Investors don’t seem that excited

‘Bout Germany’s now expedited

Designs to rearm

And that caused much harm

To Bunds, with their price dynamited

One of the biggest impacts of President Trump’s recent friction with Ukraine and its security is that European nations now realize that their previous ability to make butter, not guns, because the US had enough guns for everybody is no longer necessarily the case. Mr Trump’s turn inward, which should be no surprise given his campaign rhetoric and America First goals, apparently was a surprise to most European leaders. It seems they couldn’t believe the US would change course in this manner. Regardless, the upshot is that Europe finds itself badly under armed and is now promising to change this.

The country best placed to start this process is Germany, where soon-to-be Chancellor, Friedrich Merz has promised a €500 billion spending spree on new defense items. However, as the Germans don’t have this money laying around, they will need to borrow it. The wrinkle in this plan is that enshrined in Germany’s constitution is a debt brake designed to prevent fiscal profligacy, kind of like this. So, Merz has proposed waiving the debt brake for defense expenditures, but in order to do so, will need a two-thirds majority vote in the Bundestag (German parliament). Now given AfD has been quite anti-war, it is not clear he will be able to obtain the requisite votes but for now, that is not the concern.

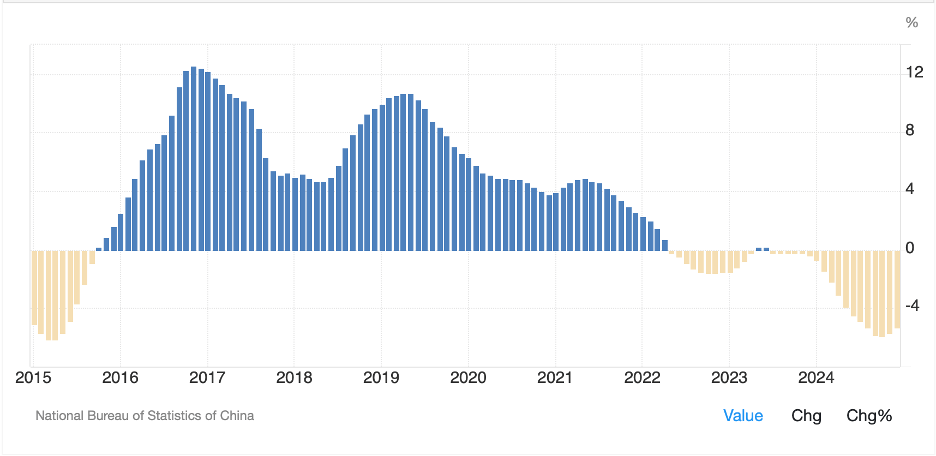

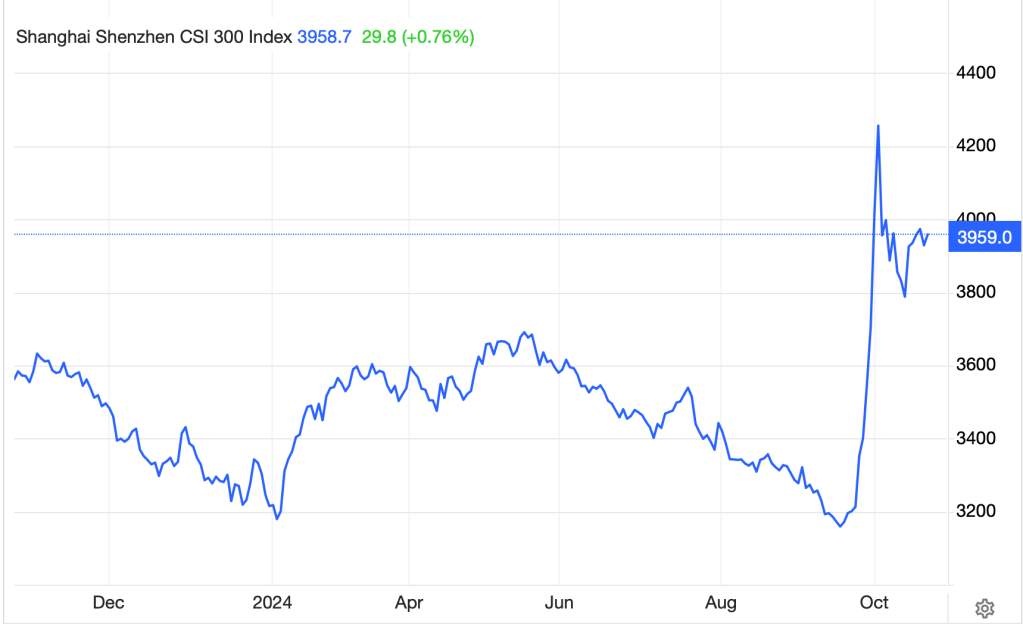

