In DC, the IMF tribe

Is meeting, and this is the vibe

Leave China alone

While they all bemoan

Das Trump to whom, problems, ascribe

Meanwhile in Beijing, Xi’s delayed

His policies as he’s afraid

If Trump wins the vote

More tariffs, he’ll float

Reducing Xi’s winnings in trade

With the US election fast approaching, it appears that virtually every aspect of life now hinges on the outcome. This is even true in ostensibly neutral NGOs like the IMF. As an example, the title of this Bloomberg article, Trump 2.0 Haunts World Economy Chiefs Gathering in Washington Before Vote is enough to make you question the neutrality of both Bloomberg and the ongoing activity at the IMF. Briefly, in this article, the authors quote several meeting participants explaining that a Trump victory could disrupt the current global “stability” in trade. (I’m not sure why they think the current situation is stable given the ongoing increases in tariffs already being implemented by the Eurozone as well as the US vs. Chinese manufactured goods, but they all are certain it will be a problem only if Trump is elected.)

In fact, earlier this week, the IMF explicitly said that a Trump victory would be negative for the global economy and that his policies would be worse for the US as well when compared to Harris’s policies. My first thought is, how do they know Harris’s policies as she hasn’t been able to articulate any, but second, the idea that a supranational organization would express its electoral preferences leading up to a major national vote is remarkable. Clearly the concept of neutrality no longer exists.

At any rate, as I explained yesterday, the US election remains THE topic on both investors’ and traders’ minds. As well, it is THE topic on every other government’s mind around the world. As such, arguably until the vote is complete and a victor declared, I suspect that all markets will see plenty of volatility with each change in the polls but limited additional secular movement.

One of the ongoing activities that passes for analysis these days is the forecasting of future bond yields or equity returns based on the winner. This is generally explained as this market will rise if one wins and fall if the other does, or vice versa. My take is this is simply another way for analysts to proffer their political views under the guise of economic analysis and as such, while I get a chuckle from these earnest descriptions of the future, I certainly don’t see them as rigorous analysis.

But really, this week, that is all that is happening. Next week, we do see a lot of data, including the NFP report as well as PCE readings and the BOJ’s interest rate decision, so perhaps there will be more market focused discussion. But right now, virtually everything you read revolves around the election and the possible results.

