In France, Monsiuer Bayrou is out

In Norway, though, Labor held stout

Japan’s been discussed

And Starmer’s soon Trussed

In governments, voters have doubt

Investors, though, see all this news

And none of them have changed their views

Just one thing they heed

And that’s market greed

At some point they’ll all sing the blues

Here we are on Wednesday and already we have seen two major (Japan and France) and one minor (Nepal) nations make governmental changes. Actually, they haven’t really changed yet, they just defenestrated the PM and now need to figure out what to do next. In Japan, it appears there are two key candidates vying to lead a minority LDP government, Sanae Takaichi and Shinjiro Koizumi, although at this point it appears too close to call. Regardless, it will be rough sledding for whoever wins the seat as the underlying problems that undermined Ishiba-san remain.

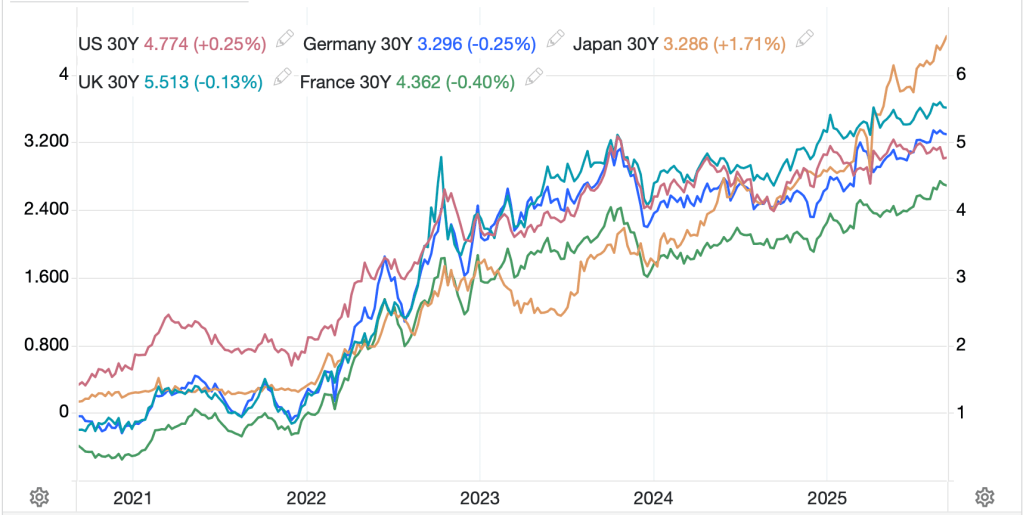

In France, President Macron has, so far, said he will not call for new elections, nor will he resign despite increasing pressure from both the left and the right for both measures. He will appoint a new PM this week and they will go through this process yet again as the underlying issue, how to rein in spending and reduce the budget deficit, remains with nobody willing to make the hard decisions. A side note here is that French 10-year OATs now trade at the same level as Italian 10-year BTPs, a catastrophic decline over the past 15 years as per the below chart.

Recall, during the Eurozone crisis in 2011, Italy was perceived as the second worst situation after Greece in the PIGS, while France was grouped with Germany as hale and hearty. Oh, how the mighty have fallen.

Nepal is clearly too insignificant from a global macroeconomic perspective to matter, but it strikes me that the fall of the PM there is merely in line with the growing unhappiness of populations around the world with their respective governments.

A friend of mine, Josh Myers, who writes a very thoughtful Substack published last night and it is well worth the read. He makes the point that the Washington Consensus, which has since the 1980’s, underpinned essentially all G10 activity and focused on privatization of assets, free trade and liberalized financial systems, appears to have come to the end of the road. I think this is an excellent observation and fits well with my thesis that the consensus views of appropriate policies are falling apart. Too many people have been left behind as both income and wealth inequality in the G10 is rampant, and those who have fallen behind are now angry enough to make themselves heard.

This is why we see governments fall. It is why nationalist parties are gaining strength around the world as they focus on their own citizens rather than a global concept. And it is why those governments still in power are desperately struggling to prevent their opponents from being able to speak. This is the genesis of the restrictions on speech that are now rampant in Germany and the UK, two nations whose governments are under extreme pressure because of policy failures, but don’t want to give up the reins of power and are trying to prevent anybody from saying anything bad about them, thus literally jailing those who do!