However, the German bund market clearly believes he will be successful as evidenced by the chart below. Overall, German 10-year yields rose 30bps yesterday, a dramatic move, and dragged most European sovereigns along for the ride as the new narrative is that all European nations will increase borrowing to spend on their defense. It is worth noting, though, that the reason German yields have been so low is because the economy there has been exhibiting approximately 0% growth for more than a year as they continue to commit energy suicide seek to achieve their idealistic greenhouse gas emission goals.

Source: tradingeconomics.com

The trick, though, is that while Germany, with a debt/GDP ratio around 60%, has plenty of fiscal space to follow through, assuming they can alter their constitution, the rest of Europe is in a much more difficult spot with both France and Italy already under EU scrutiny for their budget deficits and debt/GDP ratios. Recall, a key aspect of the Eurozone’s creation was the regulation designed to keep national budget deficits below 3% of GDP and drive the debt/GDP ratios to 60% or below. Right now, Germany is the only nation that fits within those parameters.

While I have no doubt that they will alter the rules as necessary elsewhere in Europe and certainly given the now perceived existential crisis for Europe, those limits are sure to be ignored, the story in Germany remains different because of the constitution. Markets, though, clearly believe that a lot more debt is about to be issued by European nations, hence the dramatic decline in bond prices and jump in yields.

