The Turning is coming much faster

Than forecast by every forecaster

Now Syria’s fallen

And pundits are all in

Iran will soon be a disaster

However, the impact on trading

Is naught, with no pundits persuading

Investors to sell

As all goes to hell

Is narrative power now fading?

The suddenness of the collapse of Bashar Al-Assad’s control of Syria was stunning, essentially happening in on week, maybe less. But it has happened, and it appears that there are going to be long-running ramifications from this event. At the very least, the Middle East power structure has changed dramatically as Russia and Iran both abandoned someone who had been a key ally in their networks. Russia is clearly otherwise occupied and did not have the wherewithal to help Assad, but it is certainly more interesting that Iran did not step up. Rumors are that the government there is growing concerned that an uprising is coming that may change the Middle East even more dramatically.

I have previously discussed the idea of the Fourth Turning when events arise that shake up the status quo, and this is proof positive that Messrs. Howe and Strauss were onto something when they published their book back in 1997. The thing is, even those who believed the idea and did their homework on the timing of events have been caught out by the speed of recent activities. Most of the punditry in this camp, present poet included, didn’t expect things to become unruly until much closer to the end of the decade. And maybe it will be the case that the collapse of Syria is just an appetizer to a much larger conflagration. (I sincerely hope not!). But my take is these events were not on many bingo cards, certainly not in the financial punditry world.

Now, the humanitarian situation in Syria has been a disaster for the past 13 years, ever since the civil war there really took shape and fomented the European migration crisis. Alas, it seems likely to worsen for the unfortunate souls who still live there. But for our purposes, the question at hand is will this have an impact on markets?

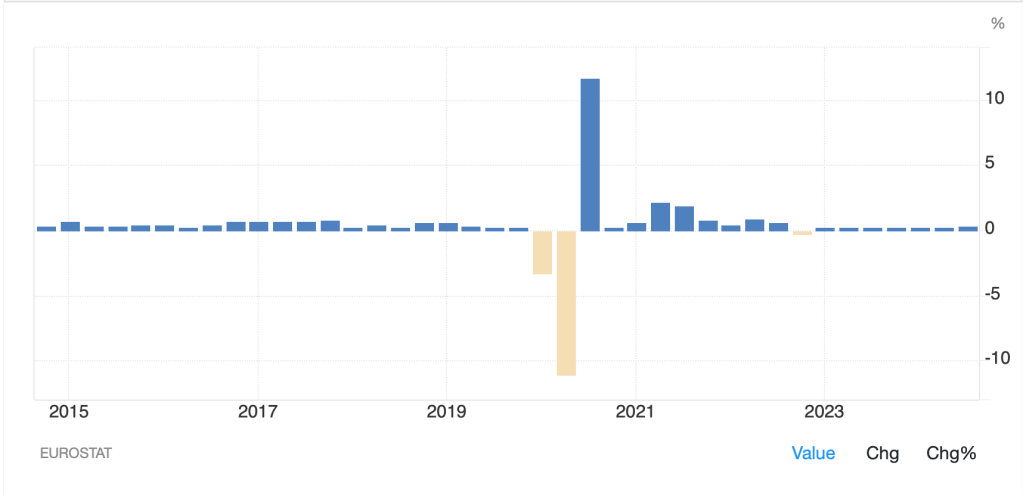

Interestingly, the answer, so far, is none whatsoever. The obvious first concern would be in oil markets given the proximity to the major oil producing regions in that part of the world. However, while oil (+1.4%) is a bit higher this morning, it remains well below $70/bbl and while I am no technical analyst, certainly appears to be well within a downtrend as per the below chart.

