The first thing we saw yesterday

Was ADP led to dismay

But Treasury news

Adjusted some views

And stocks started trading okay

However, t’were two things we learned

First NYCB stock was spurned

Now, you may recall

That their greatest haul

Was Signature Bank, which was burned

And lastly Chair Powell, at two

Explained what he’s likely to do

They’re not cutting rates

As both their mandates

Remain far ahead in their view

Just when you thought it was safe to go back in the water…

I am old enough to remember when there was a growing certainty that not only was the Fed virtually guaranteed to cut rates by the May meeting, but the March meeting was very much on the table. After all, inflation was below their 2.0% target (if you look at the recent 6-month run rate anyway) and therefore they just had to cut rates or stock prices might fall! Or something like that. But somehow, Jay and the FOMC missed that memo. Instead, what they told us was [my emphasis];

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.”

In other words, while it is highly unlikely that they will need to hike rates further, unlike the markets or the punditry, Powell has little confidence that they have won the inflation battle and rate cuts remain merely a distant prospect. Certainly, there was no obvious concern that interest rates are “too” high at this time. In other words, this was a much more hawkish statement, and Powell’s answers in the press conference were in exactly the same vein. Memories of the dovish December meeting have faded from view. And this was the denouement to quite a day, one which gave us so much new information.

Things started with a weaker than expected ADP Employment result, just 107K, although that data point’s correlation to NFP has been diminishing of late. Regardless, it was the type of softness that got people primed for a dovish Fed. Then, the QRA indicated that the Treasury will be issuing what appears to be about $45-$50 billion in new coupons this quarter to fund a $400 billion or $500 billion budget deficit. The balance of that will be via T-bills which means that while the ratio is not as aggressively leaning toward T-bills as last quarter, it is still miles above the historical rate of 20% ish. Those two stories got bond bulls hyped, although equity markets struggled on some weak earnings numbers.

And then we heard from New York Community Bank (NYCB), which you may recall, was the lucky recipient of the Signature Bank assets last March. Well, it turns out they made a hash of things, losing a bunch of money with some pretty bad loan impairments added on to increased capital requirements because they grew to a new, larger risk-weighting tier after the acquisition. At this time, there is no indication they are about to go bust, but the question has been asked a lot as the stock cratered and investors ran into Treasury debt just to be safe. As it happens, the stock, which had basically doubled over the past year after buying Signature, has reverted to its pre-acquisition price and that added jitters to everyone’s views. PS, those loan impairments were CRE based which naturally leads to the question of what is going on with other regional banks.

Finally, during the press conference, Chairman Powell was clear that a March rate cut was highly unlikely and that was the final nail in the equity market’s coffin. So, the NASDAQ led the way lower, falling -2.2% while the S&P 500 tumbled -1.6%. At the same time, 10-year yields dropped like a stone, down 12bps to 3.91%.

Looking ahead, I wonder how all those folks who were certain the Fed HAD to cut because policy was just TOO TIGHT for their liking will reframe their narrative. To my eye, yesterday’s equity declines are a blip and will not even register at the Eccles Building. There is a bit of irony in that the doves need now eat so much crow.

Ok, on to this morning, where the overnight price action saw another mixed picture in Asia, but this time with Japan (Nikkei -0.75%) sliding while Chinese shares (Hang Seng +0.5%, CSI +0.1%) edging higher. There was yet another announcement of a bit of further fiscal support from the Chinese government, but Xi remains reluctant to bring out the bazookas. European shares are also mixed with gains in the UK and Spain and losses in France and Germany. PMI data showed that the Flash numbers were pretty much spot on and all of Europe remains well below 50.0 except Norway (50.7) which benefits from its oil industry. It remains very difficult to get excited about the Eurozone’s economic prospects these days which should ultimately weigh on the ECB to cut rates sooner and the euro to suffer in that case. As to US futures, after a wipeout yesterday, this morning they are firmer by about 0.5% at this hour (6:45).

In the bond market, after yesterday’s Treasury yield collapse, 10-year yields are higher by 3bps this morning and European sovereigns have risen about 4bps on average. This movement is more a response to the large move yesterday rather than a result of new information. Overnight, JGB yields slipped 4bps, clearly following in the footsteps of Treasury yields.

As to commodities, oil (+1.0%) has bounced after a weak session yesterday that was driven by demand worries. But tensions in the Middle East seem to be reasserting themselves with several stories in the press this morning regarding the danger to the world from a potential collapse in shipping capabilities. The ongoing Houthi attacks in the Red Sea are starting to really take their toll on supply chain situations. This is not only bad for inflation readings but could well impair the ultimate delivery of critical things like oil, thus driving its price even higher. As to the metals markets, they are all under pressure this morning with gold holding on best given its haven status but all the industrial metals lower by 1% or more.

Finally, the dollar is coming up roses this morning. While in the early going yesterday, before the FOMC meeting, the dollar broadly sold off on the softer ADP and dovish QRA, Powell changed everything, and the dollar reversed course in the middle of the day and rallied back nicely. This is true against virtually all its G10 and EMG counterparts. The weakest members are AUD (-0.7%) after weak housing data Down Under added to thoughts of a rate cut coming soon. As well, we see GBP (-0.4%) just ahead of the BOE meeting where expectations are for a more dovish statement although no policy change. But we are seeing weakness in CLP (-1.3%) on the back of that weak copper price and weakness in ZAR (-0.4%) on the weak metals complex as well. Given the hawkish tilt from Powell yesterday, unless there is a concerted effort by the Fed speakers that will be flooding the tape over the coming weeks to reverse that course, I suspect the dollar will benefit in the near-term.

On the data front, this morning brings Initial (exp 212K) and Continuing (1840K) Claims, Nonfarm Productivity (2.5%), Unit Labor Costs (1.6%) and ISM Manufacturing (47.0). With NFP tomorrow, I expect that the productivity and ULC data should be of the most interest as they will play most deeply into the Fed’s thinking. Improved productivity implies that there is less reason to cut interest rates as the “neutral rate” should be higher than previously thought. In fact, that dynamic would be very positive for the dollar, and interestingly, for the equity market as well as it would be a clear boost to earnings potential. We shall see how it turns out.

Good luck

Adf

Tag Archives: #FOMC

Nary a Doubt

The two things we’re watching today

Are Jay and the new QRA

The pundits are out

With nary a doubt

That easing is coming our way

But what if this faith is misplaced

And Jay, at the presser, bald-faced

Says policy ease

Is not what we please

And we’ll not get there in great haste

Reading the Fed Whisperer, Nick Timiraos of the WSJ, this morning was enlightening only to the extent that everybody he interviewed demonstrated they have no idea what will happen, and merely described what they would like to see. Now, in fairness, I don’t think Powell himself really knows how things are going to play out as we continue to see mixed pictures on the economy. For every strong datapoint (e.g., GDP, JOLTS, Case Shiller) indicating that there are many potential inflationary pressures extant, we see some softer data points (e.g., PCE, Empire Manufacturing, Dallas Fed) that indicate policy is excessively restrictive. While it is very clear that the Fed will not adjust policy today, a look at Fed funds futures shows that the market is pricing in a 45% chance of a cut in March. A month ago, that was over 70%, so Powell must be a bit happier, but 6 weeks is such a long time in this context, anything can happen between now and then. And, oh yeah, the market is still pricing in 6 cuts this year.

Of course, long before the FOMC statement and Powell presser this afternoon, the Treasury will release its QRA and the market will learn if Secretary Yellen is going to continue down her recent path of leaning toward more T-bills and less coupons. Based on her continuous comments that the soft landing has been achieved and inflation is no longer a problem, it seems quite clear that she wants to see the Fed cut rates soon. After all, lower interest rates take pressure off the budget deficit, which is entirely her baby at this point. Interestingly, she could essentially force Powell’s hand in this situation as follows:

1. Issuing a high percentage of T-bills will lead to

2. Reducing the RRP balances and bank reserves which will

3. Force the Fed to respond by slowing/ending QT to prevent any systemic problems like seen in September 2019

Remember, we have already heard from Powell, as well as Dallas Fed President Lorie Logan, whose previous role was at the NY Fed overseeing the Fed’s reserve portfolio, that the time to discuss slowing or ending QT was fast arriving. By itself, that is a policy ease, but it would also be a signal that further changes were on their way. In fact, a continued heavy reliance on T-bill issuance would have two vectors to support the bond market; ending QT reduces the amount of bonds the market needs to absorb and reducing new supply by itself will do exactly the same thing. At least for as long as inflation remains quiescent. And in the end, that remains the biggest unknown, inflation. All these plans and ideas revolve around the premise that the Fed has won its inflation fight. But I ask you, what if they haven’t?