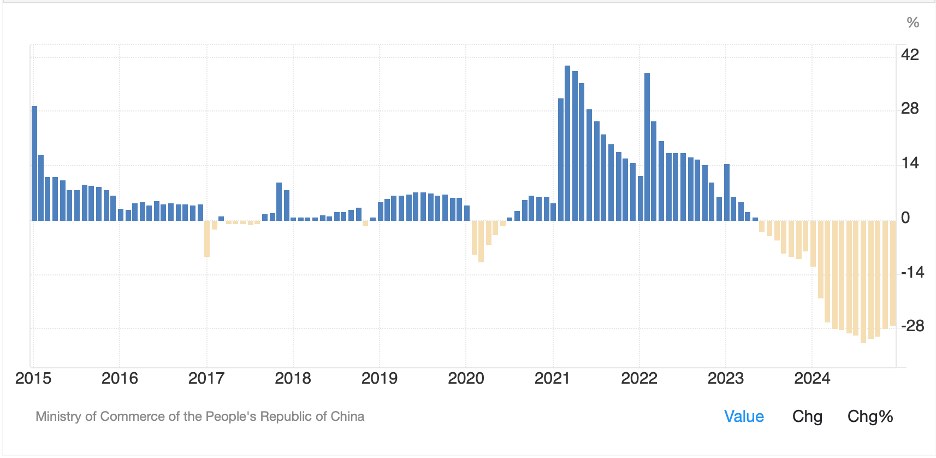

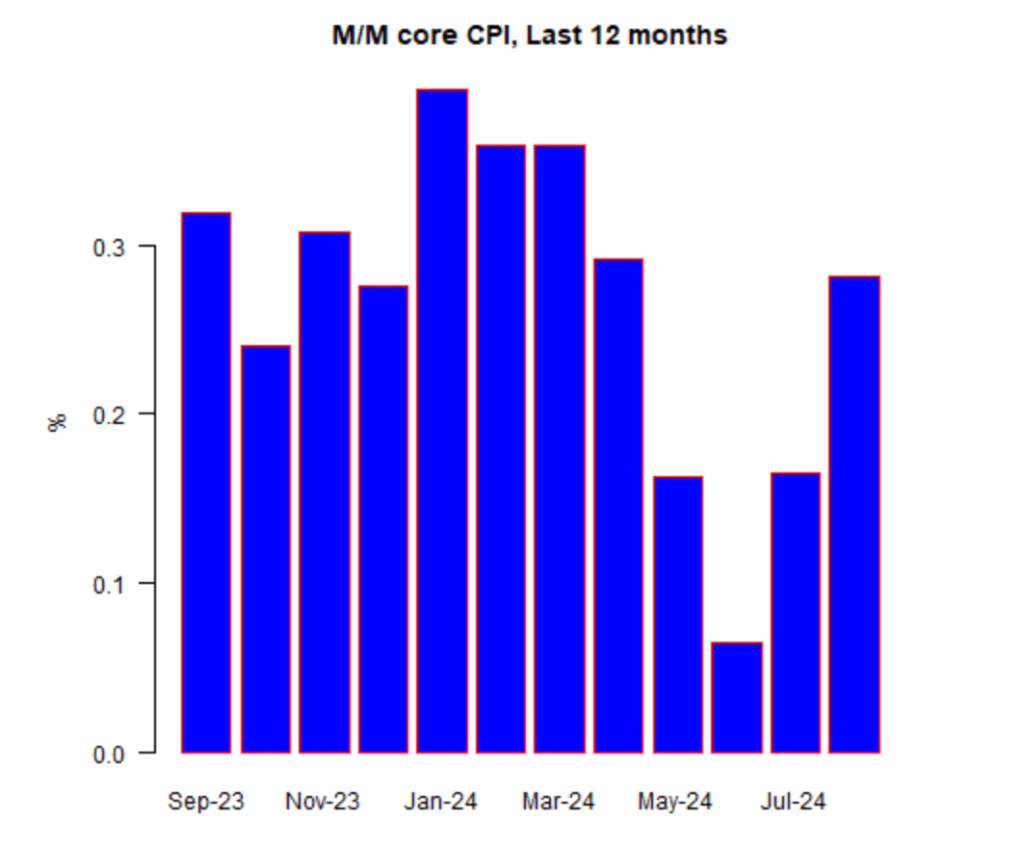

But there are other knock-on effects here as well, notably that the euro is climbing dramatically against the dollar, up nearly 4% in the past week, and far ahead of the pound and most G10 currencies with only the SEK (+1.0% overnight, +6.1% in past week) outperforming the single currency. For a while I have suggested that short-term rates were losing their sway over the FX markets and traders were looking at 10-year yields. Certainly, the recent price action indicates that remains the case as Treasury yields (+2bps) have bounced off their lows but have risen far less than their G10 counterparts. In fact, a look at the movement in 10-year government bond yields over the past month and year reveals just how significant these changes have been.

Source: Bloomberg.com

I feel safe in saying that for the next several weeks, perhaps months, this story of European defensive revival and the knock-on effects is going to be top of mind for both investors and pundits. Only history will determine if these dramatic changes in policy stances will have been effective in reducing the chance of war or not and if they will have been beneficial or detrimental to economies around the world. As much of the current narrative is driven by politics rather than economics, punditry on the latter is going to be worse than usual. Once again, I harken back to the need for a robust hedging plan for all those with exposures. As recent price action across all markets demonstrates, volatility is back, and I believe here to stay for a while.

