Inflation just won’t seem to die

No matter what Jay and friends try

Will he tempt the fates

To once more cut rates?

And if so, will bond yields comply?

It took until 1:10pm yesterday for Nick Timiraos at the WSJ to publish his article regarding the fact that Strengthening Inflation Poses Challenge for Trump, Fed. I find the title of the article interesting as, to the best of my knowledge, Mr Trump has yet to take office and enact any policies. But I suppose if Chairman Powell doesn’t like Trump (which seems to be the widely held view) he wanted to ensure his mouthpiece took a dig and distracted the audience from Powell’s problems.

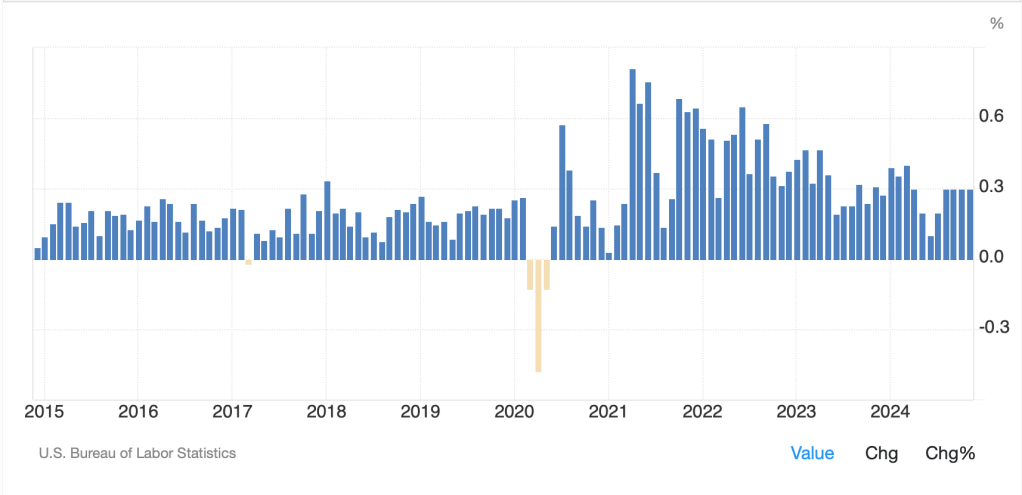

Regardless, yesterday’s CPI report was a bit firmer than forecast, at least at the second decimal place, which is enough for the punditry to discuss. Of course, it is remarkable that a statistic of this nature is considered down to the second decimal place given the broad uncertainty over its measurement overall. However, looking at the chart below, which shows the monthly CPI readings for the past ten years, it is not hard to see that monthly inflation bottomed back in June and appears to be finding a new home at the 0.3% or higher level.

Source: tradingeconomics.com

I showed the 10-year chart to also highlight that pre-Covid, the monthly readings were somewhere between 0.1% and 0.2% consistently. My point is that 0.3% per month annualizes to about 3.7% which is as good a guess as any for how inflation is going to play out going forward absent some major fiscal and monetary changes.