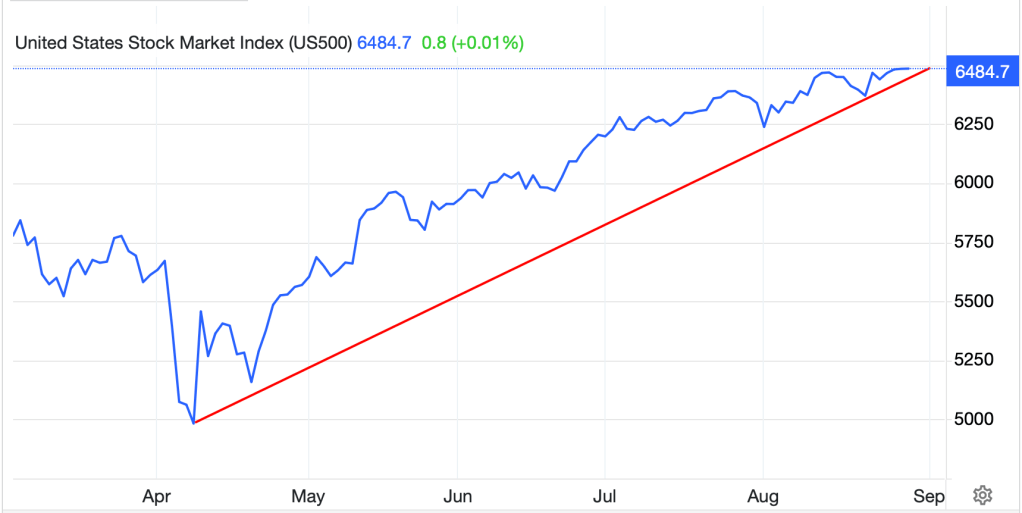

And yet…investors are sanguine about it all! At least that seems to be the case on the surface as equity indices around the world continue to trade higher with most major equity markets at or within a few percent of all-time highs. This seems like misplaced confidence to me as the one thing I consistently read is that markets are performing well in anticipation of the FOMC cutting Fed funds next week, with hopes growing that it will be a 50bp cut.