Too much digital ink has been spilled already on the inflation question and the two camps remain at distinct odds. Forgetting all the conspiracy theorists who claim inflation is really 10% or more, and looking only at serious economists and analysts, while all agree that the rate of inflation has fallen from its peak levels in the summer of 2022, there is still a pretty even split between the two sides. While I fall on the side of stickier inflation than the market is pricing, I can understand the other side of the story. But the point is, there are two very real sides to the story and the outcome remains unwritten. However, if inflation does remain stickier than the doves believe, it will destroy their entire thesis of why the Fed should be easing policy. Given the stock market is making new highs regularly, I suspect investors and traders have largely bought into the ‘inflation is over’ view. Just be careful if it’s not.

Ok, as we await today’s activities, let’s look at what happened overnight. Following a mixed session in the US yesterday, Asian markets turned back the clock a few weeks with the Nikkei (+0.6%) continuing its longer-term rally while both the Hang Seng (-1.4%) and CSI 300 (-0.9%) revert to their losing ways. It seems that investors simply do not believe that President Xi has either the ability or willingness to do anything to support the stock market there, at least, if not the economy. I believe it would be a mistake to believe he is not willing, which calls into question exactly what they are going to do to prevent things from starting to impact the economy more negatively. And perhaps we have seen the first steps. The other noteworthy story in the WSJ this morning was about how Chinese authorities are “discouraging” negative takes on the economy from being published and instead telling news outlets to publish stories about the bright prospects there.

Moving on to Europe, the main indices have moved very little thus far today after a mixture of data showing inflation in Germany and France continue to decline but Retail Sales in Germany (-1.6%) and Switzerland (-0.8%) and Industrial Sales in Italy (-1.0%) all falling sharply in December. Given the weak GDP data yesterday on the continent, none of this can be surprising. Finally, US futures are mostly lower this morning, led by the NASDAQ (-1.0%) despite (because of?) what seemed to be solid earnings from Microsoft and Alphabet. In the end, though, I sense that investors are far more focused on the QRA and FOMC right now.

Treasury yields are unchanged this morning but that is after a 4bp decline yesterday and we have seen European sovereign yields slide this morning as well, between 1bp and 3bps, which seems to be a catch up move to the Treasuries. I must mention Australian government bonds, which saw yields tumble 13bps overnight on the back of a much softer than expected CPI reading which has the market talking rate cuts there again. Finally, JGB yields edged 2bps higher, despite weaker than expected Retail Sales and IP data.

Oil prices (-1.1%) are backing off this morning after another positive day yesterday and a very strong month of January, where WTI rose > 9%. (My take is that will not help the CPI data when it comes out in a few weeks’ time.) Meanwhile, metals prices are trading near unchanged on the day as traders here are also awaiting the new information.

It should be no surprise that the dollar is, net, little changed this morning on the same premise of waiting for Godot Powell. Looking at my screen, I don’t see any currency that has moved more than 0.3% in either direction so really no information yet today.

In addition to the QRA and FOMC meeting, we see the ADP Employment Report (exp 145K), the Employment cost Index (1.0%) and Chicago PMI (48.0). Careful attention should be paid to the ECI as the Fed focuses on that metric for wage inflation data. As an indication, prior to the pandemic, that index averaged around 0.6%, but since then, it is more like 1.0% on a quarterly basis. That annualizes to more than 4% and will maintain upward pressure on inflation if it stays there. Just something else to keep in mind.

If pressed, I believe that the QRA will show reduced coupon issuance and Powell will be more dovish than not. While we know the Treasury is political, by definition, and will do everything in its power to stay in power and get re-elected, my take is the Fed is in that camp as well. I would not be surprised to see a more dovish take this afternoon after the QRA this morning. And initially, at least, that tells me the dollar will trade back toward its recent lows ceteris paribus.

Good luck

Adf

There’ll Be No Crash

Said Janet, I know we’ve been spending

Too much, but you’re not comprehending

I’ve plenty of cash

So, there’ll be no crash

Instead, stocks will keep on ascending

Til Wednesday, we’ll keep the suspense

But really, it’s just common sense

Chair Powell and I

Will help the Big Guy

And policy ease will commence

Well, the first shoe dropped yesterday afternoon as the Treasury explained that they would “only” be borrowing $760 billion in Q1, a solid $56 billion less than had been expected by the market as of yesterday morning. With that significant reduction in potential Treasury issuance, the bulls went nuts and both stocks (+0.75%) and bonds (-7bps) rallied. A cynic might believe that Secretary Yellen was trying to manipulate the stock market higher, but we all know that could never be the case. At any rate, this sets us up for Wednesday when first thing in the morning we will see the Quarterly Refunding Announcement (QRA), where Yellen will describe the ratio of short-dated T-bills to long-dated coupon issuance, and then at 2:00, the FOMC Statement will be released with Chairman Powell speaking at the press conference 30 minutes later.

Given the excitement over yesterday’s events, I suspect that at least one of the two events tomorrow will be dovish rates/bullish equities but have no idea which way it will play out. In the end, though, it doesn’t really matter. Ultimately what we have learned is that Yellen is running the show, and all Powell can do is respond. The one thing I have to wonder is, what if the government spends more than the $760 billion in Q1? Where will that money come from, and what will the impact be on the markets? (Obviously, they will simply borrow more, but it will not be an issue as there is no limit these days, nor for an entire year going forward.) However, for now, that is just a concern for grumpy old men like me.

In China, though they have announced

More stimulus and stocks first bounced

It seems traders feel

Xi ain’t got that zeal

So, sellers once more have all pounced

You may recall last week when the Chinese stock market rallied sharply after a series of announcements regarding government support. First there was the story of CNY 2 trillion of cash that would be coming home and invested in equities and then the PBOC cut the RRR by 50 basis points, freeing up another CNY 1 trillion. These moves were supposed to demonstrate that Xi was going to fix things. And he did…for a week. But now, equity markets in both Hong Kong (-2.7%) and on the mainland (-1.8%) are falling again as it seems market participants have come to believe that there are too many problems for a mere CNY 3 trillion to fix. And they could well be correct.

After all, China has been inflating their economy for decades and the property bubble they have blown is not nearly popped yet. While this could be a modest correction in the beginning of a trend higher, I have a feeling that the fundamentals have a long way to go before they make sense for international investors. With the European economy having stagnated for the past 5 quarters and the US moving an increasing amount of business to Mexico from China, it will be tough sledding in China, I fear. Ultimately, I continue to believe the renminbi will suffer as it will be the most likely outlet valve. But for now, I guess they can stand the pain.

And those are today’s stories as the market braces itself for tomorrow’s QRA and FOMC, Thursday’s BOE and Friday’s NFP data. In the meantime, let’s recap the rest of the overnight action.

Despite the robust performance in the US yesterday, only Japan and Australia managed to show any signs of life in Asia overnight as China dragged down all the other regional markets. This cannot be too surprising given the importance of the Chinese economy there, and if it is lagging other nations are going to struggle as well. Europe, however, is having a much better go of it, with gains across the board, led by Spain’s IBEX (+1.25%) after both real and nominal GDP rose more than expected with inflation ticking higher alongside economic activity. That may not bode well for the inflation story in Europe, but for now, everyone’s happy and the ECB comments have all pointed to rate cuts by the middle of the year. As to US futures, at this hour (7:45) they are just barely on the red side of unchanged, with no market even -0.1%.

You will not be surprised that European yields slipped yesterday after the US bond rally as the combination of a prospect of lower yields in the US alongside the slightly more dovish talk from the ECB speakers was plenty of catalyst for a bond rally there. While yields have edged back higher by 2bps or 3 bps this morning, they remain below yesterday morning’s levels. In the US, Treasury yields have continued their decline, down another 1bp overnight while JGB yields have edged down another 1bp as well. One other market to note, China, saw yields slip 3bps overnight and they are now at their lowest level since the early 2000’s as the market anticipated further policy ease from the government and PBOC.

