(With apologies to Henry Wadsworth Longfellow)

Listen my children and you shall hear

Of the twists and turns to come this year

Let’s look through to Christmas time, Ought Twenty-Five

At which point, I trust, we’re all still alive

To learn what’s robust, and what is austere

To start out this tale, the ‘conomy’s first

Will Trump bring us growth or disaster?

The former, my friends, percent three at worst

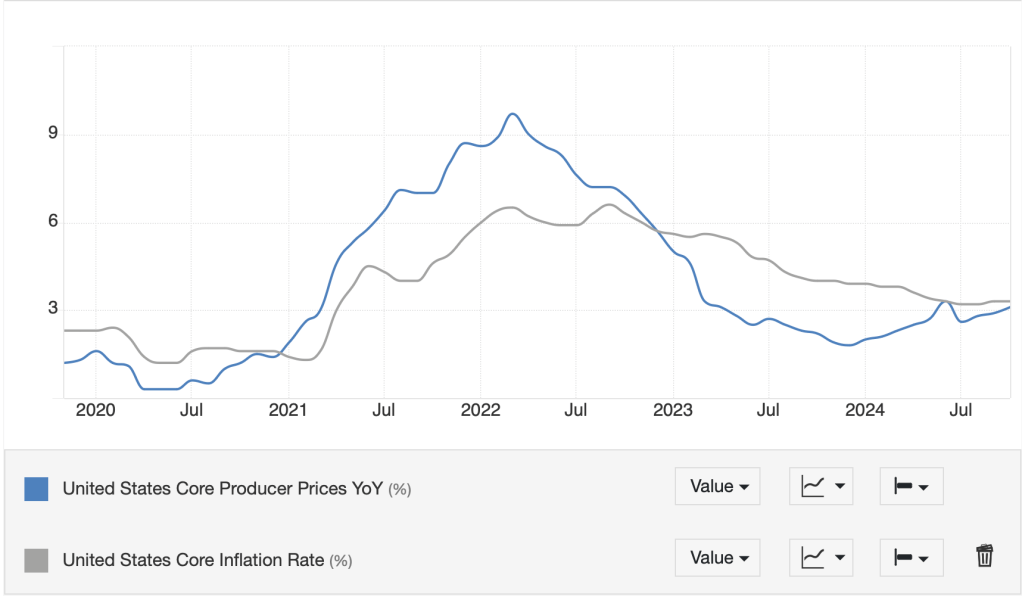

Though inflation will start rising faster

In fact, by year end, alas you will find

That prices have risen, instead of declined

Perhaps four percent, or just less

For Powell, t’will be quite a mess

At least, as of now, that’s my very best guess

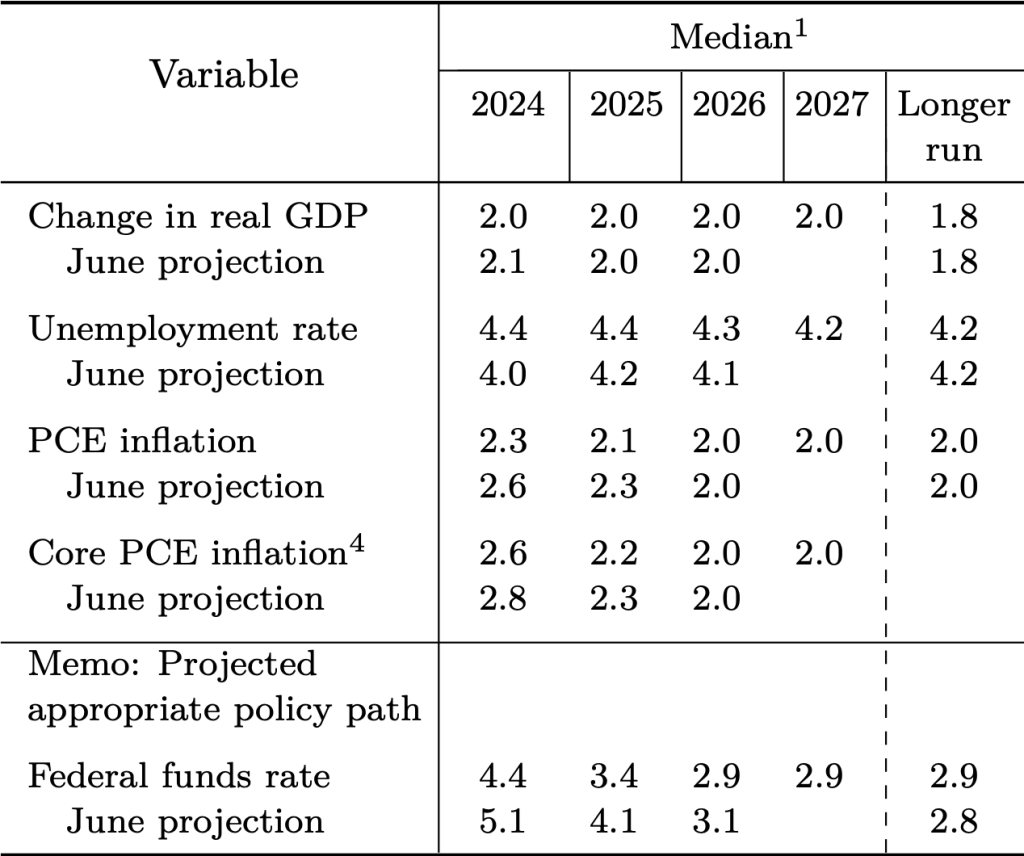

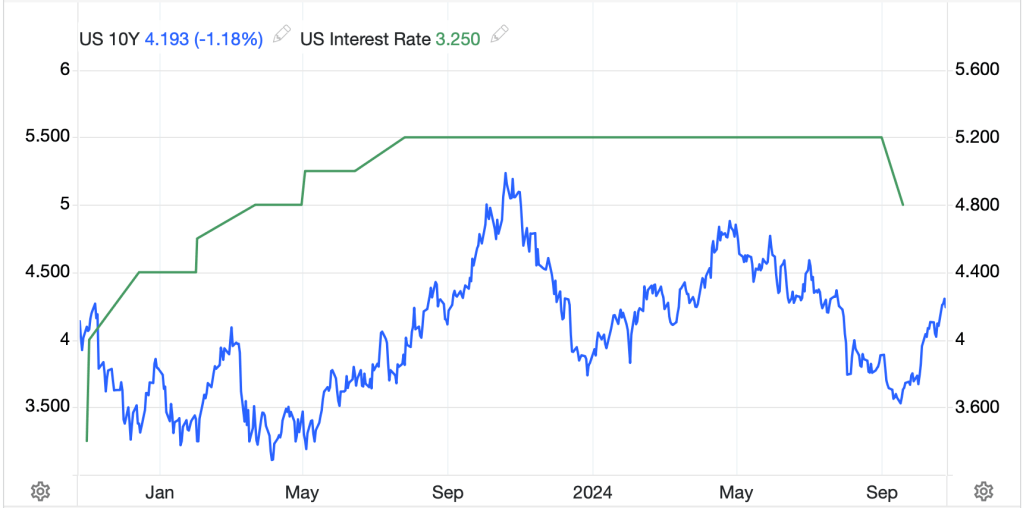

With this for context, let’s turn now to rates