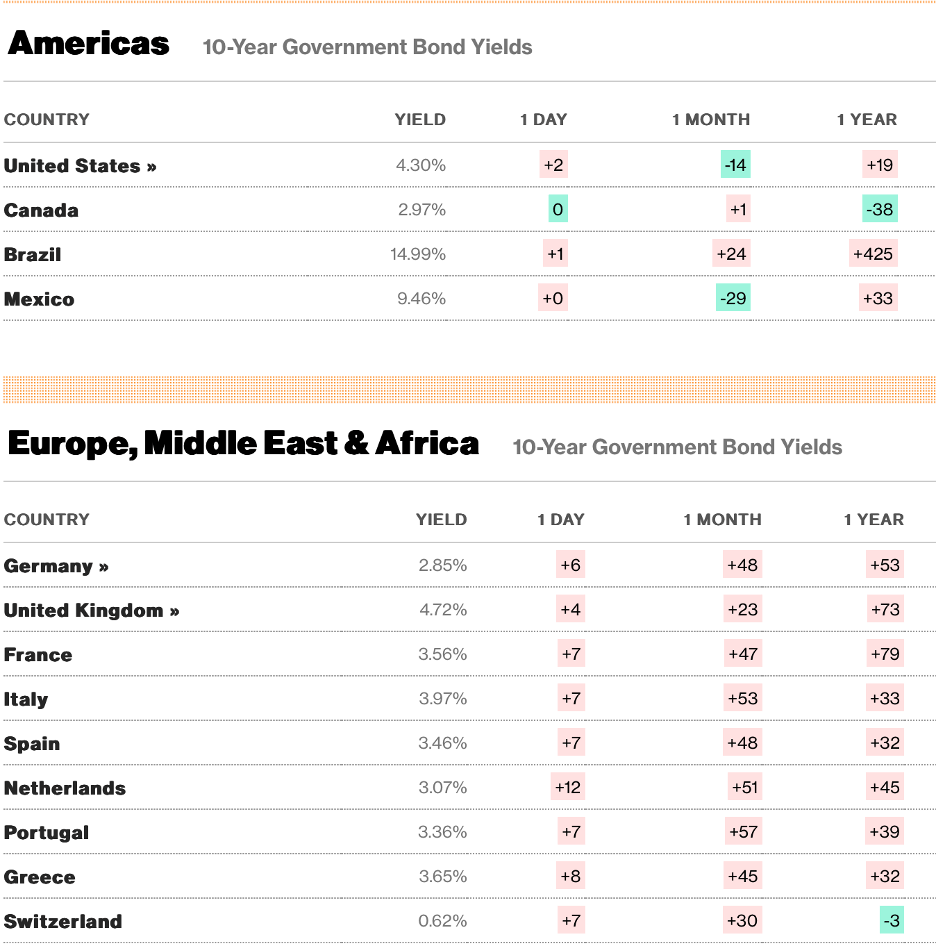

Ok, let’s run down the rest of the markets not yet discussed. Yesterday’s US equity bounce was widely appreciated by many although this morning, futures markets are all pointing lower by between -0.75% and -1.25%, enough to wipe out yesterday’s gains. As to Asia overnight, Japan (+0.8%) followed the US and both Hong Kong (+3.3%) and China (+1.4%) are continuing to get positive vibes from the Chinese twin meetings of policymakers. More stimulus continues to be the driving belief there although China’s history has shown their stimulus efforts have tended to fall short of initial expectations. As to Europe, this morning only the DAX (+0.5%) is continuing yesterday’s gains as concerns begin to grow that while Germany can afford to spend more money on defense, the rest of Europe is not in the same situation, so government procurement contracts may be less prevalent than initially hoped. This is evident in the -0.4% to -1.0% declines seen across both the UK and most of the rest of the continent.