Oil prices (-0.65%) are off a bit this morning as they continue to consolidate last week’s gains. Clearly there is still concern regarding the US response to the attacks on its base in Jordan over the weekend as the intensity of that response is still completely unknown. Weakness in China is not helping the oil market and European GDP data has also worked against the demand story, so uncertainty remains the watchword. As to gold, it is continuing to creep higher but remains in its recent 2020/2060 trading range. Lastly, the base metals are a touch softer this morning, but only a touch.

Finally, the dollar is a bit softer this morning after a benign day yesterday. In a way, this is surprising as I would have expected the greenback to slide alongside Treasury yields, but I guess given the broader dovishness from ECB and other central bankers, on a relative basis not much changed. As well, traders are reluctant to take large positions ahead of tomorrow’s big QRA and FOMC announcements. As such, I suspect that we are going to see a very quiet session here across the board, just like we had overnight.

On the data front, while not as exciting as tomorrow, we do see Case Shiller Home Prices (exp 5.8%), JOLTS Job Openings (8.75M) and Consumer Confidence (115.0) this morning. I keep listening to all the people who are telling me that falling housing prices are going to drive inflation lower, and the only reason the CPI and PCE calculations aren’t already lower is because they both have them at a lag. Then I look at Case Shiller and say, what falling housing prices? Anecdotally, in my neighborhood, we continue to see bidding wars and homes selling above asking. If rates are really going to come down further, I suspect that will only drive that process even further. The deflation story just makes no sense to me. But anyway, probably not much today and all eyes are on tomorrow.

Good luck

Adf

Not One Whit

Both headline and core PCE

Were softer, with both below three

But under the hood

It’s not quite as good

As housing and transport are key

The narrative, though, will not quit

Assuring us all this is it

Rate cuts will come soon

And stocks to the moon

But so far, for proof, not one whit.

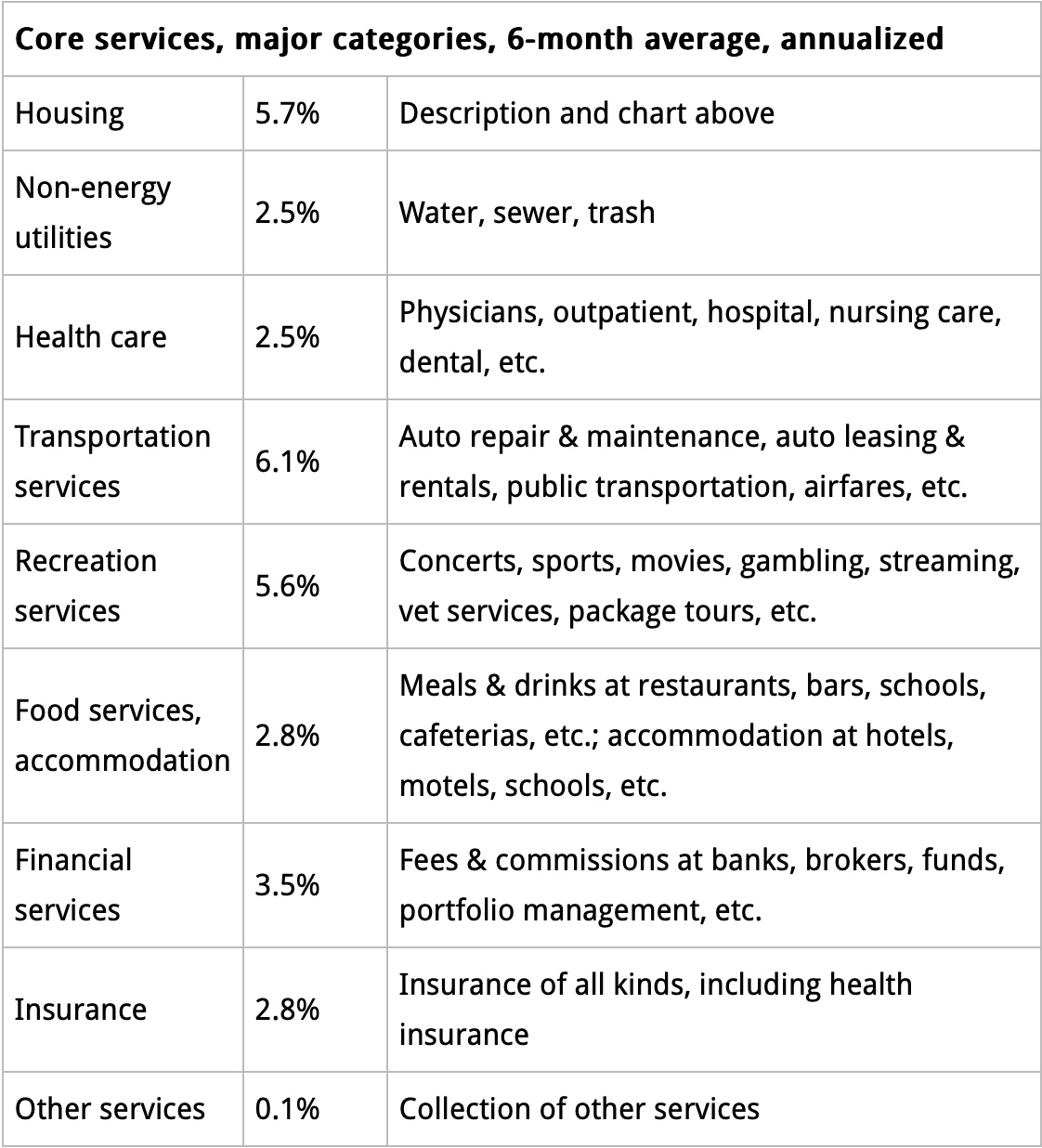

There is a very good analyst who writes regularly on the macroeconomic story named Wolf Richter. In the wake of Friday’s PCE data release, he published an article that had the following table:

It is not hard to look at this table and see a bit of the reality we all face, rather than the widely touted headline numbers regarding inflation. Housing continues to be sticky at much higher inflation rates than target, as well as transportation services, recreation services and financial services. But even the other stuff, seems to be running above the elusive 2.0% level. Now, this is the annualized rate of the past 6 months’ average readings. But as I highlighted last week regarding CPI, this seems to be the new benchmark. My point is that while the narrative is really working hard to convince us all that inflation is collapsing and the Fed is massively over-tight in its policy and needs to CUT RATES NOW, this breakdown doesn’t look quite the same. My belief is the Fed remains on hold much longer than the market is expecting/hoping for, and that at some point, equity markets and risk assets are going to come to grips with that reality. Just not quite yet.

Of course, maybe the narrative is spot on, and inflation is going to smoothly decline back to the 2% level while economic growth continues its recent above-trend course. But personally, I have to fade that bet. Based on the amount of continued fiscal stimulus, as well as the Fed’s discussion of slowing QT and their indication of rate cuts later this year, I believe that while the growth story is viable, it will be accompanied with much hotter inflation than is currently priced. The fact that breakeven inflation rates are priced at 2.50% in the 10-year does not mean that is what is going to happen. Just like the fact that the Fed funds futures market is currently pricing between 5 and 6 rate cuts in 2024 does not mean that is what is going to happen. Let’s face it, nobody knows how the rest of the year is going to play out. The one thing, however, of which we can be sure is that Treasury Secretary Yellen will spend as much money as possible in her effort to get President Biden re-elected. That alone tells me that inflation is set to rebound.

And there is one other thing to remember, as things heat up in the Red Sea, and shipping avoids the area completely, the cost of transiting stuff from point A to point B continues to rise. The cost is measured both in the dollars charged for the service and the extra 10-14 days it takes to complete the trip around the Cape of Good Hope in South Africa. It seems that the Biden Administration’s foreign policy has unwittingly had a negative impact on its economic policy plans.

In sum, when I look at both the data and the activities around the world, it remains very difficult to accept the narrative that inflation is collapsing so quickly that the Fed MUST cut rates and cut them soon. The combination of still robust US growth on the back of excessive fiscal stimulus and the increased tensions in the oil market lead me to a very different conclusion.