A subject, on which, we’ve many debates

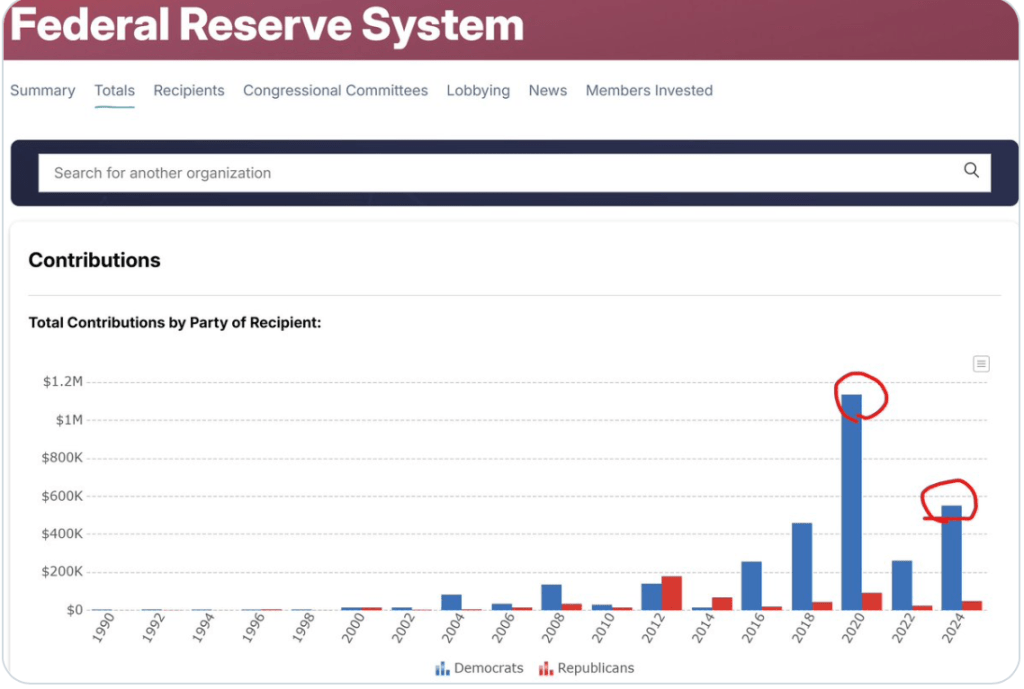

The Chairman wants to keep cutting

But that window appears to be shutting

As he’s hemmed in by those dual mandates

In fact, ere this year comes to a close

As neither growth nor inflation slows

The Fed will turn tail and be forced to raise

Fed funds, a result that’s sure to amaze

Through summer, before those hikes arrive

Prices for bonds will keep falling

Investors will start caterwauling

As yields climb to levels not lately seen

Think 10-year’s a half-point o’er five

And 30’s at six percent, stalling

With calls that Chair Jay intervene

Come solstice, yields will have reached their peak

Then Powell and friends will respond

At which point you’ll want to buy the bond

As we are overwhelmed by Fedspeak

Inflation will once again be Job One

And Powell, this mandate, will not shun

So, Fed funds will start to be raised

And Powell, by hawks, will be praised

But President Trump will be miffed

And his response will be sure and swift

With Tweets, many see as half-crazed

As rates and yields rise, what, now, of stocks?

How will they fare in this brave new world?

Seems likely sectors will be swirled

Industrials healthy, tech with a pox

Thus, indices, pressure will feel

As FOMOers soon start to squeal

This is one move they’ll want to miss out

Although I don’t foresee a great rout

Investors will then face a true paradox

Do rates matter more or growth, for stocks?

And will foreigners all lose their zeal?

Come year end, the Dow is likely to drift

Toward 40K in a modest downshift

Though Tech is another story

With the Q’s at four hunge, pretty gory.

