While everyone focused on Jay The earlier news of the day Showed Janet would not The long bond, allot, Too much, thus yields faded away Combining that news with the Fed And all of the things that Jay said It certainly seems The bulls’ fondest dreams Are likely to still be ahead

While most of the headlines yesterday afternoon and this morning revolve around the FOMC meeting and, more importantly, Powell’s press conference, I would argue that as I discussed yesterday, the biggest story was the QRA early in the morning. Historically, the Treasury has tried to keep T-Bill issuance between 15% and 20% of total Treasury issuance. However, a look at the current mix shows that Secretary Yellen already has that ratio up to 22.6%. One of the big questions was how that would play out going forward.

Recall, one of the narratives that has been invoked for the Treasury bond sell-off with corresponding rising yields, has been the supply story. You know, the US is running massive budget deficits and needs to issue more debt to fund it, so there is a lot more supply coming. A key assumption in this story was that the mix of debt, which already favored T-Bills, would not change much so the new debt would be forced into the back end of the curve. Well, that’s not how things worked. The QRA indicated that the Treasury was going to issue a lot more T-Bills, a total of $1.1 trillion over the next two quarters, raising the proportion of T-Bills to 23.2%, even further above the old ceiling. Of course, the result is much less issuance in the 5yr and longer space, thus undercutting the excess supply argument.

The results cannot be surprising as even before Powell started speaking, 10-year yields had fallen 11bps although they continued to decline afterwards as well, finishing the day lower by 16bps or so. All in all, an impressive bond rally. But let’s consider for a moment a different consequence of yesterday’s announcements, the shape of the yield curve. Prior to the QRA and the Fed, the yield curve, as measured by the 2yr-10yr spread had fallen from a low of -108bps to just -15bps and it seemed almost certain that it would normalize soon. However, now that the QRA has shown there will be more issuance out to 2yrs and less beyond, the immediate impact is the curve is going to go back to inverting further, (it is already back to -22bps) at least until such time as the Fed actually does cut rates. I have a feeling that we are going to hear a lot more about recession again even though Powell explicitly said the Fed was not expecting one. In fact, Powell and the Fed may be the only people not expecting a recession at this point!

