Undoubtedly, most are confused

And many portfolios bruised

The problem I fear

Is throughout this year

Both bulls and bears will be contused

Right now, it’s the tariff Watusi

With rules that seem quite loosey-goosey

So, traders are scared

While pundits declared

The president’s just too obtuse-y

But will volatility reign

All year with the requisite pain?

Or will, as Trump said

When looking ahead

The outcome be growth once again?

(Before I start, “Ball of Confusion” is brilliant and timeless. But isn’t Billy Joel’s “We Didn’t Start the Fire” covered and updated by Fall Out Boy, really the same song for a different generation?) Now, back to our regular programming.

- Tariffs are a tax. So, say seemingly all the most credentialed analysts and economists around.

- Tariffs are inflationary. So, say many of these same analysts and economists.

- Ergo, taxes are inflationary. So, say…well none of the credentialed analysts and economists. (H/T to Alyosha for highlighting this idea last week.)

But it is important to recognize this dichotomy as we listen to the many pundits and analysts who are now telling us that a recession is coming, if not already here, and the world is ending. It seems to me if you cannot recognize this connection then your views may be colored by something other than strict logic.

We are experiencing a complete regime change in both financial markets and economic outcomes around the world and as old as I am, the last time something like this occurred was long before I was born. I am very wary of any analyst who demonstrates any certitude in their views at this point. Frankly, I am more inclined to listen to historians than economists, as they have potentially studied previous regime changes. Alas, I have not so I am reliant on those who I read.

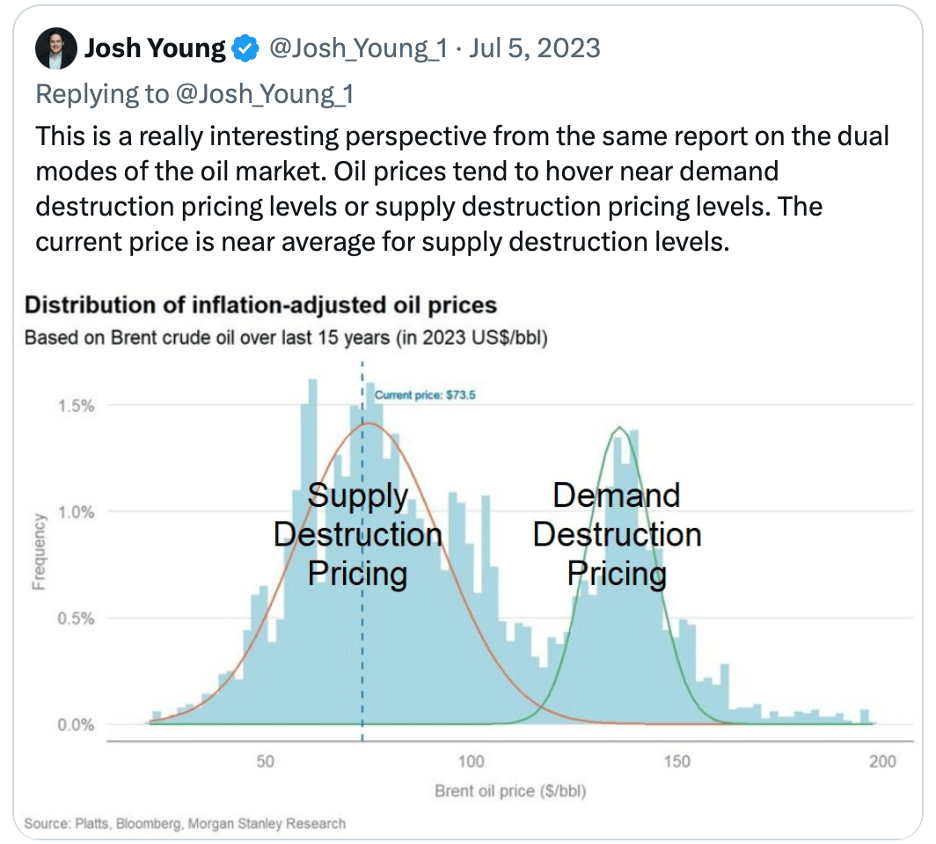

The current confusion remains over tariffs, their implementation and their impact. To me, the key point that is missing in most of the tariff discussions is the elasticity of demand for any given product. If something is highly inelastic and tariffs are added, then the price of that item is very likely to rise. However, if something has very elastic demand, then a tariff will do one of two things, either the producer will absorb the cost or the volume of sales will drop dramatically, but any price rise will be constrained.

