While pundits expected inflation

Would rise with Trump as the causation

The data has not

Shown prices are hot

Since tariffs joined the conversation

In fact, there’s a budding new theory

That’s made dollar bulls somewhat leery

If Powell cuts rates

While Christine, she waits

The dollar might soon look quite dreary

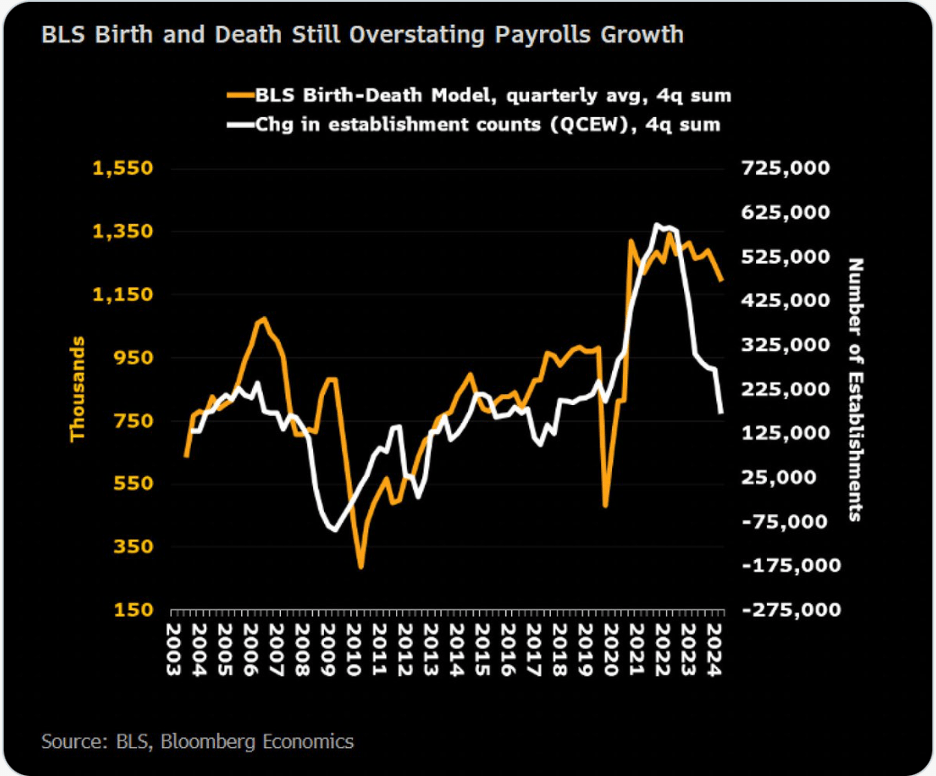

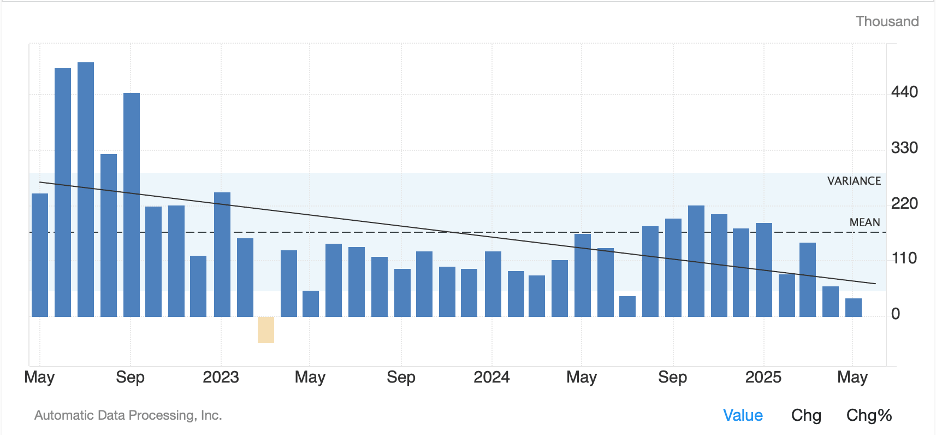

Well, it turns out measured inflation wasn’t quite as high as many had forecast, even if we ignore those whose views are completely political. Yesterday’s readings of 0.1% for both headline and core were lower despite all the tariff anxiety. The immediate response has been, just wait until next month, that’s when the tariff impact will kick in, you’ll see. Maybe that will be the case, but right now, for a sober look, the Inflation_Guy™, Mike Ashton, offers a solid description of what happened and some thoughts about how things may be going forward. Spoiler alert, tariffs are not likely the problem, let’s start thinking about money supply growth.