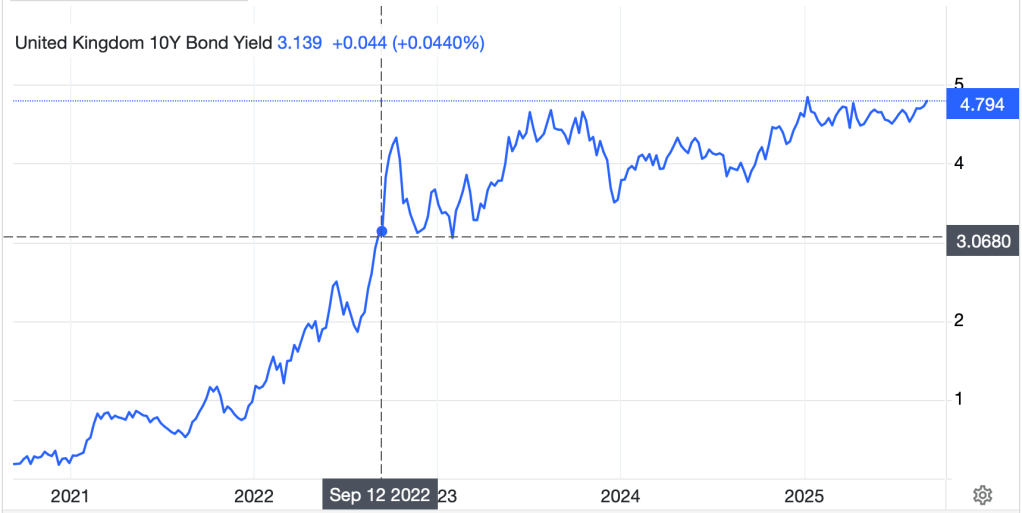

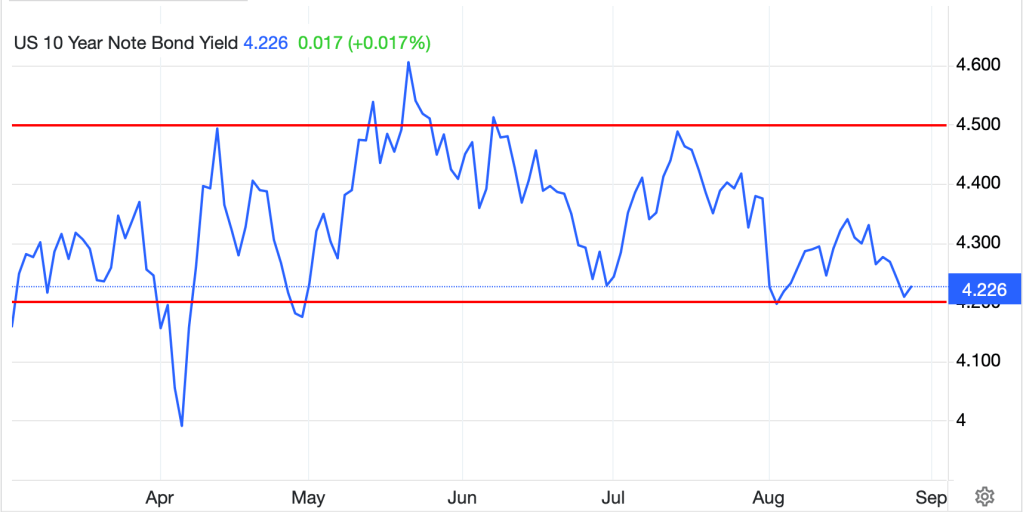

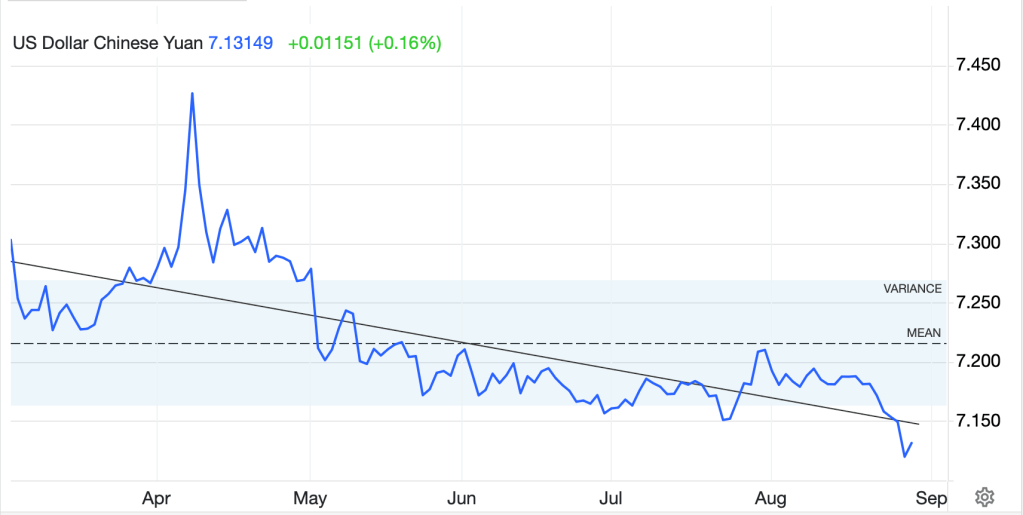

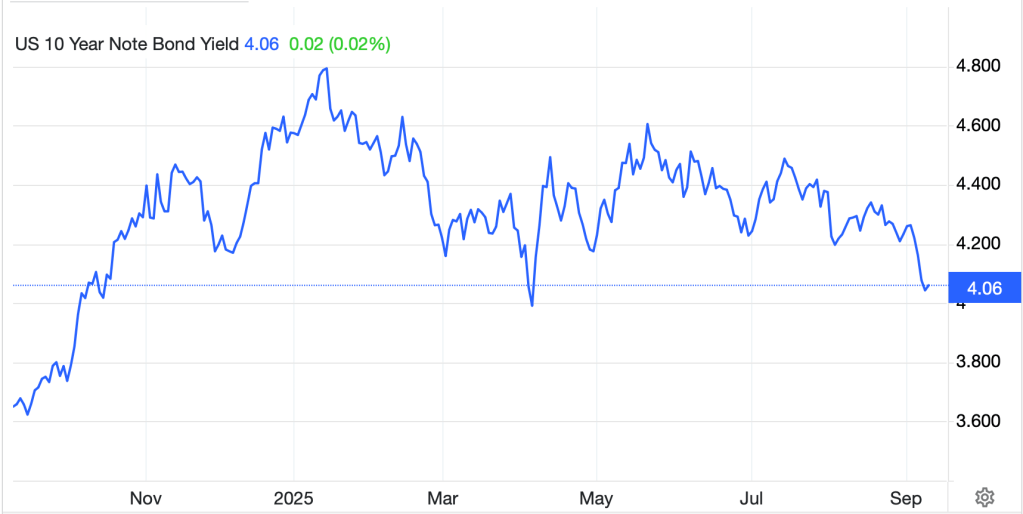

But if we look at the Treasury market, which has seen yields slide steadily since the beginning of the year, with 10-year yields now lower by 75bps since President Trump’s inauguration, it is difficult to square that circle.

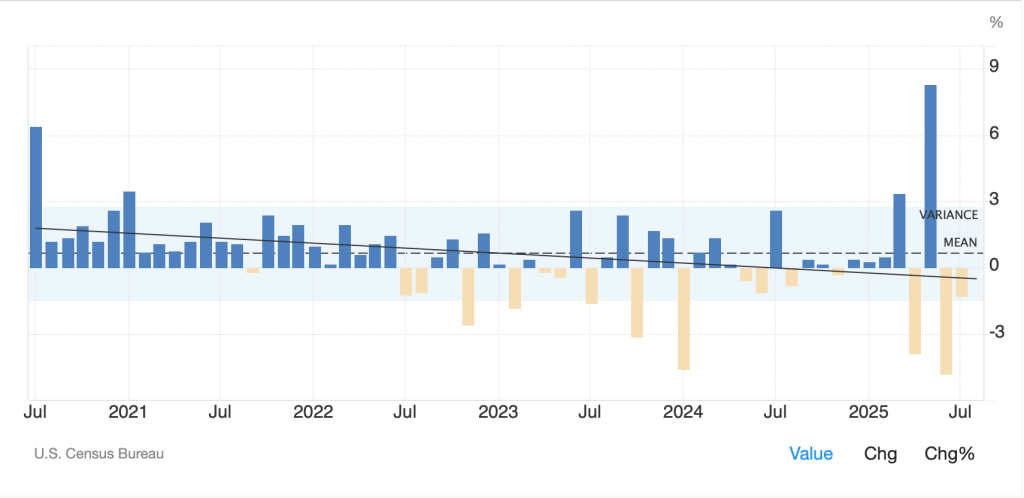

Source: tradingeconomics.com

Bond yields typically rise and fall based on two things, expected inflation and expected growth as those two have been conflated in investor (and economist) minds for a while. The upshot is if yields are declining steadily, as they have been, it implies investors see slowing economic activity which will lead to lower inflation. Now, if economic activity is set to slow, it strikes me that will not help corporate profitability, and in fact, has the potential to exacerbate the situation by forcing layoffs, reducing economic activity further. Alas, it is not clear if that will drive inflation lower in any meaningful way. The point is the bond market and the stock market are looking at the same data and seeing very different future outcomes.

