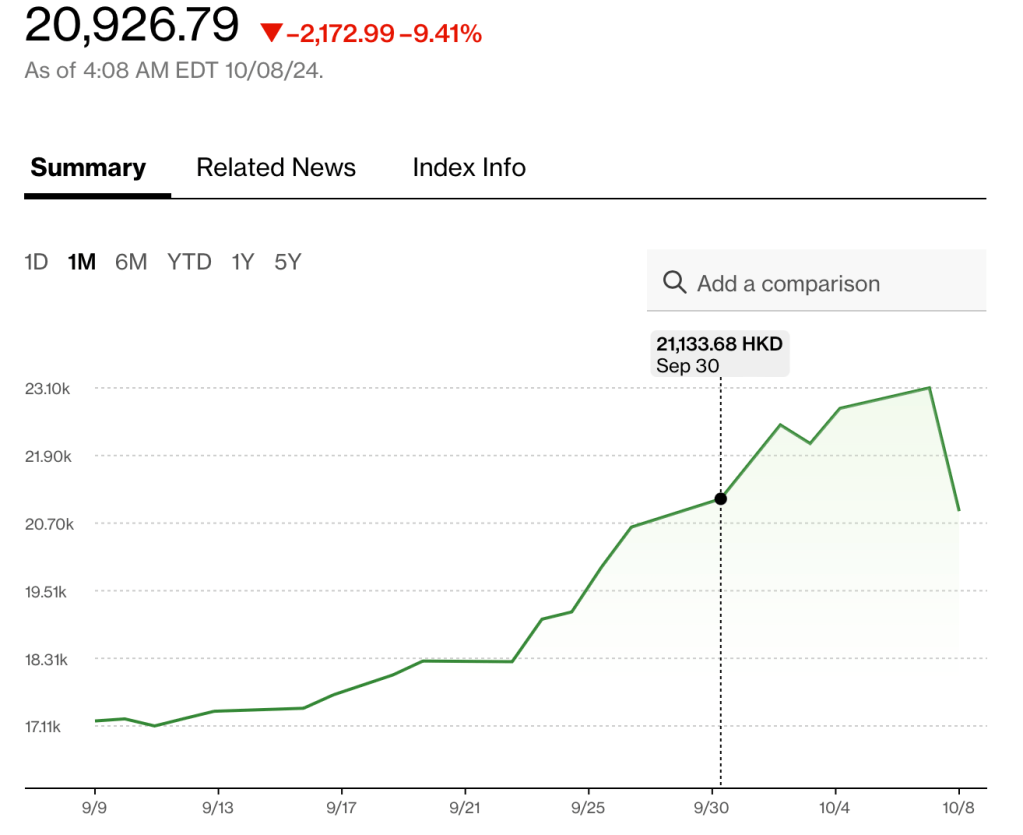

The markets in China retraced

One-fifth of their rally post-haste

Not everyone’s sure

The promise du jour

Is where traders’ trust can be placed

In Europe, attention’s now turned

To lesson’s the ECB’s learned

Their new calculation

Shows Europe’s inflation

No longer has members concerned

Let’s take a trip down memory lane. Perhaps you can remember the time when the Chinese economy seemed to be faltering, and the Chinese stock markets were massively underperforming their peers. That combination of events was enough to get President Xi to change his tune regarding stimulus and over the course of several days, first the PBOC and then the government announced a series of measures to support both the economy and the stock market specifically. In fact, way back on September 24th I described the measures taken in this post. Yep, that was two whole weeks ago! The initial response was a rip-roaring rally in Chinese equity markets (~34%), and substantial strength in the renminbi. Analysts couldn’t sing Xi’s praises loudly enough as they were certain that the government there was finally doing what was necessary to address the myriad issues within the Chinese economy.

But a funny thing happened on the way to this new nirvana, investors realized that all the hype was just that and the announced measures, while likely to help at the margins, were not going to change the big picture. Ultimately, China remains in a difficult situation as its entire economic model of mercantilistic practices is running into populist uprisings everywhere else in the world. And since domestic Chinese demand remains lackluster given the estimated $10 trillion that has evaporated in the local property markets, people at home are never going to be able to be a sufficiently large market for all the stuff that China makes.

As this realization sets in, there is no better picture of this change of heart than the chart below showing the recent performance of the CSI 300.