With that in mind, let’s see what happened overnight. Equity markets in Asia were mixed as Japan (Nikkei +0.8%) and Hong Kong (Hang Seng +0.8%) both rallied but mainland Chinese shares (CSI -0.9%) fell. This was somewhat surprising as China, in their continuing efforts to prop up their stock markets, have restricted the lending of any securities for short sales while a HK court ruled Evergrande (remember them?) should be liquidated completely. Perhaps the Chinese real estate situation is not quite fixed yet after all. I suspect that we will see other liquidations as well before it is all over. In the meantime, European bourses are mixed with the DAX (-0.4%) lagging while the FTSE 100 (+0.25%) is top dog today. There’s been no news of which to speak so this seems like position adjustments ahead of the Fed’s activities later this week. US futures, too, are mixed and little changed at this hour (7:15).

Bond markets, though, are really loving all the rate cut talk and are growing more confident that they will be coming soon as inflation collapses. Treasury yields are lower by 3bps this morning and the entire European sovereign market has rallied with yields down an impressive 5bps-7bps today. The only outlier is the JGB market, which saw the 10-year benchmark yield edge up 1bp. It is much easier for me to believe that the ECB is going to cut as inflation in the Eurozone slows alongside the faltering growth story than to believe that the Fed is going to cut into an economy growing 3+%. But that’s just me.

In the commodity markets, oil (+0.3%) continues to find support as the tensions in the Middle East expand after an attack in Jordan killed three US servicemen there. Oil is higher by 5% in the past week and more than 11% in the past month. It seems to me that will not help the inflation story. At the same time, we are seeing demand for precious metals as gold (+0.5%) and sliver (+1.0%) are both rallying on the increased nervousness around the world. Perhaps more interestingly is that copper is marginally higher this morning, something that would seem contra to the escalating tensions.

Finally, the dollar has rallied a bit this morning on net, although it is not a universal move by any stretch. For instance, while European currencies are broadly weaker, in Asia and Oceania, we are seeing strength with AUD and NZD (both +0.4%) and JPY (+0.2%) fimer. As to the rest of the world, it is a mixed session with minimal movement. Feels like a wait and see situation given all the data and info coming this week.

Speaking of the data this week, there is much to absorb.

| Today | Treasury Funding Amount | $816B |

| Dallas Fed Manufacturing | -23 | |

| Tuesday | Case Shiller Home Prices | 5.8% |

| JOLTS Job Openings | 8.75M | |

| Consumer Confidence | 115 | |

| Wednesday | ADP Employment | 135K |

| Treasury QRA | ||

| Employment Cost Index | 1.1% | |

| Chicago PMI | 48 | |

| FOMC Meeting | 5.5% (unchanged) | |

| Thursday | Initial Claims | 210K |

| Continuing Claims | 1835K | |

| Nonfarm Productivity | 2.5% | |

| Unit Labor Costs | 1.7% | |

| ISM Manufacturing | 47.3 | |

| Construction Spending | 0.5% | |

| Friday | Nonfarm Payrolls | 173K |

| Private Payrolls | 145K | |

| Manufacturing Payrolls | 2K | |

| Unemployment Rate | 3.8% | |

| Average Hourly Earnings | 0.3% (4.1% Y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.4% | |

| Factory Orders | 0.2% | |

| Michigan Confidence | 78.8 |

Source tradingeconomics.com

The first thing to understand is that this morning, the Treasury will be releasing how much funding they expect to need in Q1 of this year, currently expected at $816 billion, but Wednesday’s QRA will describe the mix of the borrowings. Recall that last quarter, Secretary Yellen changed the mix of short-dated paper to long-dated coupons substantially and completely reversed the bond market rout that was ongoing at the time. If she continues to issue far more bills than coupons, it should support the bond market and help continue to juice risk assets. Any substantial increase in coupon issuance is likely to be met with a significant stock and bond market sell-off. So, which do you think she will do?

Otherwise, looking at the other data, certainly there is no indication that housing prices are moderating. The Fed will not change rates on Wednesday, but everyone is waiting to see if they will remove the line in their statement about potentially needing to raise rates going forward. Perhaps there will be a little two-step where the QRA points to more bond issuance, but the Fed sounds more dovish to offset that news. And of course, Friday’s NFP data will be keenly watched by all observers as any signs that the labor market is cracking will get the rate cut juices flowing even faster.

All in all, we have a lot of new information coming to our screens this week. At this point, it is a mug’s game to try to guess how things will play out. However, if we see dovishness from the Fed or the QRA (more bill issuance) then I expect risk assets to perform well and the dollar not so much. The opposite should be true as well, a surprisingly hawkish Fed or more coupon issuance will not be welcomed by the bulls, at least not the equity bulls. The dollar bulls will be happy.

Good luck

Adf

Somewhat Miffed

The Minutes did naught to explain

Why Jay might need raise rates again

But if we all harken

The Fed’s Thomas Barkin

The future seems cloudy with rain

So, now it seems Jay’s somewhat miffed

As he and his team try to shift

The views he expressed

That rate cuts were blessed

And markets did act sure and swift

Remember the certainty with which market participants determined that the Fed had not only finished raising interest rates, but that they would be cutting them quite soon? That is so last year! It seems that after a powerful Santa Claus rally that was inaugurated by Secretary Yellen’s move to issue more T-bills and less coupons, and then seemingly confirmed at the December FOMC meeting, where the dot plot showed no more rate hikes and a median expectation of three cuts this year, and where Chairman Powell, when given a chance to push back on this new narrative in the press conference, went out of his way to embrace the ‘rate cuts coming soon’ narrative, the Fed is no longer happy about the situation. Instead, now they seem to want the market to ratchet back these expectations for a quick decline in interest rates. At least, that’s what we heard from Richmond Fed president Tom Barkin yesterday, “The FOMC’s December meeting got a lot of attention. We acknowledged the progress on inflation and explicitly reaffirmed our willingness to hike if necessary.” [emphasis added].

Meanwhile, the Minutes seemed to lean more hawkish than not, “It was possible that the economy could evolve in a manner that would make further increases in the target rate appropriate. Several also observed that circumstances might warrant keeping the target range at its current value for longer than they currently anticipated.” Arguably the best line, though, was “Participants generally perceived a high degree of uncertainty surrounding the economic outlook,” which is likely the most honest statement they have ever made. In the end, the Minutes didn’t sound very dovish to me, but as I mentioned above, the press conference came across far more dovishly. One other thing to note is that they mentioned QT for the first time in quite a while. It seems that they recognize the incongruity of shrinking the balance sheet while cutting interest rates, so they have begun to consider how to message any changes there.

With this new information being absorbed, the market is now in the process of re-evaluating the idea that rate cuts are going to happen as quickly and as substantially as thought just a week ago. At this time, there is just a 10% probability of a cut at the end of this month (it was nearer 20% last week) and the March probability is down to 70% (it was 79% last week) though the market is still pricing in 6 cuts in 2024. FWIW, that seems outside the bounds of how things will ultimately play out, and I maintain that while a cut could easily be made by the May meeting, I do not foresee inflation cooperating which will force a lot of rethinking.

To summarize the Fed story, the market has sensed a disturbance in the easing force that had been widely assumed and a key driver of the late 2023 risk rally. This morning, markets have stabilized after two consecutive negative days to open the year. As such, let us keep our eyes peeled for more, new and, potentially non-narrative, information going forward.

Looking at the latest data releases overnight and this morning, they consisted of the Services PMI data as well as German state inflation. Regarding the former, both Australian and Japanese data were soft although Chinese data was better than expected with the Caixin Services PMI printing at 52.9, continuing its rebound from summer lows. Across Europe, Italian (49.8), French (45.7), German (49.3) and the Eurozone composite (48.8) all showed contractionary numbers although the UK (53.4) vastly outperformed. As to the German state-by-state inflation readings, every one of them bounced sharply from last month’s recent lows and the market is looking for a sharp rebound in the national CPI to 3.7% later this morning. As I have written before, that combination of rising inflation and weak growth is a tough situation for Madame Lagarde. My money is still on her to address the growth rather than the inflation, although she will likely wait until the Fed moves before doing so in Frankfurt.

