The major discussion today

Is tariffs and if they’re in play

While Trump thinks they’re great

Economists hate

Their impact and watch with dismay

Meanwhile it has not been a week

And questions are rife ‘bout DeepSeek

The most recent questions

Are making suggestions

That China, with forked tongue, did speak

President Trump has promised to impose 25% tariffs tomorrow on all Canadian and Mexican exports to the US if those nations do not agree to further efforts to tighten border security regarding the movement of both immigrants and drugs across the borders. Even within his administration, there are many who do not want to see them imposed given the potential disruption they would cause in supply chains throughout the nation. And of course, economists abhor tariffs as a pure deadweight loss to the economy. But Trump sees the world through very different eyes, that much is clear, and as evidenced by the very short-term row with Colombia last weekend, believes they can be useful tools to achieve strategic, non-economic outcomes.

This poet is not fool enough to try to anticipate what will actually happen as the mercurial nature of President Trump’s actions is far beyond my ability to forecast. However, if history is any guide, we will see both Mexico and Canada make some additional concessions and an announcement that because of that, the tariffs will be delayed until negotiations can be completed by some new deadline. (Well, maybe I am fool enough 🤣)

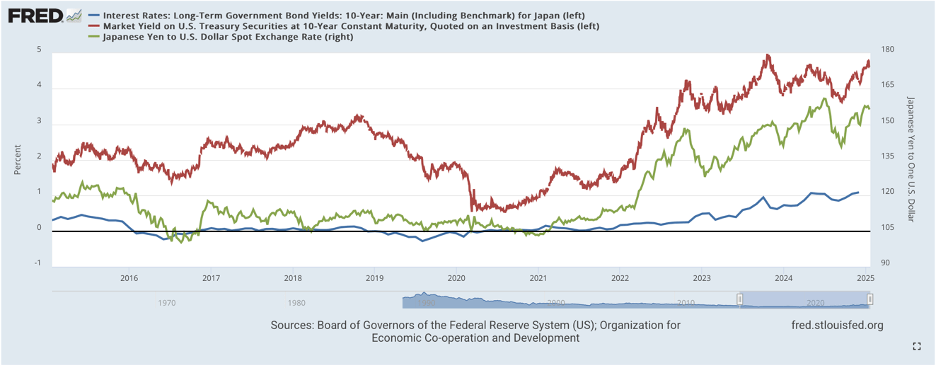

From our perspective observing market reactions, the only consistent view is that US tariffs will drive the dollar higher, or more accurately, other currencies lower, as the FX market adjusts to compensate for the tariffs. If we look back at Trump’s first term, the first tariffs were imposed on China in early 2018 on solar panels and washing machines and a few other things. A look at the chart below shows that the yuan (the green line) did, in fact, weaken substantially following those tariffs, with the dollar rising from 6.25 to 6.95 over the course of the ensuing six months. However, if we broaden our horizons beyond the renminbi to the dollar writ large, as seen by the Dollar Index (the blue line), which rose from 88 to 96 over the same period, the renminbi’s price action was directly in line with the dollar overall. There was only limited additional impact to CNY. Remember, too, that in 2018, the US equity market was performing quite well, and funds were flowing into the US, thus driving the dollar higher, not dissimilar to what we have seen over the past year. The point is that while the tariffs may have some impact, it is also likely that the dollar will move based on its traditional drivers of interest rate differentials and capital flows regardless.