I highlight this because the weekend’s ostensible pause in tariffs on electronic goods from China is the latest discussion point. It strikes me that under the thesis tariffs are inflationary, then inflation forecasts and expectations should now be declining. But I haven’t seen that yet. In the end, though, I don’t believe anybody really knows how things will evolve from here, although I believe the end goal is becoming clearer.

It appears that President Trump’s goal is seeking to isolate China from much of the developed world. He wants to create a situation where nations declare they are either with the US or against the US when it comes to economic relations. I read this morning that 75 nations are in negotiations with the US regarding tariff reductions. Given that, by themselves, the G10 represent nearly 50% of global GDP, even not knowing which nations are negotiating, the group almost certainly represents upwards of 70% or more of the global economy.

I would contend it is still very early days with respect to the results of President Trump’s actions. There is no question he has unleashed a certain amount of chaos in the government and in markets, but I don’t believe he is greatly concerned by that, and in fact he may welcome the process. Regime changes are always messy, and this one is no different. Be nimble.

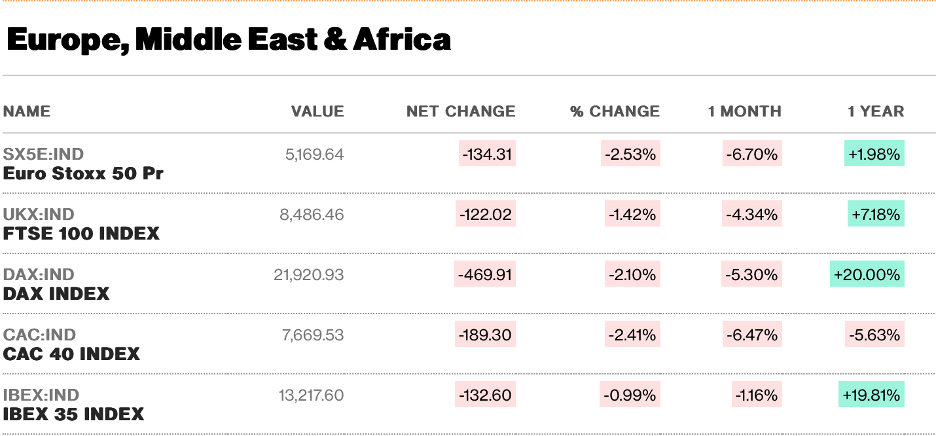

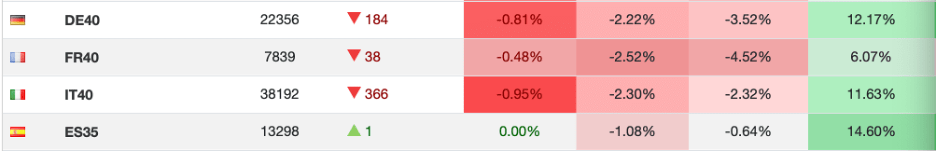

Ok, let’s look at how things behaved overnight. Friday’s US equity rally was followed by strength throughout most of Asia (Japan +1.2%, Hong Kong +2.4%, China +0.2%, Korea +1.0%, India +1.8%) with Taiwan (-0.1%) the true laggard in the region. Clearly the tariff reprieve, even if temporary, was welcomed. In Europe, too, the gains are strong and widespread with the DAX (+2.3%) leading the way but the rest of the Continent and the UK all up at least 1.8%. And at this hour (6:30) US futures are higher by around 1.0% as well.