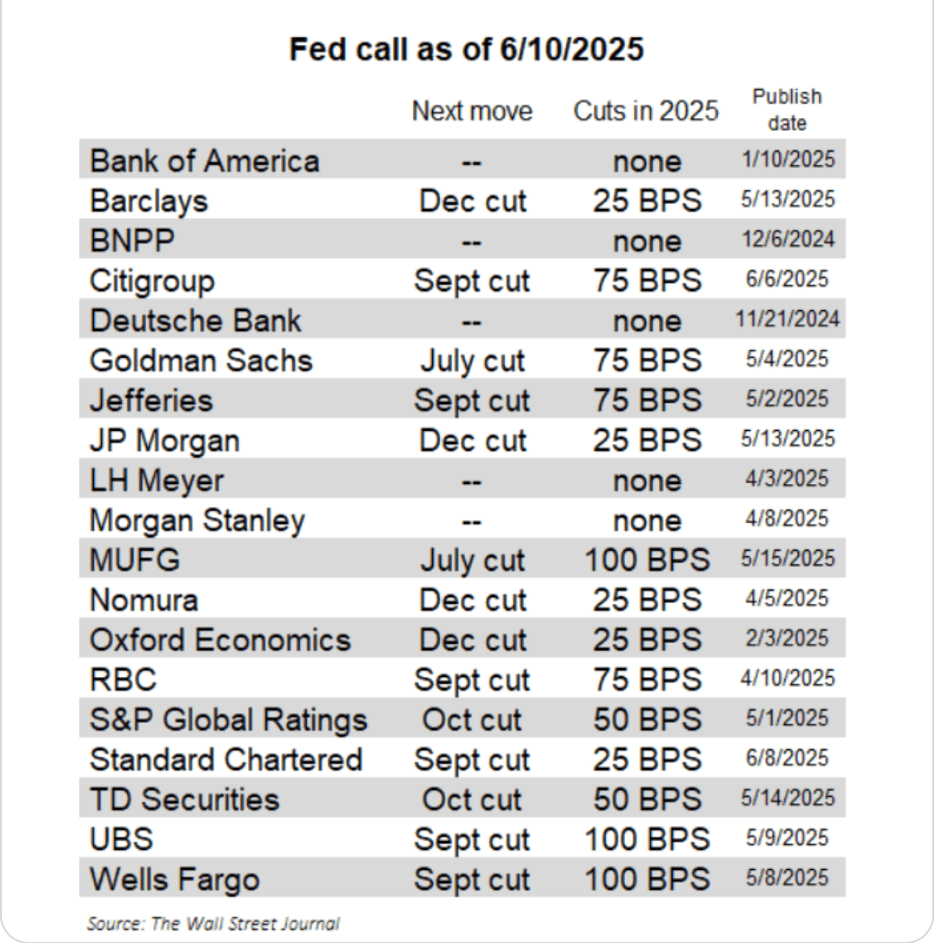

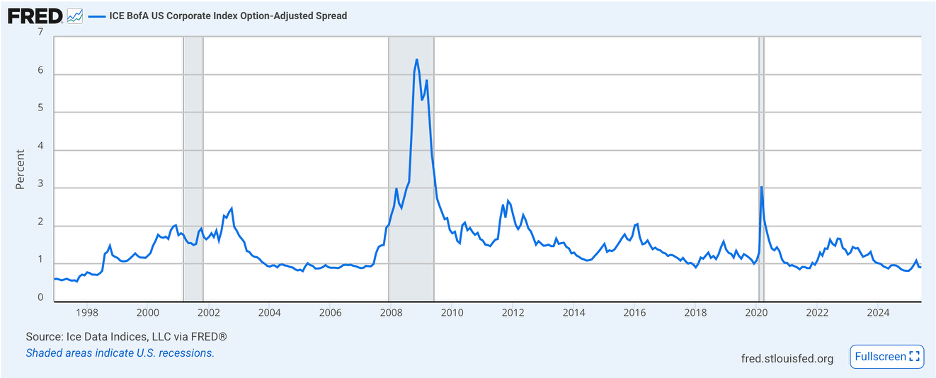

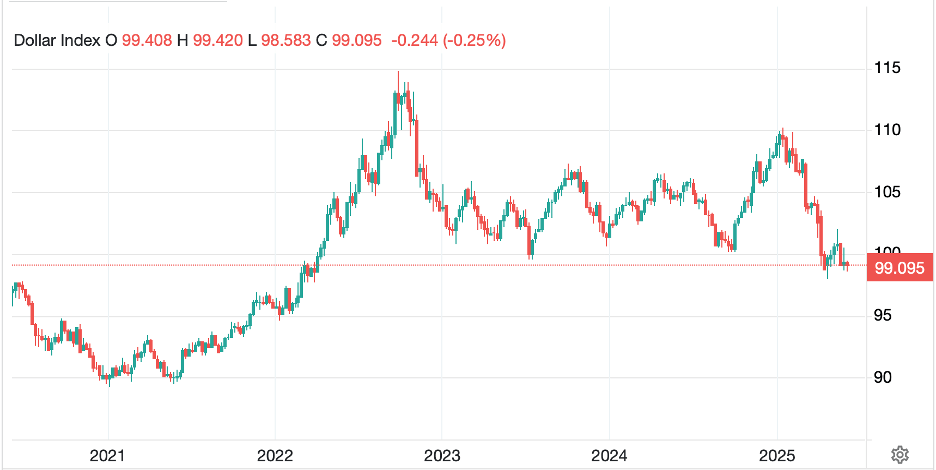

However, the market, as always, is seeking to create a narrative to drive things (or does the narrative follow the market? Kind of a chicken and egg question) and there is a new one forming regarding the dollar. Now, with inflation appearing to slow in the US, this is an opening for Chair Powell to cut rates again, despite the fact that inflation on every reading remains above their target. Meanwhile, the uncertainty that US policy is having on economies elsewhere, notably in Europe as the tariff situation is not resolved, means Madame Lagarde is set to pause, (if not halt), ECB rate cuts for a while and voilà, we have the makings of a dollar bearish story.

That seems likely to have been the driver of today’s move in the euro (+1.0%) which has taken the single currency back to its highest level since November 2021.