With all this in mind, let’s take a look at the overnight market activity. In Asia, the picture was mixed although there was more red than green on the screen. While the Nikkei (-0.5%) fell, other Japanese indices held their own, and we saw some strength in Indian shares as well. However, China remains under pressure, despite the stronger than anticipated PMI reading and that has been weighing on South Korea, Hong Kong and Australia overall. However, in Europe, we are seeing modest gains this morning, only on the order of 0.1% or 0.2%, but green is more pleasant than the red of the past two days. As to US futures, they are little changed at this hour, although again, better than their recent performance.

In the bond market, from the time I wrote yesterday morning, yields fell through the rest of the session by nearly 7bps in the 10yr Treasury market, and this morning, they have bounced back from the closing levels by 4bps. We have seen similar price action throughout Europe where yesterday’s declines to closing lows have been reversed and we are now between 6bps and 9bps higher than the end of Wednesday’s session. JGB yields, though, remain anchored at 0.60%, unchanged.

Oil (+1.0%) is continuing to rebound as the situation in the Middle East seems to be getting more complex. The Houthis continue to attack Red Sea shipping, Israel killed a Hezbollah leader in Lebanon, potentially widening the conflict and there was a terrorist bombing in Iran (with the best guess it was internally executed by an unhappy faction) which can only serve to increase the overall tension levels. While the broader weakness we have seen in this space is likely a response to weaker overall economic activity, especially in China, at some point, that activity will pick up and I expect oil prices to do so as well. In the metals complex, base metals are under further pressure this morning, with both copper and aluminum down -0.6% or so, although gold (+0.2%) is bucking that trend, perhaps on the back of the dollar’s marginal weakness this morning.

Speaking of the dollar, as measured by the DXY it is -0.2% softer this morning with pretty uniform losses vs the major G10 and EMG currencies. The one exception is the yen (-0.6%) which continues to suffer based on the idea that the BOJ will not be able to consider interest rate normalization in the wake of the recent earthquake on the country’s west coast. In truth, the dollar seems to be quite the afterthought in markets right now, with much greater focus on the bond market and central bank actions as the drivers. While I would carefully watch if the dollar starts to break these correlations, I don’t see it as a key driver right now.

On the data front, we see a few things this morning, starting with ADP Employment (exp 115K) and then Initial (216K) and Continuing (1883K) Claims. As well the Services PMI data is released later this morning (51.3) and finally we get the EIA oil inventories with another large draw of 3.7 million barrels expected which ought to continue to support the black, sticky stuff.

There are no Fed speakers on the calendar although we must all be watchful for the pop-up CNBC interview if they feel their message, whatever it may currently be, is not getting proper attention. While the first two sessions of the year were certainly uncomfortable for risk assets, I do not believe that my idea of a solid first half followed by more evident problems in the second half of the year has been dismantled. Clearly, tomorrow’s NFP data will be critical, and we will discuss it ahead of the release. Until then…

Good luck

Adf

Miles Off Base

This poet was miles off base

As Powell, more growth, wants to chase

So, hawks have been shot

With nary a thought

While doves snap all stocks up apace.

It seems clear that Jay and the Fed

Decided inflation is dead

Through Q1 at least

Bulls will have a feast

Though after, take care where you tread

It turns out that not only were my tail risk ideas wrong, I was on the wrong side of the distribution! Powell has decided that the soft-landing narrative is the best estimator of the future and wants to make sure the Fed is not responsible for a recession. Concerns over inflation, while weakly voiced, have clearly dissipated within the Eccles Building. I hope they are right. I fear they are not.

In fairness, once again, yesterday I heard a very convincing argument that inflation was not only going to decline back to the Fed’s target of 2.0%, but it would have a 1 handle or lower by the middle of 2024 based on the weakening credit impulse that we have seen over the past 18 months. And maybe it will. But, while there is no question that money supply has been shrinking slowly of late, which has been a key part of that weakening credit impulse story, as can be seen from the chart below based on FRED data from the St Louis Fed, compared to the pace of M2 growth for decades, there are still an extra $3 trillion or so floating around the economy. Iit seems to me prices will have a hard time falling with that much extra cash around.

Of course, there is one other place that money may find a home, and that is in financial assets. So, perhaps the outcome will be a repeat of the post-GFC economy, with lackluster growth, and lots of money chasing financial assets while investors lever up to increase returns. My guess is that almost every finance official in the world would take that situation in a heartbeat, slow growth, low inflation and rising asset prices. The problem is that series of events cannot last forever. As is usually the case with any negative outcome, the worst problems come from the leverage, not the idea. When things are moving in one’s favor, leverage is fantastic. But when they reverse, not so much.

A little data is in order here. According to Statista, current global GDP is ~$103 trillion in current USD, current global stock market capitalization is ~$108 trillion, and the total amount of current global debt is ~$307 trillion according to the WEF. In a broad view, the current debt/equity ratio is about 3:1 and the current debt/sales ratio is the same. While this is not a perfect analogy, usually a debt/equity ratio of 3.0 is considered pretty high and a company that runs that level of debt would be considered quite risky. Now, ask yourself this, if economic activity only generates $108 trillion, how will that >$300 trillion of debt ever be repaid? The most likely answer is, it never will be repaid, at least not on a real basis.

If you wonder why central bankers favor lower interest rates, this is the primary reason. However, at some point, there is going to be more discrimination between to whom lenders are willing to lend and who will be left out because they are either too risky, or the interest rate demanded will be too high to tolerate. When considering these facts, it becomes much easier to understand the central bank desire to get back to the post-GFC world, doesn’t it? And so, I would contend that Chairman Powell has just forfeited his efforts to be St Jerome, inflation slayer.

The implication of this policy shift, and I would definitely call this a policy shift, is that the near future seems likely to see higher equity prices, higher commodity prices, higher inflation, first higher, then lower bond prices and a weaker dollar. The one thing that can prevent the inflation outcome would be a significant uptick in productivity. While last quarter we did see a terrific number there, +5.2%, the long-term average productivity growth, since 1948 is 2.1%. Since the GFC, that number has fallen to 1.5%. We will need to see a lot more productivity growth to keep goldilocks alive. I hope AI is everything the hype claims!

Today, Madame Christine Lagarde

And friends are all partying hard

Now that Jay’s explained

Inflation’s restrained

And rate cuts are in the vanguard

This means that the ECB can

Lay out a new rate cutting plan

The doves are in flight

Which ought to ignite

A rally from Stuttgart to Cannes

Let’s turn to the ECB and BOE, as they are this morning’s big news, although, are they really big news anymore? Both these central banks have been wrestling with the same thing as the Fed, inflation running far higher than target, although they have had the additional problem of a much weaker economic growth backdrop. As long as the Fed was tightening policy, they knew that they could do so as well without having an excessively negative impact on their respective economies. But given that pretty much all of Europe is already in recession, and the UK is on the verge, their preference would be to cut rates as soon as possible.

But yesterday changed everything. Powell’s bet on goldilocks has already been felt across European markets, with rallies in both equity and bond markets in every country. The door is clearly wide open for Lagarde and Bailey to both be far more dovish than was anticipated before the FOMC meeting. And you can be sure that both will be so. While there will be no rate cuts in either London or Frankfurt today, they will be coming soon, likely early next year.

At this point, the real question is which central bank will be cutting rates faster and further, not if they will be cutting them at all. My money is on the ECB as there is a much larger contingent of doves there and the fact that Germany and northern European nations are already in recession means that the hawks there will be more inclined to go along for the ride. Regardless, given the Fed has now reset the central bank tone to; policy ease is ok, look for it to happen everywhere.

Right now, this is all that matters. Yesterday’s PPI data was soft, just adding fuel to the fire. Inflation data that was released this morning in Sweden and Spain saw softer numbers and while Retail Sales (exp -0.1%, ex autos -0.1%) are due this morning along with initial Claims (220K), none of this is going to have a market impact unless it helps stoke the fire. Any contra news will be ignored.

Before closing, there are two things I would note that are outliers here. First, Japanese equity markets bucked the rally trend, with the Nikkei sliding -0.7% and the TOPIX even more (-1.4%) as they could not overcome the > 2% decline in USDJPY yesterday and the further 1% move overnight. That very strong yen is clearly going to weigh on Japanese corporate profitability. The other thing is that there is one country that is not all-in on the end of inflation, Norway. This morning, in the wake of the Fed’s reversing course, the Norges Bank raisedrates by 25bps in a total surprise to the markets. This has pushed the krone higher by a further 2.3% this morning and nearly 4% since the FOMC meeting.

