Markets have embraced

Trump’s whirlwind. Thus, Ueda

Is free to hike rates

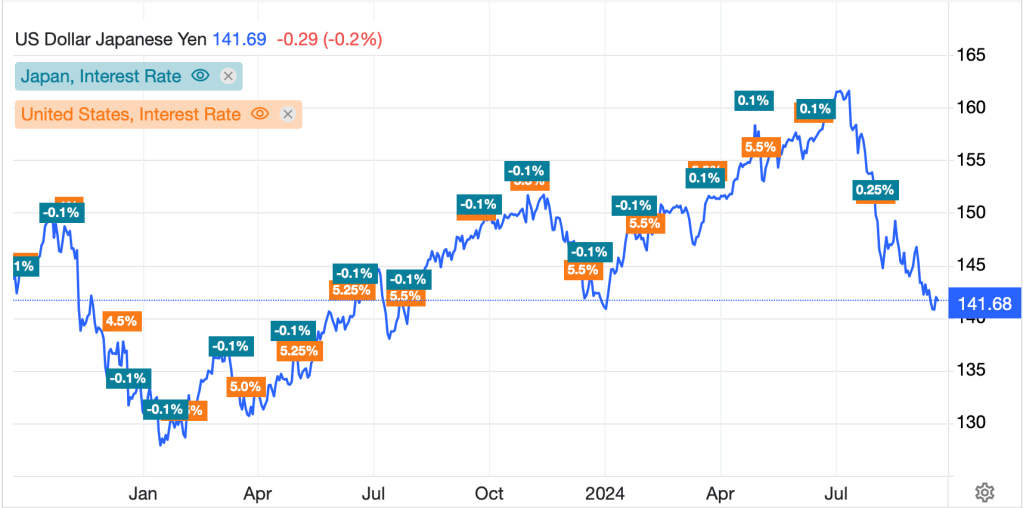

Tonight, the BOJ is apparently set to hike rates by 25bps. The market probability is essentially 100% and the key clue is that the Nikkei news organization wrote an article about it that was published after the first day of the BOJ’s two-day meeting. At the December BOJ meeting, Ueda-san explained that if inflation remained at or above their 2.0% target (it has) and if there were no major ructions in markets after President Trump’s inauguration (there haven’t been), then the BOJ was likely to continue to move their policy rate toward what they believe is a neutral stance. Currently, that neutral stance is mooted at 1.00%, so a 25bp hike tonight takes the overnight rate to 0.50%, somewhat closer.

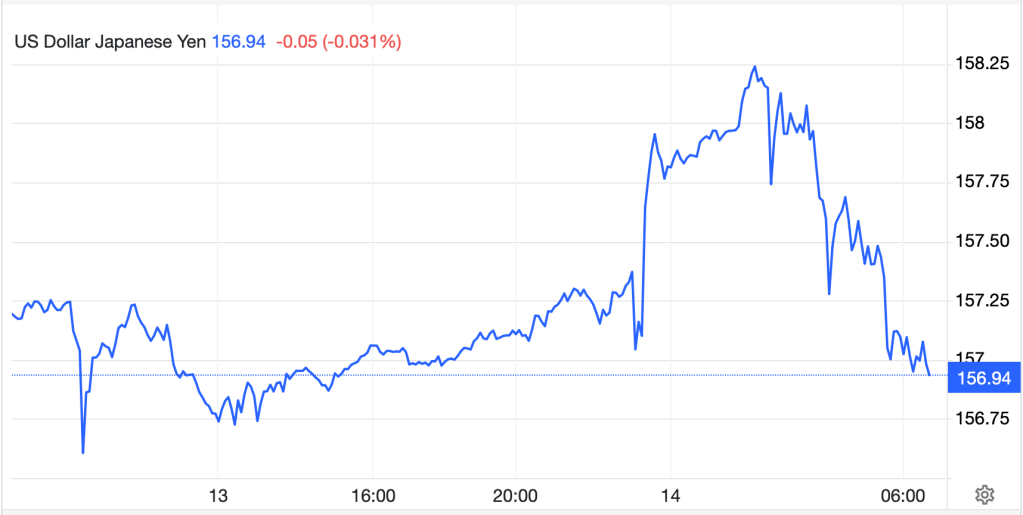

With all this widely anticipated and markets pricing in the result, the key question is how what Ueda-san will say during his press conference that follows the meeting. There are many who are looking for a so-called ‘dovish’ hike, where there is no indication of the timing of any further rate hikes and a benign view of the future. Certainly, a look at the FX market, where the yen (unchanged today, -0.8% in the past week) doesn’t indicate a great deal of fear over a much tighter policy.