Source: tradingeconomics.com

Last night’s 7% decline, which followed a similar one in Hong Kong the night before, has certainly stifled some of the ebullience that existed two weeks ago. Now, the market has still gained a very healthy 25% from its lows last month, certainly nothing to sneeze at, but are the prospects really that great going forward? Only time will tell, but I am not confident absent another significant bout of fiscal stimulus, something on the order of a helicopter money drop. And that doesn’t seem like Xi’s cup of tea.

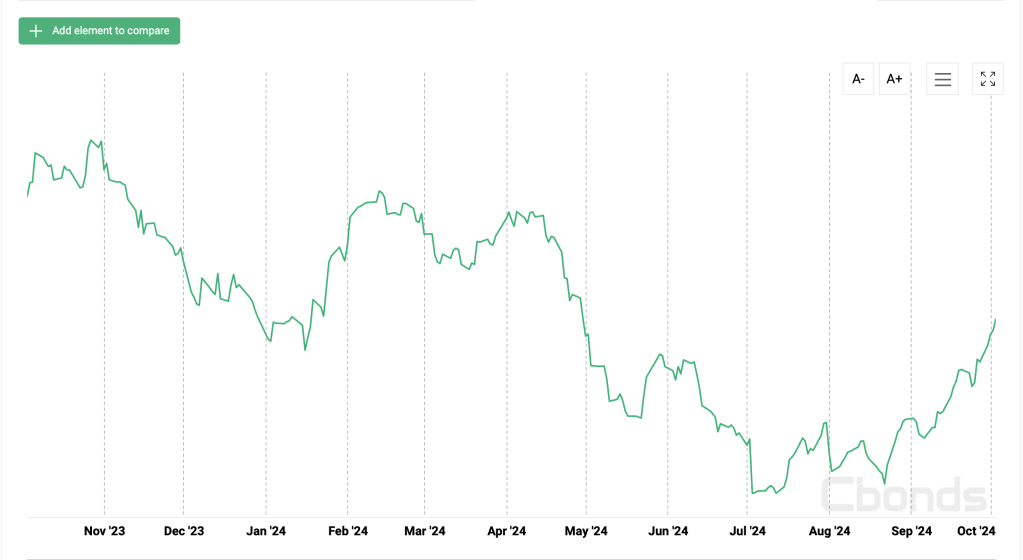

Turning to Europe, the economy there remains in the doldrums with some nations far worse off than others. Germany remains Europe’s basket case, as evidenced by this morning’s Trade Balance release there. While the balance grew to €22.5B, that was because imports fell a larger than expected -3.4%, a signal that domestic activity is still lagging. With the ECB set to meet next week, the market is currently pricing a 90% probability of a 25bp rate cut with talk of another cut coming at the following meeting as well.

You may remember that Madame Lagarde was insistent that there was no guaranty that the ECB would be cutting rates at every meeting once they started, rather that they would be data dependent. But with the combination of slowing economic activity, especially in Germany, and the ensuing political angst it has created amongst the governments throughout Europe, it seems that many more ECB members have seen the inflation light and have declared a much higher degree of confidence that it will be at, or even below, their 2% target soon enough. And maybe it will be. However, similar to the Fed’s prognosticatory record, the ECB has a horrific track record of anticipating future economic variables. A key problem for Europe is the suicidal energy policies they continue to promulgate. Granted, some nations are figuring out that wind and solar are not the answer, but Germany is not one of them, at least not yet. And as long as these policies remain in place and electricity prices continue to rise (they are already the highest in the world) then inflation pressures are going to continue.

Bringing this conversation around to more than macroeconomic questions, the market impact of recent data is becoming clearer. While the US economy continues to show resilience, as evidenced by that blowout NFP report last Friday, and Europe continues to falter, the previous assumptions on rate movements with the Fed being the most aggressive rate cutter around are changing. The result is the euro, which has slipped more than 2% in the past two weeks, is likely to continue to fall further, putting upward pressure on Eurozone inflation and putting the ECB in a bind.