Source: tradingeconomics.com

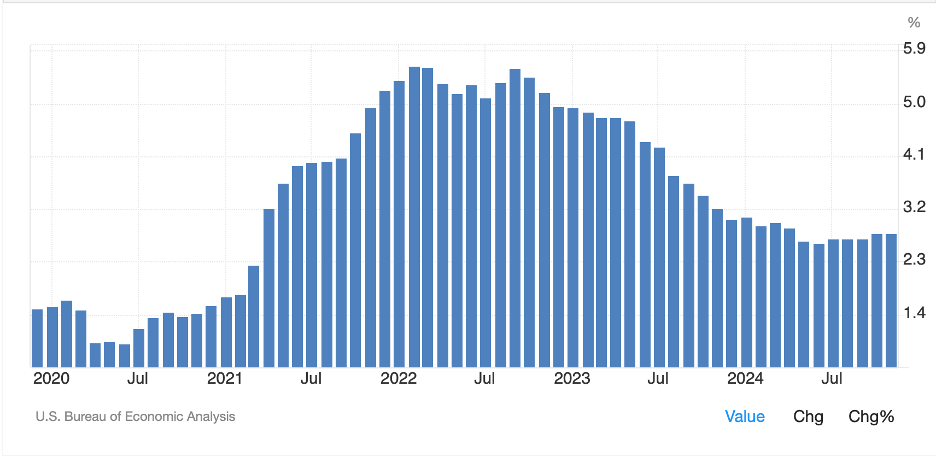

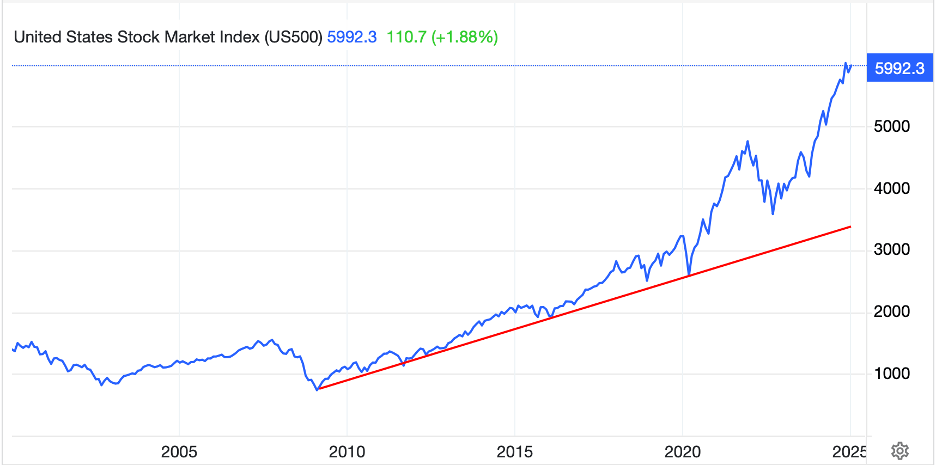

Away from the tariff talk, though, there is precious little other market related news, at least on a macro basis. Yesterday’s data showed that GDP grew a tick less than anticipated at 2.3% in Q4, but Real Consumer Spending, which is a critical part of the economic picture, rose at 4.2%, a very solid performance and an indication that things in the economy are still ticking along just fine. (The difference between that number and the GDP number is due to inventory adjustments, which are seen to wash out over time.). In fact, arguably, that solid growth was a key reason that the equity markets in the US had another strong session yesterday, with gains across the board.

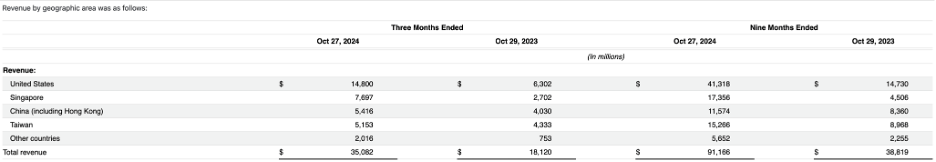

Well, there is one other thing on many people’s minds, and that is the veracity of the claims about DeepSeek. You may recall I highlighted the question of all those Nvidia sales to Singapore earlier in the week as somewhat strange. Well, I was not the only one asking that question and this morning in Bloomberg, there is an exclusive story about a US government investigation into whether China actually got the most advanced H100 chips via Singapore after all. If that is the case, then perhaps the DeepSeek claims are not as impressive as they were initially made out. I suspect if this turns out to be the case, that worries over the need for AI to no longer utilize the most advanced chips will dissipate and the tech rally will regain momentum.

So, let’s look at markets now. China and Hong Kong remain closed for their New Year celebrations. Japan (+0.15%) had a modest gain and the truth is that only two Asian bourses had strong sessions, Singapore (+1.45%) and India (+1.0%) with the rest of the region mostly a touch firmer. In Europe, all markets are slightly stronger this morning, on the order of 0.3% or so, as the combination of yesterday’s ECB rate cut and hints at future cuts by Madame Lagarde, seem to be underpinning the markets. Certainly, today’s Eurozone data, showing German Unemployment climbing a tick to 6.2% while Retail Sales there fell -1.6% in December don’t seem like a rationale to buy equities. In the US futures market, though, we are seeing solid performance, 0.5% or more, as I believe many are jumping back on the AI bandwagon.

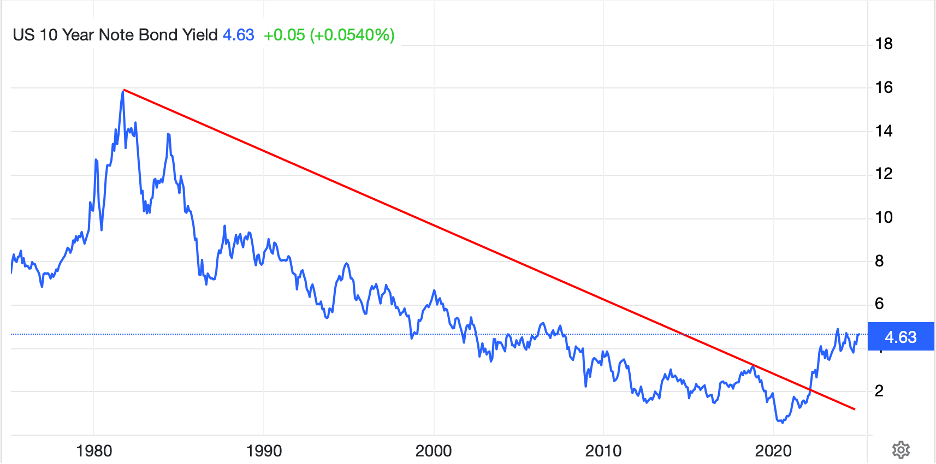

In the bond market, Treasury yields have edged higher by 1bp, and remain just north of 4.50% as the tension between solid growth and slowing inflation dreams keeps the market quiet. In Europe, though, yields are continuing their decline from yesterday, with sovereign yields down by between -3bps and -4bps as investors look for further easing from the ECB as the Eurozone sinks slowly toward recession. However, in Japan, JGB yields rose 3bps as data overnight showed inflation remains above target and expectations for another rate hike in the first half of the year rise.