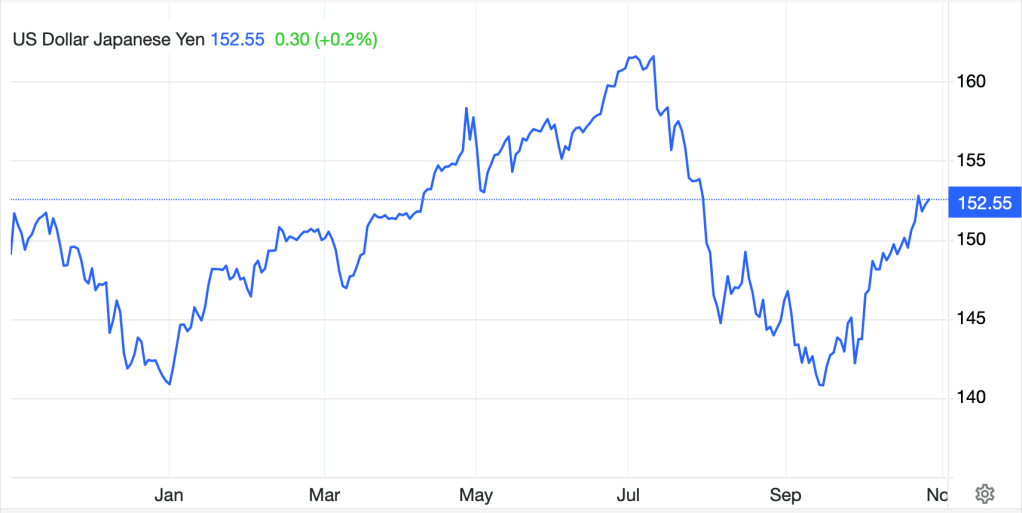

We’ve already discussed bonds, although I should mention that JGB yields have risen 10bps as well, up to new highs for the move and finally above 1.50%

In the commodity space, oil (+0.65%) which has had a very rough week, falling more than -5% in the past seven days, seems to be finding a bit of support. Recall yesterday’s chart showing the bimodal distribution and that we are now in supply destruction territory. Ultimately, that should support the price, but the timing is unclear. In the metals markets, this morning sees red across the board, although not dramatically so, with both precious and base metals sagging on the order of -0.5%.

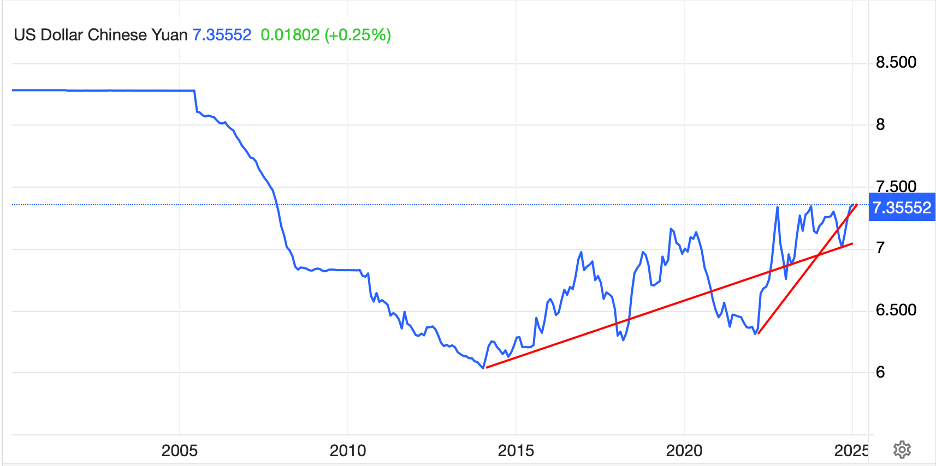

And lastly the dollar continues to decline, albeit not as swiftly as yesterday. However, while it is considerably weaker vs. its G10 counterparts, versus the EMG bloc, the story is far less clear. For instance, the only notable EMG currency gaining ground this morning is CLP (+1.2%) while virtually every other major emerging market currency is actually slipping a bit. Look at this list; CNY -0.2%, MXN -0.25%, PLN -0.3%, ZAR -0.15%, INR -0.3% and HUF -0.5%. I have a feeling we are going to see more behavior like this going forward, where G10 currencies are now trading on a different basis than EMG currencies.

On the data front, this morning brings Initial (exp 235K) and Continuing (1880K) Claims as well as the Trade Balance (-$127.4B) and Nonfarm Productivity (1.2%) and Unit Labor Costs (3.0%) all at 8:30. We also hear from two more Fed speakers, Waller and Bostic later in the day. Yesterday’s ADP employment data was much weaker than expected, falling to 77K, while the ISM Services data held up well although the prices paid piece did rise. In addition, there has been a change in tone from the Fed speakers as we are now hearing mention of the possibility of stagflation due to the Trump tariffs, although there was no indication as to which way they will lean if that is the economic path forward.

I continue to highlight volatility as the watchword for now and the near future at least. As long as politics has become the key driver, and as long as President Trump is that driver, given his penchant to shake things up, the one thing of which I am sure is we have not seen the last dramatic change in perception. With that in mind, my view is the dollar will remain under pressure for a while yet.

Good luck

Adf