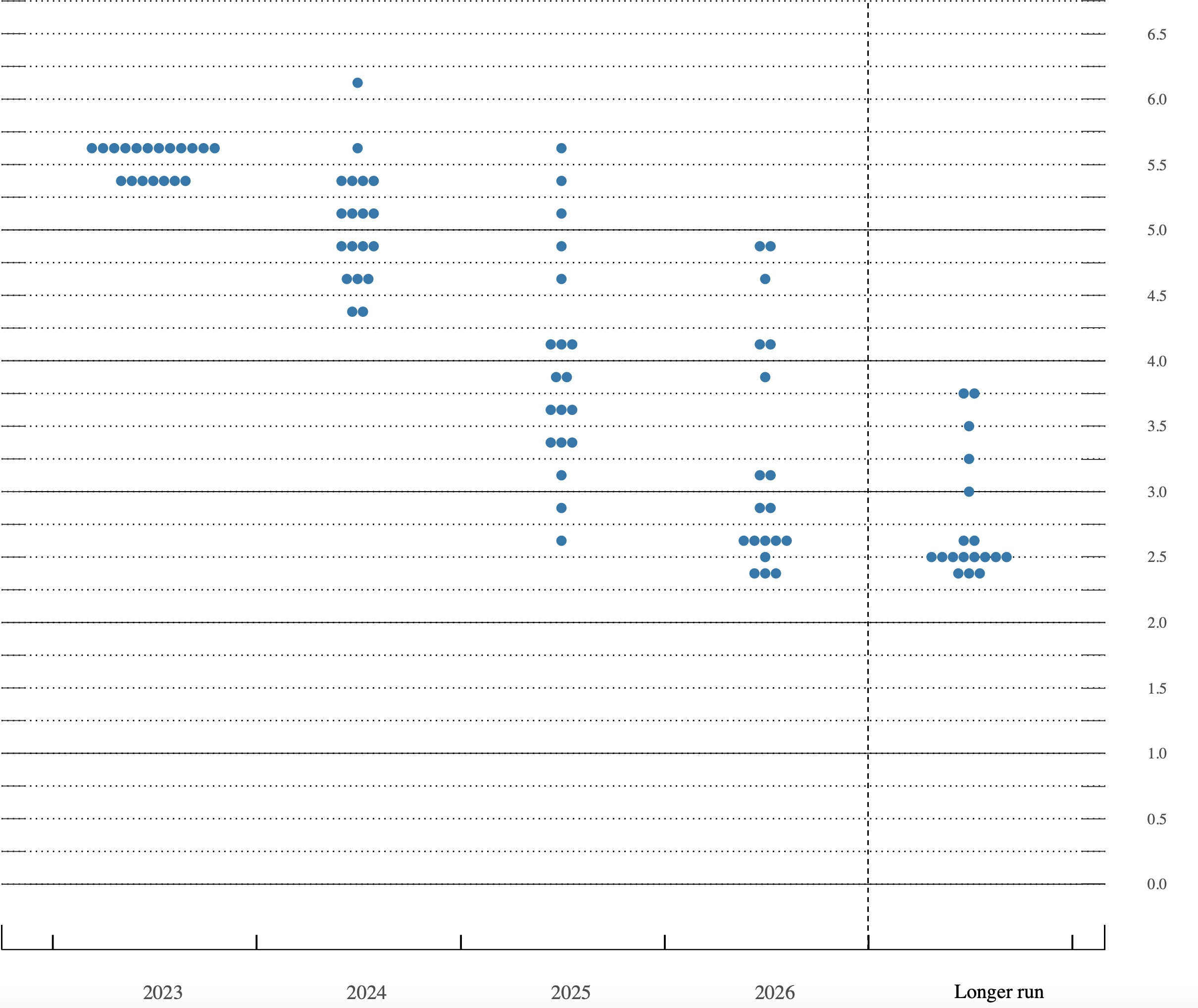

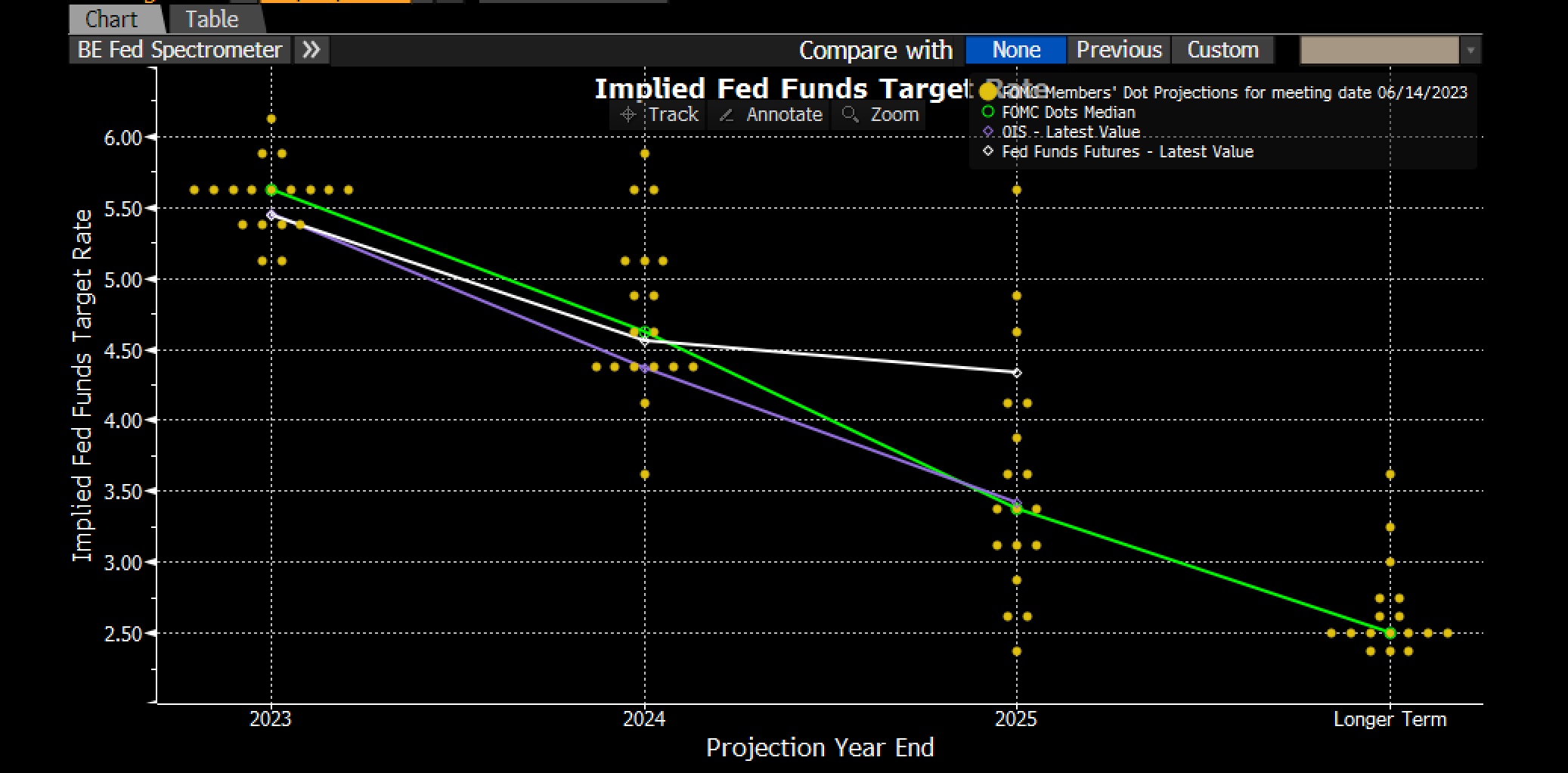

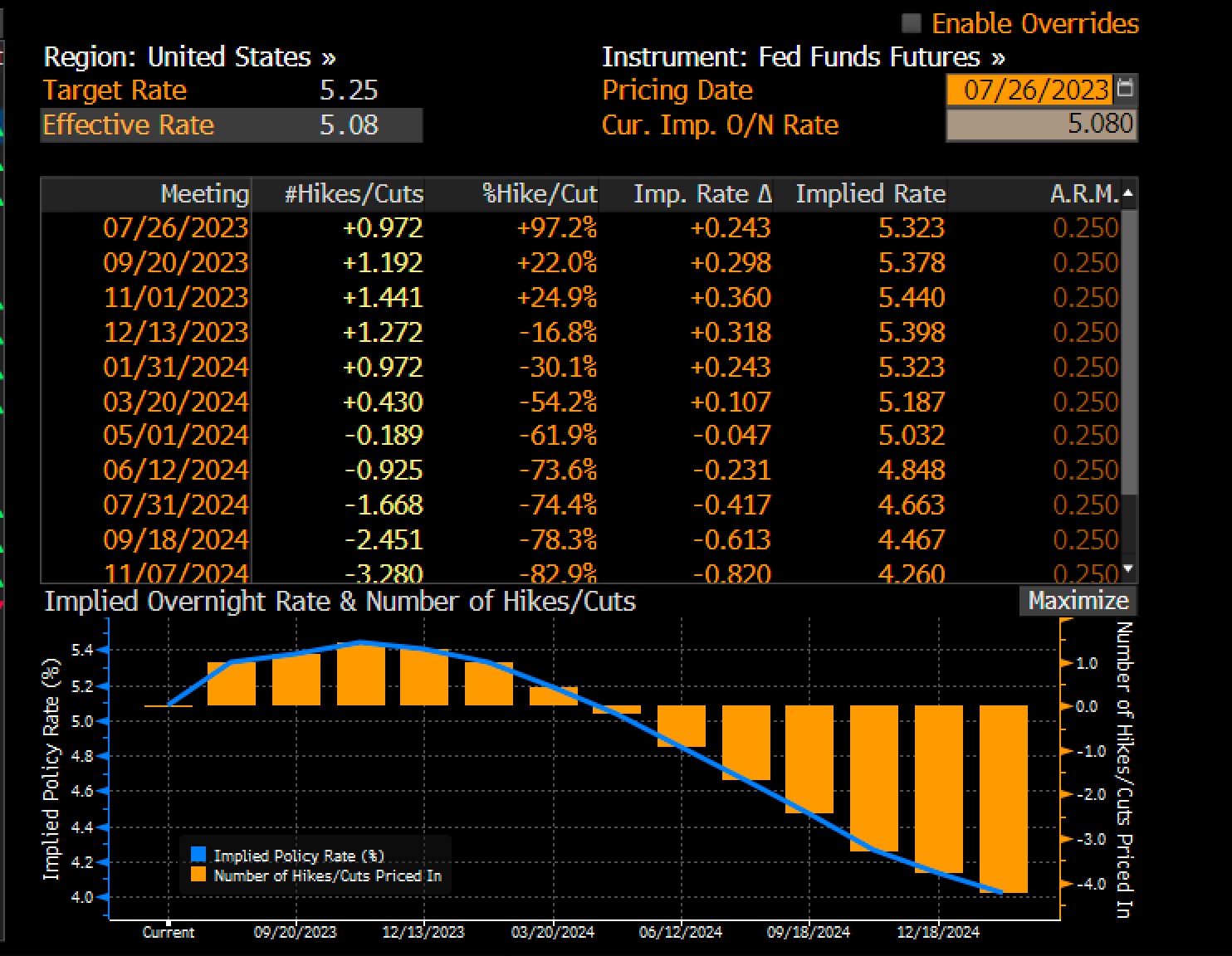

A quick look at the Fed funds futures market shows that for the December FOMC meeting, the market is currently pricing a 20% probability of a 25bp rate hike. That is slightly lower than before the FOMC meeting yesterday, but within the margin of error. However, at this point, the market has a 43% probability of a rate cut in May, with that probability growing as you head out further in time. One of the things Powell reiterated yesterday is that the committee is not even discussing the idea of a rate cut. Of course, he also said that they don’t believe a recession is coming so it is not surprising the market has a different rate view than the Fed.

