Seems President Xi is annoyed

His stock market has been devoid

Of buyers, so he

Has banned, by decree

The strategies quant funds employed

But otherwise, markets are waiting

To see if inflation’s abating

The PCE print

Will give the next hint

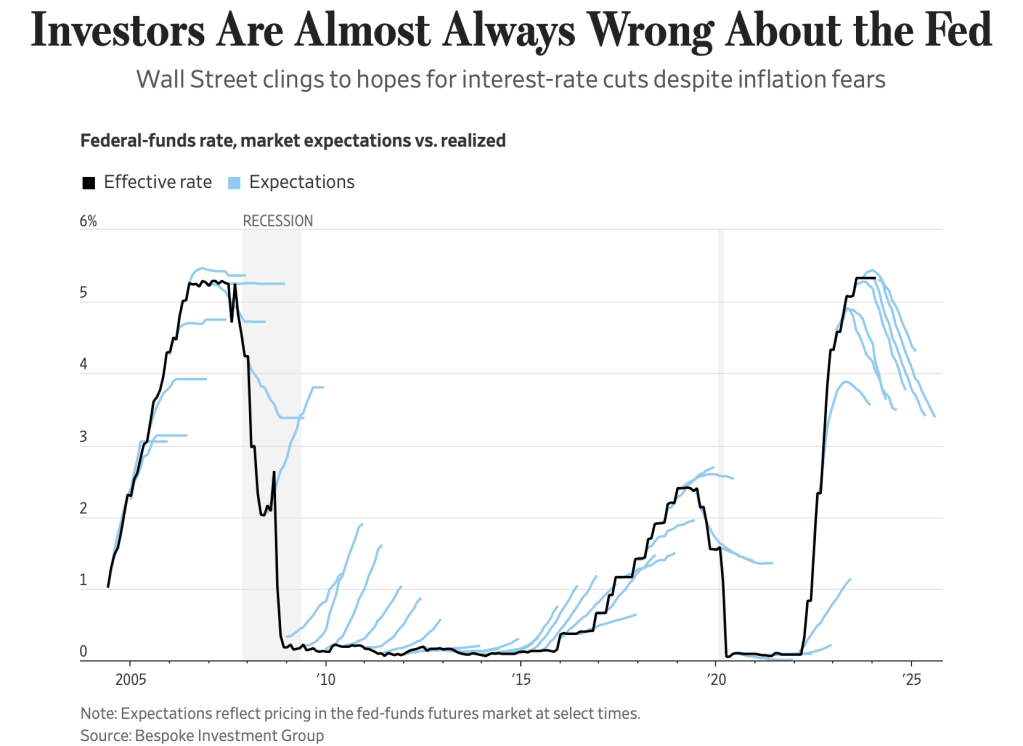

If cuts, Jay will be advocating

Market activity remains on the quiet side of the spectrum as all eyes continue to focus on the Fed, and by extension all central banks. As an indication, last night the RBNZ left their OCR rate on hold, as widely expected, but sounded less hawkish in their views, dramatically lowering the probability that they may need to hike rates again. Prior to the meeting, there was a view hikes could be the case, but now, cuts are seen as the next step. The upshot is the NZD fell -1.2% as all those bets were unwound. One of the reasons this was so widely watched is there are some who believe that the RBNZ has actually led the cycle, not the Fed, so if hikes remained on the table there, then the Fed may follow suit. However, at this stage, I would say all eyes are on tomorrow’s PCE print for the strongest clues of how things will evolve.

Before we discuss that, though, it is worth touching on China, where last night “unofficially” the Chinese government began explaining to hedge funds onshore that they could no longer run “Direct Market Access” (DMA) products for external clients. This means preventing new inflows as well as winding down current portfolios. In addition, the proprietary books using this strategy were told they could not use any leverage. (DMA is the process by which non broker-dealers can trade directly with an exchange’s order book, bypassing the membership requirement, and in today’s world of algorithmic trading, cutting out a step in the transaction process, thus speeding things up.)

Apparently, this was an important part of the volume of activity in China, but also had been identified as a key reason the shares in China have been declining so much lately. Last night was no exception with the Hang Seng (-1.5%) and CSI 300 (-1.3%) both falling sharply and the small-cap CSI 1000 falling a more impressive -6.8%. Once again, we need to ask why the CCP is so concerned about the most capitalist thing in China. But clearly, they are. I suppose that it has become a pride issue as how can Xi explain to the world how great China is if its stock market is collapsing and investment is flowing out of the country. This is especially so given the opposite is happening in their greatest rival, the US.

