There once was a banker named Powell

Who fought, prices, high with a growl

Then going got tough

So he said, “enough”

And basically, threw in the towel

His problem’s inflation’s alive

And truthfully, starting to thrive

The worry is he

Will soon say that three

Percent’s the rate for which he’ll strive

With several days to digest the latest FOMC meeting results, and more importantly, the Powell press conference, my take is the Chairman recognizes that to get to 2.0% is going to be extremely painful, too painful politically during this fraught election cycle. And so, while he tried very hard to convince us all that the Fed was going to get to 2.0%, he stressed it will “take time”. The subtext of that is, it’s not going to happen in the next several years, at least, and this poet’s view is it may not happen again for decades. The key to recognizing this subtle shift is to understand that despite increased forecasts for both growth and inflation, the Fed remains hell-bent on cutting interest rates. Even the neo-Keynesian views which the Fed follows would not prescribe rate cuts in the current economic situation. But rate cuts are clearly on the table, at least for now.

This begs the question, why is he so determined to cut interest rates with the economy growing above trend? At this stage, the explanation that makes the most sense to me is…too much debt that needs to be refinanced in the coming years.

Consider, current estimates for total debt around the world are on the order of $350 trillion. That compares to global GDP of just under $100 trillion. Many estimates indicate that the average maturity of that debt is about 5 years which means that something on the order of $70 trillion of debt needs to be refinanced each year. Now, the US portion of that debt is estimated at about $100 trillion, of which ~$34.5 trillion is Treasury debt, and the rest is made up of corporate, mortgage, municipal and private debt. Remember, too, that total US GDP is currently about $28 trillion as of the end of February (according to the FRED database from the St Louis Fed), so the ratio here is similar to the global ratio. [Note, this does not include unfunded mandates like Social Security and Medicare, just loans and bonds outstanding.]

Here’s the problem, we have all heard about the fact that the US debt service has climbed above $1 trillion per annum and given the underlying principle is growing, that debt service is growing as well. In addition, on the private side, there is a huge proportion of corporate debt that has become a serious problem for banks and investors, notably the loans made for commercial real estate, but personal and credit card debt as well. The Fed cannot look at this situation and conclude that higher rates, or even higher for longer, is going to help all the debtors. And if the debtors default…that is going to be an economic disaster of epic proportions.Add it up and the only logical answer is Powell is going to gaslight everyone with the idea that the Fed is going to remain vigilant regarding inflation. And they will right up until the time when the pain becomes too great, or too imminent and they cut. I think that we are seeing the first signals from markets this is going to be the case from both gold and bitcoin. But if I am correct, and the Fed cuts despite still elevated inflation readings, look for the dollar to decline sharply, at least initially until other central banks cut as well, look for bonds to fall sharply and look for hard assets to rally. As to stocks, I expect that initially it will be seen as a positive and juice the rally, but that over time, stocks will begin to lag hard assets. Quite frankly, this looks like it is a 2024 event, so perhaps if that first cut really comes in June, the summer is going to be far more interesting than anybody at the Fed would like to see.

