The story that’s driving the news

Is one on which most have strong views

Both neighbors have claimed

Their borders are tamed

So, tariffs, the Prez, will not use

Meanwhile, data yesterday showed

That managers are in growth mode

The ISM rose

And Fed speakers chose

To validate rate cuts have slowed

The major economic story is, of course, the news that both Canada and Mexico have altered their behavior in order to prevent the imposition of 25% tariffs on their exports to the US. Both nations have now promised to police the border between themselves and the US more tightly, and it also seems that the US now has operational control, via military overflights, of the Mexican border. While there are many pundits who believe all this activity was merely theater and could have been accomplished without tariff threats, none of them are in a position of power. In the end, I think it is very difficult to conclude anything other than Trump got what he wanted and achieved it via his preferred means.

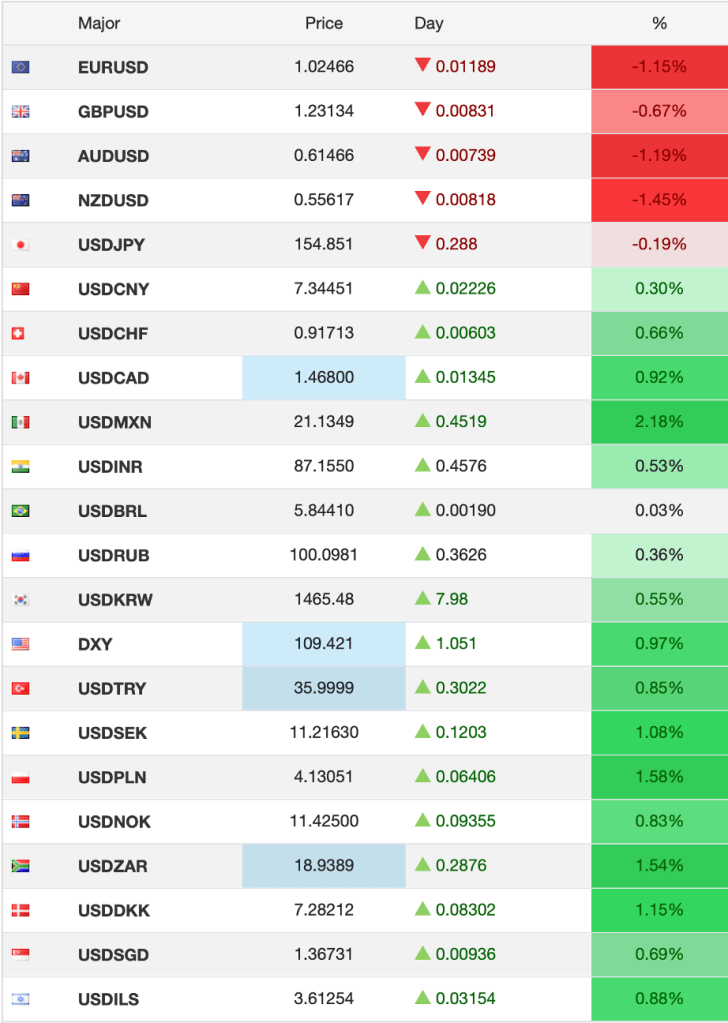

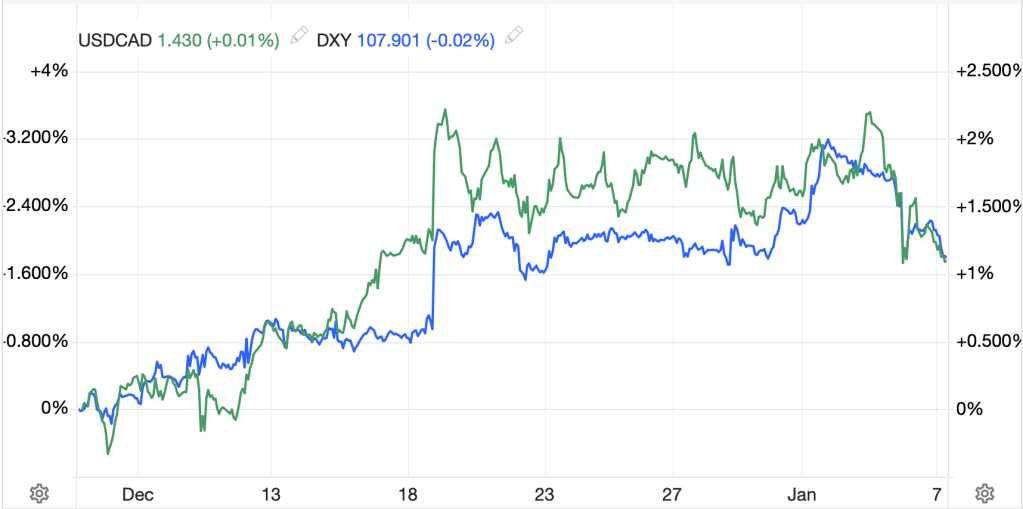

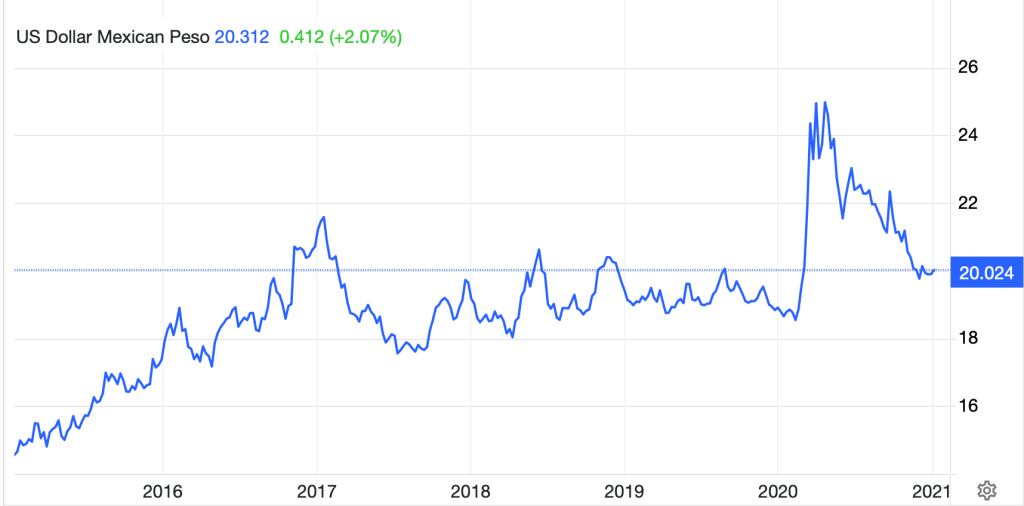

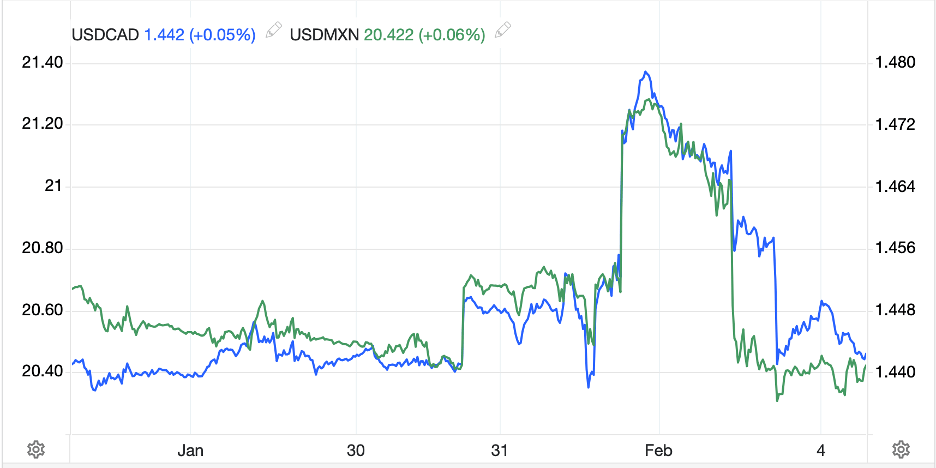

The market response was very much what you might expect. The early sharp declines in the CAD and MXN were reversed and the day ended with both currencies at basically the same levels they closed on Friday. However, as you can see from the chart below, there was clearly some excitement and panic during the session, with back and forth 2% movements.