Source: tradingeconomics.com

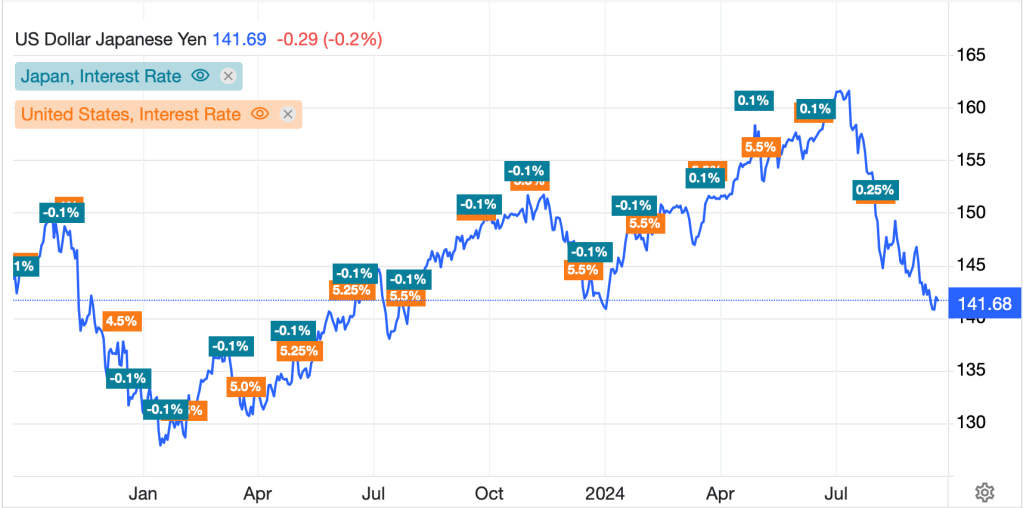

Next on our list would be the FX markets, perhaps with expectations that haven currencies would be in demand. Yet, the dollar is sliding against most of its counterparts this morning, with the notable exception of the yen (-0.3%) which is the one currency under more pressure. That is the exact opposite behavior of a market that is demonstrating concern over future disruptions. As to securities markets, they are much further removed from the situation and while US futures are edging lower at this hour (6:20), slipping about -0.15%, overnight activity showed no major concerns and European bourses are mixed, but all within 0.3% of Friday’s closing levels.

Finally, bond markets are essentially unchanged this morning, with Treasury yields higher by 1bp and European sovereigns almost all unchanged on the day. We did see yields slip a few bps in Asia, likely on the back of the weaker than forecast Chinese inflation data, but the bond market is certainly showing no signs of concern over the geopolitics of the moment.

On Sunday the Chinese did meet

And promised they’d finally complete

Their stimulus drive

And therefore revive

The growth that has been in retreat

A story that has had an impact on markets this morning is the Chinese Politburo’s comments that they are going to implement a “more proactive” fiscal policy in the upcoming year along with “moderately loose” monetary policy as President Xi scrambles to both improve the growth impulse and prepare for whatever President-elect Trump has in store for China once he is inaugurated. Now, we have heard these words before and to date, each effort has been, at the very least, disappointing, if not irrelevant. But hope is a trader’s constant companion and so once again we saw specific markets respond to the news.

Interestingly, mainland Chinese shares did not respond as enthusiastically as one might have expected with the CSI 300 actually slipping -0.2%. But the Hang Seng (+2.75%) embraced the news warmly. In the FX markets, early weakness in CNY was reversed although the renminbi closed the onshore session essentially unchanged on the day. The big winners were AUD (+0.9%) and NZD (+0.5%) as traders bid up the currencies of the two nations likely to benefit most given their export profiles of commodities to China. But beyond those market moves; it is hard to make a case that anyone was listening.

Ok, let’s look at the rest of the overnight session and see what we can anticipate in the week ahead. Japanese shares (Nikkei +0.2%) were little changed overnight while the big mover in Asia was Korea (-2.8%) as the ructions from the brief interlude of martial law last week continue to weigh on the short-term future of the government and economy there. However, away from those markets, the rest of Asia saw movement of just +/- 0.3% or less, hardly newsworthy. In Europe, the story is also mixed with the CAC (+0.5%) leading the way higher, perhaps on the back of the successful reopening of the Notre Dame cathedral, or more likely on the back of hopes that the luxury goods sector would improve based on Chinese stimulus supporting that economy. As to the rest of the continent, more laggards than winners but movement has been small, 0.2% or less, although the FTSE 100 (+0.4%) is also higher this morning led by the mining shares in the index, also related to Chinese stimulus.

We have already discussed the bond market, which has been extremely quiet ahead of this week’s CPI and next week’s FOMC meeting so let’s turn to the commodity markets, where not only is oil rallying, perhaps more related to China than the Middle East, but we are seeing metals markets rally as well with both precious (Au +0.9%, Ag +2.2%) and industrial (Cu +1.6%, Zn +2.0%) performing well. Surprisingly, aluminum (-0.25%) is not playing along this morning but if the China story is real, it should follow suit.

Finally, the rest of the currency story shows KRW (-0.5%) continuing to feel the pain, along with its stock market, from the politics last week. At the same time, we are seeing solid gains in ZAR (+1.1%) on the metals moves and NOK (+0.4%) on the back of oil’s rally. Elsewhere, while the dollar is broadly softer, it is of a much lesser magnitude, maybe 0.2% or so.