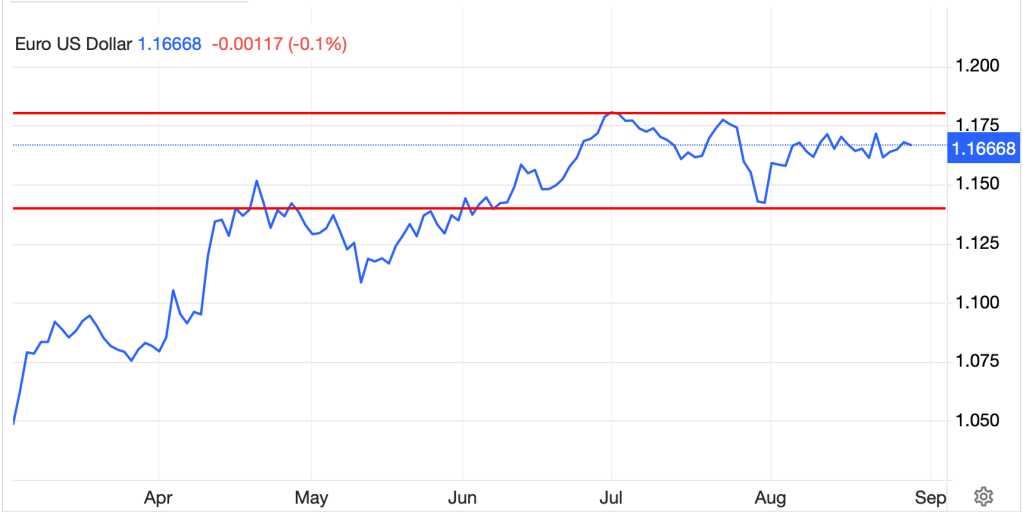

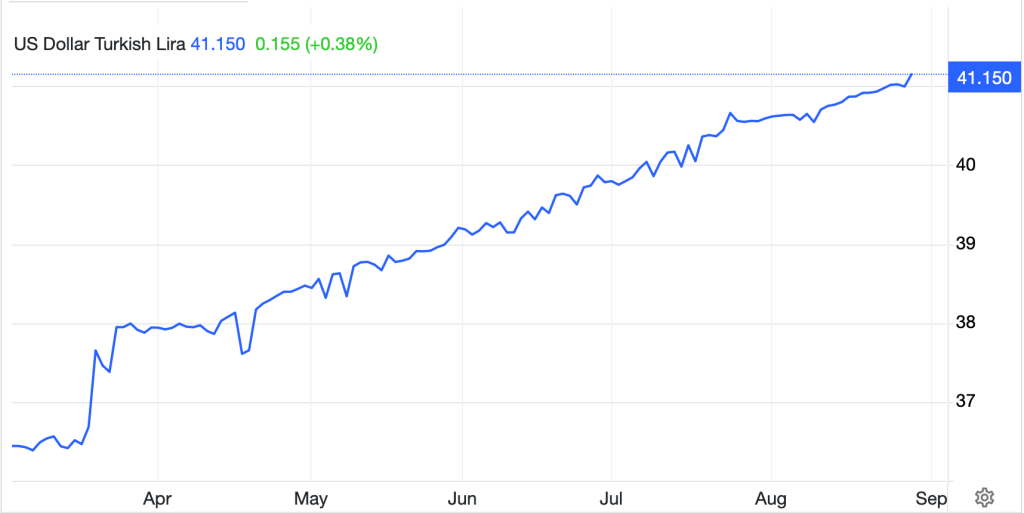

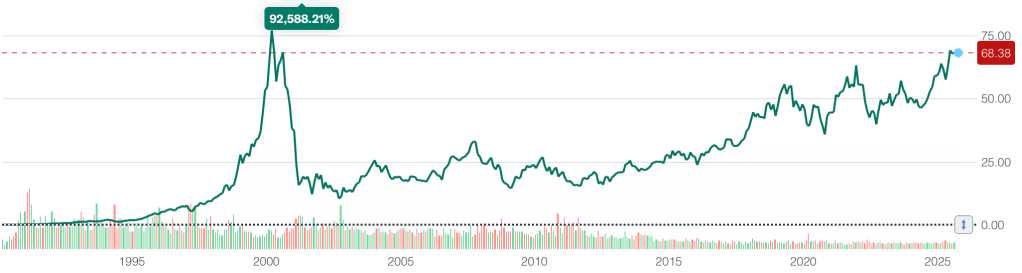

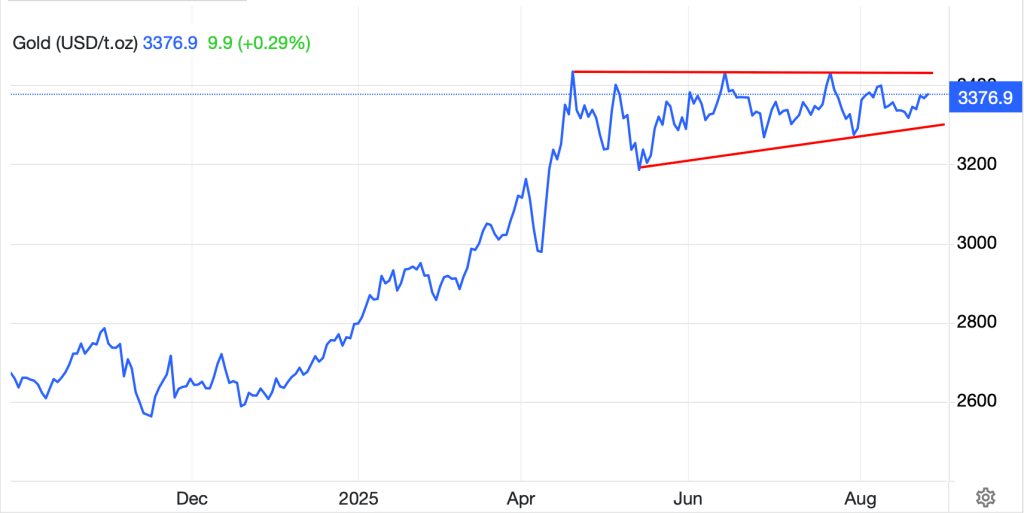

Is there a tiebreaker we can use here? The FX market might be one place, but the weakness in this idea is that FX rates are relative rates, not descriptive of the global economy. Sure, historically the dollar has been the ultimate safe haven with funds flowing there when things got rough economically, but its recent weakness does not foretell that particular story. Which brings us to the only other asset class around, commodities. And the one thing we have seen lately is commodity prices continuously rising, or at least metals prices doing so, specifically gold. Several millennia of history showing gold to be the one true store of value is not easily forgotten, and that is why the barbarous relic has rallied 39% so far in 2025.

A number of analysts have likened the current situation to that of Wile E Coyote and I understand the idea. It certainly is a potential outcome so beware.

Well, once again I have taken much time so this will be the lightning round. Starting with bonds, this morning, yields in the US and Europe are higher by 2bps across the board, with one exception, France which has seen yields rise 6bps as discussed above. JGB yields are unchanged as it appears investors there don’t know what to think yet and are awaiting the new PM decision.

In equities, yesterday’s very modest late rallies in the US were followed by a mixed session in Asia (Japan -0.4%, China -0.7%, HK +1.2%) although there were more winners (Korea, India, Taiwan, Thailand) than laggards (Australia, New Zealand, Indonesia) elsewhere in the region. In Europe, mixed is also the proper adjective with the CAC (+0.4%) remarkably leading the way higher despite lousy IP data (-1.1%) while Germany (-0.4%) and Spain (-0.4%) both lag. As to US futures, at this hour (7:20) they are marginally higher, 0.15% or so.

Oil (+0.8%) continues to trade back and forth each day with no direction for now. I’m sure something will change the situation here, but I have no idea what it will be. Gold (+0.5%) meanwhile goes from strength to strength and is sitting at yet another new all-time high, above $3600/oz. While silver and copper are little changed this morning, the one thing that seems clear is there is no shortage of demand for gold.

Finally, the dollar is arguably slightly lower this morning, although mixed may be a better description. The euro (-0.15%) is lagging but JPY (+0.6%) is the strongest currency across both G10 and EMG blocs. Otherwise, it is largely +/-0.2% or less as traders ponder the data.