Source: tradingeconomics.com

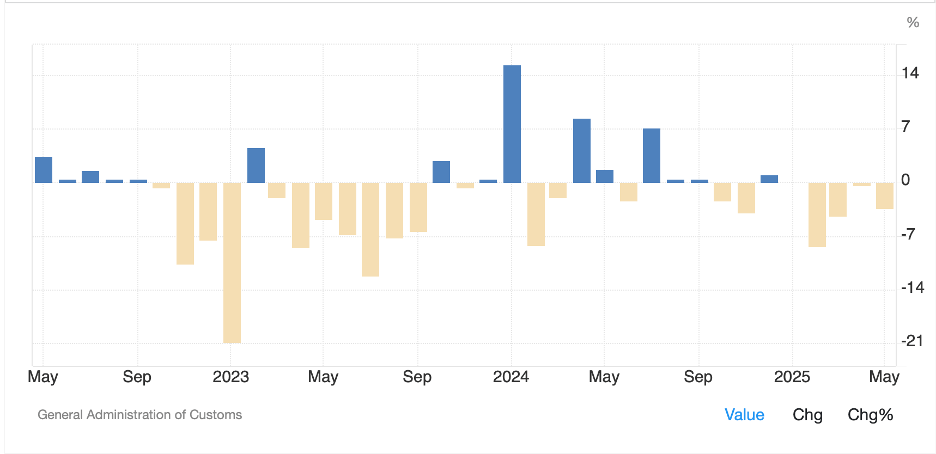

Now, if you are President Trump and are seeking to reduce the trade deficit while bringing manufacturing capacity back to the US, this seems like a pretty big win. Lower inflation and a lower dollar both work towards those goals. Not surprisingly, the president immediately called for the Fed to cut rates by 100 basis points after the release. As much as FOMC members seem to love the sound of their own voices, perhaps this is one time where they are happy to be in the quiet period as no response need be given!

At any rate, the softer inflation data has had a significant impact on the dollar writ large, with the greenback sliding against all its G10 counterparts, with SEK (+1.3%) leading the way, although CHF (+1.1%), NOK (+0.9%) and JPY (+0.8%) have also been quite strong. However, the biggest winner was KRW (+1.3%) as not only has there been dollar weakness, but new president, Lee Jae-myung, has proposed tax cuts on dividends to help support Korean equity markets and that encouraged some inflows. Other EMG currencies have gained as well, although those gains are more muted (CNY +0.3%, PLN +0.6%) and some have even slipped a bit (ZAR -0.5%, MXN -0.1%). Net, however, the dollar is down.

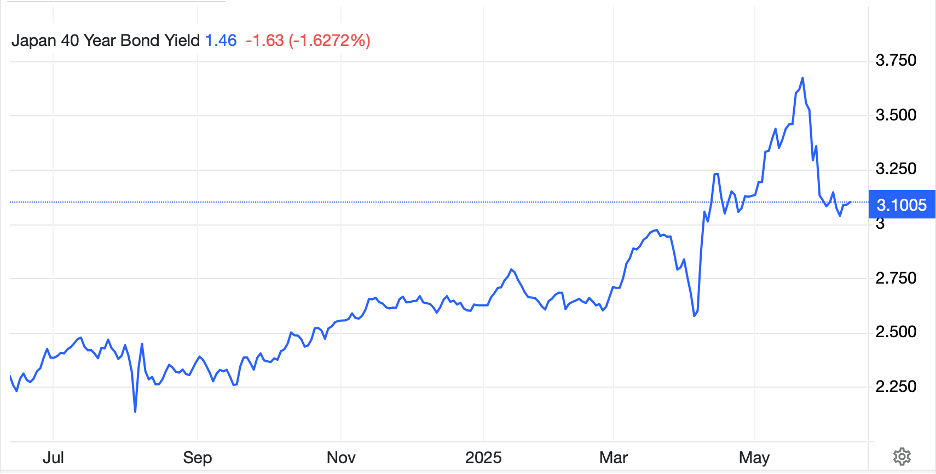

Yesterday, I, and quite a few other analysts, were looking for more heat in the inflation story. Clearly, if that is to come, it is a story for another day. With this in mind, we shouldn’t be surprised that government bond yields have also fallen around the world with Treasuries (-5bps) showing the way for most of Europe (Bunds -6bps, OATs -5bps, Gilts -6bps) and even JGBs (-2bps) are in on the action.

