The FX Poet will be in Nashville at the AFP Conference October 21-22, speaking about effective ways to use FX options in a hedging program. Please come to the presentation on Monday at 1:45 in Grand Ballroom C2 if you are there. I would love to meet and speak.

Said Governor Waller, inflation

Is falling and so there’s temptation

To cut really fast

And if our forecast

Is right, there will be celebration

The problem is, if we are wrong

And price rises we do prolong

We’ll get all the blame

At which point we’ll frame

Our mandate as “jobs must be strong”

Meanwhile, in China it seems

That President Xi’s fervent dreams

Of finding more growth

Is stuck cause he’s loath

To listen to Pan Gongsheng’s schemes

First, a mea culpa, as while banks and the bond market were closed yesterday, the equity market was open, and the rally continued. Although, that doesn’t really change anything I wrote yesterday. But the stories that got the press yesterday were about Fed Governor Chris Waller and his speech. Waller is considered one of the key FOMC members as his policy research has been consistent and more accurate than most others, as well as because he doesn’t appear to be nearly as partisan as some other governors.

At any rate, he eloquently made the case that the Fed was going to continue to cut rates, albeit perhaps more slowly than previously expected, because even though economic activity remains strong and inflation is above our goals, we remain confident that we are still going to achieve our targets. In fact, I think his words are worth reading directly [emphasis added]:

“Whatever happens in the near term, my baseline still calls for reducing the policy rate gradually over the next year. The median rate for FOMC participants at the end of 2025 is 3.4 percent, so most of my colleagues likewise expect to reduce policy over the next year. There is less certainty about the final destination…While much attention is given to the size of cuts over the next meeting or two, I think the larger message of the SEP is that there is a considerable extent of policy restrictiveness to remove, and if the economy continues in its current sweet spot, this will happen gradually.”

On to the next story, China and the still-to-come stimulus package. According to Bloomberg, there is a new plan to allow local governments to swap up to CNY 6 trillion (~$840B) of their outstanding “hidden” debt, which is in the name of special funding vehicles, to straight local government debt, which should carry lower interest rates. The problem is that both the size of this program and its ultimate effect are seen as insufficient to address the issues. Certainly, reducing interest payments will help a bit, but the debt problem, along with the property problems, are so much larger than this, at least 10X the proposed CNY 6 trillion, that this will barely make a dent.

Ultimately, the only solution that seems viable is that the central government borrows more money (its current outstanding debt is at just 25% of GDP) and funds new projects, gives it out to citizens in a helicopter money drop, or something other than investing in more production for exports. This seemed to be where PBOC Governor Pan Gongsheng was headed several weeks ago. Alas, President Xi has spent a decade stripping power away from the private sector and amassing his own. I find it highly unlikely he will willingly cede any of that power simply to help his citizens. Recent analyst updates for Chinese GDP growth in 2024 have fallen back below his 5.0% target, and I imagine they are correct.

Which brings us to this morning, where the biggest market mover is oil (-5.1%) which is falling on a combination of several things. First, news that President Biden has convinced Israeli PM Netanyahu to not strike Iran’s oil fields, thus removing a key supply issue and war premium. Next, the fact that China’s stimulus efforts are so weak implies lower demand from the world’s largest oil importer, and finally, OPEC just cut its forecast for oil demand for 2024 and 2025 although they have not reduced their supply estimates. The upshot is that oil has given back all its gains of the past month and is presently back at its longer-term technical support level of $70/bbl. Where it goes from here is anybody’s guess, but absent a resurgence of the Middle East war premium, I suspect it has further to decline.