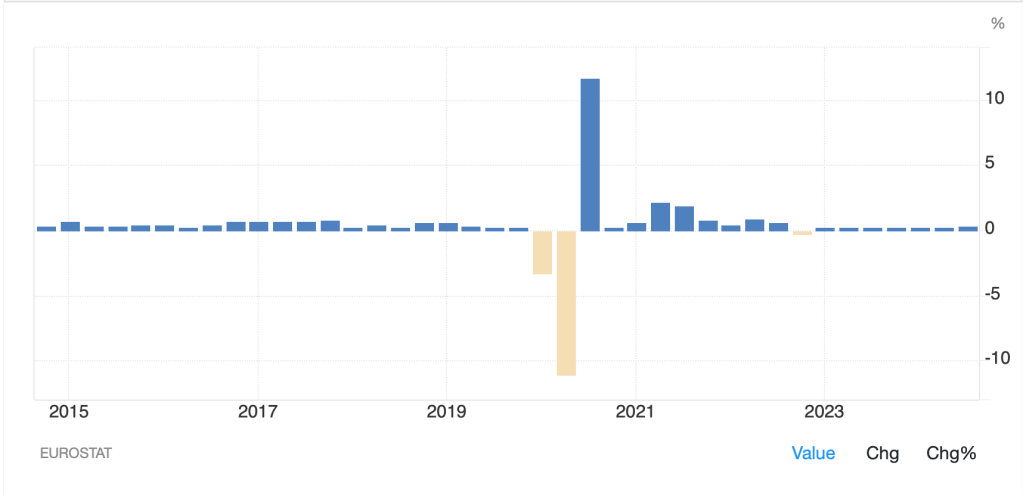

Attention, now must, to Europe we turn

A region, which lately’s been a concern

Governments falling and growth, oh so weak

This is a place investors will spurn

As profits, returns and value they seek

The ECB mandate, inflation alone

Will suffer as weaker growth they bemoan

Thus Madame Lagarde, much further will cut

Which leads to a case, quite open and shut

As interest rates slide, back to, Percent, One

The euro, itself will, too, come undone

‘ Neath Parity when, December, we look

The euro will trade, as it’s been forsook

And don’t be surprised if Sterling, as well

Falls down to One-Ten, by hook or by crook

As Starmer and Labor face a death knell

In China, though Xi is certain to try

His best to attain real 5% growth

When push comes to shove hist’ry shows he’s been loath

To help demand rather than add to supply

And adding to troubles, a falling birthrate

Is just one more thing that will, Xi, frustrate

As such, come December, a Yuan below Eight

Is likely with further rate cuts coming nigh

Japan is our next discussion to nourish

Ishiba is anxious for growth there to flourish

As such, raising rates is highly unlikely

His bet will be paychecks are greater than ‘flation

If not, he will be condemned to damnation

And soon lose his job, on that we agree

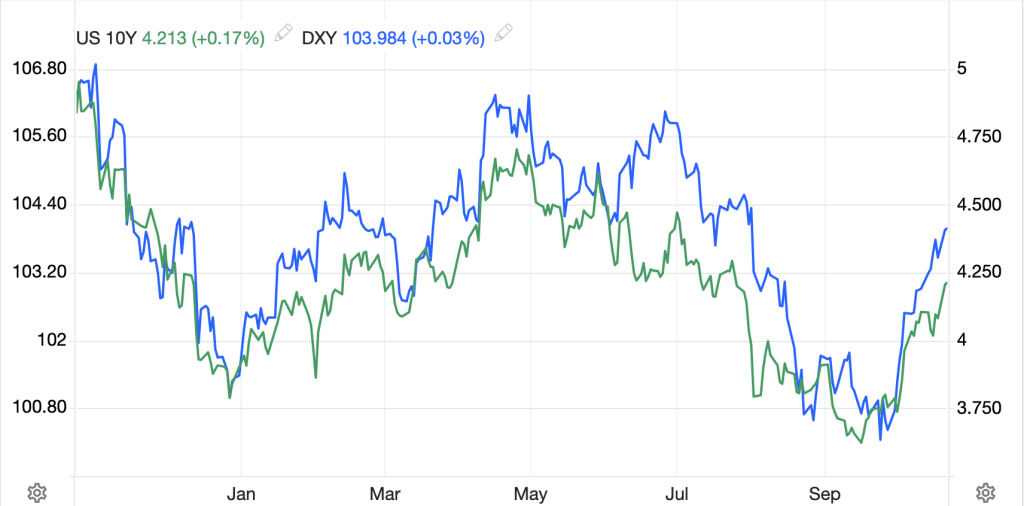

The upshot for FX seems clear

The yen will struggle to find support

And so, come the end of the year

We’ll see levels not seen in decades

One Seventy’s likely where it trades

As yen’s weakness, Ueda can’t thwart

Let us turn now to EMG

Whose moneys all tumbled throughout Twenty-Four

When looking ahead I foresee

Troubles ahead, though perhaps not as bad