As we head toward the Christmas holidays and the beginning of a new year, it seems like the early going will be quite positive for risk assets and quite negative for the dollar. Keep that in mind as you consider your hedging activities for 2024.

Good luck

adf

The Doves Will Be Shot

Inflation was just a touch hot

And certainly more than Jay sought

So, later today

What will the Fed say?

My sense is the doves will be shot

Instead, as Jay’s made manifest

Inflation is quite a tough test

So, higher for longer

Or language much stronger

Is like what he’ll say when he’s pressed

Let’s think a little outside of the box this morning, at least from the perspective of virtually every pundit and their beliefs about what will happen at the FOMC meeting today. At this point, most of the punditry seems to believe that Powell cannot be very much more hawkish, especially since the market is expecting comments like inflation is still too high and the Fed will achieve their goal. So, there is a growing camp that thinks any surprise can only be dovish, since if he doesn’t push back hard enough or talk about loosening financial conditions being a concern, the equity market response will be BUY STONKS!!!

But what if, the thing Powell really wants, or perhaps more accurately needs, is not a soft landing, but a full-blown recession! Think about it. As I have written repeatedly, the idea that the Fed will cut rates by 125bps next year because growth is at 1.5% or 2.0% and inflation has slipped to 2.5% seems like quite an overreaction. But given the current US debt situation ($34 trillion and counting) and the fact that the cost of carrying that debt is rising all the time, what would get the Fed to really cut rates? And the only thing that can do it is a full-blown, multiple quarters of negative GDP growth, rising Unemployment Rate, recession. If come February or March, we start seeing negative NFP numbers, and further layoff announcements as well as declining Retail Sales and production data, that would get the Fed to act.

At least initially, we would likely see inflation slide as well, and with that trend plus definitive weakness in the economy, it would open the door for some real interest rate cuts, 400bps in 100bp increments if necessary. Now, wouldn’t that take a huge amount of pressure off Treasury with respect to their refi costs? And wouldn’t that encourage accounts all over the world to buy Treasuries so there would be no supply issues? All I’m saying is that we cannot rule out that Powell’s master plan to cut rates is to drive the economy into a ditch as quickly as possible so he can get to it. In fact, it would open the door to restart QE as well.

This is not to say that this is what is going to happen, just that it is not impossible, and I would contend is not on anyone’s bingo card. Now, Powell will never say this out loud, but it doesn’t mean it is not the driving force of his actions. Powell is incredibly concerned with his legacy, and he has made abundantly clear that he will not allow his legacy to be the second coming of Arthur Burns. Instead, he has his sights on the second coming of Paul Volcker, the man who killed the 1970s inflation dragon. St Jerome Powell, inflation slayer, is what he wants as his epitaph. And causing a recession to kill inflation and then cut rates is a very clever, non-consensus solution.

How will we be able to tell if I’m completely nuts or if there is a hint of truth to this? It will all depend on just how hard he pushes back on the current narrative. Yesterday’s CPI results could best be described as ‘sticky’, not rebounding but certainly not declining further. Shelter costs continue apace at nearly 6% Y/Y and have done so for more than 2 years. I was amused this morning by a chart on Twitter (I refuse to call it X) that showed CPI less shelter rose at just 1.4% with the implication that the Fed needs to start cutting rates right away. The problem with that mindset is that shelter is something we all pay, and there is scant evidence that housing markets are collapsing. In fact, according to the Case Shiller index, they are rising again. I would contend that there is plenty of evidence to which Powell can point that makes his case for an economy that is still running far too hot to allow inflation to slide back to their target. And that’s what I expect to hear this afternoon.

Speaking of recession, let us consider the situation in China, where despite the CCP’s annual work conference just concluding with some talk of building a “modern industrial system” the number one goal this year, thus boosting domestic demand, they announced exactly zero stimulus measures to help the process. Data from China overnight showed that their monthly financing numbers were all quite disappointing compared to expectations and the upshot was a further decline in Chinese and Hong Kong equity markets. This ongoing economic weakness and the lack of Xi’s ability or willingness to address it continues to speak to my thesis that commodity prices will remain on the back foot. If you combine the high interest rate structure in the G10 with a weaker Chinese economy, the direction of travel for energy and base metals is likely to be lower. The one exception here is Uranium, where there is an absolute shortage of available stocks and a renewed commitment around the world to build more nuclear power plants.

At the same time, Europe remains pretty sick as well, with Germany leading the entire continent into recession, and likely dragging the UK with it. Germany, France, Norway, the UK and others are all sliding into negative growth outcomes. While Chairman Powell will continue to push back on the idea of rate cuts soon, I expect that tomorrow, when both the ECB and BOE meet, they will open the door to rate cuts early next year. Inflation in both places has been falling sharply and there is no evidence that Madame Lagarde or Governor Bailey is seeking to be the next Paul Volcker. Both will blink with the result that both the euro and the pound should feel pressure.

Summing it all up, today I think we get maximum hawkishness from the Fed with Powell pushing back hard on the market pricing. Initially, at least, I expect we could see yields rise a bit and stocks sell off while the dollar continues its overnight rise. But I also know that there are far too many people invested in the idea that the Fed must cut soon, and they will be back shortly, buying that dip until they are definitively proven wrong.

As to the rest of the overnight session, aside from China’s weak performance, South Korea also lagged, but the rest of the APAC region saw modest gains. Europe, meanwhile, is all green, although it is a very pale green with gains on the order of 0.2%, so no great shakes. Finally, US futures are firmer by 0.1% at this hour (7:15) after yesterday’s decent gains.

Bond yields are sliding this morning, down 2bps in the US and falling further in Europe with declines of between -3bps and -6bps on the continent as investors and traders there start to price in a more aggressive downward path for interest rates by the ECB. UK yields are really soft, -9bps, after GDP data this morning was disappointing across the board, especially the manufacturing data.

Oil prices (+0.45%) which got slaughtered yesterday, falling nearly 4%, are stabilizing this morning, as are gold prices, which fell yesterday, but not quite as much as oil. However, the base metals complex continues to feel the pressure of weak Chinese demand. I continue to believe that there are structural supply issues, but right now, the macro view of weak economic activity is the main driver, and it is driving prices lower.

Finally, the dollar is firmer this morning as weakness elsewhere in the world leaves fewer choices for where to park funds. While the movement has not been overly large, it is quite uniform across both G10 and EMG currencies. The laggards have been NZD (-0.6%) after a softer than expected CPI reading and ZAR (-0.6%) on the back of weakening metals prices. If I am correct about the path going forward, the dollar should perform well right up until the Fed responds to much weaker economic activity and starts to cut rates aggressively. At that point, we can see a much sharper decline in the greenback.

Ahead of the FOMC meeting, this morning we get November PPI (exp 1.0%, 2.2% core) which would represent a small decline from last month’s data. We will also see the EIA oil inventory data, which has shown a recent history of builds helping to drive the oversupply narrative there.

At this point, it is all up to Jay. I suspect that markets will be quiet until then, and it will all depend on the statement, the dot plot and the presser.

Good luck

Adf

No Matter What

The story that’s got the most press

Is CPI’s sure to regress

So, Jay and the Fed

Without any dread

Can start cutting rates with success

But what if instead of a nought

The data is higher than thought?

Will markets adjust?

Or will folks still trust

That rate cuts come no matter what?

While all eyes truly remain on the FOMC meeting announcement tomorrow afternoon, and of course, the ensuing press conference by Chairman Powell, this morning brings the November CPI report, which could well have an impact on tomorrow’s outcome. Current median expectations are for a M/M headline release of 0.0% leading to a Y/Y result of 3.1%. As to the core (ex food & energy) result, M/M is forecast to be 0.3% with the Y/Y result being unchanged at 4.0%.

Lately, the inflation bulls, aka the deflationistas, have been harping on the fact that if you annualize the past 3 months’ worth of data or the past 6 months’ worth of data, the annualized outcome is 2.5% or lower, and so the Fed has basically done their job and returned inflation back to their target. In the very next breath, they explain that with inflation back at target, they can start to cut rates because otherwise they will choke off the economy.