Kanda told us all

“We are always prepared” to

Prevent yen weakness

Meanwhile in Beijing

The central bank responded

Nothing to see here

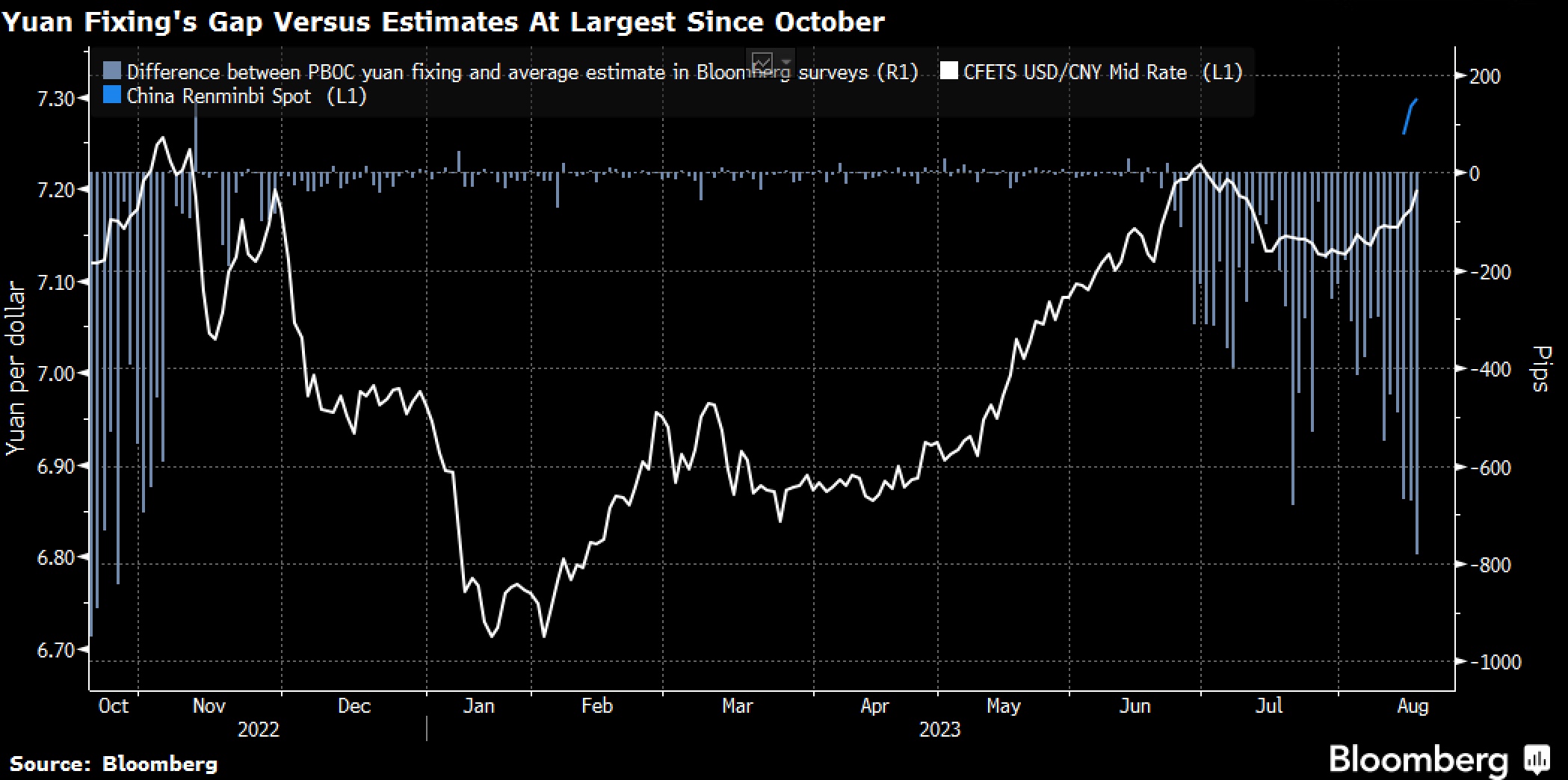

“The current weakening of the yen is not in line with fundamentals and is clearly driven by speculation. We will take appropriate action against excessive fluctuations, without ruling out any options.” So said Masato Kanda, the current Mr Yen at the MOF. It seems possible, if not likely, the yen’s decline in the wake of the BOJ move last week came as a bit of a surprise. This morning, the yen (+0.1%) has edged away from its lows from last week, but USDJPY remains above the 151 level and very close to the level when the MOF/BOJ intervened in October 2022. Adding to the pressure was Friday’s very surprising sharp decline in the CNY, which many in the market took to mean the PBOC was comfortable with a weaker yuan.