Source: tradingeconomics.com

Here’s the thing, I think you all need to be prepared for this type of activity on a regular basis for the next four years. Certainly, there is nothing to suggest that President Trump is going to change his style and as long as he is successful in achieving his aims in this manner, he will continue with these activities. Consider this as well, no national leader wants to appear weak, especially to their electorate, and so when President Trump turns his focus to a smaller nation, those leaders are very likely to try to stand up to the pressure, at least in public. But in the end, most nations are far more reliant on the US market to buy their stuff than the other way around. After all, the US is basically the consumer of last resort globally. As such, very few nations can truthfully withstand an onslaught of this magnitude.

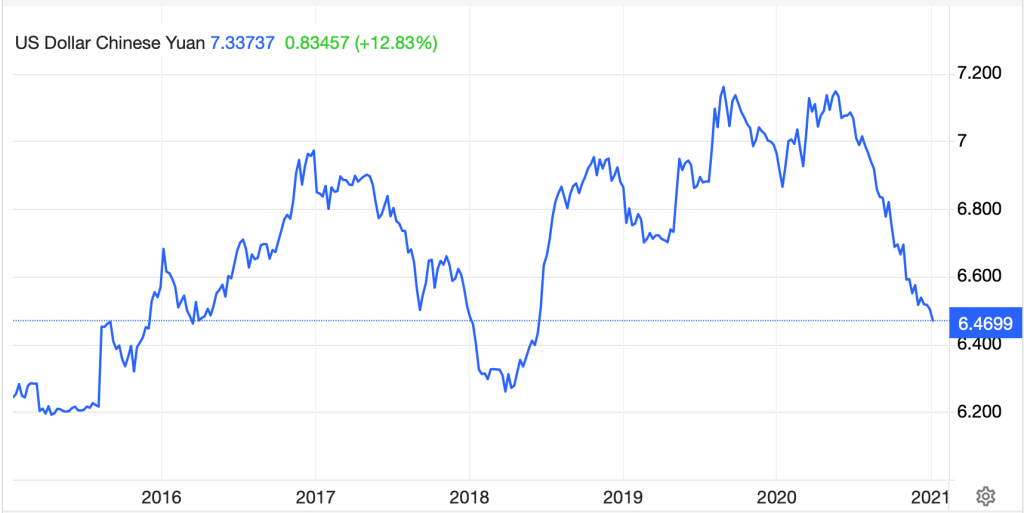

Now, turning to the state of the US economy, President Trump got some very positive news from the ISM data which printed at 50.9, its highest level since September 2022 and far higher than forecasts. In fact, it is not hard to look at the recent trend in this data series and believe we are going to see positive economic growth going forward

Source: tradingeconomics.com

However, the downside here was that the Prices Paid portion of the index also rose, back to 54.9, implying that inflation pressures remain extant within the economy. Now, you and I both know that is the case as we all deal with these prices on a daily basis, but until the data starts to become more obvious, it appears the Fed is always the last to know.