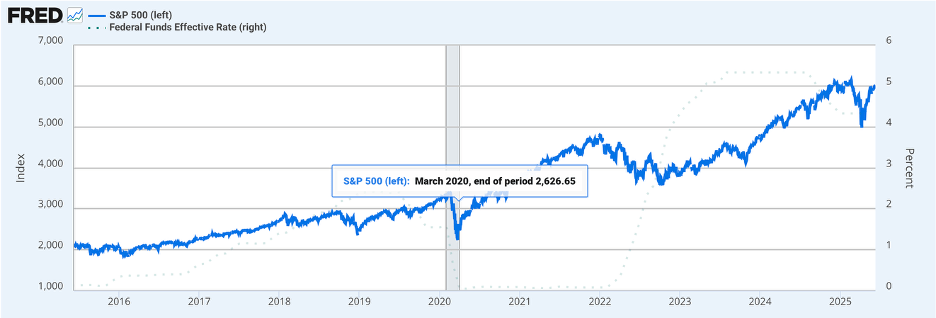

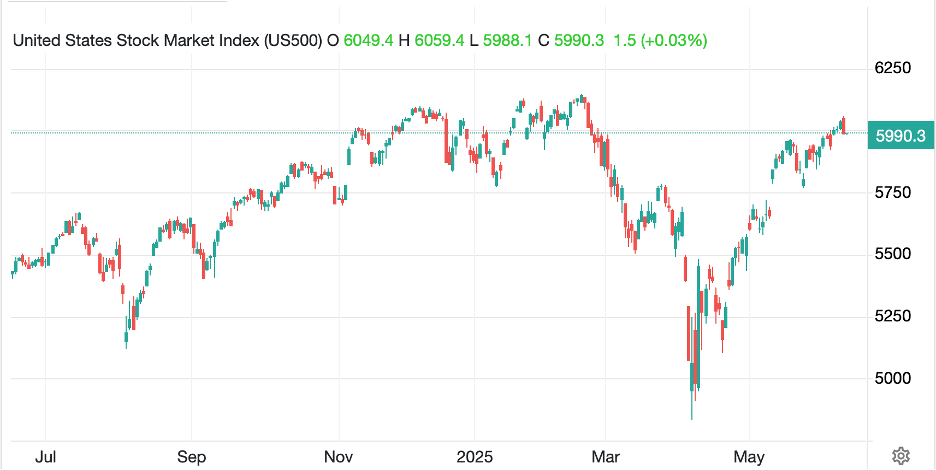

Earlier this week, the tone of commentary was that inflation was coming back, and a US stagflation was inevitable. This morning, that narrative has disappeared. Interestingly, I would have thought the combination of the cooler CPI and the trade truce between the US and China would have the bulls feeling a bit better. Alas, the equity markets have not responded in that manner at all. Despite the soft inflation readings, US equity markets yesterday edged lower, albeit not by very much. But that weakness was followed in Asia (Nikkei -0.65%, Hang Seng -0.4%, CSI 300 -0.1%) with India, Taiwan and Australia all under pressure although Korea (+0.45%) bucked the trend on that dividend tax story. And Europe, this morning, is also unhappy with the DAX (-1.1%) leading the way lower followed by the IBEX (-.9%) and CAC (-0.7%). The FTSE 100 (-0.1%) is faring a bit better as, ironically, weaker than expected GDP data this morning (-0.3% in April) has reawakened hope that the BOE will get more aggressive cutting rates. US futures are in the red as well this morning, -0.5% across the board. Perhaps this is the beginning of the long-awaited decline from overbought levels. Or perhaps, this is just a modest correction after a strong performance over the past two months. After all, the bounce in the wake of the Liberation Day pause has been impressive. A little selling cannot be a surprise.