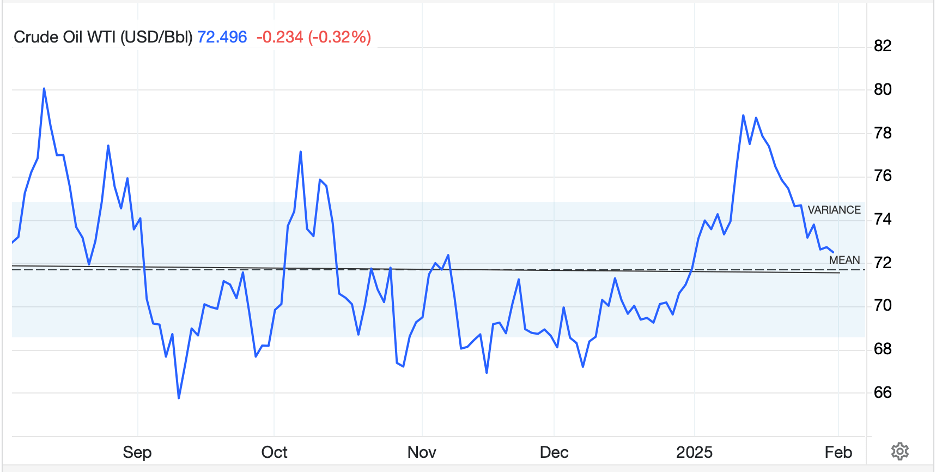

In the commodity markets, oil (-0.35%) continues to chop around in the middle of its trading range with no strong directional impulse (see chart below).

Source: tradingeconomics.com

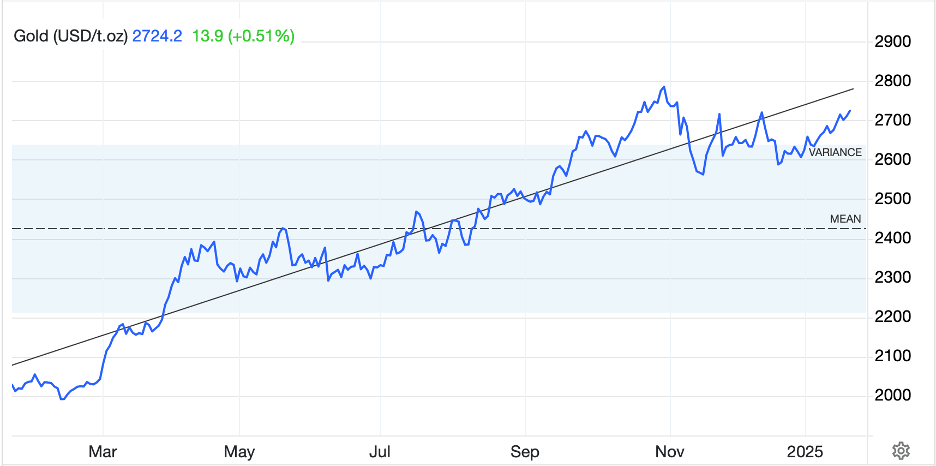

It is very difficult to know how to view this market in the short run given the potential for disruptions by tariffs and even more sanctions, but nothing has changed my long-term view that there is plenty of oil around and prices will remain here or decline. In the metals markets, both gold and silver are little changed on the morning although both have been in the midst of a strong rally with gold making new all-time highs in the cash market yesterday. Copper (-0.7%) is offered this morning but is still much higher than at the beginning of the month/year.

As to the dollar, it is modestly firmer this morning rallying against most of its G10 counterparts, but not by very much, 0.3% (JPY) at most. Versus its EMG counterparts, though, there is more strength with PLN (-0.6%) and ZAR (-0.4%) both under a bit of pressure. The latter is responding to ESKOM, the national electrical utility, announcing that they may need to impose rolling blackouts to help repair parts of the grid.

On the data front, this morning brings Personal Income (exp 0.4%) and Spending (0.5%) but of more importance it brings PCE (0.3%, 2.6% Y/Y) and core PCE (0.2%, 2.8% Y/Y) along with the Chicago PMI (40.0) release at 9:45. We also hear our first post-meeting Fed speaker, Governor Bowman, this morning but it would be shocking if she said anything other than they are going to be patient to watch inflation slowly move toward their target, almost as if by magic.

Once again, tape bombs are the biggest risk, as they will be for the next four years, but I imagine all eyes will be on Trump and the tariffs as the key driver. For now, nothing has dissuaded me from my view the dollar is more likely to rise than fall, but we need to see how things evolve.

Good luck and good weekend

Adf