The speed of the change underway

In global relations today

Is spinning more heads

And tearing more threads

Than ever before, one might say

For markets, the question of note

Is how will investors all vote

Are bulls still in charge

Or bears now at large

Who seek, excess profits, to smote

It is becoming increasingly difficult to focus only on market activity given the extraordinary breadth of important, non-market activities that are ongoing. When I think back to previous periods of significant market volatility and uncertainty, it was almost always driven by something endogenous to finance and the economy. Going back to Black Monday in 1987, or the Thai baht crisis in 1997 or the Russia Default in 1998, the dot-com crash in 2000, and the GFC in the wake of the housing bubble (blown by the Fed) in 2008-09, all these periods of significant market volatility were inward looking.

But not today. Trump 47 has become the most significant presidency since Ronald Reagan with respect to changing both domestic and international realities. The key difference is that Mr Reagan worked within the then consensus view of international relations, merely pushing them to the limit while Mr Trump sees those views as constrictions needing to be removed.

In fairness, the world was a very different place in the 1980’s, notably for the fact that China was not a major player in any sphere of economic activity and was essentially ignored. That is no longer the situation, and the entry of another power player has complicated things. Arguably, this is why the president sees the old rules as obsolete, they were built for a different time with a different cast of characters. Regardless, for those of us paying attention to markets, it is imperative to widen our view to include international relations as well as international finance.