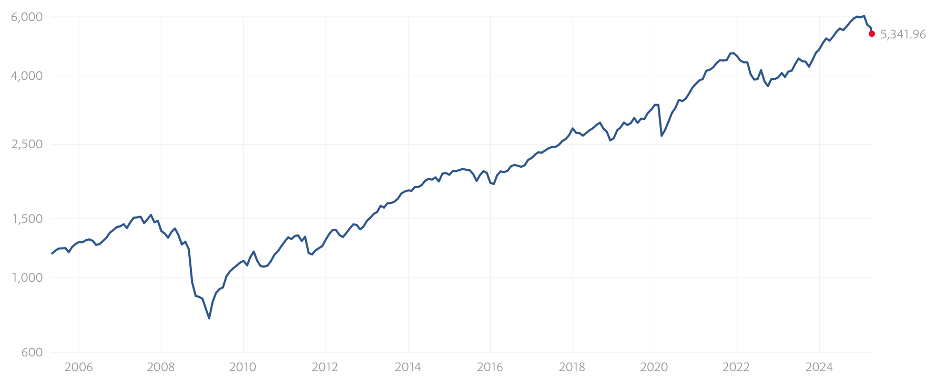

But let’s keep things in perspective. The below chart of the S&P 500 over the past 20 years can help you understand the magnitude (or lack thereof) of the recent decline. Yes, the index is lower by about 12% from the all-time highs set in February, and yes, uncertainty is rife. But if you ever wanted to understand what has happened since the Fed’s response to the GFC led to the financialization of the entire economy, the latest minor dip is being described as catastrophic by the punditry. It’s not!

Source: multpl.com

Next, the Treasury bond market has been the focus of a great deal of angst lately. Once again, these same analysts and economists claim the world is ending because yields have risen over the past week. I grant the movement has been sharp, but my experience tells me that when a market as liquid as 10-year Treasuries moves this sharply, it is a position liquidation that is driving the move. In fact, both the 10-year and 30-year auctions last week seemed to have gone quite well, with strong demand. So, I am not of the opinion the bond market is about to collapse, nor do I believe that China is liquidating their Treasury holdings. Rather, hedge funds carrying significant leverage and being forced to unwind seems the most likely culprit here. Too, remember that 10-year yields are right in the middle of their range for the past six months at 4.43% (-6bps today).

Source: tradingeconomics.com

In fact, European sovereign yields are also retreating this morning led by Italy and Greece (-9bps) with German bunds (-4bps) the laggard of the session. With equity markets around the world rallying, it doesn’t appear this is safe haven buying. However, I do believe that there are many investors who are pushing at least some of their equity portfolios into fixed income amidst overall uncertainty.

Turning to commodities, oil (+1.25%) seems to have found a bottom, at least in the short-term, just below $60/bbl. While a recession doesn’t necessarily drive inflation lower, I am very comfortable with the idea that it reduces demand for energy and oil prices can slip. Is the recent move a harbinger of recession? I think there is too much noise to discern the signals the market is giving us right now, although a recession, which has been long awaited by many analysts, certainly seems possible.

As to the metals markets, while both gold (-0.7%) and silver (-0.3%) are a bit softer this morning, one need only look at their performance in the past week (both higher by more than 7%) to recognize that there is a great deal of growing demand for precious metals. Dr Copper (+0.9%), like oil today, is not indicating that a recession is coming as it, too, rose 7% last week and is higher by 15% YTD. Again, there is a lot of noise to get through to find the signal.