Even if I grant the first part of this thesis, of which I am suspect, it is the corollary rate cuts that make no sense at all. Thus far, the bulk of the data that we have been observing has shown that the economy has held up extremely well despite 525 basis points of rate hikes over the course of less than two years. This was made evident by Friday’s payroll report as well as the Q3 GDP report and much of the hard data that abounds. Given the economy’s clear resilience to this higher rate structure, I can see no good case for the Fed to cut.

In fact, I think the key for the entire macroeconomic outlook revolves around just how long the US economy can maintain its growth trajectory with interest rates at their current levels. The one thing of which we can be certain is that the Fed is not going to pre-emptively cut rates because they think a recession might show up, at least not now while inflation remains well above their target. If the US economy continues to perform, meaning grow at 2%-2.5% over time while the Unemployment Rate stays below 4.5%, I would argue there is no incentive for the Fed to cut, at least not on a macro basis. (There may be political reasons for them to cut, but that’s a different story.) Now, if growth continues apace, will that be bullish or bearish for stocks? For bonds? For the dollar? For commodities? I would say that these are the questions we need to answer and are why the Fed remains such an important part of the discussion. Do not discount a world where 10-year yields are 5.5%, Fed funds are 5.25% and GDP is 2.0% while inflation runs at 3.0%. This could well be the near future. It would also likely be quite a negative for risk assets.

My point is there continues to be a great dichotomy of thought as to how the future will unfold as we all are looking for the next clue to support our thesis. While I continue to believe that a slowdown is coming, to date, there has been no clear evidence that is the case. In fact, Friday’s Michigan Sentiment data was substantially better than anticipated while inflation expectations fell alongside the price of gasoline. In fact, a marginally stronger than anticipated print this morning will simply be more proof that the market’s current anticipation for rate cuts in 2024, which sit between 4 and 5 cuts, will need to be repriced. If risk assets have rallied on the basis of future Fed rate cuts, that could be a problem. Just sayin’!

Ok, ahead of the data, this is what we have seen. Yesterday’s modest US equity rally was followed by generally modest strength in Asia with the best performer being the Hang Seng (+1.1%). Last night, China’s government made a series of announcements describing all the sectors of the economy that they would be supporting going forward with fiscal policy, although there were no numbers attached to any of it, it was all cheerleading. Saturday night, Chinese CPI data was released at -0.5% both M/M and Y/Y, while PPI there fell to -3.0%. The implication is that economic activity is not going very well. In fact, it might be appropriate to define it as a recession, although I’m sure that won’t be the case. However, looking for China to be the world’s growth engine may be a bad call for the time being. As to Europe, it is a mixed picture there, with both modest gainers and modest laggards and no real direction overall. US futures are higher by 0.2% at this hour (7:30) but are obviously keenly focused on the data release.

Yesterday’s bond market price action, where yields backed up, has been completely reversed this morning with 10-year Treasury yields lower by 5bps and European sovereign yields lower by even more, 6bps-7bps while UK gilts have really rallied, with yields there down by 12bps after the employment data showed wage pressures declining far more than anticipated.

On the commodity front, oil is drifting lower again this morning, down -0.6%, although the metals complex is showing strength with gains in gold (0.4%) and copper (0.3%), which seem to be rising on the back of a weaker dollar and lower US rates. But a quick aside on oil and the commodities space in general. I have made the point that the commodity markets are the only ones that are pricing in a recession. And I would contend that is still the case. Perhaps, though, I have been looking in the wrong place for that economic weakness. Consider that China is the largest consumer of raw commodities in the world, by a wide margin. Consider also that the Chinese economy is having all kinds of difficulty as the dash for growth seems to have reached its apex and is now sliding lower. As I mentioned above, the idea that China is in a recession may not be absurd, and perhaps the fact that the commodity markets, in general, have been so soft is simply a recognition of that fact. If this is the case, we need to watch Chinese economic activity closely in order to get a sense of the trend in commodities. Or perhaps, we need to watch the trend in commodities to better understand the Chinese economy. When base metals turn higher, look for Chinese stocks to do the same.

Finally, the dollar, as mentioned above, is under pressure this morning, down -0.3% when measured by the DXY. The biggest mover is JPY (+0.7%) but we are seeing all the G10 bloc as well as the bulk of the EMG bloc rallying against the greenback. Speaking of Japan, last night there was further commentary pushing back on the idea of any movement by the BOJ next Monday regarding the normalization of monetary policy in the near future. I maintain that nothing will happen before they see the wage negotiation outcomes in March and, in the meantime, they are praying quite hard for the recent global inflation trend to remain downward as this will allow them to maintain their QE and fund the government.

And that’s really it for the day, as the CPI is the only news to be released. Unless it is significantly different than the current expectations, I suspect that things will be quiet today, modest continued equity and bond rally as everybody places their bets that the Fed is getting ready to start to cut rates. I’m not holding my breath.

Good luck

Adf

The New Allegory

On Friday, the data surprised

With job growth more than advertised

So, bonds took a bath

And stocks strode a path

Where growth is what’s now emphasized

But what of the soft landing story?

Will rate cuts now be dilatory?

If Jay just stands pat

Will stocks all go splat?

Or is this the new allegory?

Well, this poet was clearly wrong-footed by Friday’s employment report where not only were non-farm payrolls stronger than anticipated at 199K, but hours worked rose and the Unemployment Rate fell 2 ticks to 3.7%. While revisions to previous reports were lower, as they have been all year, the report did not point to an imminent slowing of the economy nor a recession in the near-term. Arguably, the soft-landing crowd made out best, as equity markets, which initially plunged on the report following Treasury prices, rebounded as investors decided that growth is a better outcome than not. Yields jumped higher, as would be expected, rising 8bps in the US with larger gains throughout Europe before they went home for the weekend. And finally, the dollar flexed its muscles again, rallying universally with gains against 9 of the G10 currencies, averaging 0.4% (only CAD (+0.1%) managed to hold its own) and against most of the EMG bloc with a notable decline by ZAR (-1.1%), although MXN (+0.6%) bucked the trend.

Does this mean the soft landing is coming? As we start the last real data intensive week of 2023, it remains the favored narrative, but is by no means assured. After all, before the end of this week we will have seen the latest CPI reading in the US (exp 3.1% headline, 4.0% core) and we will have heard from the FOMC, ECB and BOE as well as several smaller central banks like the Norgesbank and the SNB. And let us not forget that the BOJ meets next Monday. So, there is plenty of new, important information that is coming soon and will almost certainly drive potential narrative changes.

Perhaps an important part of the discussion is to define what we mean by a soft landing, or at least what the ‘market’ means by the concept. My best understanding is as follows: GDP slides to 1% or so, but never goes negative. Unemployment may edge higher than 4.0%, but only just, with a cap at the 4.2% or 4.3% area, and inflation, as measured by Core PCE finds a home between 2.0% and 2.5%. This result, measured inflation falling back close to target while the growth and employment story just wobbled a bit, would be nirvana for Powell and friends.

How likely is this outcome? Ultimately, history is not on their side as arguably the only time the Fed ‘engineered’ a soft landing was in 1995, and on an analogous basis they had already started cutting rates by this time in the cycle. The fact that we are still discussing higher for longer implies that there is much more pain likely to come than the optimists believe. We have already seen the first signs of trouble as the number of bankruptcies soar and stories about non-investment grade companies needing to refinance their debt at much higher interest rates than the previous round fill the news. Certainly, Friday’s employment data is encouraging for the economic situation, but the chink in the armor was the wage data which showed more resilience (+0.4%) than expected. Given the Fed’s focus on wages and their impact on inflation, the fact that wage growth remains well above the levels the Fed deems appropriate to meet their inflation target is not a sign that policy ease is coming soon.

And ultimately, I believe that is the critical feature here. The economy has held in remarkably well considering the pace and size of the interest rate changes we have already seen. The big unknown is how much of that interest rate change has really been felt by the economy. Obviously, the housing market has felt the impact, and to some extent the auto industry, but otherwise, it is not as clear. Do not be surprised if this period of slow economic activity extends for a much longer time than in the past as the drip of companies that find themselves unable to refinance at affordable rates slowly grows. By 2025, about $1 trillion of corporate debt that was issued at much lower interest rates will need to be refinanced. I’m not worried about Apple refinancing their debt, but all the high-yield debt that was snapped up with a 4% or 5% handle during the period of ZIRP will now be at 10% or so and it is an open question if those business models will be functional with financing that expensive.