As last year’s distress, though still quite sad

Ten percent falls or more, you’d agree

Are signals investors, these moneys, deplore

Let us start south of the border

Where last year, pesos fell 20%

For Ms. Scheinbaum t’will be a tall order

To soothe Donald Trump and maintain her smile

When fighting inflation all the while

As Banxico, last year’s hikes do augment

This won’t be enough to arrest its fall

Though it won’t fall to Covid lows

Next winter we’ll all be in thrall

When Twenty-Three on your screen shows

And finally, Brazil, the land of the Samba

Is likely to see its currency bomb-a

Inflation has bottomed, and is rising

While Lula has nought enterprising

The central bank, rates, will certainly raise

But t’wont be enough, the real to praise

Come Christmas, the real, to Seven will jump

Though that is no way to make friends with Trump

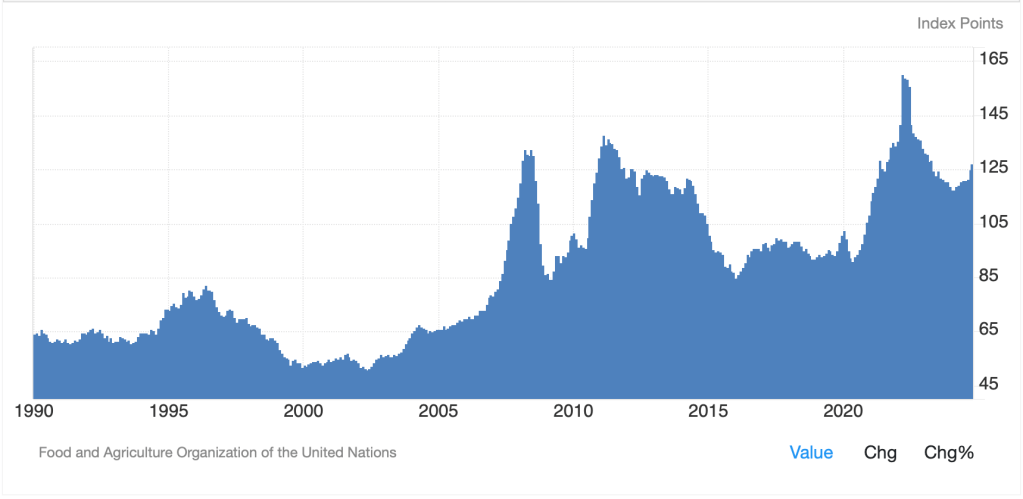

These forecasts rely on the Fed

Adjusting their story as prices won’t sink

But if Powell cuts, we must rethink

‘Cause things will be very different ahead

The dollar will suffer, commodities soar

Investors, T-bonds, will say issue no more

While stocks will rise sharply, say Dow 50K

But truly, that strikes me as widely astray

In sum, please remember that I’m just one man

And though I attempt to weave a strong thread

Oft times things don’t go according to plan

Dear readers, I hope, that I’ve not misled

For all of you who have stuck with me through the gyrations past, and perhaps will do so for the gyrations future, thank you for giving me your time and consideration.

I truly appreciate your thoughts and feedback on each and every note.

Have a very happy and prosperous 2025

Adf