In Germany, growth has been fading

Down Under, inflation’s upgrading

Chair Jay gave his views

But it was old news

And Trump, for more cuts, is crusading

Some days, there is less to discuss than others, and this morning that seems to be the case. Even my X feed had very little of interest. Arguably, the top story is German Ifo readings came out much lower than expected and have now reversed most of the gains that occurred from front-running US tariff policy changes. Germany’s bigger problem, though, is that the trend here is abysmal, as ever since Russia’s invasion of Ukraine and the dramatic rise in energy prices there, the German economy has been under significant pressure. A look at the 5-year history of the Ifo series does an excellent job of explaining why growth has completely stalled there.

Source: tradingeconomics.com

In fact, if we look at the last three+ years of GDP activity in Germany, as per the below chart, we see that seven of the thirteen quarters were negative while two were exactly flat and the sum total of growth was -0.9%. It’s amazing what happens to a nation that decides to impose extreme conditions on the production of energy domestically. Or perhaps it’s not so amazing. After all, economic activity is merely energy transformed. If the cost of energy is high, economic activity is going to be slow.

Source: tradingeconomics.com

I highlight this because it runs counter to the narrative that Europe is a better place to invest than the US, which has been the thesis of the ‘end of American exceptionalism’ trade. Germany is the largest European nation by far and had been a manufacturing powerhouse. But those days appear to have passed. If Germany is going to continue to lag, and I see no reason for that to change based on the current political dynamic there, please explain the idea behind long-term strength in the euro. As I wrote yesterday, if the Fed cuts aggressively, the dollar will decline in the short run, but one cannot look at the trajectories of the relative economies and claim Europe is the place to be in the long run.

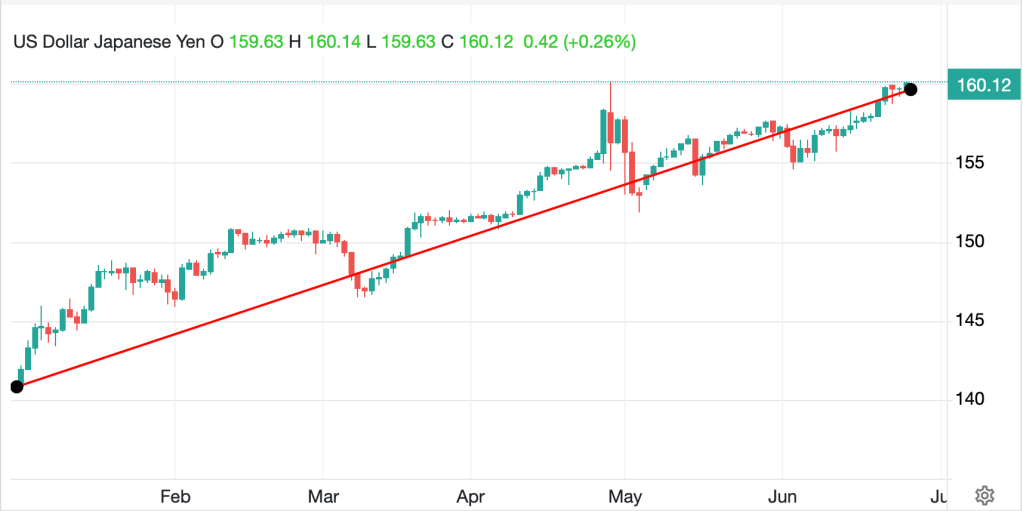

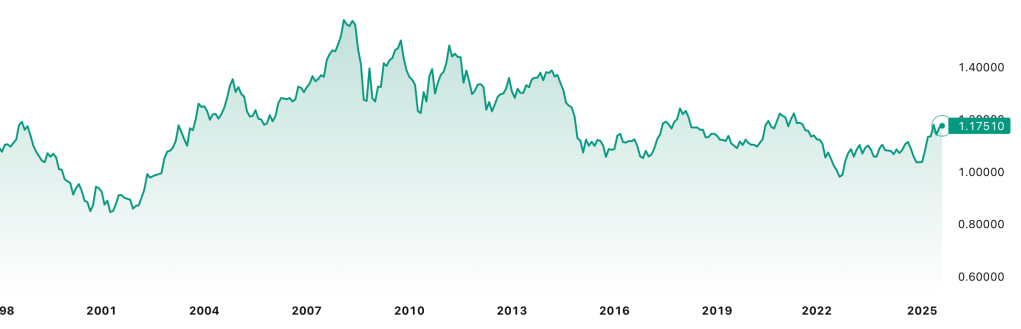

This morning, the euro (-0.5%) has responded logically to the data but the dollar is broadly stronger as well after Chair Powell’s speech yesterday where he continued the modestly hawkish tone from the FOMC press conference. He continues to agonize over the fact that inflation won’t fall while unemployment is edging higher, although he finally admitted that tariffs would likely have a temporary, one-off impact on prices. While there is no doubt the dollar has fallen since the beginning of the year, a 10% or 15% move is hardly unprecedented, but rather occurs pretty frequently. A look at the below chart from the beginning of the euro’s existence in 1999 shows at least six or seven other instances when the euro rallied that much in a short period of time.

