The markets are worried that France

If given a half-decent chance

Will vote for Le Pen

And so, seems the ten-

Year OAT is now looked at askance

But ECB “sources” have said

There’s no TPI straight ahead

The French, rather, must

Show they won’t be “Trussed”

Else traders will leave them for dead

On an otherwise quiet summer morning, the ripples from the European Parliament election continue to grow. Not only did French President Macron dissolve parliament there and call new elections, but it appears the German government is far closer to falling as well. However, right now, France is the story of note.

Elections in France are a two-stage affair where multiple candidates run for specific seats and then the two largest vote-getters in each district have a runoff a week later, if nobody won an outright majority. Additionally, as is common throughout Europe, it is not a two-party affair like in the US, but there are several political parties vying for seats. What makes this election so different from previous votes is the fact that the parties on the right are leading in all the polls. Historically, throughout Europe, the right wing was anathema given that so many believed anything right of center would lead to the second coming of the Nazi Party. This is the main reason that Europe has been consistently left of the US politically since the end of WWII.

However, what we have seen over the course of the past decade, and what has accelerated rapidly in the post-Covid era, is that many citizens of most Western countries are feeling dissatisfied with the politics of the left. Immigration, which is obviously a huge issue in the US, is no less a problem in Europe. The other key policy discrepancy is in the politics of global warming climate change global boiling, as it has become clearer each day that the policies that have been enacted, and those promised, have done nothing but raise the price of energy and the cost of living for all Europeans with no corresponding benefit to the climate.

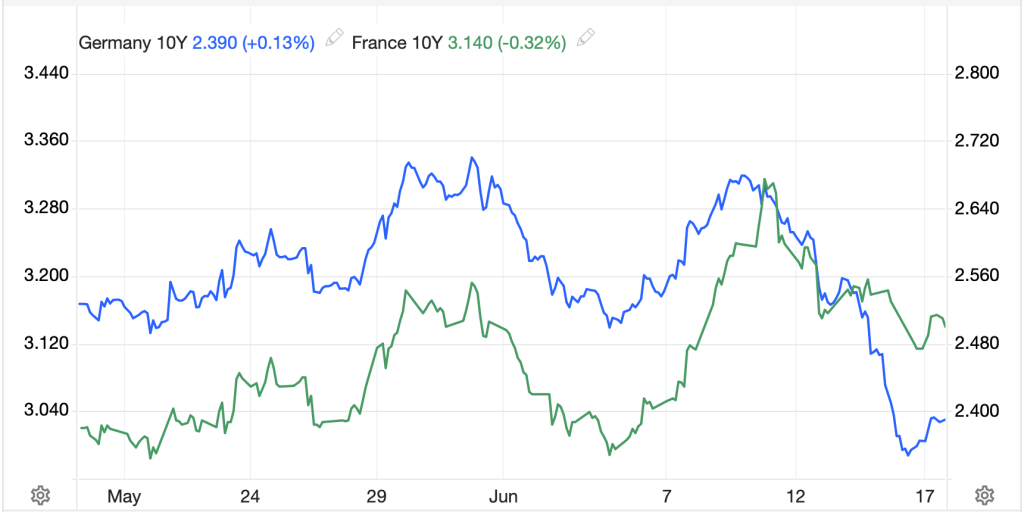

The upshot is that many citizens throughout the continent are ready for a change, and this is beginning to frighten financial markets. This can be seen in the chart below from tradingeconomics.com that shows German 10-yr yields in blue on the right-hand axis and French 10-yr yields in green on the left-hand axis. While the spread has been creeping higher for the past six months, it has widened dramatically in the past week and is now at its widest (80 basis points) since the Eurozone crisis in 2013.

Source: tradingeconomics.com

It is not clear to me why financial markets are so concerned with excess spending by the right, as compared to excess spending by the left, but that seems to be the pattern. (Recall the UK’s issue in October 2022 when Liz Truss, the newly minted PM, proposed a great deal of unfunded spending and the UK Gilt market sold off so sharply it put a number of insurance companies at risk and forced the BOE to buy gilts despite their efforts to shrink the balance sheet.)

