The balance sheet, so said Chair Jay

Is really the very best way

For policy ease

And so, if you please,

QT is soon going away

Rate cuts are now back on the table

As we work quite hard to enable

Those folks lacking jobs

By printing up gobs

Of cash, just as fast as we’re able

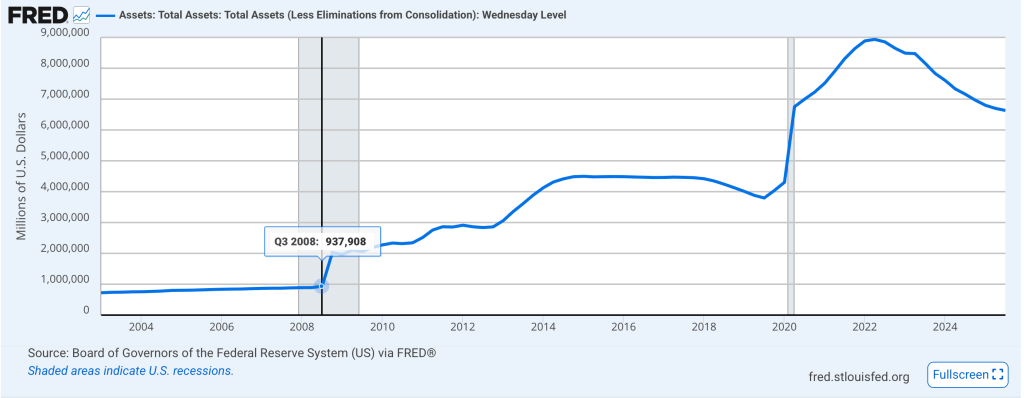

Chairman Powell spoke yesterday morning in Philadelphia at the NABE meeting and the TL; DR is that QT, the process of shrinking the Fed’s balance sheet, is coming to an end. Below is a chart showing the Fed’s balance sheet assets over the past 20+ years. I have highlighted the first foray into QE, during the financial crisis, and you can see how that balance sheet has grown and evolved since then.

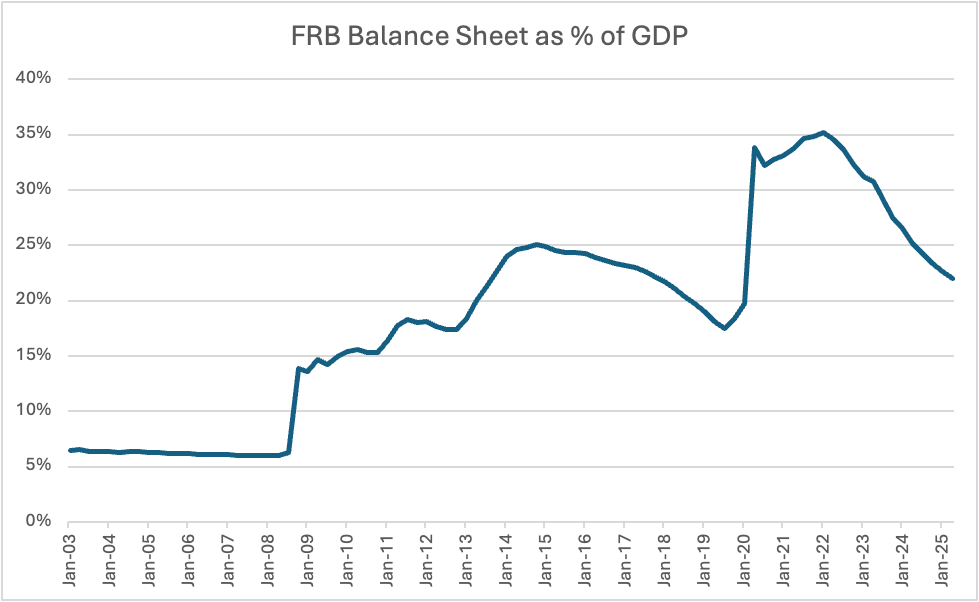

And the below chart is one I created from FRED data showing the Fed’s balance sheet as a percentage of the nation’s GDP.

Pretty similar looking, right? The history shows that the GFC qualitatively changed the way the Fed managed monetary policy, and by extension their efforts at managing the economy. As is frequently the case, QE was envisioned as an emergency policy to address the unfolding financial crisis in 2008, but as Milton Friedman warned us in 1984, “Nothing is so permanent as a temporary government program.” QE is now one of the key tools in the Fed’s toolkit as they try to achieve their mandates.

There has been a great deal of discussion regarding the issue of the size of the Fed’s balance sheet, paying interest on reserves, something that started back in 2008 as well, and what the proper role for the Fed should be. But I assure you, this is not the venue to determine those answers.

