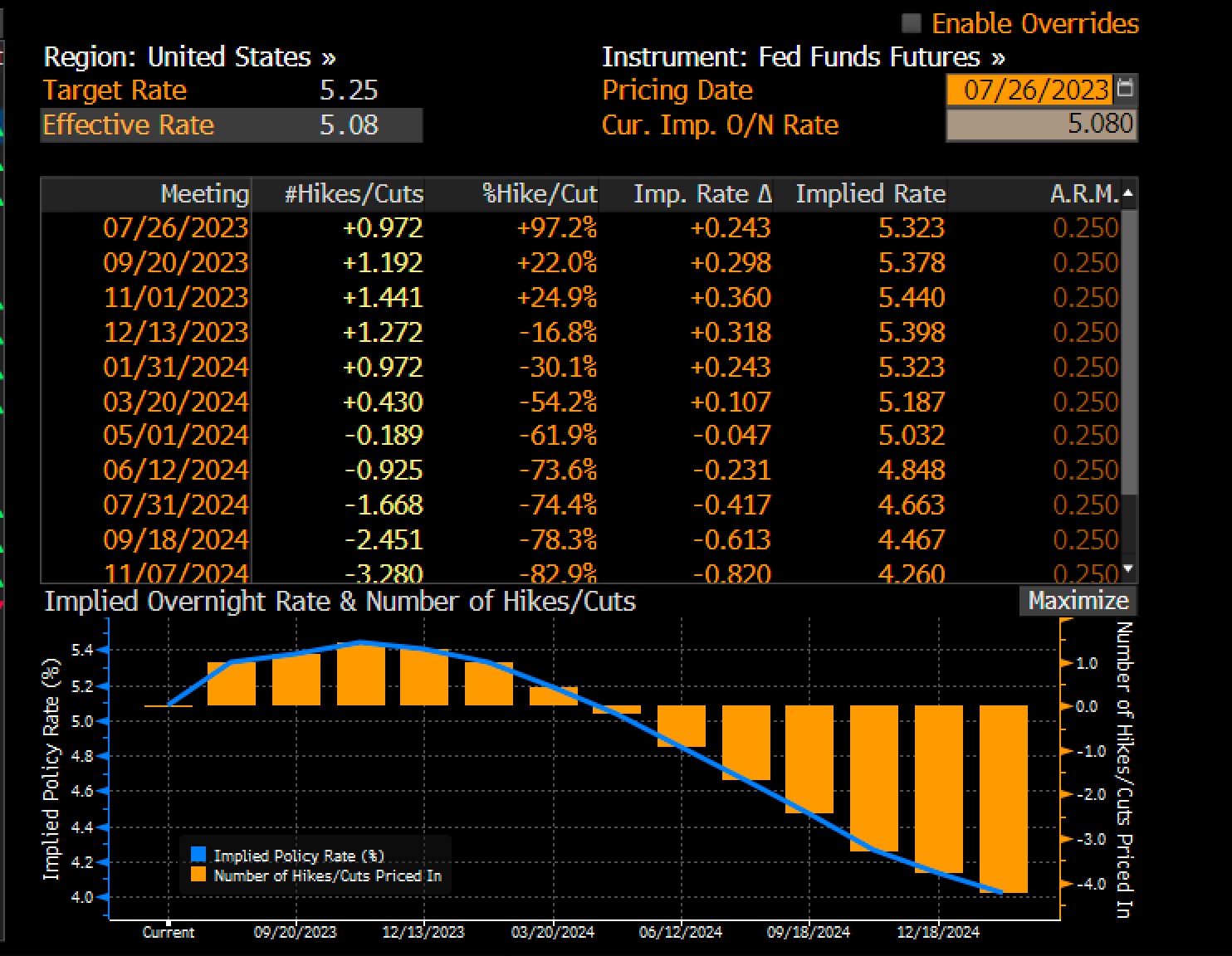

A quarter is baked in the cake Ere next time, when Jay takes a break At least that’s the view Of so many who Get paid for, such statements, to make The question, of course, is why Jay Would wait, lest inflation’s at bay The narrative, though, Is all-in that low Inflation is now here to stay Well, it’s Fed Day so all focus will be there until this afternoon at 2:00 when the Statement is released and then, probably more importantly, at 2:30 when Chairman Powell begins his press conference. Under the guise of a picture is worth a thousand words, I believe the next two charts, both unadulterated from Bloomberg are very effective at describing the current market expectations. The first is a tabular and graphic depiction of the Fed funds futures market over the next year, which shows that today’s hike is fully priced in, and then there is a just under 50% probability of a hike either September or November. After that, though, the market is convinced that Fed funds are going to fall, with more than 100 basis points of decline priced in through 2024.