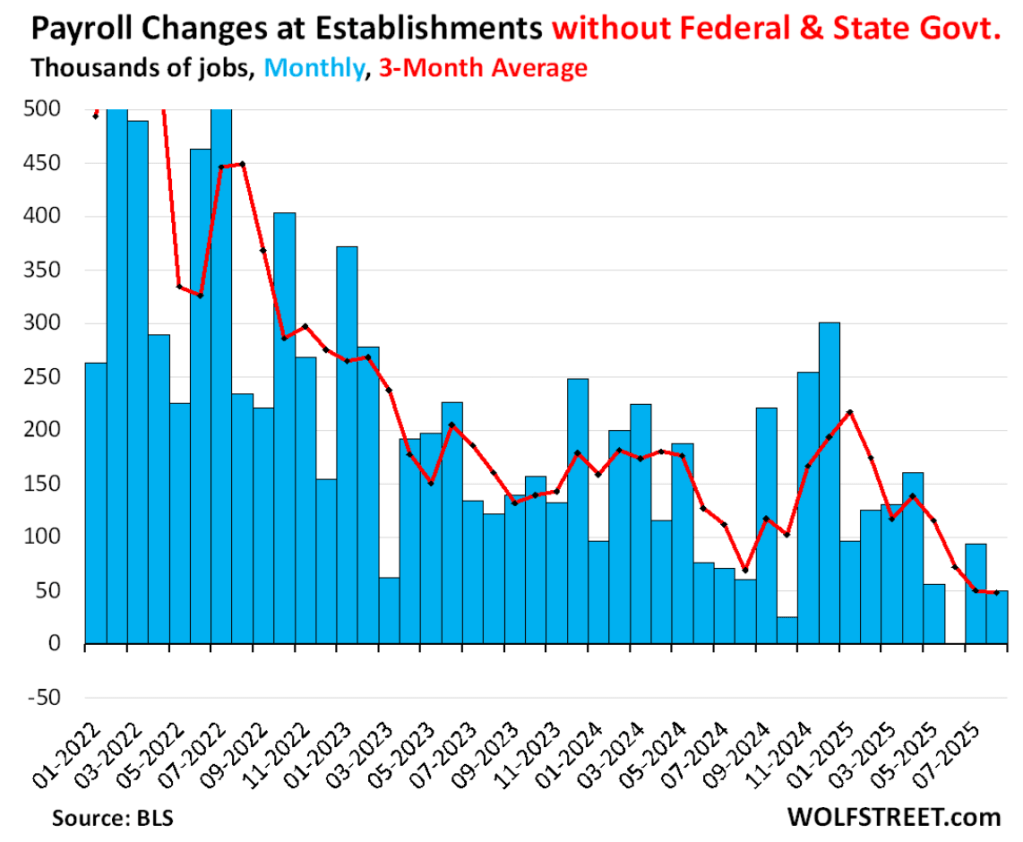

While CPI is released on Thursday, I think this morning’s NFP revision is likely to be the most impactful number we see this week, and truly, ahead of the FOMC next week.

| Today | NFP Revision | -500K to -950K |

| Wednesday | PPI | 0.3% (3.3% Y/Y) |

| -ex food & energy | 0.3% (3.5% Y/Y) | |

| Thursday | ECB Rate Decision | 2.0% (unchanged) |

| CPI | 0.3% (2.9% Y/Y) | |

| -ex food & energy | 0.3% (3.1% Y/Y) | |

| Initial Claims | 235K | |

| Continuing Claims | 1950K | |

| Friday | Michigan Sentiment | 58.0 |

Source: tradingeconomics.com

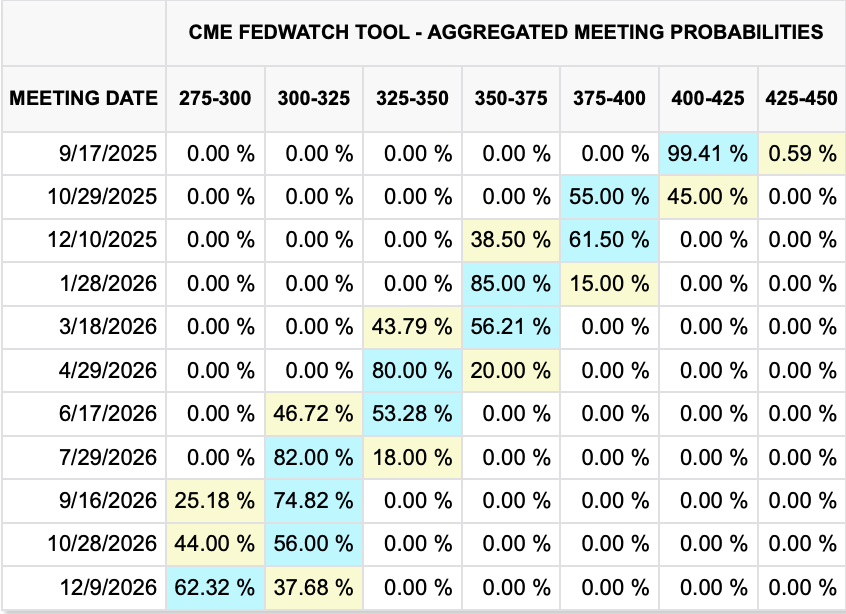

As I type, the Fed funds futures market is pricing a 12% probability of a 50bp cut next week and an 80% chance of 75bps this year.

Source: cmegroup.com

If the NFP revisions are more than -500K, I suspect that rate cut probabilities will rise sharply with the dollar falling, gold rising, and bond yields heading lower as well. Equity markets will probably rally initially, although it strikes me that this type of bad news will not help corporate earnings. So, buckle up for the fun this morning on a release that has historically been ignored but is now clearly center stage.

Good luck

Adf