At any rate, back in 2022, the ECB created a new program, the Transmission Protection Instrument (TPI) to help them prevent Italian BTPs from collapsing during the pandemic, thus maintaining what they believed to be an appropriate spread between bunds and BTPs. While that spread peaked at 250bps, it is now a much more sedate 155bps, and despite Giorgia Meloni being a right-wing PM, the markets seem comfortable.

However, with the ructions in France, there are many questions as to whether the ECB will dust off the TPI again to prevent a greater dislocation of French OATs vs. bunds. Remember, too, that Madame Lagarde may have a personal vested interest in France, given her nationality, but as of yet, there has been no willingness to discuss using this tool. However, if OATs continue to widen vs. Bunds, you can be certain this discussion will heat up even more. We have already seen French stocks fall sharply, with French bank stocks down more than 10% in the past week. It is movement like this that typically draws a response from central banks. And of course, the euro is not immune to this situation as evidenced by its nearly 2% decline since the beginning of the month. We will need to watch this closely until the elections at the end of the month and the second round on July 7th.

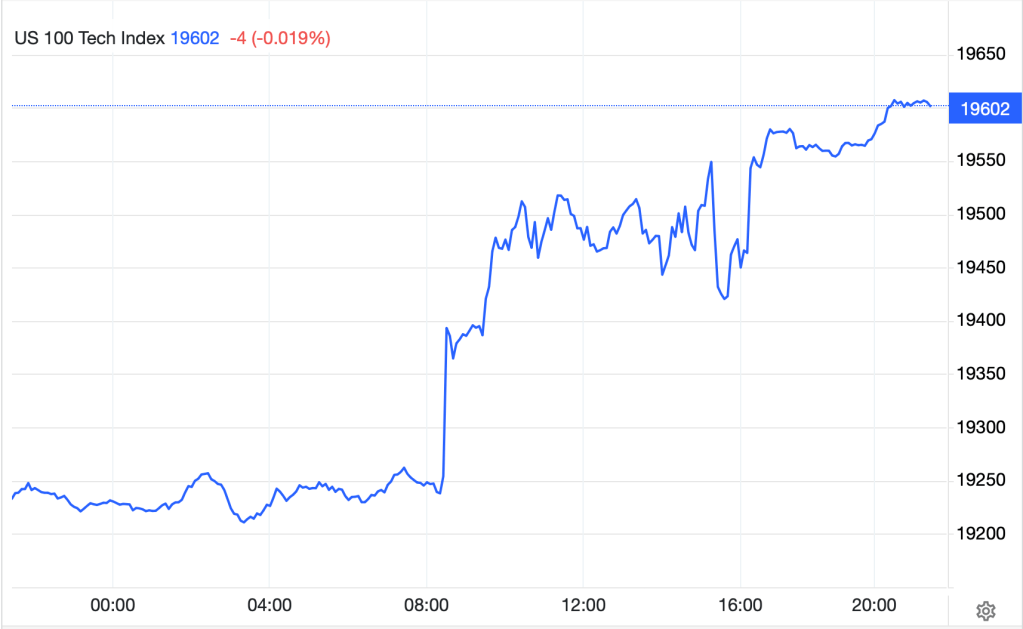

Beyond that, however, markets remain relatively dull. Friday’s weaker than expected Michigan Sentiment data combined with the higher than expected inflation expectations was not very well received by risk assets (other than Nvidia and Apple) although by the end of the day, US major indices closed near flat. Japanese shares fell sharply (Nikkei -1.8%) while the rest of Asia closed with much smaller declines, albeit they were declines. In Europe, this morning, the picture is mixed with the big three markets, UK, Germany and France, all little changed on the day (a change for France of late) although there is more movement elsewhere but no consistency with both gainers and losers of up to 0.5%. And following its recent pattern NASDAQ futures are edging higher this morning while DJIA futures are falling although neither has moved very much. Arguably, the question is how long can the Magnificent 7 6 3 1 continue to rally in the face of increasing headwinds?

In the bond markets, yields are creeping higher with Treasuries (+2bps) bouncing off recent lows while European sovereigns all have shown similar yield gains except French OATs (+7bps) as the stress there continues to grow. However, Asian bonds did little overnight with JGBs slipping one more basis point and now back to 0.92%, nearly 15bps lower than its peak at the end of May. Things in Japan just take a verrryyy long time to play out.