Source: tradingview.com

In fact, to demonstrate the politicization of the current world, one need only go back to the period in 2008 when the euro peaked at 1.60 or so to see that it was not seen as a global calamity, simply a period where US monetary policy had loosened dramatically relative to the rest of the world.

The other marginally interesting story this morning is Australia’s inflation rate, which came in at 3.0%, higher than expected and demonstrating what appears to be a break in the declining trend previously seen.

Source: tradingeconomics.com

This matters as AUD (+0.1%) is outperforming all its G10 peers this morning on the back of the idea that the RBA will be stuck on hold, rather than cutting rates again soon. Too, this weighed on Australian equities (-0.9%) which underperformed other Asian markets overnight.

But that’s really all the interesting stuff, and it wasn’t that interesting, I fear. So, let’s look at the rest of the market behavior overnight. While I thought it was illegal, yesterday resulted in US equity markets declining on the session, albeit less than 1%. And this morning, you’ll be happy to know, the futures are all modestly green. As to Asian markets, Japan (+0.3%), China (+1.0%) and HK (+1.4%) all had strong sessions although it appears most of the other regional bourses declined. The Chinese story making the rounds is the lessening in trade tensions between the US and China was seen as a key positive while HK survived Typhoon Ragasa without any major impacts. But Korea, India, Taiwan and Singapore were all softer on the session.

In Europe, markets have generally done little with marginal declines the norm although, surprisingly, Germany’s DAX is unchanged on the day despite the weak Ifo data. However, it is hard to get excited about anything happening there right now.

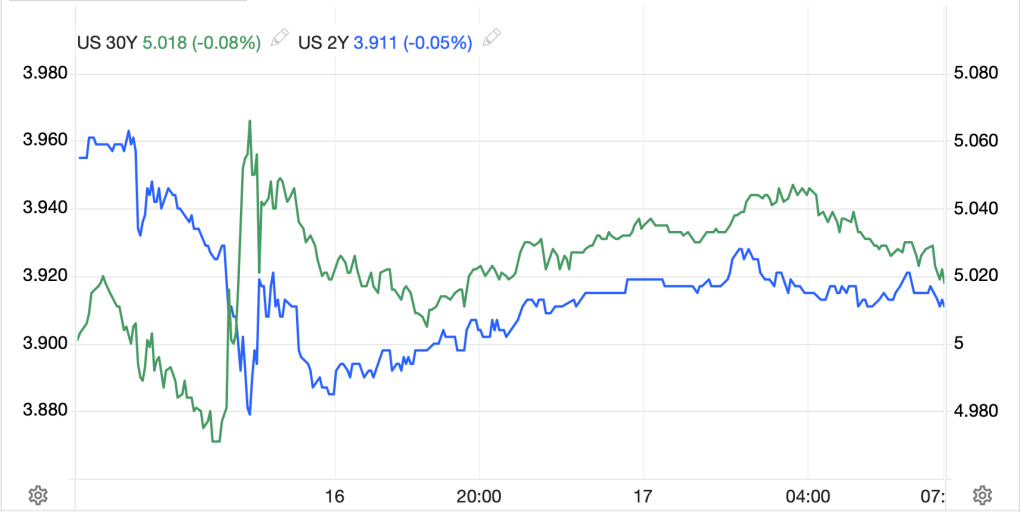

Bond yields fell yesterday with Treasuries declining -4bps although this morning they have edged back higher by 1bp. Perhaps Powell’s tone yesterday was enough to keep the bond vigilantes on the sidelines, or perhaps there is simply not enough new information to change any views right now. The Fed funds futures market continues to price a 94% probability of a cut at the end of next month and apparently bond investors are cool with that. European yields are also little changed this morning as were JGB yields last night.

In the commodity space, oil (+1.1%) is heading back toward the top of the range I highlighted yesterday, but still more than $1 away and there have been no stories to drive things. This is all just range trading in my view. As to the metals markets, this morning gold and silver are essentially unchanged, consolidating their recent gains while copper (-.0.75%) is slipping slightly and has retraced some of its gains from earlier in the month. Remember, copper is much more an economic play than a fear play or inflation play.

Finally, the dollar is firmer across the board this morning with gains against almost all G10 counterparts on the order of 0.5% and against EMG counterparts it is more like 0.8%. Even CNY (-0.25%) is weakening as it appears Chinese state banks are selling renminbi in the spot market and hedging in the swap market to help mitigate its recent gains. It is beginning to feel like the dollar’s decline this year, which has been widespread, is coming to an end.

On the data front, today brings only New Home Sales (exp 650K) and EIA oil inventories. Yesterday’s Flash PMI data was right in line with expectations, and my take is until NFP a week from Friday, there is going to be little of interest on the data front for markets overall. Even PCE this week will have to be significantly different from expectations to have any impact.

It appears that absent Stephen Miran convincing the rest of the FOMC to cut rates aggressively, a very low probability event, the dollar is finding a bottom, and the next major move will be higher on the basis of stronger growth in the US vs. the rest of the world. Of course, if the Fed does start to get more aggressive, then the dollar will suffer, I just don’t see that happening anytime soon.

Good luck

Adf