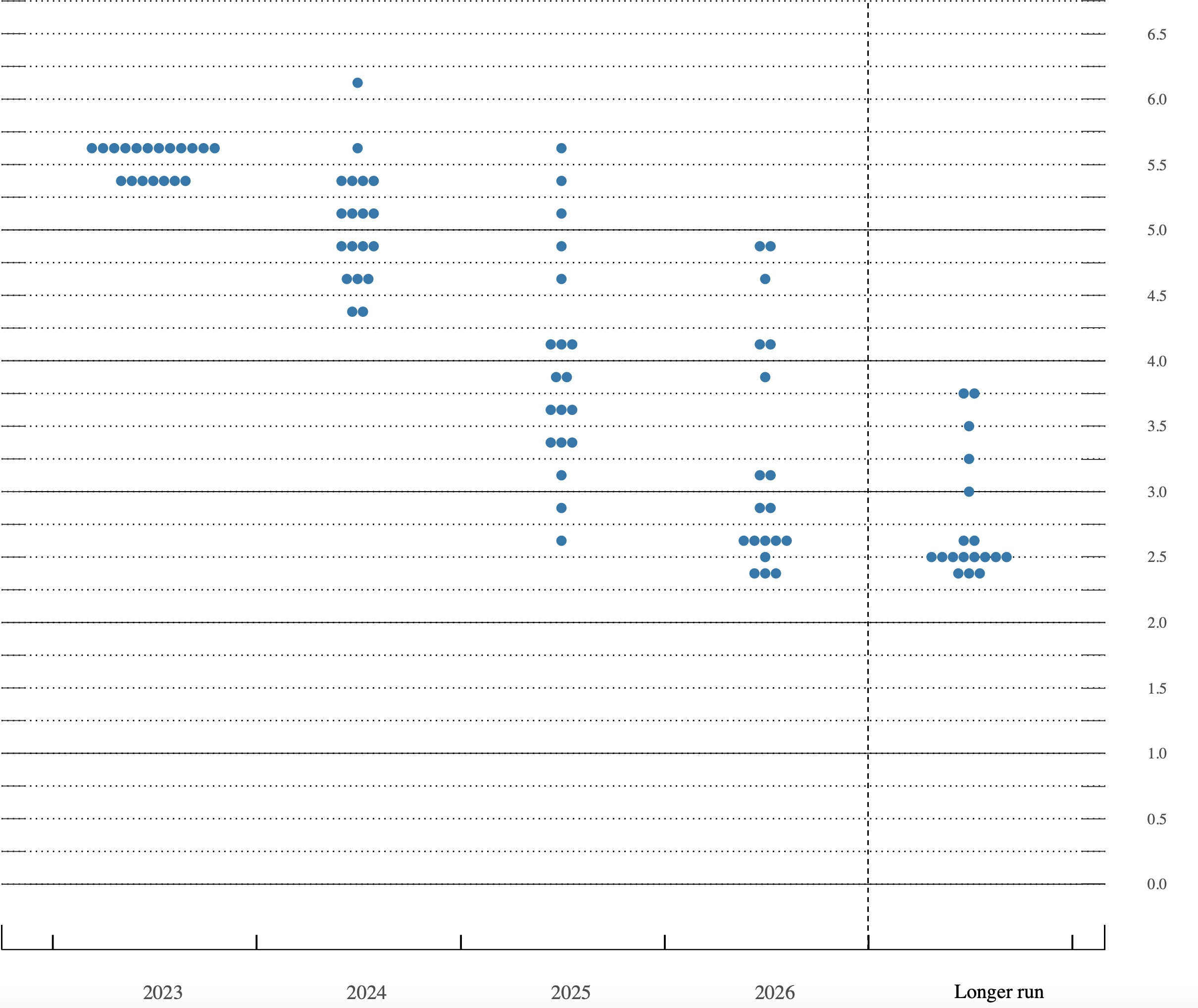

Aside from the fact that this is important because we all suffer the consequences in our daily lives, from a markets perspective, I believe this is the money line in the article [emphasis added], “Officials have indicated sticky inflation could lead them to slow the pace of rate reductions or stop altogether.” Yet, despite this strong hint that the Fed is getting uncomfortable with the market’s current assessment of how much further Fed funds are going to decline, the futures market is pricing a 98.6% probability of a cut next week.

In fairness, the market is now pricing only two more rate cuts after next week for all of 2025, a number that has been declining slowly over the past month. But ask yourself how the Fed will behave if their firmly held belief that inflation is still heading toward their 2% goal starts to falter under the weight of continued high readings. There are a few analysts who are discussing rate hikes for next year for just this reason. That, my friends, would upset the apple cart!

The central bank theme of the week

Is current rates need quite a tweak

Despite CPI

That’s still on the fly

More havoc, these bankers, will wreak

Down Under, though they didn’t cut

The doves’ case was open and shut

The Swiss and Canucks

Made changes, deluxe

While Christine, a quarter, will strut

While we are beginning to see some changes in the market’s perception of the Fed’s future path, those changes are not obvious elsewhere. So far this week, the RBA left rates on hold, as they had promised, but explained the need to cut was upon them, demonstrating far less concern over inflation than in the past. You may recall that the AUD fell sharply after the RBA statement put cuts in play going forward. Then, yesterday, the BOC cut 50bps, as expected, as they, too, have turned their focus to economic activity and away from inflation, which continues above their target. This morning, the Swiss National Bank surprised the markets with a 50bp cut, taking their base rate back down to 0.50%, expressing concern that inflation was slowing too rapidly and could become a problem. Finally, shortly the ECB will announce their policy rate with the market highly confident a 25bp cut is on the way, although there are a few looking for 50bps.

