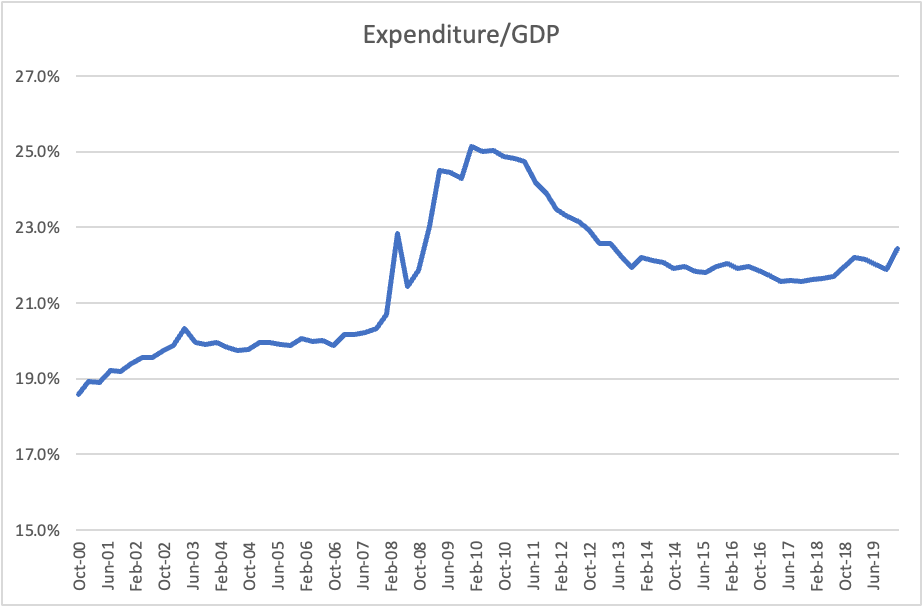

Arguably, we are somewhere between numbers 1 and 2 right now, but they can escalate this process quickly. However, in the end, what matters for currencies over time are relative fiscal and monetary policy settings. History has shown that to strengthen a currency, a country must run a tight monetary and loose fiscal policy. To weaken a currency, the opposite is true. Given the US 7% budget deficits and highest interest rates in the G10 + QT, it is pretty clear that the dollar should be strong. Now, if the BOJ were to raise rates aggressively, it would have a chance to alter the trajectory of the yen, but while Ueda-san has implied that they may raise rates back to zero after the spring wage negotiations, assuming they agree large increases, unless there is a strong belief that they are going to continue to raise rates to attack inflation in Japan (which isn’t really a big problem) then absent the Fed starting to ease, there is no good reason to think the yen will strengthen very much at all. Now, if the Fed does start cutting aggressively, that is a different story, but based on yesterday’s CPI, that feels like it is a long way in the future.

And those are the most noteworthy things to absorb. Now, a look at the rest of the overnight session shows that Japanese stocks were softer, but the rest of Asia (absent China which is still on holiday) was mixed, with gains and losses around. Europe, this morning, though is firmer, up about 0.5% except the UK, which is higher by 0.9% after CPI there fell more than expected, encouraging talk that the BOE will be cutting sooner. Now remember, yesterday the UK lagged after their employment data was stronger than expected, especially wage data, so it is not clear which one to believe. As to US futures, they are firmer at this hour (8:00), up about 0.5%.

After yesterday’s massive yield rallies, it is no surprise to see them slipping a bit today, with Treasury yields lower by 1bp and most European sovereign yields down by 3bps (UK Gilts are -6bps on that inflation data). Overnight, the Asian session saw government bonds there slide with yields higher across the board although JGB yields were the laggard, rising just 3bps.

In the commodity markets, oil (flat today) is the only market that didn’t sell off yesterday and it has maintained those gains. This is despite a much bigger inventory build than anticipated as it seems continued concerns over a wider Middle East war are extant, as is a new worry, as Ukraine has been able to bring the attack to Russia more effectively, sinking another Russian ship in the Black Sea last night. Recall, they have been attacking Russian oil infrastructure and if they are successful in that effort, it will definitely give oil prices a boost. But the rest of the commodity markets got crushed yesterday with gold, copper and aluminum all falling sharply. This morning, though, those three markets are little changed, simply licking their wounds and not extending any losses.

Finally, the dollar is also little changed this morning, but that is after a massive rally across the board yesterday against both G10 and EMG currencies. Against most major counterparts, it has traded back to levels last seen in mid-November, although the pound has been holding up better than most, with smaller net moves. It is ironic that the dollar strengthens on a high inflation print as fundamentally, high inflation is supposed to weaken a currency. Of course, this move has nothing to do with inflation per se, and everything to do with interest rate expectations.

On that subject, it is worth noting that the latest Fed funds futures rate cut probabilities are now; March 8.5%; May 37.9%; and there are now just 4 cuts priced into the year, down from 7 about a month ago.

There is no hard economic data released although the EIA oil inventories do come out later this morning. We also hear from two Fed speakers, Goolsbee and Barr, and I imagine we could get a little ‘we told you so’ in their comments today.

If recent history is any guide, I suspect that equity markets will rebound a bit further early, but potentially drift lower as the day wears on. The bulls were clearly shaken as their narrative took a big hit. But this was just one data point of many. I don’t believe the end is nigh, but in the longer term, it is not hard to believe that the Fed will remain the tightest policymaker of all the central banks and that will help the dollar while hurting risk assets.

Good luck

Adf