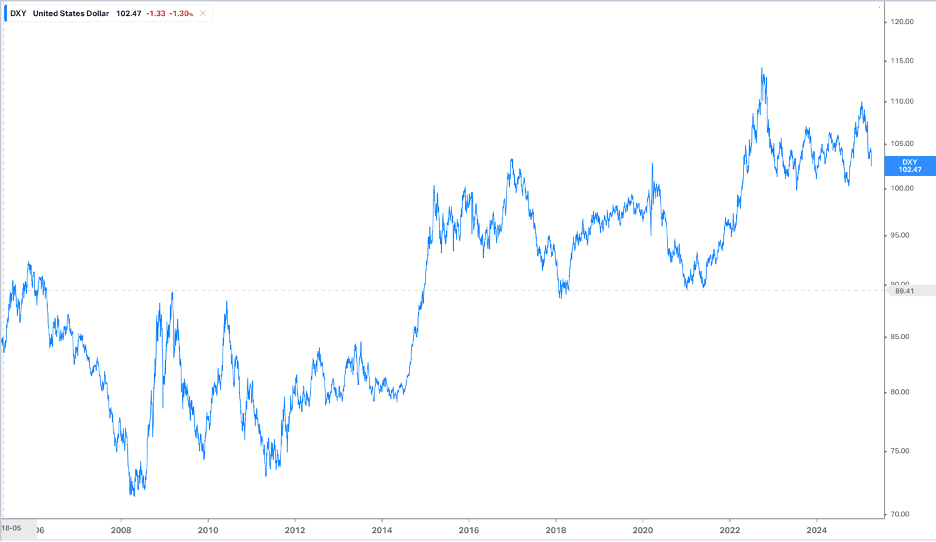

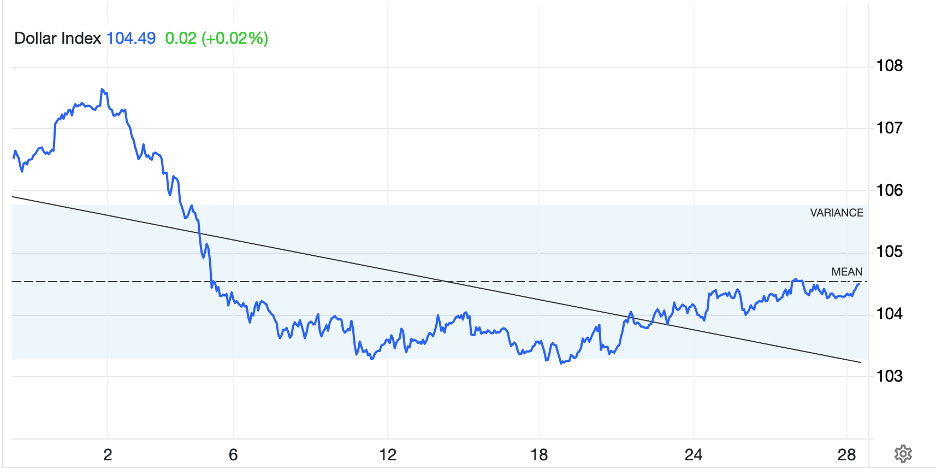

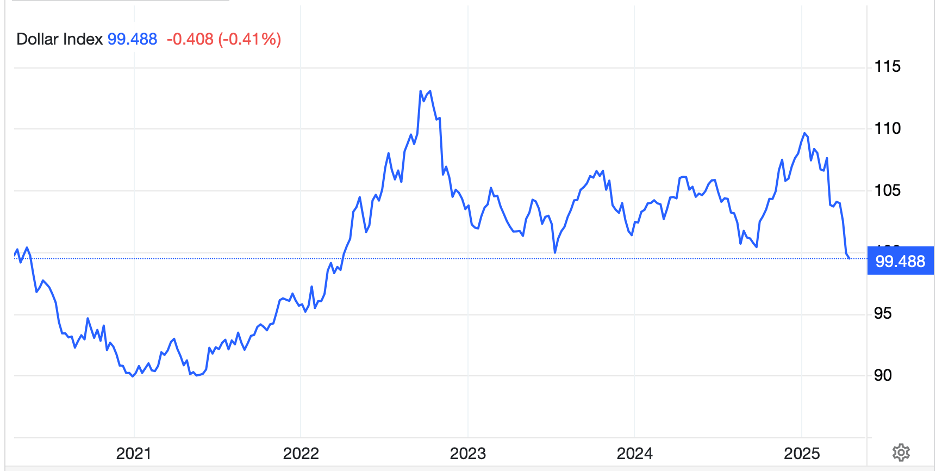

Finally, the dollar, is lower again today and is back at levels last seen…in September 2024. And before that in July 2023 and March 2022. In fact, if you look at the chart of the DXY below, I challenge you to show me that this decline was more dramatic than any of the three other major declines we have lived through in the past 3 years.

Source: tradingeconomics.com

Net the dollar has declined by about 10% since its recent peak in February, not insubstantial, but not unprecedented by any stretch. In fact, over the long-term, the dollar is within spitting distance of its long-term average, which as measured by the DXY is about 104. Looking at individual currencies, there is a strange grouping of currencies that have fallen vs. the greenback this morning, BRL (-0.85%), TRY (-0.5%), CHF (-0.5%) and CNY (-0.4%). Given the pause in tariffs on Chinese electronic goods, CNY is confusing, as is CHF, which might imply havens are out of favor (but then why is JPY stronger?). TRY is its own case and BRL is quite confusing. Commodity prices have held their own or risen lately, and BRL is nothing, if not a commodity currency. I need to search further here. Perhaps we are seeing some carry trades being unwound.

I apologize as once again my Monday missive has grown too long for comfort. I will highlight the data tomorrow with Retail Sales on Wednesday as the most important data release this week and the BOC and ECB meetings on Wednesday and Thursday respectively with the market looking for no change and a 25bp cut respectively.

The world is a messy place right now, with armed conflict now being joined by economic conflict. Opinions are hardening along political lines, and I don’t see how this changes in the short run. If you are managing risk, maintain your hedges, even if they seem expensive. There are too many opportunities for large movements that can be costly.

Good luck

Adf