The job growth that everyone thought

Existed, seems like it was fraught

Meanwhile ISM

Showed further mayhem

As growth slowed while prices were hot

The funny thing was the reaction

Where stocks were a source of attraction

But at the same time

Bond buys were a crime

With sellers the ones gaining traction

The NFP data was certainly surprising as the headline number fell to its lowest level, 12K, since December 2020 with the worst part, arguably, the fact that government jobs rose 40K, so there were 52K private sector job losses. That is just not a good look, nor were the revisions to the previous months which saw another 112K jobs reduced from the rolls. It cannot be surprising that the Fed funds futures market immediately took the probability of a rate cut to 99% this week and raised the December probability to 82%, up more than 10 points in the past week. After all, Chair Powell basically told us that he has slain inflation, and they are now hyper focused on the employment mandate. With that in mind, the futures reaction makes perfect sense.

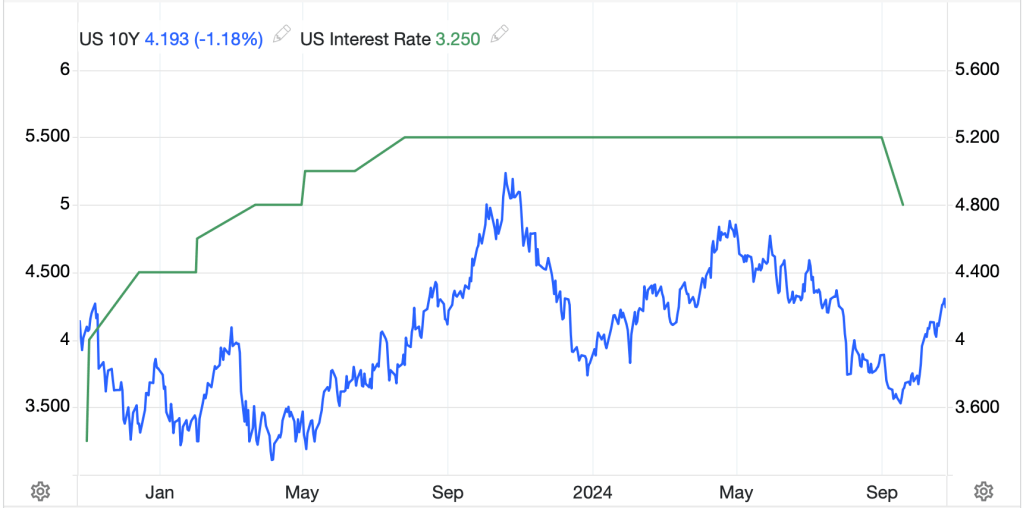

Perhaps even more surprising was the market reaction, or the dichotomy of market reactions, which saw equity markets in the US rally nicely, with gains between 0.4% and 0.8% in the major indices, while Treasury yields spiked 10bps despite the data. That yield spike helped carry the dollar higher as the greenback rallied smartly against virtually all its counterparts by more than 0.50%, and it undermined commodity prices.

The most common explanation here, though, had less to do with the NFP data and more to do with the recent polls regarding the US election, where it appeared the former president Trump was gaining an advantage. Remember, the ‘Trump trade’ is being described as a steeper yield curve with benefits for the dollar and US equities on the back of stronger growth and higher inflation.

There once was a US election

Where both candidates lacked affection

The worry it seems

Is half the world’s dreams

Are likely soon met with dejection

Meanwhile for investors worldwide

This week ought to be quite a ride

To all our chagrins

No matter who wins

Look for either outcome denied

However, this morning, the markets have changed their collective mind, with virtually all of Friday’s movement now unwound, at least in the bond and FX markets. What would have caused such a reversal? Well, the latest polls show that the race is much tighter than thought on Friday, with VP Harris gaining ground in a number of them, which now has most pundits simply calling for their favored candidate to win, rather than trying to read the polls. As such, the Trump trade has been partially unwound and my sense is that until there is an outcome, it will be difficult for markets to do more than increase the amplitude of their moves amid less and less actual trading. At least, that is true in bonds, FX and commodities. Stocks, as we all know, are legally mandated to rise every day, so are likely to continue to do so.

And now, despite the fact that the Fed meets on Thursday, with a rate cut all but assured and ostensibly a great deal of interest in Chairman Powell’s press conference, all eyes are on the election. Remember, too, not only is that the case in the US, but also around the world. Whether friend or foe of the US, pretty much all 195 nations on the planet are invested in the outcome.

With that in mind, and since this poet has no deep insight into the outcome, let me simply recount the overnight market activity with the understanding that many trends have the opportunity to reverse depending on the results.