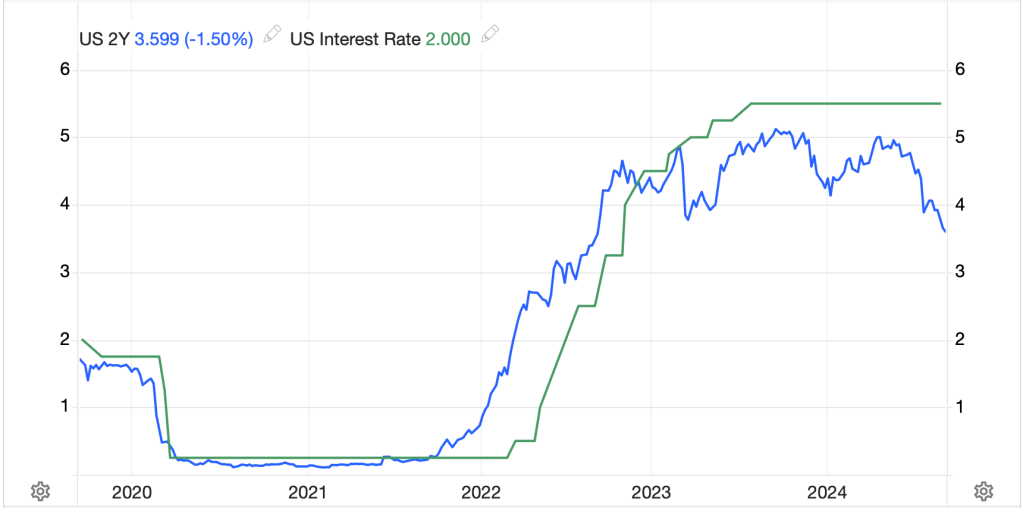

However, of more importance than the speech, per se, was that during the Q&A that followed, Mr Powell explained that the Fed was soon reaching the point where they were going to end QT, and that they were going to seek to change the tenor of the balance sheet to own more short-term assets, T-bills, than the current allocation of holding more long-term assets including T-bonds and MBS. And this was what the market wanted to hear. While both the NASDAQ and S&P 500 both closed slightly lower on the day, as you can see from the chart below, the response to Powell’s speech was immediate and impressive.

Source: tradingeconomics.com

Too, other markets also responded to the news in a similar manner, with gold, as per the below chart accelerating its move higher.

Source: tradingeconomics.com

While the dollar, as per the DXY, responded in an equally forceful manner, falling sharply at the same time.

Source: tradingeconomics.com

Summing up, Chairman Powell basically just told us that inflation was no longer a fight they were willing to have and support of the economy and employment is Job #1. Of course, this may not work out that well for long-term bond yields, which when if inflation rises are likely to rise as well, I think Powell knows that he will be gone by the time that becomes a problem, so maybe doesn’t care as much.

But here’s something to consider; there has been a great deal of talk about the animus between the Fed and the Treasury, or perhaps between Powell and Trump, but Treasury Secretary Bessent has already made clear they will be issuing more T-bills and less T-bonds going forward, which is a perfect fit for the Fed’s proposition to hold more T-bills and less T-bonds going forward. This is not a coincidence.

Now, while that was the subject that got most tongues wagging in the market, the other story of note was the ongoing trade spat between the US and China. It is hard to keep up with all the changes although it appears that soy oil imports from China are now on the menu of items to be tariffed, and the WSJ this morning explained that China is going to try to pressure President Trump by doing things to undermine the stock market as they see that as a vulnerability. Funnily enough, I think Trump cares less about the stock market this time around than last time, as he is far more focused on issues like reindustrialization and jobs here and elevating labor relative to capital, which by its very nature implies stock market underperformance.

But that’s where things stand now. So, let’s take a turn around markets overnight. Despite a mixed picture in the US, Asian equity markets had a fine time with Tokyo (+1.8%), China (+1.5%) and HK (+1.8%) all rallying sharply on the prospect of further Fed ease. Regarding trade, given the meeting between Presidents Trump and Xi is still on the schedule, I think that many are watching the public back and forth and assuming it is posturing. As well, Chinese inflation data was released showing deflation accelerating, -0.3% Y/Y, and that led to thoughts of further Chinese stimulus to support the economy there. Of course, their stimulus so far has been underwhelming, at best. Elsewhere in the region, green was also the theme with Korea (+2.7%), India (+0.7%), Taiwan (+1.8%) and Australia (+1.0%) all having strong sessions. One other thing about India is the central bank there intervened aggressively in the FX market with the rupee (+0.9%) retracing to its strongest level in a month as the RBI starts to get more concerned over the inflationary impacts of a constantly weakening currency.

In Europe, the CAC (+2.4%) is leading the way higher after LVMH reported better than expected earnings (Isn’t it funny that the US market is dependent on NVDA while the French market is dependent on LVMH? Talk about differences in the economy!), and while that has given a positive flavor to other markets, they have not seen the same type of movement with the DAX (+0.1%) and IBEX (+0.7%) holding up well while the FTSE 100 (-0.6%) continues to suffer from UK policies. As to US futures, at this hour (7:40) they are all firmer by 0.5% to 0.9%.