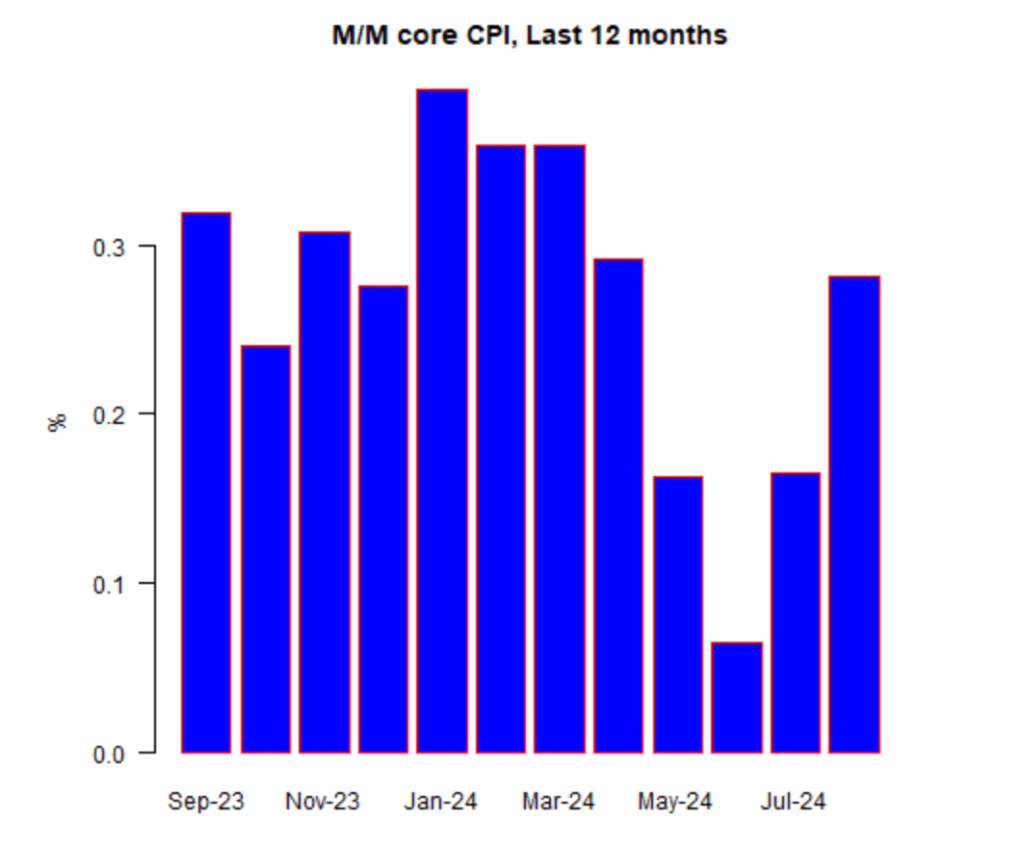

On the data front, this week brings two central banks (BOC and ECB) and a bunch of stuff, although CPI on Wednesday will be the most impactful.

| Tuesday | NFIB Small Biz Optimism | 94.2 |

| Nonfarm Productivity | 2.2% | |

| Unit Labor Costs | 1.9% | |

| Wednesday | CPI | 0.2% (2.7% Y/Y) |

| -ex food & energy | 0.3% (3.3% Y/Y) | |

| BOC Meeting | 3.25% (current 3.75%) | |

| Thursday | ECB meeting | 3.0% (current 3.25%) |

| Initial Claims | 220K | |

| Continuing Claims | 1870K | |

| PPI | 0.3% (2.6% Y/Y) | |

| -ex food & energy | 0.2% (3.3% Y/Y) |

Source: tradingeconomics.com

Last week saw what appeared to be stronger payroll data on the surface, with the NFP rising 227K and upward revisions, while the Unemployment Rate rose the expected 1 tick to 4.2%. As well, Average Hourly Earnings rose more than expected, to 4.0%. And yet, the Fed funds futures market raised the probability of a rate cut next week to 87% (it was over 90% for a while in the session). Now, there has been a group of analysts who have been claiming that the headline payroll data is very misleading and actually the jobs market is much weaker than the administration is portraying, and it seems they got a bit more traction in their case last week. Nonetheless, it is hard for me to look at the data and justify another rate cut by the Fed, at least if their objective is to push inflation back to 2.0%. Of course, that is another question entirely!

Mercifully, the Fed is in their quiet period so we will not hear from them until they pronounce things at the FOMC meeting a week from Wednesday. Until then, I expect that the China story, as well as assorted Trump related stories, will drive things although keep a wary eye on the Middle East for anything more explosive. As to the dollar, I have consistently explained that if the Fed eases in the face of rising inflation, that will undermine the greenback. It will be very interesting to see how things play out this week and next as a set-up for 2025. For now, I don’t see a good reason for a large move, but if I were a hedger, I would make sure that I am as hedged as I am allowed to be.

Good luck

Adf