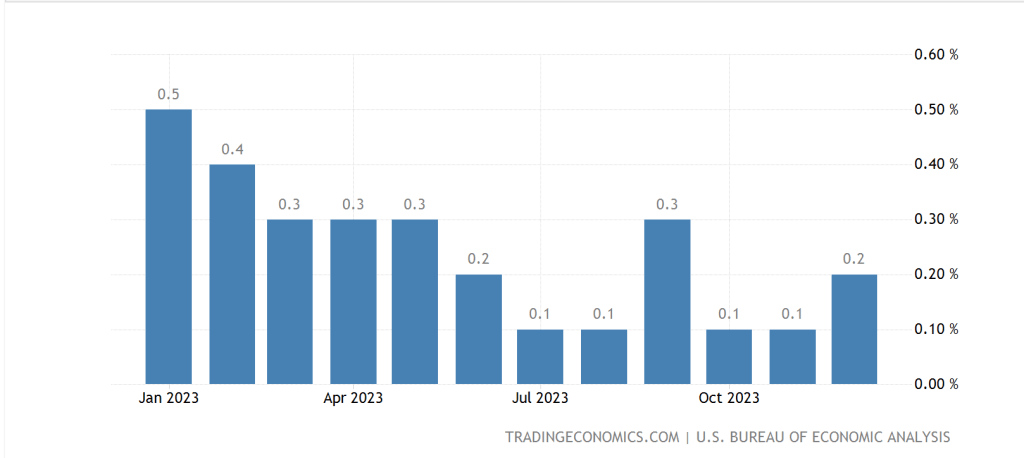

But back to PCE. It appears that this PCE print has become pivotal to many macroeconomic views. At least that is the case based on how much discussion surrounds it from both inflation hawks and doves. As of now, and I don’t suppose it will change, the current consensus view of the M/M Core PCE print is 0.4% with a Y/Y of 2.8%. As can be seen from the below chart from tradingeconomics.com, this will be the highest print in a year, and it would be easy to conclude that the trend here has turned upwards.

Of greater concern, though, is the idea that just like we saw the CPI data run hotter than expected earlier this month, what if this number prints at 0.5%? Currently, the inflation doves are making the case that the trend is lower, and that if you look at the last 3 months or 6 months, the Fed has already achieved their target. Their answer is the Fed should be cutting rates and soon. For them, a 0.5% print would be much harder to explain and likely force a rethink of their thesis.

On the other side of the coin, the inflation hawks would feel right at home with that type of outcome and continue to point to the idea that the ‘last mile’ on the road back to 2.0% is extremely difficult and may not even be achievable without much tighter policy. While housing is a much smaller part of the PCE data than the CPI data, remember, CPI saw strength throughout the services sector and that will be reflected.

One thing to consider here is the impact a hot number would have on the Treasury market. Yields have already backed up from their euphoric lows at the beginning of the month by nearly 50bps. Given the recent poor performance in Treasury auctions, where it seems buyers are demanding higher yields, if inflation is seen to be rising again, we could see much higher yields with the curve uninverting led by higher 10-year yields. I’m not saying this is a given, just a risk on which few are focused. In the end, tomorrow has the chance to be quite interesting and potentially change some longer-term views on the economy and the market’s direction.

But that is tomorrow. Looking overnight, while Chinese stocks suffered, in Japan, equity markets were largely unchanged. In Europe this morning, there is more weakness than strength with the FTSE 100 (-0.7%) and Spain’s IBEX (-0.7%) leading the way lower although other markets on the continent have seen far less movement. As to US futures, at this hour (8:00), they are softer by about -0.3%.

In the bond market this morning, Treasury yields have fallen 2bps, while yield declines in Europe have generally been even smaller, mostly unchanged or just -1bp. The biggest mover in this space was New Zealand, where their 10-year notes saw yields tumble 9bps after the aforementioned RBNZ meeting.

Oil prices (-0.3%) are giving back some of their gains yesterday, when the market rallied almost 2% on stories that OPEC+ was getting set to extend their production cuts into Q2. It is very clear that they want to see Brent crude above $80/bbl these days. In the metals markets, while precious metals are little changed, both copper and aluminum are softer by about -0.5% this morning. I guess they are not feeling any positive economic vibes.

Finally, the dollar is much firmer this morning against pretty much all its counterparts. While Kiwi is the laggard, AUD (-0.7%), NOK (-0.7%) and CAD (-0.4%) are all under pressure as well. The same is true in the EMG bloc with EEMEA currencies really suffering (ZAR -0.5%, HUF -0.7%, CZK -0.4%) although there was weakness in APAC overnight as well (KRW -0.4%, PHP -0.6%).

On the data front, this morning brings the second look at Q4 GDP (exp unchanged at 3.3%), the Goods Trade Balance (-$88.46B) and then the EIA oil inventory data. We also hear from Bostic, Collins and Williams from the Fed around lunchtime. Yesterday’s data was generally not a good look for Powell and friends as Durable Goods tanked, even ex-transport, while Home Prices rose even more than expected to 6.1% and Consumer Confidence fell sharply to 106.7, well below the expected 115 reading.

As we have been observing for a while now, the data continues to demonstrate limited consistency with respect to the economic direction. Both bulls and bears can find data to support their theses, and I suspect this will continue. With that in mind, to my eye, there are more things driving inflation higher rather than lower and that means that the Fed seems more likely to stand pat than anything else for quite a while. Ultimately, I think we will see the ECB and BOE decide to ease policy sooner than the Fed and that will help the dollar.

Good luck

Adf