In the bond market, yields continue to edge lower with Treasuries (-2bps) actually lagging the European sovereign market where yields have declined between -3bps and -4bps across the board. In fact, UK gilts (-5bps) are doing best as investors are growing more comfortable with the idea the BOE is going to cut rates again after some dovish comments from Governor Bailey yesterday.

In the commodity space, oil (+0.2%) is consolidating after it fell again yesterday and is now lower by nearly -6% in the past week. However, the story continues to be metals with gold (+1.3%), silver (+2.8%), copper (+0.5%) and platinum (+1.7%) all seeing continued demand as the theme of owning stuff that hurts if you drop it on your foot remains a driving force in the markets. And as long as central banks are hinting that they are going to debase fiat currencies further, this trend will continue.

Finally, the dollar, as discussed above, is softer, down about -0.25% vs. most of its G10 counterparts this morning although NOK (+0.8%) is the leader in what appears to be some profit taking after an exaggerated decline on the back of oil’s decline. In the EMG bloc, we have already discussed INR, and after that, quite frankly, it has not been all that impressive with the dollar broadly slipping about -0.2% against virtually the rest of the bloc.

On the data front, we see Empire State Manufacturing (exp -1.0) and get the Fed’s Beige Book at 2:00 this afternoon. Four more Fed speakers are on the docket, with two, Miran and Waller, certainly on board for rate cuts, with the other two, Schmid and Bostic, likely to have a more moderated view. Earlier this morning Eurozone IP (-1.2%) showed that Europe is hardly moving along that well. Meanwhile, despite the excitement about Powell’s comments, the Fed funds futures market is essentially unchanged at 98% for an October cut and 95% for another in December. I understand why the dollar slipped yesterday, but until those numbers start to move more aggressively, I suspect the dollar’s decline will be muted.

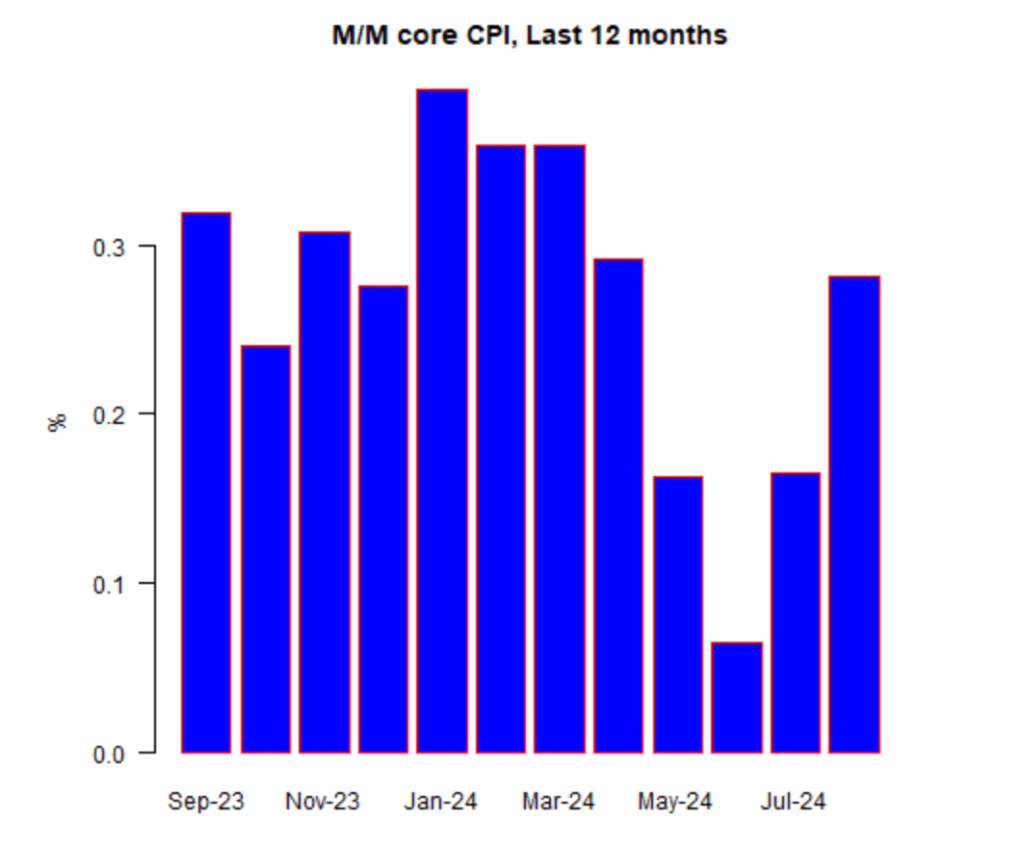

One other thing, rumor is that the BLS will be reporting the CPI data a week from Friday at 8:30am as they need it to calculate the COLA for Social Security for 2026. If that is hot, and I understand that expectations are for 0.35% M/M, Chairman Powell and his crew may find they have a really tough choice to make the following week.

Good luck

Adf