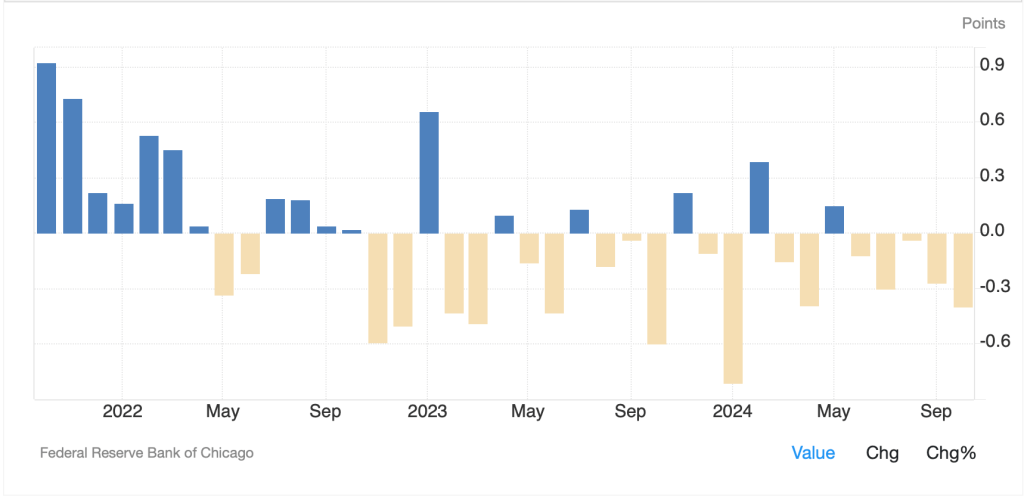

Speaking of the Fed, while only one speaker was on the schedule, Atlanta Fed President Bostic, we heard from three of them anyway as it remains clear to me there is a strong belief in the Marriner Eccles building that a key part of their job is to never shut up constantly pitch their narrative to try to keep markets in line. So, as well as Bostic, we heard from Chicago’s Goolsbee and Boston’s Collins and they all basically said the same thing, perhaps best stated by Ms Collins, “There’s no urgency for making additional adjustments. The data is going to have to tell us. At some point I certainly would see additional normalization in terms of what the policy stance is.” The last part of her comment refers to the idea that she, and truthfully all three, believe that further rate cuts remain appropriate despite the ongoing growth and continued stickiness of prices. And to think, some people believe that Trump and the Fed are not on the same page. They all want lower rates!

Ok, let’s turn to markets and see how they have behaved overnight. Yesterday, after a pretty horrible opening on the basis of tariffs, tariffs everywhere, the news that they would be postponed saw US markets rebound, although still close lower on the session. In Asia, Japan (+0.7%) rallied as so far, Japan remains out of the tariff sightlines, and Hong Kong (+2.8%) traded much higher in its first post-holiday session although mainland Chinese share trading doesn’t reopen until tonight. Elsewhere in Asia, the screens were largely green, perhaps on the thesis that tariffs are just a negotiating tactic. In Europe, the picture is more mixed with the UK (-0.2%) lagging while Spain’s IBEX (+0.8%) is the leading gainer. The rest of the continent, though, is seeing gains on the order of just 0.2%, so not much love. And at this hour (7:10) US futures are little changed.

In the bond market, Treasury yields, after edging higher by a few bps yesterday, are up another 2bps this morning and pushing back to 4.60%. In Europe, sovereign yields are also firmer this morning, up between 2bps and 4bps across the board, although this is after sharply lower yields yesterday on still weak PMI data from the continent. As well, Mr Trump is hinting that he is going to turn his tariff sights on Europe soon, so there has to be some trepidation there. After all, Europe, which is already a basket case due to self-inflicted energy-based wounds, really cannot afford a trade fight with the US, especially since they have a net trade surplus on the order of $200 billion with the US. Finally, JGB yields rose 3bps and are now at their highest level since May 2010 and look for all the world like the trend remains strongly intact as per the below chart.