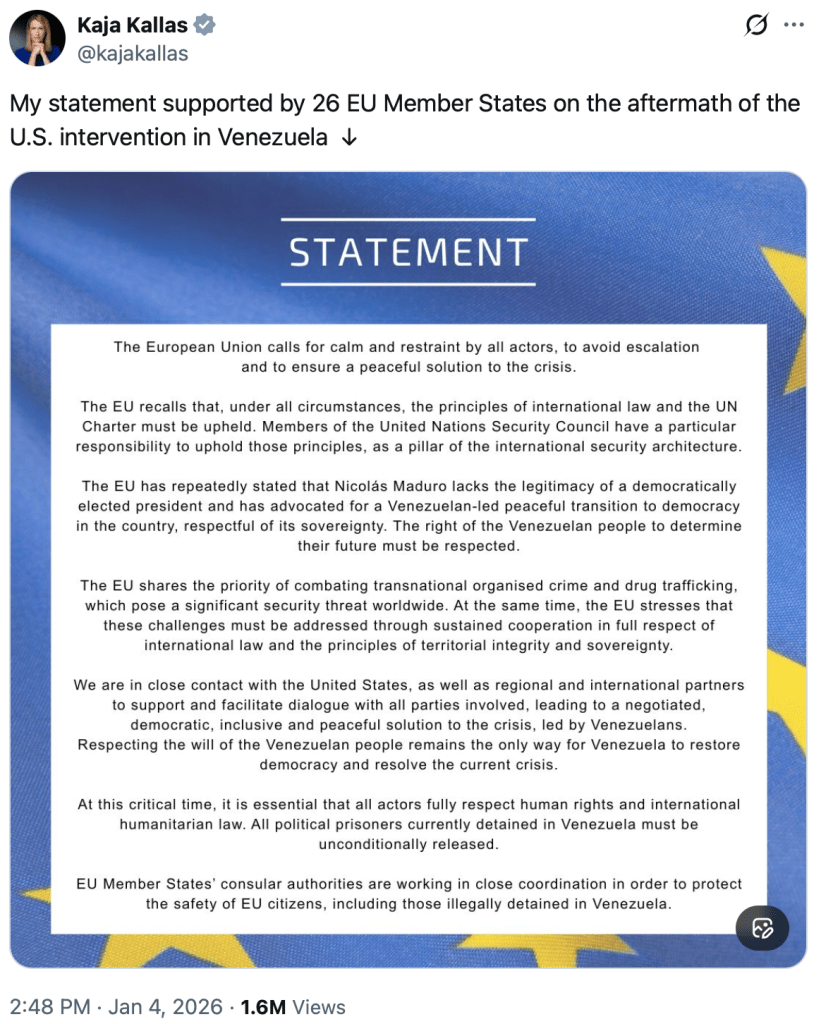

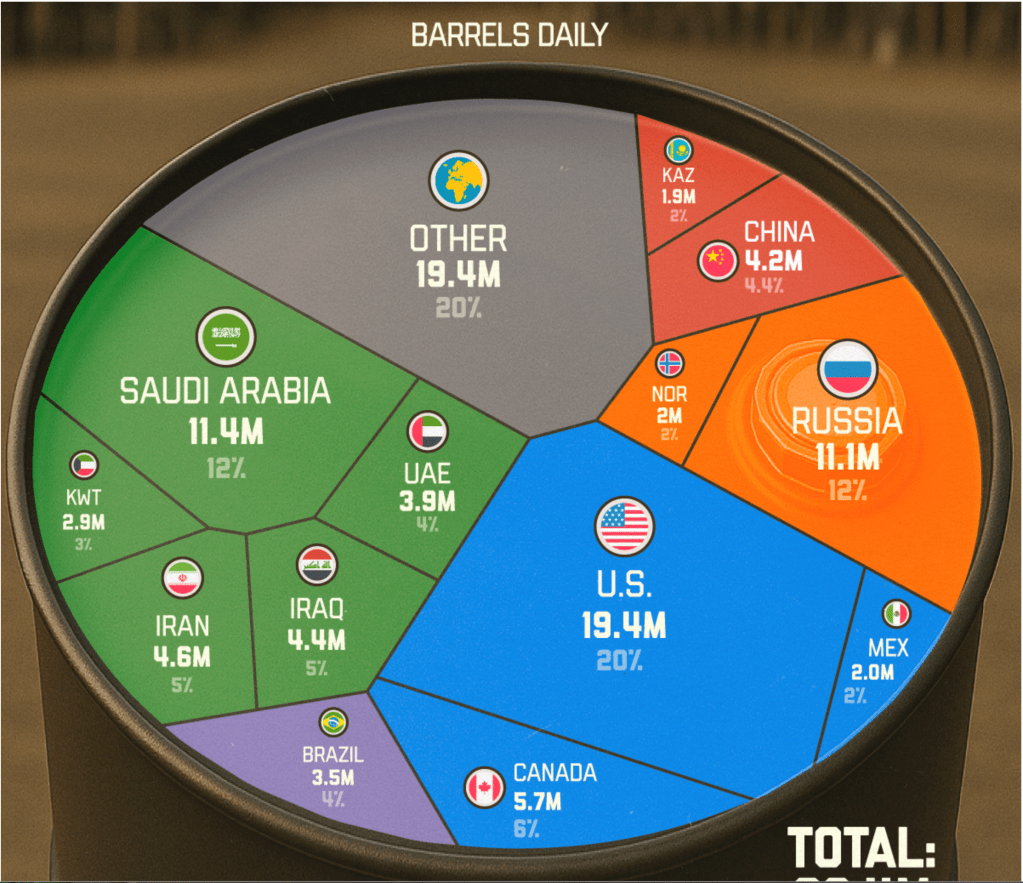

With that as preamble, a look at today’s headlines reminds us that keeping up with the news is not for the faint of heart. Starting with Venezuela and the impact on oil (+1.6%), news sources are littered with articles explaining why the US acted as we did and the potential implications for energy markets and energy producing countries. From what I can tell, Venezuela recognizes that they are completely beholden to US demands at this point with respect to their oil industry (mining as well I presume although that gets less press). And you can be sure that means they will be expected to pump more, with US corporate help, and direct their sales to the US, as opposed to Cuba, China and Iran.

Despite today’s rally, it remains my strong opinion that the price of oil has further to decline. The trend continues to be sharply lower, as per the below chart, and the domestic political demand of reducing gasoline prices is going to keep this particular trend intact, I believe.

