On the horizon

The specter of BOJ

Intervention climbs

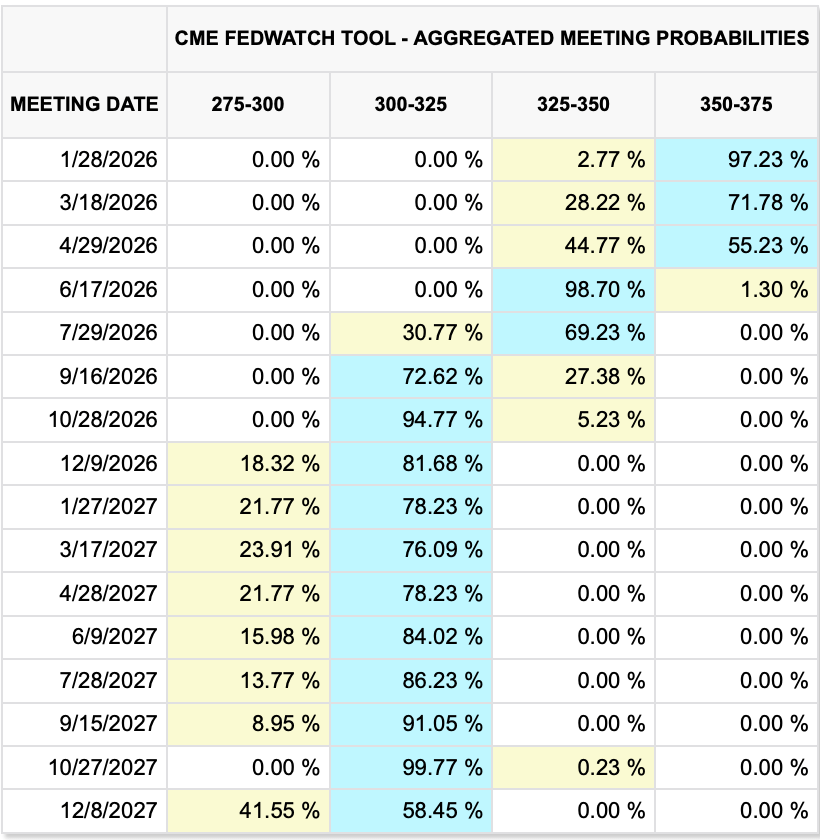

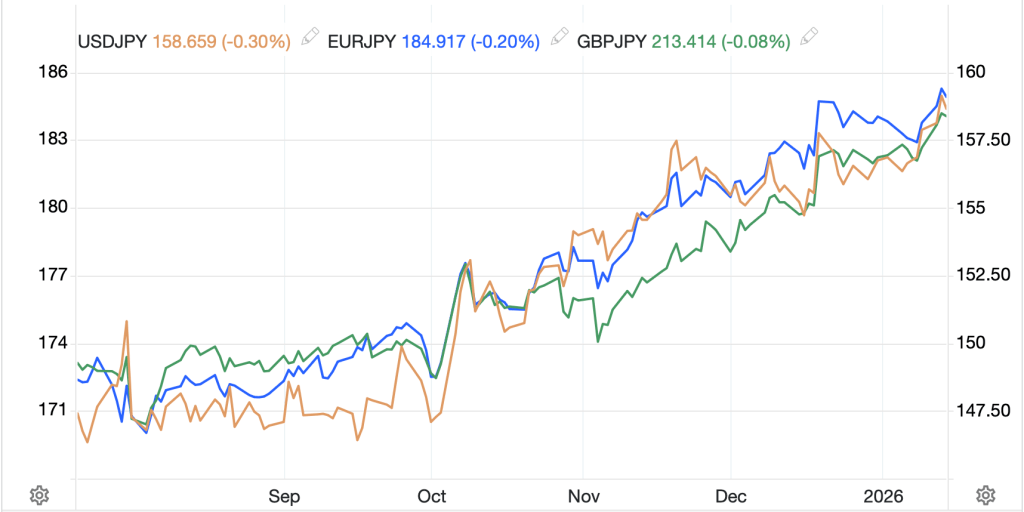

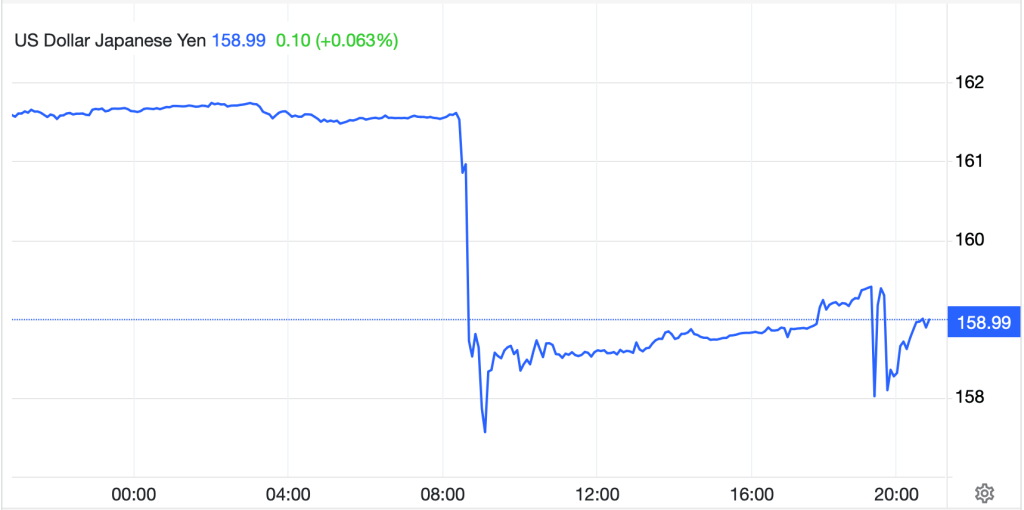

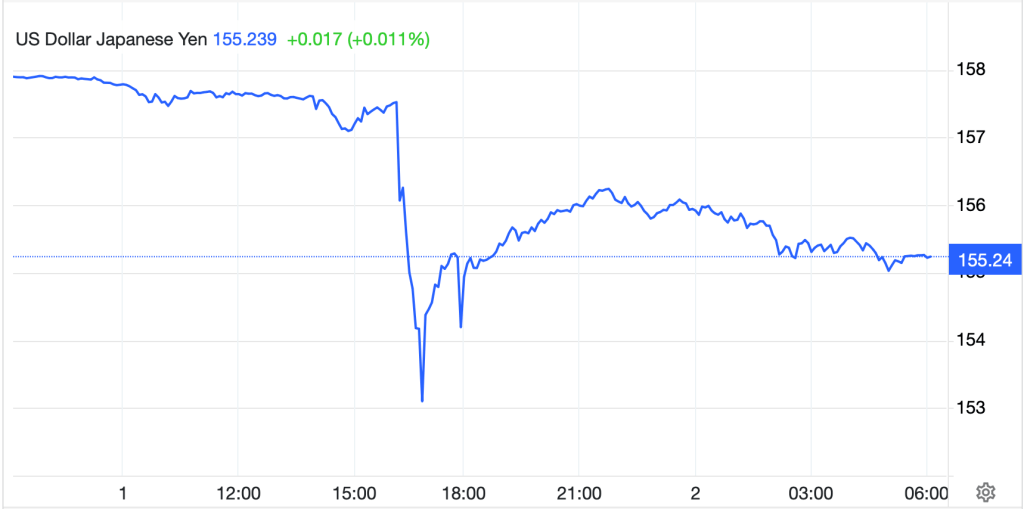

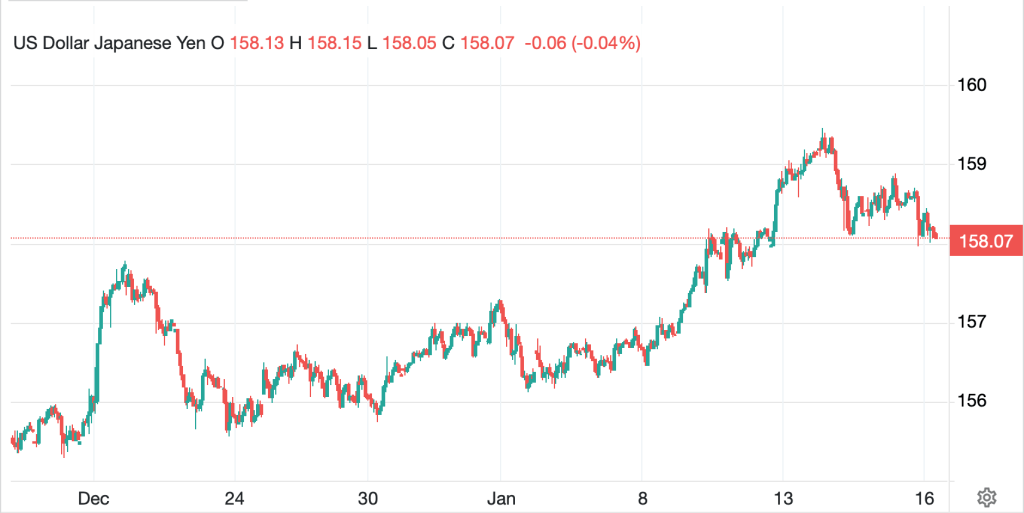

For those of you who don’t know, the genesis of this note was a daily update during my time covering US corporates for their FX hedging needs. The poetry was episodic… until it wasn’t. At any rate, this is the reason I sometimes harp on particular currencies rather than markets more generally. And right now, while the dollar, writ large, is not that interesting, as I have been explaining for months, the yen (+0.3%) is becoming interesting in its own right as its recent spate of weakness has opened the door to intervention. Last night, I would say we took a half-step forward on this journey as, while the BOJ did not check rates, FinMin Katayama was more explicit in her discussion about the yen’s weakness, even discussing the fact that the ‘agreement’ that her predecessor made with Treasury Secretary Bessent has no restrictions on intervention if deemed appropriate.