Source: tradingeconomics.com

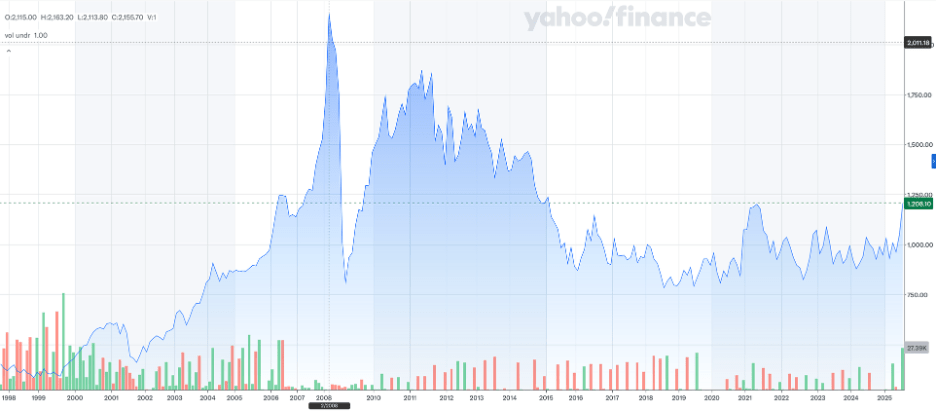

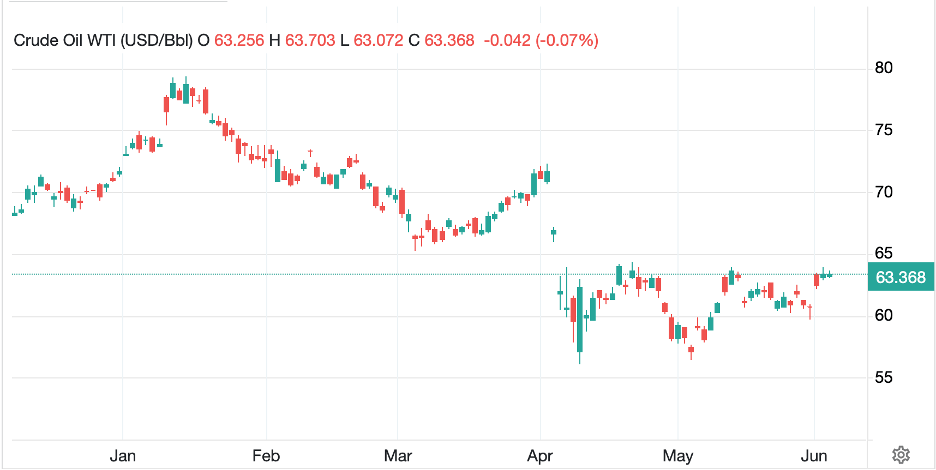

Lastly, we turn to commodities where the one consistency is that gold (+0.5%) has no shortage of demand, at least in Asia. It seems that despite a 29% rise year-to-date in the barbarous relic, US investors are not that interested. Those gains dwarf everything other than Bitcoin, and yet they have not caught the fancy of the individual investor in the US. However, I believe that demand represents an important measure of the diminishing trust in the US dollar, at least for the time being. The other metals are less interesting today. As to oil (-1.9%), it has rallied despite alleged production increases from OPEC and weakening demand regarding economic activity. Some part of this story doesn’t make any sense, although I don’t know which part yet.

This morning’s data brings Initial (exp 240K) and Continuing (1910K) Claims as well as PPI (0.2%, 2.6% Y/Y headline; 0.3%, 3.1% core). While there are no Fed speakers, there is much prognostication as to how the CPI data is going to alter their DOT plot and SEP information next week at the Fed meeting.

Finally, the situation in LA does not appear to have improved very much and it is spreading to other cities with substantial protests ostensibly planned for this weekend. However, market participants have moved on as nothing there is going to change macroeconomic views, at least not yet. If inflation is quiescent, the Fed doesn’t have to cut to have the tone of the conversation change. That is what we are seeing this morning and this can continue quite easily. When I altered my view on the strong dollar several months ago, I suggested a decline of 10% to 15% was quite viable. Certainly, another 5% from here seems possible over the next several months absent a significant change in the inflation tone.

Good luck

Adf

PS – having grown up in the 60’s I was a huge Beach Boys fan and mourn, with so many others, the passing of Brian Wilson. In fact, I wanted to write this morning’s rhyme as new lyrics to one of his songs, either “Fun, Fun, Fun” or “Surfin’ USA” two of my favorites. But I realise that I have become too curmudgeonly as both of those are wonderfully upbeat and I just couldn’t get skeptical words to work.