Source: tradingeconomics.com

News overnight indicated that two more shadow fleet tankers have been apprehended which is simply all part of the same plan, bring Venezuela back online legitimately with a focus to sell to the US. The other global issue that is going to weigh on the price of oil are the ongoing protests in Iran which if ultimately successful at overthrowing the Ayatollah’s theocracy, will almost certainly bring Iran back into the brotherhood of nations, and see the end of sanctions on Iranian oil. While that is bad news for China (and India) who buy a lot of cheap sanctioned oil, it will increase production and weigh on market prices.

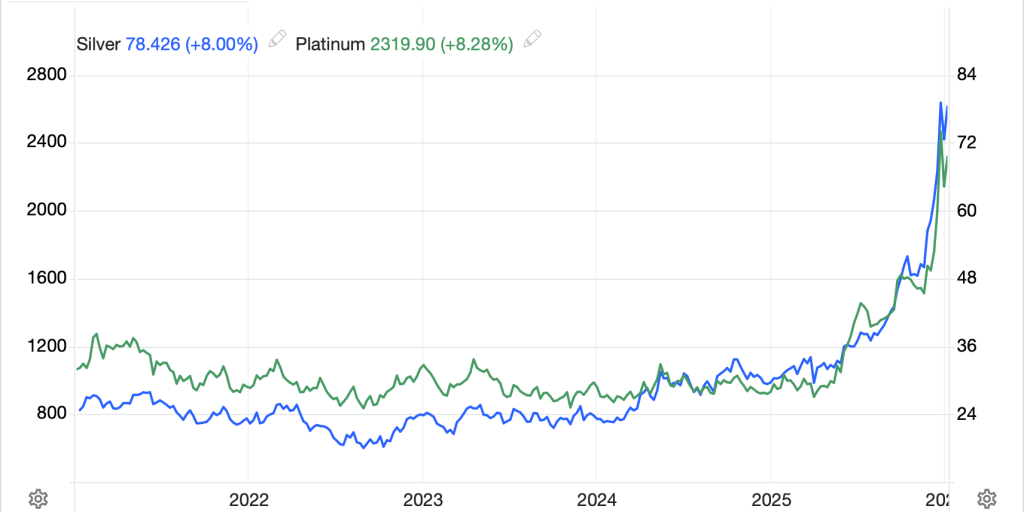

The other sector of the commodity markets, metals, have been their own roller coaster of late, with far more volatility than any other product, cryptocurrencies included. It cannot be a surprise that we are seeing prices retrace after the extraordinary price action over the past several months. The silver (-4.4%) chart below is the very definition of a parabolic move and history has shown that moves of this nature tend to see, at the very least, short-term sharp reversals, even if the ultimate trend is going to continue.

Source: tradingeconomics.com

The underlying features in these markets remain supply shortages, meaning that there is more industrial demand for utilization than there is new supply that comes to market each year. In silver, the number apparently is ~100 million ounces, and deliveries of physical metal remain the norm these days. That is a telling feature of the market as historically, cash settlement was sufficient. Given the recent run, it is no surprise that gold (-0.8%) and platinum (-6.5%) are also declining sharply, but nothing has changed my view that these will trend higher this year. One last thing about silver (h/t Alyosha), the Bloomberg commodity index (BCOM) is rebalancing next week and given the huge moves in precious metals, along with the lack of change in percentage allocation, there will be significant selling over the course of the next week, upwards of 70 million ounces of silver, which will go a long way to satisfying the shortage this year. It will be interesting to see if demand remains intact.