Following are her remarks from last evening, “We can take decisive measures against sudden movements that do not reflect fundamentals. This refers to intervention, and there are no constraints or restrictions on this. I have repeatedly stated that we will take bold action including all the different measures available. We shared the view that recent moves have been excessive and do not reflect fundamentals.” Then, she followed that up by referring back to her discussions with Bessent in Washington on Monday. “For many years before I took office, the Treasury secretary has held the personal view that monetary policy has been behind the curve.”

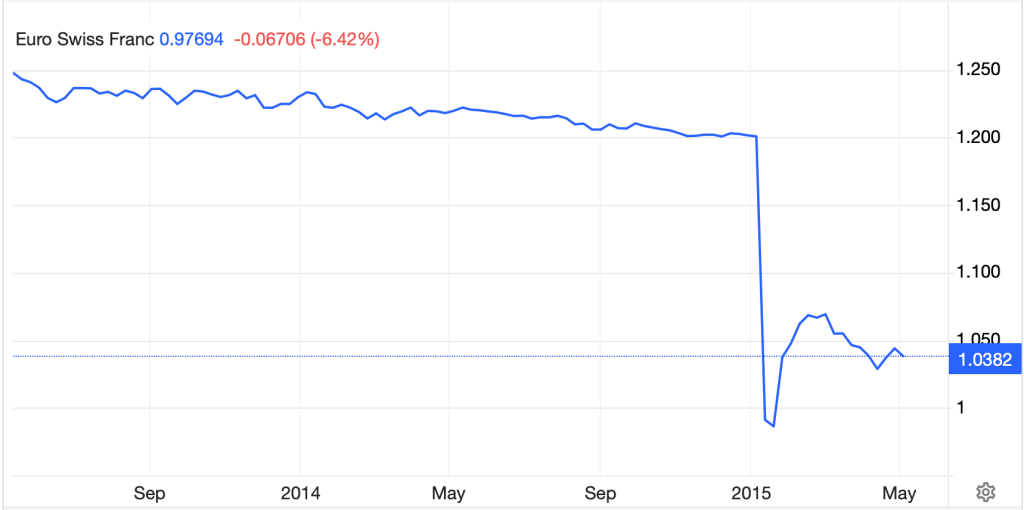

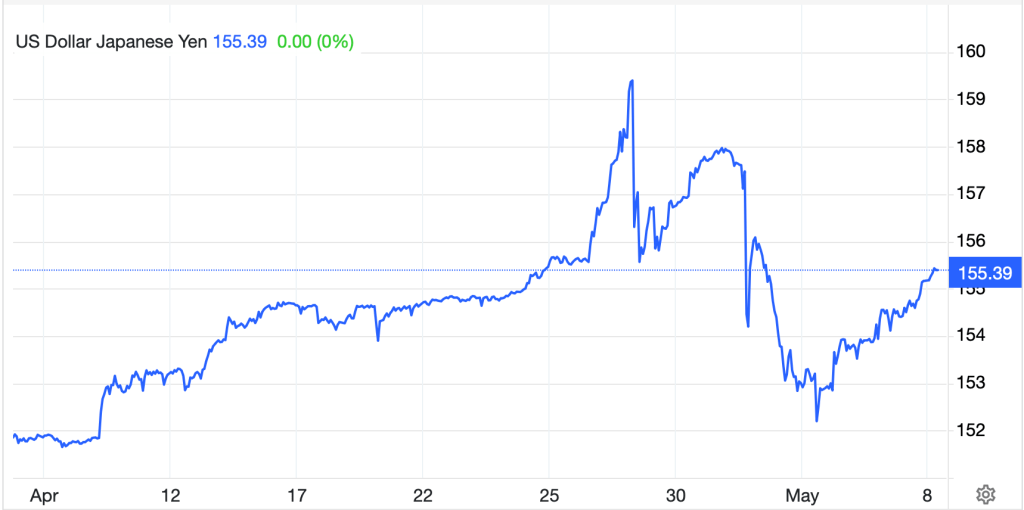

The chart below shows that for now, jawboning is the preferred measure to prevent further yen weakness, but as jawboning is only ever a temporary solution, it seems clear to me that there will be intervention at some point. In fact, given Monday is a bank holiday in the US, implying less liquidity as banks run skeleton staffs, that may be an ideal time to get the most bang for their buck.