Economically, a weaker yuan seems to make sense, but the PBOC’s concern is that it could lead to increased capital outflows, something which they are desperate to prevent. As such, last night, the CNY fixing was nearly 1200 points stronger than expected, with the dollar rate below 7.10, and we saw significant dollar selling by the large Chinese banks. Apparently, Friday’s movement was a bit too much. I suspect that these two currencies will continue to track each other at this point with both currently at levels which, in the past, have been demarcation lines for intervention.

Here’s a conspiratorial thought, perhaps the Fed’s dovishness is a response to the weakness in the yen and Powell’s best effort to help the BOJ avoid having to intervene again. The thing about intervention is it, by definition, represents a failure of monetary policy, at least in the market’s eyes. And in the end, all G10 central banks are in constant communication.

Ok, let’s survey the markets overnight. All the currency activity seemed to put a damper on equity investors as Asia saw weakness across the board with Japan (Nikkei -1.2%) falling, although still above 40K, and both Hong Kong and mainland shares in the red. In Europe this morning, red is also the predominant color, although the declines are more muted, ranging from -0.1% (DAX) to -0.4% (CAC). Finally, US futures, at this hour (7:00) are also slipping lower, down 0.25% on average.

In the bond market, Treasury yields are backing up 3bps this morning, bouncing off the critical 4.20% technical level again. As well, in Europe, sovereign yields are rising between 2bps and 3bps across the board. There has been no data of note, but we have heard a bit more from ECB bankers with a surprising comment from Austria’s Holtzmann that he saw no reason for rate cuts at all. That is an outlier view! And despite what is happening in the FX markets, JGB yields remain unchanged yet again.

Turning to commodities, oil (+0.3%) is edging higher this morning as, after a strong rally early in the month and a small correction, it appears that $80/bbl is a new floor for the price. In the metals markets, after last week’s pressure lower, this morning both precious (gold +0.3%) and base (copper +0.1%) metals are edging higher. There has not been much in the way of news driving things in this session.

Finally, the dollar is a touch softer this morning, but that is after a strong week last week. We’ve already touched on the Asian currencies, and it is true the entire bloc, which had been under pressure, is a bit stronger this morning. But we are seeing strength across the board with G10 currencies higher on the order of 0.2% and most EMG currencies firmer by between 0.1% and 0.2%. So, while the movement is broad, it is not very deep. I maintain this is all about US yields and the fact that despite Powell’s newfound dovishness, the Fed remains the tightest of the bunch.

On the data front, there is a lot of information to be released, but I suspect all eyes will be on Friday’s PCE data.

| Today | Chicago Fed Nat’l Activity | -0.9 |

| New Home Sales | 680K | |

| Tues | Durable Goods | 1.0% |

| -ex Transport | 0.4% | |

| Case Shiller Home Prices | 6.8% | |

| Consumer Confidence | 106.7 | |

| Thursday | Initial Claims | 215K |

| Continuing Claims | 1808K | |

| Q4 GDP | 3.2% | |

| Chicago PMI | 46.0 | |

| Michigan Sentiment | 76.5 | |

| Friday | Personal Income | 0.4% |

| Personal Spending | 0.4% | |

| PCE | 0.4% (2.4% Y/Y) | |

| Core PCE | 0.3% (2.8% Y/Y) |

In addition to that menu, Fed speakers will be about with five scheduled including Chairman Powell on Friday morning. Remember, too, that Friday is a holiday, Good Friday, with market liquidity likely to be somewhat impaired as Europe will be skeleton staffed. As well, it is month end, so my take is if Powell veers from the script, or perhaps reinforces the dovish theme, we could see an outsized move. Just beware.

Recent activities by the BOJ and PBOC indicate that the market has found a sore spot for the central banks. If the data this week doesn’t cooperate, meaning it remains stronger than forecast, it will be very interesting to hear what Chairman Powell has to say on Friday. Cagily, he speaks after the PCE data, so he will be able to respond. But especially if that data comes in hot, we are likely to see more volatile markets going forward. However, today, it is hard to get too excited.

Good luck

Adf