The funny thing about all these cuts is that other than Switzerland, where recent CPI readings were at 0.7%, inflation remains above target levels and is demonstrating the same type of behavior as in the US, where it bottomed during the summer and is rebounding. As well, especially in Europe, unemployment does not appear to be a major problem in these nations. This begs the question, why are central banks so keen to cut rates if inflation remains sticky above their target levels and economic activity is hanging on?

I have no good answer for this although I suspect there may be significant pressure from finance ministries regarding the cost of all that government debt that is outstanding and needs to be refinanced. Alas, even though almost every central bank’s primary mandate is to maintain low inflation, it has become clearer by the day that following that mandate is not seen as important as other concerns. Whether those concerns are economic activity or financing outstanding debt, or perhaps something else, I fear that we are heading back into a world where higher inflation is going to be the norm everywhere in the world. Plan accordingly.

Ok, after another couple of record high closes in the US yesterday, let’s see how things have played out ahead of the ECB this morning. In Asia, both Japan (+1.2%) and China (+1.0%) rallied on the brightening tech outlook, the prospect of further rate cuts and the ongoing hopes for that Chinese bazooka to finally be fired. As well, Hong Kong (+1.2%) and Korea (+1.6%) also fared well, although the rest of the region was more mixed on much smaller movement. In Europe, the best description ahead of the ECB is unchanged, with every bourse within 0.1% of Wednesday’s closing levels. US futures at this hour (7:15) are pointing modestly lower, however, down about -0.2%.

In the bond market, despite all the surety of rate cuts, investors are not comfortable holding duration, and we are seeing yields continue to rise across the board. Treasury yields are higher by another 3bps and back to 4.30% while European sovereign yields are all higher by between 3bps and 5bps. It seems the bond markets are not convinced that central banks are behaving properly. Perhaps the “bond vigilantes” will truly make a return after all.

In the commodity markets, oil (+0.1%) which managed to capture the $70/bl level is holding on this morning after the IEA raised its demand forecast for 2025 based on increased expectations for Chinese demand (because of the stimulus that is expected.). In the metals market, that Chinese stimulus is helping copper (+0.5%) although the precious sector is consolidating yesterday’s gains with gold (-0.3%) backing off slightly and silver unchanged. However, gold is back above $2700/oz and appears to have finished its consolidation.

Finally, the dollar is mixed this morning, broadly holding onto its recent gains, but seeing some weakness against specific currencies. For instance, BRL (+1.0%) responded to the fact that the central bank there, bucking the global trend, hiked the Selic rate by 100bps, a quarter point more than expected, as their concern over rising inflation increases. (It seems they are one of the few central banks that is focused on their job, not the politics!). But away from that outlier move, we see AUD (+0.45%) rising on stronger than expected jobs growth data while NOK (+0.4%) is continuing to benefit from oil’s recent gains. On the flip side, CHF (-0.35%) is suffering for the larger than expected SNB rate cut and GBP (-0.2%) is under modest pressure as traders debate whether the BOE will cut rates next week or not.

On the data front, Initial (exp 220K) and Continuing (1880K) Claims lead the way alongside PPI (0.2%, 2.6% Y/Y headline, 0.2%, 3.2% Y/Y core) at 8:30 this morning. Beyond that, there is a 30-year auction this afternoon and that is really it. I don’t see PPI having a great deal of impact and with CPI behind us, and Timiraos having told us that the Fed is going to slow the pace of cuts, I’m not sure what else there is to watch. Obviously, this morning’s ECB meeting matters, but really, it is hard to get overly excited about the outcome there. I suspect that attention will now be focused on the FOMC next week, with much more concern over the dot plot and SEP than the 25bp cut that seems a foregone conclusion.

If the Fed is truly slowing the pace of cuts, once again, it becomes difficult to see how the dollar will soften vs. its major counterparts. Keep that in mind for now.

Good luck

Adf