Source: tradingeconomics.com

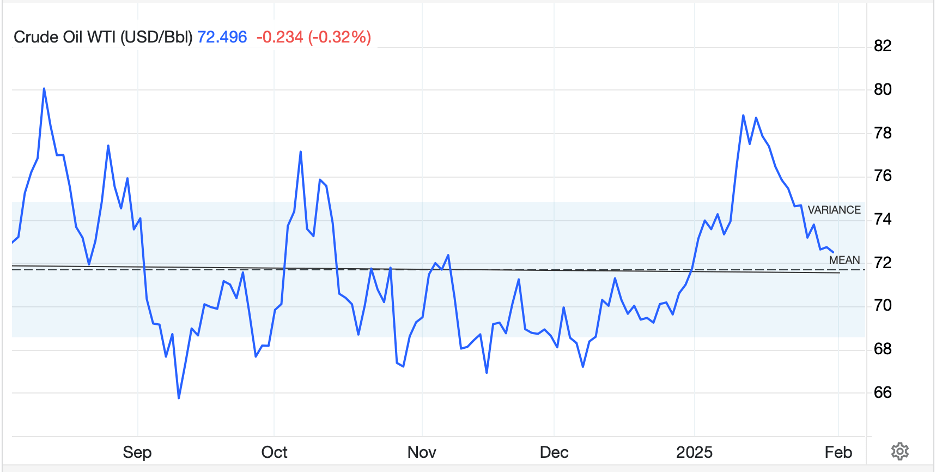

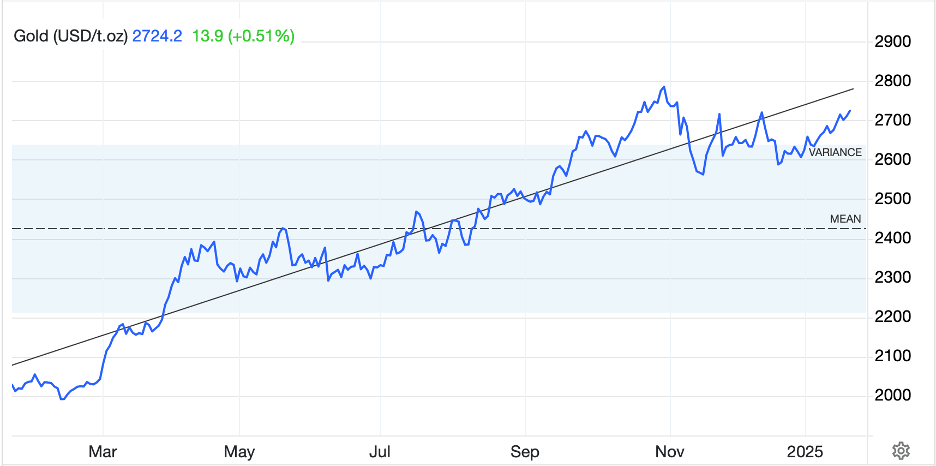

In the commodity markets, confusion in energy reigns as yesterday’s initial rally on Canadian tariff news has been completely reversed with oil (-2.1%) and NatGas (-4.2%) both falling sharply today. But what is not falling is gold (+0.1%) which made yet another new all-time high yesterday and continues to defy gravity. This has helped the entire metals complex with both silver and copper higher by 0.5% this morning.

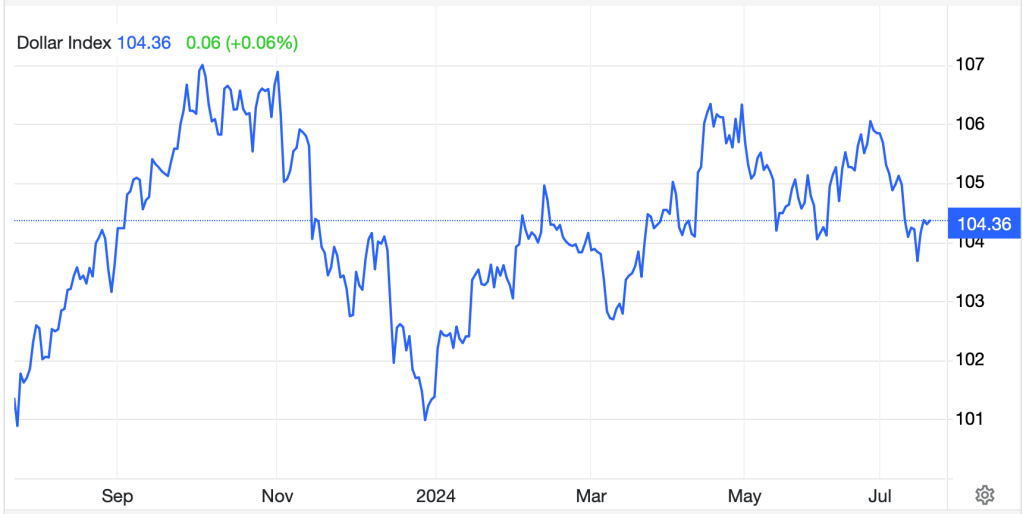

Finally, the dollar continues its general winning ways this morning. Yesterday saw early gains, also on the tariff story, which as evidenced by the chart at the beginning of the note, reversed. But in the other currencies, the euro and pound remain under modest pressure along with Aussie, as all three are softer by about -0.3% today, with the yen (-0.4%) along for the ride. In the EMG bloc, MXN (-0.6%), BRL (-1.2%) and ZAR (-0.3%) are also under pressure as though the immediate tariff threat seems to have abated, fear remains the driving force in the space. Add to the tariff fears the fact that the US economy continues to outperform its peers, and the Fed has basically put the kibosh on any rate cuts anytime soon and it is easy to understand why money is flowing this way.

On the data front, JOLTS Job Openings (exp 8.0M) and Factory Orders (-0.7%, +0.6% ex Transport) are today’s information, and we hear from more Fed speakers. It seems clear, so far, that the Fed mantra is wait and see as things evolve under President Trump. Unless one of these speakers (Bostic, Daly, Jefferson) offers a different view, which seems unlikely, then I suspect the dollar will continue to find more support than resistance for now.

Good luck

Adf