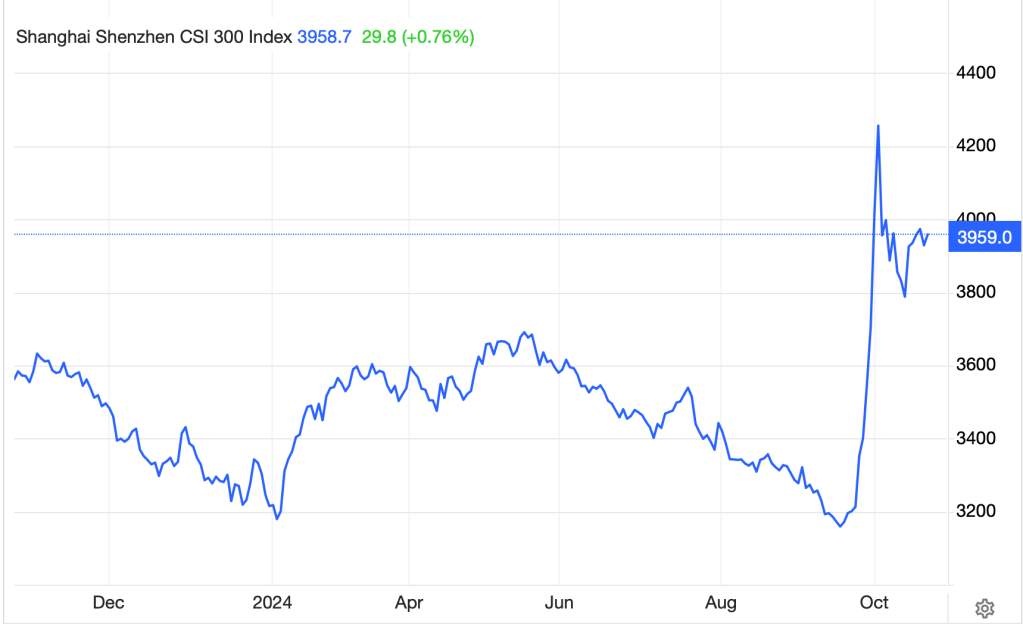

Starting with equity markets, Japanese shares (-2.6%) fell sharply as a combination of both their domestic political struggles (remember their government situation is unclear after the recent snap election) and the significant rebound in the yen (+0.9%) weighed on equities there. India (-1.2%) also struggled but elsewhere in the time zone, stocks rallied nicely led by China (+1.4%) and Korea (+1.8%) as visions of that Chinese fiscal bazooka continue to dance in investors dreams. Interestingly, the WSJ had an article this morning downplaying the idea, which based on their history makes a great deal of sense to me. Turning to Europe, most markets there are firmer, albeit only modestly so, with gains from the CAC and IBEX (+0.3% each) outpacing the DAX (0.0%). Finishing off, US futures are basically unchanged at this hour (7:00).

In the bond markets, while the Treasury move Friday did help drag European yields somewhat higher, it was nothing like seen in the US and this morning, those yields are essentially unchanged, +/- 1bp in most cases. The only data of note was the final PMI data which confirmed the flash data from last week. As to JGB yields, they have been stuck in the mud for a while now, still hanging below the 1.0% level with no designs of a large move.

Oil prices (+3.1%) are rebounding nicely on news that OPEC+ has delayed their previous plans to start increasing production as of December this year. Concerns about oversupply in the global market plus the return of Libyan production and record high US production have convinced them they better leave things as they are. Metals markets are a bit firmer this morning with gold (+0.2%) actually somewhat disappointing given the magnitude of the dollar’s decline, while both silver (+1.25%) and copper (+1.1%) show nice gains.

Finally, the dollar is under severe pressure across the board. The biggest gainers are MXN (+1.2%), NOK (+1.2%) and PLN (+1.1%) although most gains are on the order of 0.7% or more. Certainly, the oil story is helping NOK, and given the concerns that traders have about prospective tariff increases on Mexico if Trump wins, the idea that the race is closer than previously thought has supported the peso. As to the zloty, it seems that their PMI data, printing at 49.2, a fourth consecutive rise) has traders looking for a more hawkish central bank on the back of stronger economic activity.

On the data front, aside from the election and the Fed, there is other information, although it is not clear that anyone will notice.

| Today | Factory Orders | -0.4% |

| Tuesday | Trade Balance | -$84.1B |

| ISM Services | 53.8 | |

| Thursday | BOE Rate Decision | 4.75% (current 5.00%) |

| Initial Claims | 223K | |

| Continuing Claims | 1865K | |

| Nonfarm Productivity | 2.5% | |

| Unit Labor Costs | 1.1% | |

| FOMC Rate Decision | 4.75% (current 5.0%) | |

| Friday | Michigan Sentiment | 71.0 |

Source: tradingeconomics.com

Of course, the election will dominate everything, and it certainly appears that there will be legal challenges from the losing side regardless of the outcome. My expectation is that markets will remain jumpy with outsized moves on low volumes until there is more clarity. It is not often that an FOMC meeting is seen as an afterthought, but much to Chairman Powell’s delight, I sense that is going to be the case this week.

I have already voted early and I encourage each of you to vote as the more voices heard, the better the case the winner will have at achieving a mandate. And the reality is, we need a president with a mandate if we are going to see broad-based positive changes in the nation going forward.

Good luck

adf