In the commodity markets, oil (+0.25%) has managed to eke higher this morning, but the metals markets remain under pressure (Au -0.5%, Ag -1.0%, Cu -1.6%) as confidence in the economy ebbs alongside significant position reductions as metals had been one of the market themes for the first half of the year. While I still like the long-term story, it seems clear there is no love for the space right now.

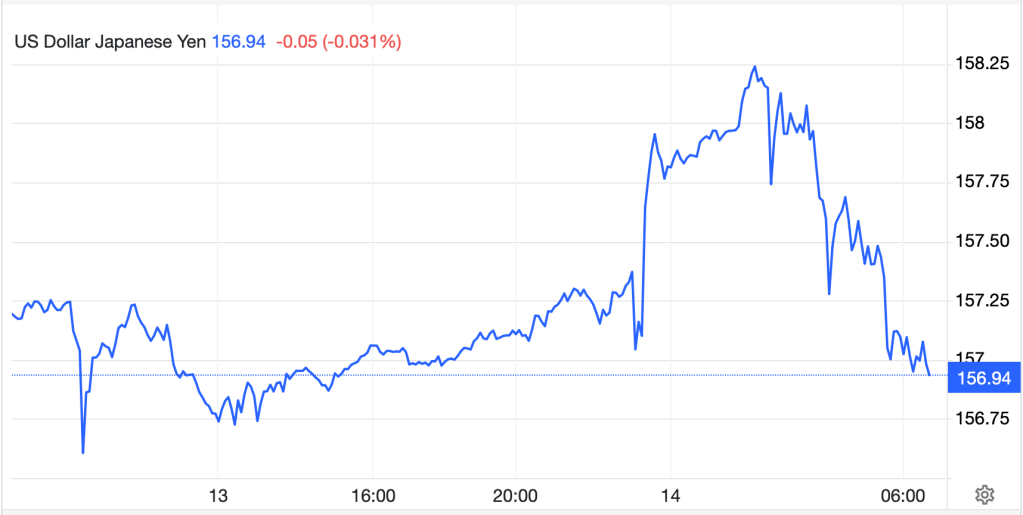

Finally, the dollar is mixed this morning with modest gains and losses overall across both G10 and EMG blocs. The biggest winner is ZAR (+0.7%) which continues to retrace post-election losses as the new coalition government is gaining adherents in the investor community. Alas, MXN (-0.2%) continues to feel pressure as concerns grow that president-elect Sheinbaum is going to be far more left leaning than markets expected. In the majors, there is not much of distinction today with both gainers and laggards, although more laggards than gainers. It should be no surprise that JPY (-0.25%) is pushing back to 158 given the yield moves overnight.

On the data front, there is some important stuff to be released this week, as well as a plethora of Fedspeak.

| Today | Empire State Manufacturing | -9.0 |

| Tuesday | Retail Sales | 0.2% |

| -ex Autos | 0.2% | |

| IP | 0.3% | |

| Capacity Utilization | 78.6% | |

| Thursday | Initial Claims | 235K |

| Continuing Claims | 1810K | |

| Philly Fed | 4.5 | |

| Housing Starts | 1.38M | |

| Building Permits | 1.45M | |

| Friday | Flash PMI Manufacturing | 51.0 |

| Flash PMI Services | 53.3 | |

| Existing Home Sales | 4.09M | |

| Leading Indicators | -0.4% |

Source: tradingeconomics.com

In addition to the data, we hear from seven Fed speakers with Richmond’s Thomas Barkin regaling us twice. I would contend the narrative is searching for a direction other than BUY NVIDIA, as we continue to see a mixed picture. While the NFP was strong, it appears data since then has softened. If this remains the case, then the talk of a Fed cut sooner rather than later is going to really start to come back. While July is only priced for a 10% chance of a cut, the market has September in its sights with a nearly two-thirds probability currently priced. If the data weakens, that is viable. In that scenario, I would expect the dollar to suffer and everything else to rally. But we need to see a lot more soft data to reach that point.

Good luck

Adf