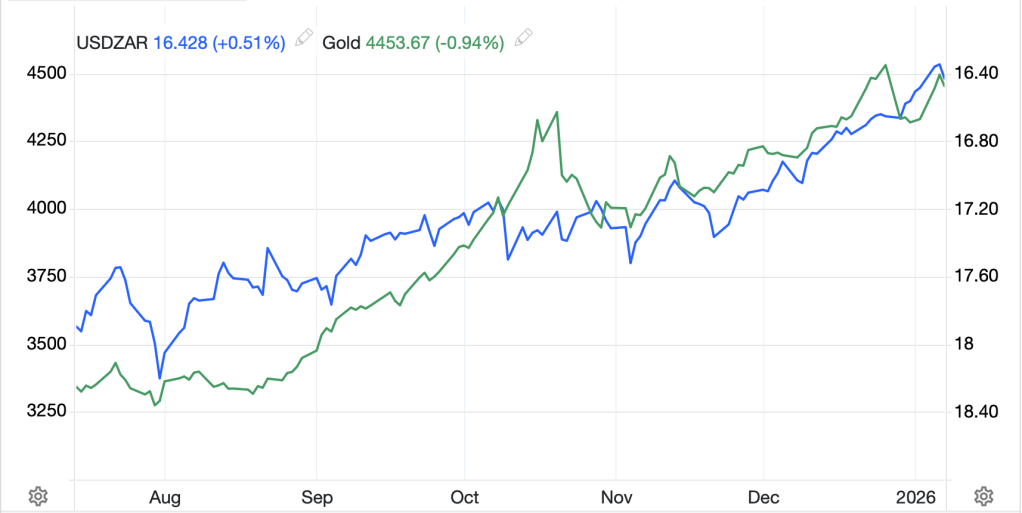

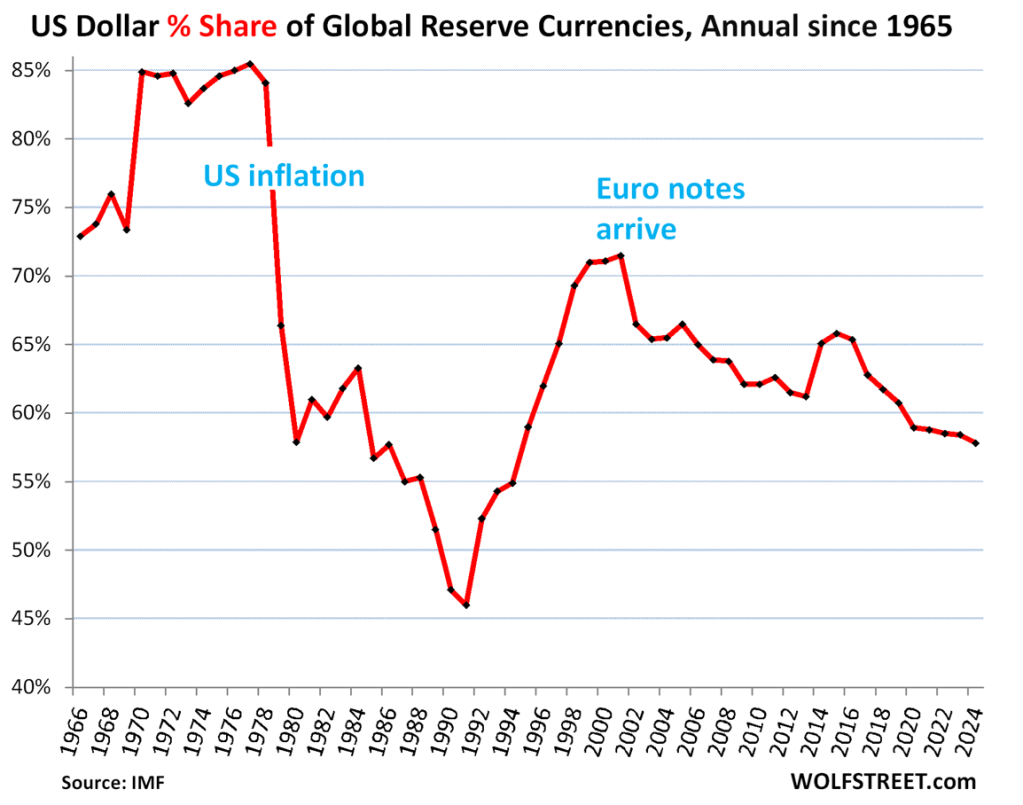

If we turn to the dollar, rumors of its death remain exaggerated. Certainly, the price action thus far this year, and even over the past six months, points to gradual strength (see chart below from tradingeconomics.com).