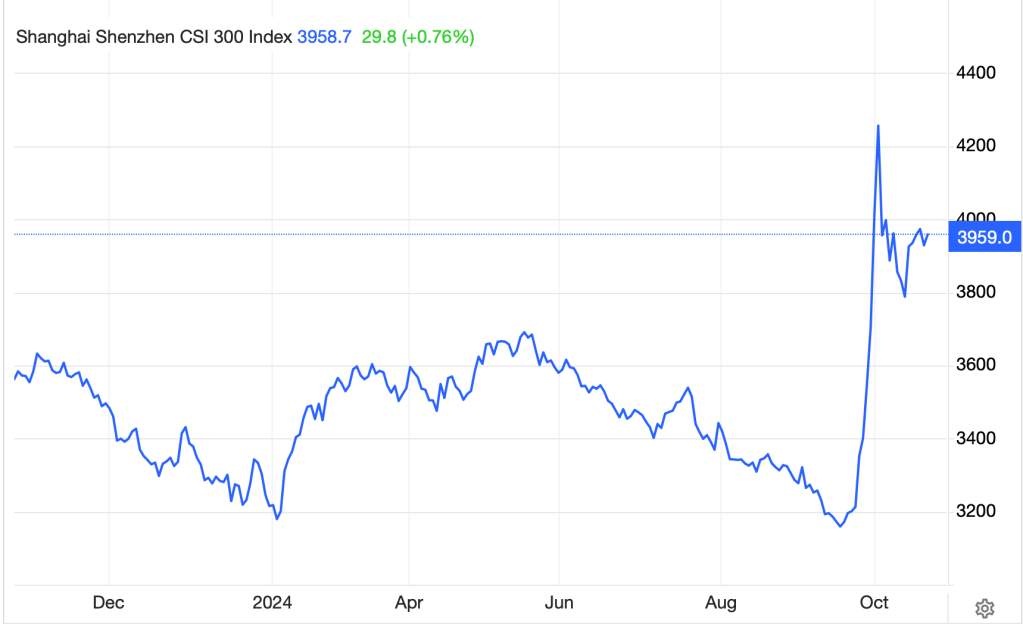

So, with that in mind, let’s take a look at what happened overnight. Yesterday’s mixed US session, with the DJIA slipping while the other major indices rallied a bit, led to a mixed picture in Asia as well. Japanese shares (-0.6%) suffered a bit as Japan, too, is heading toward a general election and questions about whether new PM Ishiba will be able to win a majority in the Diet are very real this time. Apparently, even in a homogenous society like Japan, there are questions about the ruling party and how much it is focused on helping the population. As to the rest of Asia, both China (+0.7%) and Hong Kong (+0.5%) managed modest gains, but there are still many questions as to exactly how much stimulus China is going to inject into the economy there. In fact, you can see the market asking those questions by the chart below, where the spike was the initial euphoria that something was going to be done, and the retracement is the realization that it was hope and not policy that drove things.

Source: tradingeconomics.com

The numbers show that after a >30% rally in a few sessions, investors have unwound about one-third of the climb as they await the outcome of the National People’s Congress meeting to see if a new fiscal package will be approved. (Cagily, they have set the dates for the meeting to be November 4-8 to make sure that they can encompass the outcome of the US election in their decisions. The rest of Asia saw a mix of gainers (Taiwan, Philippines, Australia) and laggards (India, Singapore, Malaysia) with other markets barely moving.

Meanwhile, in Europe, this morning is a down day, although the losses are quite modest (CAC -0.3%, IBEX -0.4%, FTSE 100 -0.2%) as traders head into the weekend with limited confidence on how things will play out going forward. As to the US, at this hour (7:30), futures are pointing slightly higher, 0.2% or so.

In the bond market, Treasury yields (-2bps) have backed off their highs from earlier in the week but remain far above the levels seen prior to the Fed’s rate cut in September. A view growing in popularity is that the 10yr yield will rise above 5.0% if Trump is elected while it will decline to 3.5% in a Harris victory. Personally, I cannot see any outcome that doesn’t boost yields as there seems to be scant evidence that either side will slow spending and the Fed has made it clear that higher inflation is ok, at least by their actions, if not yet by their words. As an aside, I couldn’t help but notice comments from Secretary Yellen explaining that the budget deficit was getting out of hand and “something” needed to be done about it, as though she had no part in the situation! Meanwhile, European sovereign yields are mostly edging higher this morning, but only by 1bp or 2bps, as they continue to hold onto the gains that came alongside the Treasury market. In the end, Treasury yields remain the key global driver.

In the commodity markets, oil (+0.7%) is bouncing slightly this morning after yesteray’s decline. The talk in the market is that the Saudis are considering opening a price war to regain market share after they have withheld so much production. That would certainly be a different tack than their recent activities and I imagine that President Putin would not be pleased, but that is one rumor. As to the metals markets, they are under pressure this morning with all the major metals somewhat softer (Au -0.2%, Ag -0.9%, Cu -0.2%) as we continue to see profit taking in the space after a very large run higher over the course of the entire year.

Finally, the dollar is little changed overall this morning with no G10 currency having moved even 0.2% since the close yesterday although we have seen a couple of EMG currencies (KRW -0.7%, ZAR +0.3%) with a little dynamism. The won fell further after weaker than forecast GDP encouraged traders to look for further rate cuts by the BOK while the rand’s movement appears more trading than fundamentally focused as there was neither data nor commentary to drive things.

On the data front, this morning brings Durable Goods (exp -1.0%, ex Transport -0.1%) and Michigan Sentiment (69.0). As explained above, the data doesn’t seem to matter right now with all eyes on the election. There are no Fed speakers scheduled but it is not clear that all their chatter this week had any impact. The market is still pricing a 25bp cut in November and a 75% probability of another one in December, which is what it has been doing for a while.

It is very difficult to observe recent market activity and come away with a strong directional view. My take continues to be that the December rate cut will lose its support based on the data and the dollar will appreciate accordingly. But right now, that is a minority view.

Good luck and good weekend

Adf