The PMI data was soft

Which helped keep stock prices aloft

As many now think

That yields will soon sink

And, therefore, stock prices have troughed

But really, the data to come

Is much more important to some

‘Cause if PCE

Is still on a spree

Then many more depths we may plumb

First two mea culpas on yesterday’s note. Clearly, the ECB is considering a cut, not a hike as I mentioned inadvertently at one point and my info on the timing of Alphabet’s earnings release was incorrect, it was not yesterday but is due tomorrow.

Markets remain generally comfortable with the current situation as all eyes continue to be on Friday’s activity. Remember, not only do we get the PCE data in the US, but before NY walks in, the BOJ will have met and announced any potential policy changes (unlikely) but hinted at future moves (more possible). However, until then, quarterly earnings and secondary data are all we have.

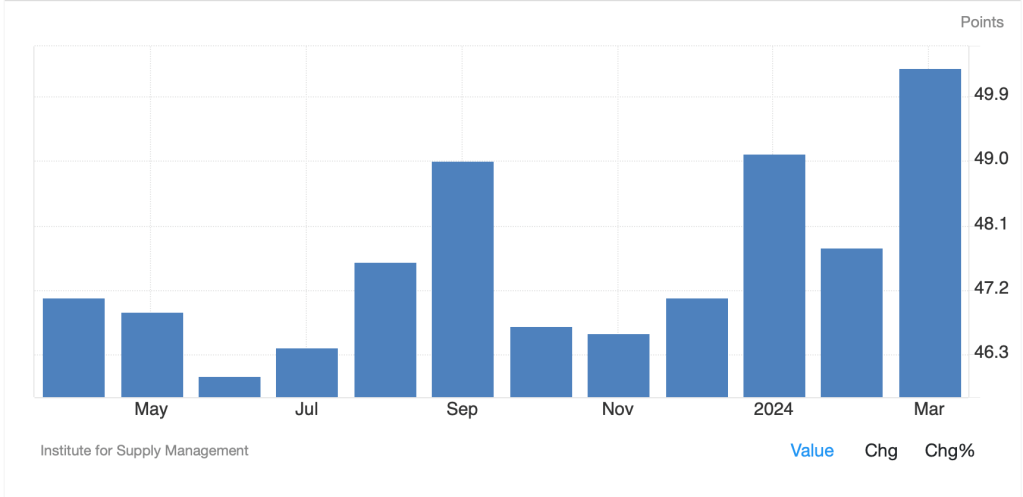

This brings us to yesterday’s activity where the US Flash PMI data was weaker than expected in both Manufacturing (49.9) and Services (50.9) while both were anticipated to print at 52.0. Of course, in a world of rising rates and concerns that the Fed is going to become yet more hawkish when they meet next week, weak data is seen as a potential cure. The result was a rally in stocks and bond prices (yields fell), albeit not a very dramatic one. After the equity market close, Tesla reported their earnings and while they were softer than the median analyst expectations, it appears they beat the whisper numbers and Elon said enough things to encourage a rebound in the company’s share price.

Now, you know that if I am discussing Tesla earnings, there is absolutely nothing going on in the markets. So, let’s turn our attention to something a bit longer term, and quite speculative, but important if it comes about. I am referring to the story that is getting more traction regarding Robert Lighthizer, who was President Trump’s trade advisor for the entire term, and who recently has discussed the goal of weakening the dollar if Trump is re-elected.

One of the things that annoys me is that so many political hacks players believe that they can drive market prices without making major underlying policy changes. And, generally speaking, they recognize that changing the underlying policies is either out of their hands or would cause other, more serious problems even if they were achieved. This is a perfect example of that type of thinking.

The underlying issue, I believe, is the Trump focus on the trade deficit as being a crucial indicator and something about which the US should be overly concerned. Let’s start by looking at a history of the dollar’s value (as measured by the EURUSD) compared to the monthly trade balance.

Source: tradingeconomics.com

The green line, based on the left-hand axis, is the trade balance while the blue line, on the right-hand axis, tracks the EURUSD exchange rate. The first thing to see is that there is not a very strong relationship. In fact, the R2 is just 0.07, so virtually no relationship. However, in your old finance textbooks, there is a theory that a weaker exchange rate improves the trade balance at the expense of increasing inflation. And that certainly makes sense, but I believe that relationship is more representative of countries whose currency is not the global reserve currency. In the current situation, the dollar’s movement is dependent on many other things, and the trade balance is more frequently an indicator of the strength of the US economy. After all, when things are going well, we are importing much more stuff than we can produce and so the trade balance turns more negative. Looking at the chart, the periods when the trade deficit shrank (rising green line) are the same periods when the US was in a recession.

The other problem for a Trump administration that is seeking to weaken the dollar is that the other consequences of the policy actions that would likely lead to a weaker dollar will not be welcomed. First, and foremost, we will see inflation rise pretty rapidly as not only import prices, but also commodity prices would all move much higher. The other likely outcome would be an increased reticence for foreigners to hold US assets overall, as a declining dollar will reduce their value in local currency terms. Right now, the US equity markets represent nearly 70% of global equity market assets in value. That has been a virtuous circle of foreign buyers of US assets driving prices higher and the dollar higher as US deficit spending drives growth. But that can certainly turn into a vicious cycle of a weakened dollar driving sales of US assets by foreigners, leading to falling equity prices and a reduction in that percentage of global market cap. And one thing we know is that Mr Trump is very concerned with the value of the stock market, so a falling one would be seen as a big problem.

I raise this issue because it is getting more press and will impact the narrative, especially as we get closer to the election. While I don’t believe that the US has the ability to unilaterally weaken the dollar ceteris paribus, I would not be surprised to see this topic gain in mindshare and have an impact for a while.

The reason I focused on this is there has still been very little else to consider. Right now, everybody is happy as equity markets have rebounded around the world following yesterday’s US rally while bond yields, which dipped yesterday, are rebounding this morning by between 4bps and 6bps. Both of these are indicators of economic strength.

In the commodity markets, yesterday’s oil rally on the back of a much bigger inventory draw than expected, according to the API, is moderating this morning while metals prices, seem to be finding a bottom after their recent correction. Given how far and how fast metals prices rose over the past several weeks, a correction was overdue, and welcome to markets as things are now set for the next leg higher, I believe. Nothing has changed my view on this story.

Finally, the dollar is firmer this morning after a modest decline yesterday on the back of the rates selloff. In fact, some currencies are under more substantial pressure like SEK (-0.75%) and NOK (-0.75%) although those are the largest movers on the day. Perhaps the biggest news is that USDJPY finally breached the 155.00 level and now has its sights set on 160. I expect that we will hear much more talk tonight from MOF speakers regarding the yen, but I see no reason to believe the BOJ will act because of this move. However, as I mentioned last week, for all you JPY asset and revenue hedgers, I would be using JPY puts here, either purchased or in collars, because I suspect we will see a sharp decline on any intervention, and that day is drawing closer, I fear.

On the data front, Durable Goods (exp 2.5%, 0.3% ex transport) is this morning’s release and then the EIA oil inventory data comes later this morning. And that’s really it. Tomorrow, we have more data, Initial Claims, and Q1 GDP, and then, of course the PCE on Friday. But for now, it’s still an earnings driven market I think. So macro is on the back burner till Friday.

Good luck

Adf