In the end, I think this is a seminal shift in policy with the combination of Treasury and Fed actions indicative of a much easier policy stance going forward. I have built my views based on the Fed maintaining its higher for longer stance and continuing to stress the system which remains massively leveraged. However, if he is no longer going to follow that path, and I think we learned yesterday that the inflection point is here, then we need to rethink the future. One consequence of this policy change, though, is that inflation, which I have maintained is going to remain far stickier than many anticipate, is going to become an even bigger problem down the road. I just don’t know how far down the road that will be. But for now, I think we are going to continue to see equities rebound into year end, bond yields fall, the dollar fall, and commodity prices rebound. This is going to be a classic risk-on scenario through the end of the year in my view.

And despite, or perhaps because of, continued weaker data, that is what we are seeing in markets around the world. Yesterday’s ISM Manufacturing data was quite soft at 46.7, and this morning the PMI data from the rest of the world was generally awful with all European readings between 40 and 45. Yesterday’s ADP Employment data was soft, at 113K which just added fuel to the policy easing fire and though the JOLTS Job Openings data was still strong, the net perception is slower times are ahead, and with them, lower interest rates.

A look around markets shows that after yesterday’s US rally, with the NASDAQ leading the way higher by 1.6%, Asian shares rallied (Nikkei +1.1%, Hang Seng +0.75%) and we are seeing strength across the board in Europe with all major indices higher by at least 1.25%. And don’t worry, US futures are pushing higher again, up about 0.5% at this hour (7:15).