Again, I have a hard time understanding the argument that the dollar will decline this year based on the fact that the US economy continues to outperform the rest of the G10, there are substantial inward investment promises that are beginning to be seen (shipbuilding, semiconductors, steel) and the US interest rate structure remains higher than the rest of the G10. While I understand markets look forward, it is becoming increasingly difficult for me to see the benefits of European monetary policy as a driver for owning the euro, and given their industrial/energy policies are disastrous, I don’t see the rationale. The same can be said for the pound, I believe.

In today’s session, while the movement is mostly marginal (EUR 0.0%, GBP -0.1%, SEK -0.3%, AUD -0.4%), the trend remains intact and the movement is broad with almost all G10 and EMG currencies slipping a bit further. Money goes where it is best treated, and I am hard pressed to find other nations that treat money better. Although…

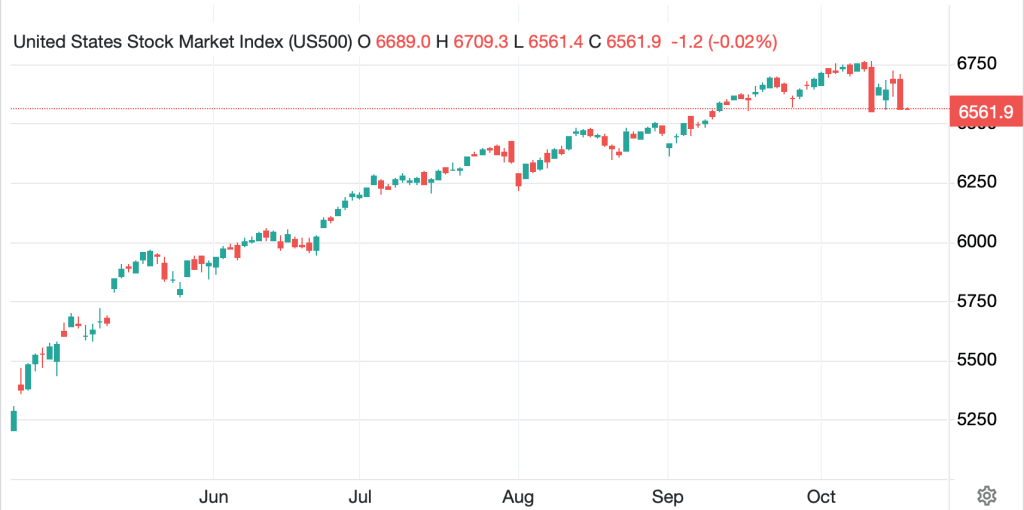

The equity markets are a bit shakier this morning after two presidential tweets yesterday regarding institutional ownership of housing (he wants to end that for single family homes) and defense company spending priorities (he wants defense companies to end stock buybacks and dividends and invest in R&D and production). It is not clear to me whether he can successfully force these actions, but his bully pulpit is significant. These resulted in sharp declines in directly impacted companies, but regarding defense, he also came out of a meeting with Congressional leaders and said he wants to budget there to grow to $1.5 trillion.

The upshot is confusion here which was evidenced by more weakness than strength in the US session and similarly, declines in Asia (Japan -1.6%, China -0.8%, HK -1.2%). Elsewhere in the region, India (-0.9%) continues to be the laggard, but there was more red than green overall. In Europe, red is also today’s color, albeit not as bright as in Asia. The DAX (-0.2%), CAC (-0.25%) and FTSE 100 (-0.3%) are emblematic of the situation as investors dismissed better than expected German Factory Order data (+5.6%) although the rest of the data released was mostly at expectations. I guess the question is does Europe treat money better than the US? I would argue not, but that’s just my view. Meanwhile, at this hour (7:55), US futures are down slightly, about -0.1% across the board.