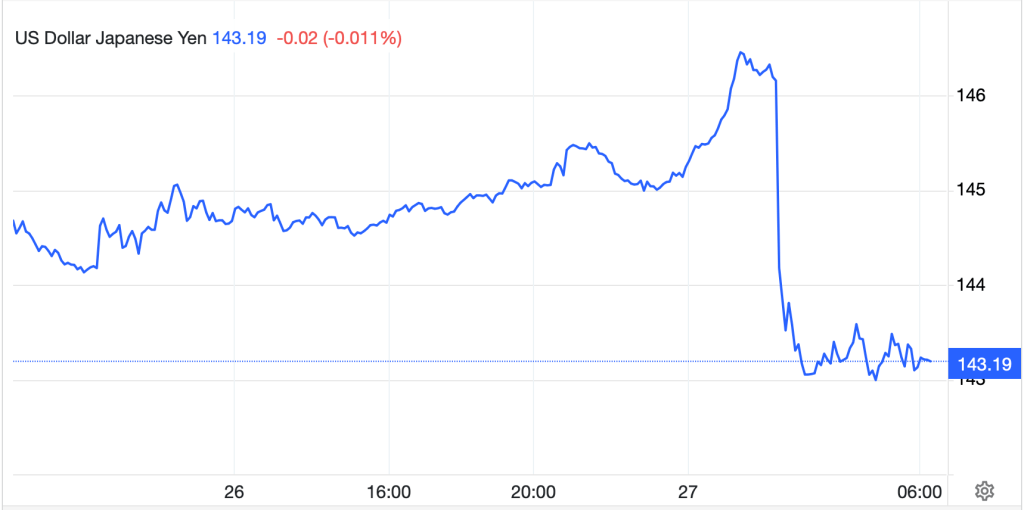

Ok, those seem to be the drivers in markets today as we all look forward to tomorrow’s US CPI report. A tour of the rest of the overnight session shows that Japan (+0.9%) continues to rebound from its worst levels a month ago as worries of aggressive monetary policy tightening continue to abate. The latest view is the BOJ won’t move until January at the earliest. The rest of Asia was mixed with the biggest gainer being New Zealand (+1.7%) which responded to the RBNZ cutting rates by 50bps, as expected, but explaining that further cuts were in line as they expected inflation to head below the middle of their 1% – 3% target range. In Europe, the picture is mixed with more gainers than laggards but no movement of more than 0.3%, a signal that not much is happening. US futures are similarly little changed at this hour (7:45) this morning.

In the bond market, Treasury yields have edged higher by 1bp and continue to trade above 4.00%, a level that had been seen as critical when the market moved below that point. Given the overall lack of activity today, it should be no surprise that European sovereigns are also within 1bp of yesterday’s closing levels while JGB yields, following suit, rose a single basis point overnight. It feels like the market is awaiting the CPI data tomorrow to make its next moves.

Oil prices were clobbered yesterday, falling nearly 6% at one point on the session before a modest late bounce. This morning, they are slipping another -0.5% as market participants seem tired of waiting for a Middle East conflagration and instead have focused on the fact that more supply is coming on the market amidst softening demand. Libya is back to full output of 1.2mm bpd and OPEC is still planning to increase production while China and Europe show softer growth. That China story continues to undermine copper (-1.6%) although the precious metals, after downdrafts yesterday, are little changed this morning.

Finally, the dollar continues to find support on the strength of reduced Fed rate cut expectations alongside growing expectations for cuts elsewhere. NZD (-1.0%) is today’s laggard though the rest of the G10 are all showing declines. In the EMG bloc, the dollar is also higher universally, but the moves here are more modest. In fact, away from NZD, the next largest declines have been seen in NOK (-0.6%) and SEK (-0.5%), but LATAM, APAC and EEMEA are all softer as well.

On the data front, this morning brings EIA oil inventories, with a net draw expected and then at 2:00 we see the FOMC Minutes from the last meeting. But those are stale given the payroll report. Instead, we hear from seven more Fed speakers today which will set the tone. Yesterday’s speakers seemed to have been on the same page as Monday’s, with caution the watchword but rate cuts described as necessary despite the payroll report. Whatever there mental model is, it is clearly pointing to rate cuts are necessary.

It feels like today is going to be quiet as markets await tomorrow’s CPI data. The dollar seems likely to retain its bid, though, as the US is still the ‘cleanest shirt in the dirty laundry’ and global investors seem determined to own assets here.

Good luck

Adf