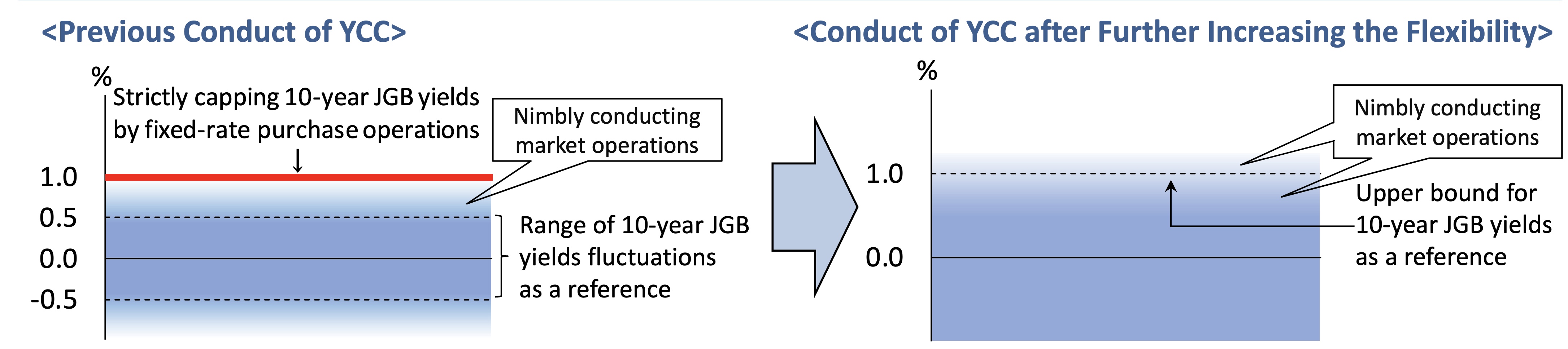

It is, of course, no surprise that bond yields around the world are lower with European sovereigns declining by between 7bps and 12bps after both Australia and New Zealand saw yields tumble 16pbs and 25bps respectively. Even JGB yields are softer by 3bps. In fact, Dutch central bank president Klaas Knot, one of the most hawkish ECB members, is on the tape this morning with the following quote, “We should be a little patient and not raise rates too much.” That may be the most dovish thing he has ever said. The point here is that until such time as inflation really comes roaring back (and I fear that day will come), the direction of travel in interest rates is lower.

Oil prices, which remained under some pressure in the past week, have bounced 1.4% this morning with the movement seeming to be a response to the policy changes while gold (+0.3%) is also climbing, although a bit slower than I might have expected. But we are seeing strength throughout the commodity complex on the lower rate story with copper (+0.5%) rallying despite the prospects of a recession.

Finally, the dollar is under pressure across the board with the DXY down -0.7% led by the euro (+0.6%), AUD (+0.7%) and NZD (+0.95%). The yen (+0.4%) is a bit of a laggard today, though remains above the 150 level, but I suspect that we are going to see dollar weakness continue going forward. Against EMG currencies, we are also looking at a weaker greenback with KRW (+1.0%) leading the way, but strength through APAC and EEMEA and MXN (+0.6%) firmer as the only representative of LATAM that is trading at this hour. Yesterday Banco Central do Brazil cut their SELIC rate by 50bps to 12.25% as widely expected and BRL rallied 2% on the day. Again, the theme is now a weaker dollar going forward.

To show how big a deal yesterday was, the BOE meets this morning, and nobody is even discussing it. Expectations are for no policy change, although perhaps given the sudden dovishness breaking out worldwide, they will consider a cut! We also see a bunch of US data as follows: Initial Claims (exp 210K), Continuing Claims (1800K), Nonfarm Productivity (4.1%), Unit Labor Costs (0.7%) and Factory Orders (2.4%). There are no Fed speakers on the schedule today, but they get started again tomorrow. Remember, tomorrow we also see NFP, so still some fireworks potentially.

For now, though, the new trend is risk on, dollar down.

Good luck

Adf