Source: tradingeconomics.com

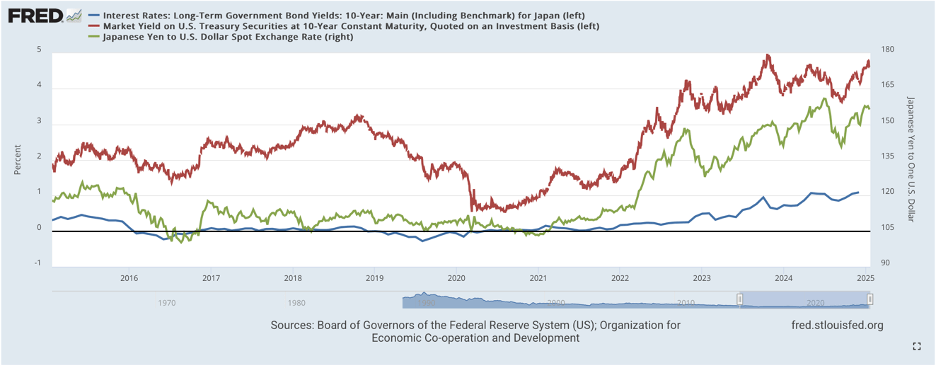

There has been a background narrative that explains the BOJ’s ongoing tightening is going to reach a point where Japanese investors are going to repatriate much of their overseas investment, driving a forceful upward move in the yen and having major negative impacts on risk assets around the world as liquidity retreats. This is based on the idea that the Japanese are the largest exporters of capital in the world which is one of the key reasons equity markets are rallying everywhere, so if they bring that money home, that means they will sell their foreign equity holdings and buy yen. While I believe this is a neatly wrapped idea, I would contend Japanese investment prospects are not yet near the same as in the US, so this idea may be premature. In fact, a look at the chart below showing 10-year US Treasury and JGB yields overlaid with USDJPY indicates that the rate differential is nowhere near where it might need to be in order to encourage that type of behavior. My take is absent some type of multilateral agreement to weaken the dollar, this will not happen organically.

Source: FRED database

In China, though communists rule

They favor the capital tool

Of equity bourses

And so, Xi endorses

A government stock buying pool

Elsewhere in the world, as we try to get outside the maelstrom that is Donald Trump, I couldn’t help but notice that, once again, Xi Jinping has called on his finance minions to do something, anything, to support the stock market. And I cannot help but be struck by the irony of the Chinese Communist Party being so concerned about the situation in the most capitalistic institution of all. The WSJ had an article discussing the latest measures that are on the board, including forcing encouraging insurance companies to increase the local equity portion of their portfolios and utilizing 30% of premium income to buy stocks. This is on top of the PBOC reducing interest rates last year for companies that want to repurchase shares.

It continues to be very difficult for me to accept the idea that the Chinese are playing 4-D chess with long-term goals in mind while the US is playing checkers. If that is the case, then the Chinese, or at least President Xi, is a really bad player. His economy is under dramatic pressure because the property bubble he inflated has been shrinking for the past three years, undermining both the population’s wealth (property was their store of value) and confidence, while he ramps up more beggar thy neighbor trade policies at the same time the US has just elected a president whose middle name is Tariff. Their population is shrinking because of the ‘foresight’ of their leadership to impose a one-child policy for two generations and while millions of people will risk their lives to immigrate to the US, people are looking to leave China. Once again, I cannot look at this situation and conclude anything other than the CNY (-0.15%) is going to gradually decline all year long, and maybe not so gradually if pressure really builds.

Ok, let’s take a look at how markets are handling the latest set of Trumpian pronouncements and reactions by targets of his ire. After yet another rally in the US, albeit on declining volumes so not as exciting as it might otherwise have been, Japanese shares rallied (+0.8%) as investors seem to believe that the interest rate hike tonight will be accompanied by a more dovish stance at the press conference. Mainland Chinese shares (CSI 300 +0.2%) eked out a gain after the latest news discussed above, although Hong Kong shares (-0.4%) did not follow suit. After all, the focus is on mainland shares. The rest of the region was widely dispersed with gainers (Taiwan, Singapore, Philippines) and laggards (Korea, Australia, Thailand), many of these moves in excess of 1%. It appears investors don’t know which way to turn yet given the speed of changes emanating from Washington.

In Europe, most bourses are modestly firmer (DAX +0.3%, CAC +0.5%) as we continue to hear more from ECB speakers that not only are rates going to be cut, but they are increasingly certain that they will achieve their inflation target. Maybe they will. As to US futures, at this hour (7:00) they are mixed to slightly softer with the NASDAQ (-0.4%) the laggard.

In the bond market, the decline in yields appears to be over, at least for now, as Treasuries (+3bps) continue to bounce from their recent lows at 4.54%. As is almost always the case, this has carried European sovereign yields higher as well, by between 1bp and 3bps across the continent and UK and we saw JGB yields gain 1bp overnight. I would contend there is still a great deal of uncertainty as to how the Trump administration is going to handle the conundrum of reducing inflation while expanding growth. Outside of declining energy prices, which may be coming, it will be a tall task, and inquiring minds want to know.

Speaking of energy prices, oil (+0.35%) is edging higher after a lackluster session yesterday. As with most markets, uncertainty is rife right now although this is clearly an area where Mr Trump is focused on expanding output. NatGas (-0.3%) is a touch softer as forecasts for the end of the current Polar Vortex keep getting moved up. Metals markets are under some pressure this morning, with gold (-0.3%) backing away from that all-time high level and both silver and copper fading as well. However, volumes remain light here implying not much interest overall.

Finally, the dollar is a touch stronger this morning, but there are few large movers in either the G10 or EMG blocs. In fact, every G10 currency is within 0.2% of yesterday’s closing levels and none of them are at extremes. The biggest loser today is ZAR (-0.6%) which seems to be responding to the precious metals complex backing off a bit overnight. It remains very difficult to get a read on the dollar with all the other things ongoing. As it happens, this is one market that has not received any Trumpian attention at all…yet.

We finally have a smattering of data this morning with the weekly Initial (exp 220K) and Continuing (1860K) Claims to be followed by the EIA’s oil inventory data where it appears a modest net build across products is forecast. With the Fed quiet, and very little focus on Powell and company right now, today looks to be shaping up as another equity focused day with the dollar likely taking its cues there. While we never know what will hit the tape these days, absent a new surprise vector, there is no reason to look for significant movement today at all.

Good luck

Adf