So, perhaps, the story will be as follows: economic activity is going to muddle along at low rates for an extended period, another 2 or 3 quarters, until such time as the debt ‘time-bomb’ explodes with refinancing rates high enough to force many more bankruptcies and start a more aggressive recessionary cycle with layoffs leading to rapidly rising Unemployment rates and economic activity falling more sharply. In this timeline, we are talking about the recession becoming clear in Q3 of 2024, a time when most of that $1 trillion of corporate debt will be current. While interest rates will certainly be slashed at some point, this does not bode well for risk assets in the second half of 2024. For now, though, it certainly seems like the current narrative is going to continue.

There’s no urgency

To change policy quite yet

But…some day we will

A quick story about the BOJ which last night pushed back firmly against the growing narrative that they were about to start normalizing interest rate policy with a rate hike in either December or January. Instead, several stories were released that described the recent decline in both GDP and inflation as critical and the fact that they still don’t have enough information with respect to wages in Japan, given the big spring wage negotiation has not yet happened, to make a decision. In other words, the BOJ was successful at convincing markets to behave as the BOJ wants, not as the rest of the world wants. The upshot was that the yen weakened sharply (-0.9%) while the Nikkei rose 1.5% and JGB yields were unchanged. The BOJ pivot remains one of the biggest themes in the macro community, mostly because it is seen as the place where the largest profits can be made by traders. But my experience (4 years working for a Japanese bank) helps inform my view that whatever they do will take MUCH longer to happen than the optimists believe.

Ok, let’s try a quick trip around markets here for today. Aside from Japan, most of Asia had a good equity session with Hong Kong (-0.8%) the only real laggard. Remember, a key story there remains the Chinese property sector as many of those firms are listed in HK. Meanwhile, European bourses are mixed although movements haven’t been very large in either direction. The worst situation is the UK (FTSE 100 -0.5%), while we are seeing some gains in the CAC and DAX, albeit small gains. Finally, US futures are pointing a bit lower, -0.2%, at this hour (7:45).

In the bond market, after Friday’s dramatic price action, Treasury yields are continuing to rise, up 5bps this morning, although European sovereign yields are little changed on the day, with the bulk of them slipping about 1bp. Given most saw quite large moves on Friday, and given the imminent policy decisions by the big 3 central banks, I suspect traders are going to be quiet for now.

Oil prices (-0.3%) are slipping slightly this morning but are mostly consolidating Friday’s gains. On the metals front, though, everything is red with gold, silver, copper and aluminum all under pressure. Again, this is the one market that has been pricing a recession consistently for the past several months while certainly equity markets have a completely different view.

Finally, the dollar is continuing to rebound on the strength of rising Treasury yields. While the euro is little changed on the day, the yen is driving price action in Asia with weakness also seen in CNY, KRW and TWD. As well, ZAR (-0.8%) continues to suffer on weaker commodity pricing and both MXN and BRL are under pressure leading the LATAM bloc lower. At this point, I would say the FX market has more faith in Powell’s higher for longer mantra than some other markets.

As mentioned, there is a lot of data this week:

| Today | NY Fed Inflation Expectations | 3.8% |

| Tuesday | NFIB Small Biz Optimism | 90.9 |

| CPI | 0.0% (3.1% Y/Y) | |

| -ex food & energy | 0.3% (4.0% Y/Y) | |

| Wednesday | PPI | 0.1% (1.0% Y/Y) |

| -ex food & energy | 0.2% (2.3% Y/Y) | |

| FOMC Rate Decision | 5.5% (unchanged) | |

| Thursday | ECB Rate Decision | 4.5% (unchanged) |

| BOE Rate Decision | 5.25% (unchanged) | |

| Retail Sales | -0.1% | |

| -ex autos | -0.1% | |

| Initial Claims | 221K | |

| Continuing Claims | 1891K | |

| Friday | Empire State Manufacturing | 2.0 |

| IP | 0.3% | |

| Capacity Utilization | 79.2% | |

| Flash PMI Manufacturing | 49.1 | |

| Flash PMI Services | 50.5 |

Source tradingeconomics.com

Thursday also has the Norges Bank and SNB, both of whom are expected to leave rates on hold. For today, it strikes me that the discussion will continue as pundits try to anticipate what the FOMC statement will say and how Powell sounds in the press conference. As such, it is hard to get excited that there is going to be a big move in either direction. With all that in mind, my overall read on the economy is that while we may muddle along in the US for a while yet, it will be better than many other places in the world, notably the EU, the UK and China, and so the dollar is likely to hold up far better than most expect…at least until Powell changes his tune.

Good luck

Adf

Too Clever by Half

Said Jay, “it would be premature”

To think we’ve arrived at a cure

For higher inflation

Though there’s a temptation

By some to claim that we are sure

Instead, if we think it’s correct

More rate hikes we will architect

Investors, however,

Think Jay is too clever

By half and this view did reject

As we start a new week that will culminate in the payroll report on Friday, I think it is appropriate to consider how last week finished, notably how Chairman Powell left things leading into the Fed’s quiet period ahead of their next FOMC meeting on the 13th of this month. To my ears, the two most important comments were as follows: “The strong actions we have taken have moved our policy rate well into restrictive territory, meaning that tight monetary policy is putting downward pressure on economic activity and inflation.” A little later he explained, “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.”

Now, interpretation is a subjective idea already, but FWIW my interpretation is he clearly understands they have tightened policy quite substantially, perhaps enough to achieve their goal of 2% inflation, but in a nod to this nation’s history, and ostensibly his hero, Paul Volcker, he is not going to get fooled by a temporary respite in inflation. I believe he has made perfectly clear in the past that the Fed, or at least Chairman Powell, is willing to push the economy into a recession if he believes it is necessary to truly end inflation.

Of course, the biggest problem that he has is that the Fed is losing its ability to manage the situation as the Treasury continues to issue extraordinary amounts of new debt to fund spending. This fiscal dominance results in a situation where the Fed’s actions have a diminishing impact on the macroeconomic variables they are trying to manage. In fact, as I consider this situation it is actually a viable explanation for the fact that the market is very clearly ‘fighting the Fed’.

One of the most common refrains from the post GFC period, when the Fed first introduced QE and kept repeating the exercise, driving asset prices substantially higher, although having very limited impact on goods and services inflation, was that investors, ‘don’t fight the Fed.’ The idea was that if the Fed was going to continue to print money, whatever the macroeconomic story was had limited impact on risk asset prices. The Fed was the dominant factor and would continue to be so going forward.

And that proved to be sage advice right up until the end of 2022. The huge rally was supported by their easy money, and the reversal in 2022 was a result of them tightening policy substantially. However, since then, and especially since the debt ceiling law was suspended until 2025, the Treasury has been able to issue as much debt as they like, and the government has been spending as quickly as possible. While the Fed’s policy tightening was dramatic throughout 2022, it has slowed dramatically this year, and now it is being eclipsed, at least in a market response sense, by the flood of money entering the economy. The result is that despite the Fed’s effort to maintain tight monetary policy, they are being overwhelmed by the Treasury’s profligate ways. Hence, fighting the Fed is making sense. It has largely worked in 2023 and while higher for longer may be the Fed’s mantra, it is being trumped by Yellen’s mantra of ‘issue another $1 trillion in T-bills just in case.’

Setting aside, for a moment, the potential negative implications of the surge of Treasury issuance, its ability to crowd out private funding and therefore slow economic activity, from the market’s perspective, all those Federal dollars are being spent somewhere, and between the subsidies for ‘green’ energy, and the reshoring efforts across numerous manufacturing sectors, that money is circulating in the economy quite rapidly. Since the government doesn’t really care what interest rate they pay (they will just borrow more to pay that interest), there is no financial brake on this activity. It needs to be political. And given there is a presidential election next year, the incentive for the incumbent administration to slow spending is not merely zero, it is negative.

Ultimately, I believe this means that the Fed’s importance with respect to market movements overall is diminishing, although they will still have some impact. Rather, I think we need to watch the spending plans more carefully. One other thing to remember, especially for all the dollar bears out there, is that historically, a nation that runs tight monetary and loose fiscal policy winds up with a stronger currency. This alone implies that news of the dollar’s demise may be greatly exaggerated.