Now, compare that to the second chart, the Dot Plot from the June FOMC meeting:

In truth, the two curves look pretty similar with perhaps the biggest difference the Fed’s current belief that they will absolutely hike twice before the end of 2023 rather than simply a 50% probability of such. So, can we just assume this is the way things are going to be? After all, if markets and the Fed agree on the same outcome, it seems likely to be realized, no?

Alas, this is where the narrative is based on crystal balls, not on data. Whether it is the punditry or the Fed (or the FX Poet), nobody knows how things are actually going to play out. One of the things that seems to be a throwaway line by every Fed speaker but is actually the most important part of the commentary is that their views are based on, ‘if the economy evolves as we expect it to.’ The problem is that the history of Fed prognostications is awful.

Obviously, the most recent glaring error was the ‘inflation is transitory’ narrative that they peddled for a year while inflation was rising sharply for many very clear reasons. Why we should think that their modelling prowess has improved since then is beyond me. I have often opined that the problem for the Fed is that every one of their models is broken since they don’t accurately reflect the economy, not even a little bit. Add to that the underlying premise which is that inflation is naturally at 2% and will head back there on its own, something with exactly zero empirical or theoretical support, and you have a recipe for policy errors.

The latest policy error was the transitory delay, but perhaps the bigger problem for the Fed is the potential for a relatively unprecedented set of economic variables with higher than target inflation combined with slow economic activity yet low unemployment (due to the shrinkage of the labor force.). I don’t think their playbook has a play to address that problem and I fear that the politics of the outcome will have a disproportionate impact on any policies they implement. If there is one thing of which we can be sure, it is that political solutions to economic problems are the worst kind with the longest-term negative impacts.

It is for this reason that Powell’s press conference is so widely anticipated as that is where we will learn any new information. But until then, I expect that markets will remain relatively benign.

A quick tour of the overnight session shows that there was no follow through to Monday night’s Chinese equity performance with the main exchanges in China and Japan all modestly lower. Europe, however, is having a much tougher time this morning with the CAC (-2.0%) leading the way lower as concerns seem to be growing over the ongoing central bank tightening policies continuing into a recession. There was vanishingly little data and no commentary of note, but we have seen some weaker than expected earnings numbers out of the continent, a sign that not all is well. As to US futures, they are essentially unchanged at this hour (8:00) as investors await this afternoon’s Fed meeting. I would be remiss, though, not to point out that there were several worse than expected earnings numbers, notably from Microsoft, which is a chink in the armor of the idea of infinite growth for AI.

Meanwhile, bond markets are under pressure in Europe with yields higher across the board there, on the order of 2.5bps to 3.5bps. This appears to be a move based on expectations of continuing higher interest rates from the ECB. Treasury yields, though, are unchanged on the day, and at 3.88%, currently sit right in the middle of the trading range we have seen for 2023. As to JGB yields, they slipped 2bps last night with limited concern that Ueda-san is going to rock the boat tomorrow night.

Oil prices (-1.0%) are a bit softer, but this looks like a trading correction after a strong run higher rather than a fundamentally based story. Base metals are also softer this morning as the Chinese inspired euphoria seems to have dissipated quickly while gold (+0.4%) is creeping higher despite rising yields and a modestly firmer dollar. It appears to me there is an underlying bid to the yellow metal that will not go away regardless of the macro situation.

Finally, the dollar is slightly firmer this morning as risk aversion seems to be supporting the greenback. JPY (+0.35%) is the G10 outlier on the plus side with the commodity bloc under the most pressure (AUD -0.7%, NOK -0.7%, SEK -0.5%). In the emerging markets, THB (+0.7%) has been the best performer after a surprisingly positive Trade Balance with a large negative one anticipated. However, the rest of the EMG space is mixed with some very weak currencies (HUF -1.0%, ZAR -0.9%) and some other modestly strong ones (BRL +0.4%, MYR +0.3%). The forint story continues to revolve around central bank activity, with concerns they will ease policy with inflation still high, while the rand is simply suffering from its commodity basis. Meanwhile, the real jumped after Fitch upgraded the country’s debt rating BB (stable) from BB-.

Ahead of the FOMC decision, we see New Home Sales (exp 725K) but that will be a nonevent given the afternoon’s agenda. It is a fool’s errand to try to anticipate exactly how Powell will respond to the questions he receives, or even exactly how they will phrase their current views. As such, today is one to watch and wait, then evaluate afterwards.

Good luck

Adf