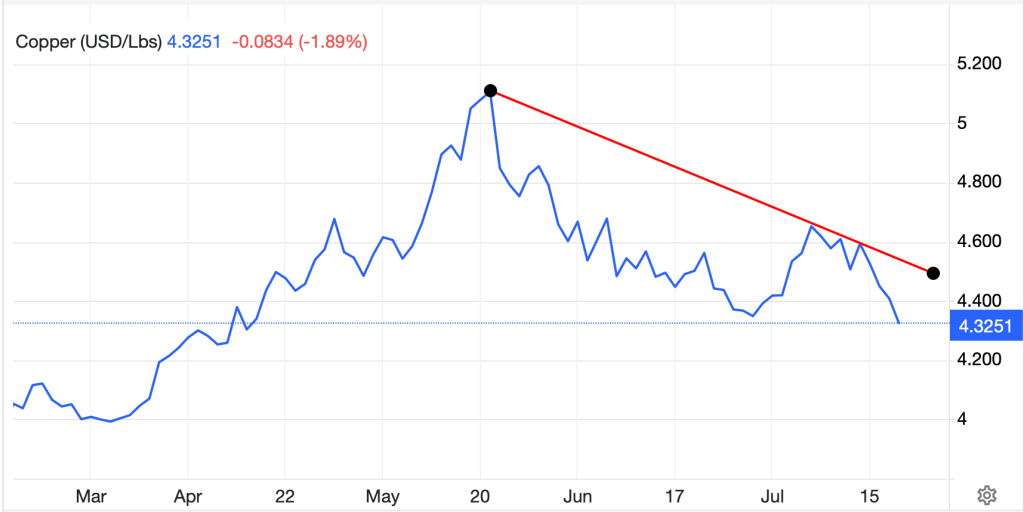

As to the metals complex, gold (+0.2%) continues to ignore all the signs that it should be falling and is holding within 1% of its recent all-time high prints amid stories that global central banks continue to acquire the barbarous relic. However, both silver and copper are feeling some stress amid the weaker Chinese growth story.

In fact, that weaker Chinese growth story hit equities there hard with the CSI 300 (-2.7%) and Hang Seng (-3.7%) both falling sharply on the disappointing fiscal plans. However, the rest of Asia took their cues from the US rally, and we saw strength virtually across the board. Interestingly, Taiwan’s TAIEX (+1.4%) completely ignored the China story, perhaps an indication its economy is not nearly so tightly linked as in the past. In Europe, the picture is mixed with the DAX (+0.3%) rallying on a slightly better than expected German ZEW Economic Sentiment Index (13.1, up from 3.6), while Spain’s IBEX (+0.3%) rallied on better than expected inflation data. However, weakness is evident in France (CAC -0.8%) on weakness in the luxury goods sector (the largest part of the index) suffering from weaker Chinese demand. US futures are essentially unchanged at this hour (7:15) as we await Retail Sales later this week.

In the bond market, yields have fallen across the board (Treasuries -3bps, Bunds -4bps, OATs -5bps) as lower oil prices and concerns over slowing growth have investors thinking inflation will continue its downward trend. Well, at least some investors. One of the more interesting recent market conditions is the performance of inflation swaps, which have seen implicit inflation expectations rise more than 50bps in the past five weeks as per the chart below from @parrmenidies from X (fka Twitter).

This likely explains the sharp yield rally since the Fed cut rates, but does not bode well for future inflation declining.

Finally, the dollar is little changed net this morning. Not surprisingly, given the ongoing disappointment of China’s stimulus ,CNY (-0.5%) is amongst the worst performers of the session. But we have seen weakness in ZAR (-0.3%), CLP (-0.4%) and KRW (-0.4%) to show that EMG currencies are under pressure. As to the G10, movement has been much smaller with JPY (+0.3%) the biggest mover overall and one of the few gainers.

On the data front, Empire State Manufacturing (exp 2.3) is the only number coming out and we hear from three more Fed speakers (Daly, Kugler and Bostic). That cleanest shirt analogy remains the most apt these days with the US spending its way to better short-term results and adding long-term problems. But the market is happy for now. With that in mind, I don’t see a reason for the dollar to suffer much in the near term.

Good luck

Adf