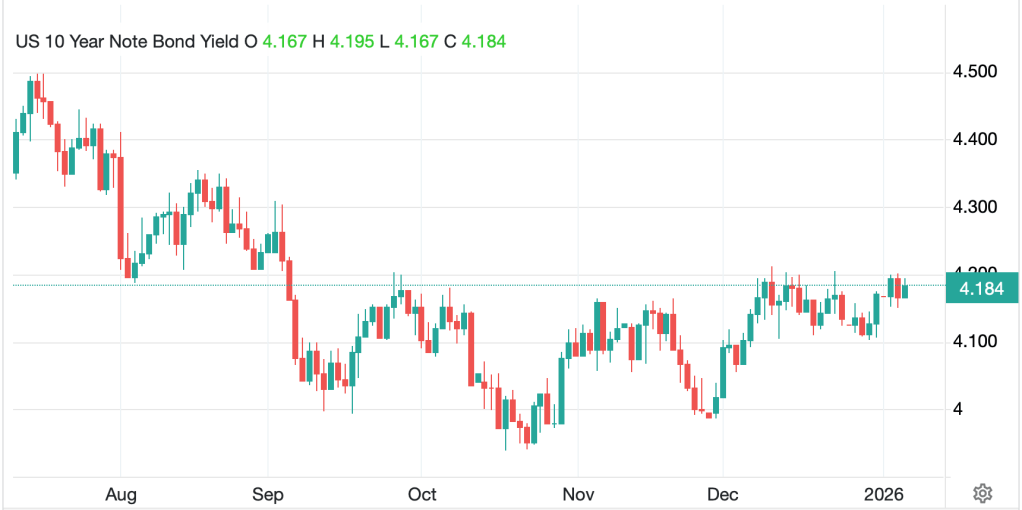

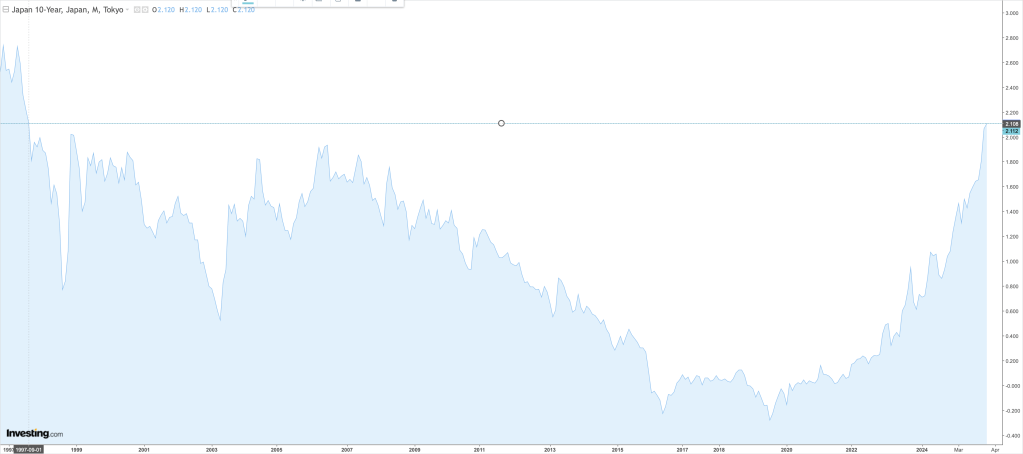

Finally, the bond market remains an afterthought almost everywhere. Perhaps the most amazing thing President Trump has accomplished is to remove the focus on the latest tick in the 10-year bond as a key metric for the economy. So, this morning, its 1bp rise just leaves it right in that 4.0% – 4.2% range that has existed for months. Most European sovereign yields edged higher by about 3bps with Germany (+7bps) the outlier here after that strong Factory Orders data. Also worth noting is that JGB yields slipped -5bps overnight as the market prepares for the first 30-year JGB auction of the year. Recent 10-year auctions have been received quite well, hence the anticipation of something good here.

On the data front, Initial (exp 210K) and Continuing (1900K) Claims lead the way along with the Trade Balance (-$58.9B) and then Consumer Credit ($10.0B) this afternoon. Yesterday’s ADP data was a touch softer than expected but the JOLTS data was much worse, showing a decline in job openings of 300K and falling well short of expectations of 7.6M. At this point, though, to the extent that people are paying attention to the data, tomorrow’s NFP is of far more import I believe.

The hardest thing about these markets is the White House bingo card and its surprises that can change working assumptions. Absent something new there, I see the dollar drifting higher helped by both its recent trend and the short-term pullback in metals.

Good luck

Adf