Source: tradingeconomics.com

But remember, even if/when they intervene, the impact will only be temporary. Perhaps keeping a floor underneath the currency for a month or two. Ultimately, though, it will follow the fundamentals, and if those are such that the US continues to grow rapidly and receive investment flows, unless the BOJ raises rates dramatically to moderate those flows, the yen will ultimately weaken further. Now, ask yourself if you think the BOJ can raise rates aggressively given the combination of Japan’s 250% debt/GDP ratio and the fact that Takaichi-san’s policy mix is to borrow more and run things as hot as possible.

Away from the mess in Japan

A story of note is Iran

But tensions have waned

And thus, it’s explained

The oil complex can, down, stand

Looking elsewhere for news of note, there continues to be an enormous amount of energy focused on Minneapolis, which has no market impact. Remarkably, Venezuela has become an afterthought to the markets as the new narrative is their natural resources are not economically retrievable at current prices. Iran remains a hot topic in the oil market, but the concerns registered by traders early in the week have ebbed overall, although this morning, Texas tea is higher by 1.5% and back over $60/bbl.

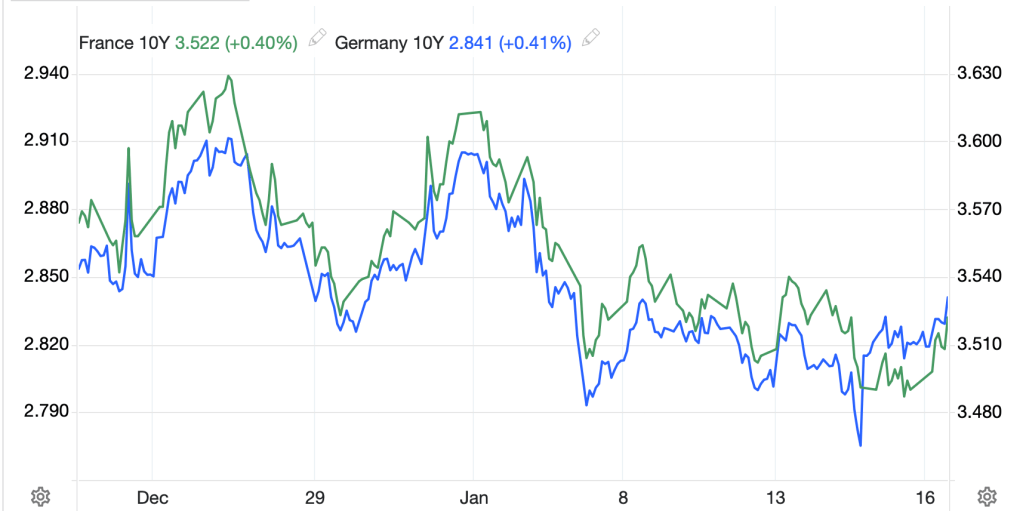

Looking at other markets, bonds remain somnolent, with yields up 1bp this morning, reversing yesterday’s decline of -1bp but still firmly within the 4.00% – 4.20% range. European sovereign yields have edged higher by 2bps this morning and overnight JGB yields rose 3bps. However, it remains difficult to see any significant pattern over the past month as evidenced by the chart below of French and German 10-year yields. Net movement has been a handful of basis points overall.

Source: tradingeconomics.com

Even the metals markets, which have been THE story for the past months, have calmed down a bit as they consolidate their recent remarkable gains. This morning, gold (-0.25%), silver (-2.1%), copper (-1.5%) and platinum (-3.2%) are all softer, but all remain higher on the week and over the past month, with silver having gained 37% since this time in December, and sitting above $90/oz.

Equity markets in the US rebounded yesterday, seemingly on some decent earnings data, but overnight, there was little love with Japan (-0.3%), China (-0.4%) and HK (-0.3%) all slipping from recent highs. Elsewhere in the region, though, there was much more positivity as Korea (+0.9%), India (+0.25%), and Taiwan (+1.9%) all rallied with the latter benefitting from the agreement of a trade deal with the US that cut tariffs on Taiwanese exports in exchange for a $250 billion commitment of investment into the US.

In Europe, France (-0.8%) is the laggard du jour as ongoing budget negotiations in the government are no closer to completion and showing signs of breaking down. As to the rest of the continent, modest declines are the order of the day while the UK is unchanged. US futures at this hour (7:40) are pointing higher, however, led by the NASDAQ at +0.7%.

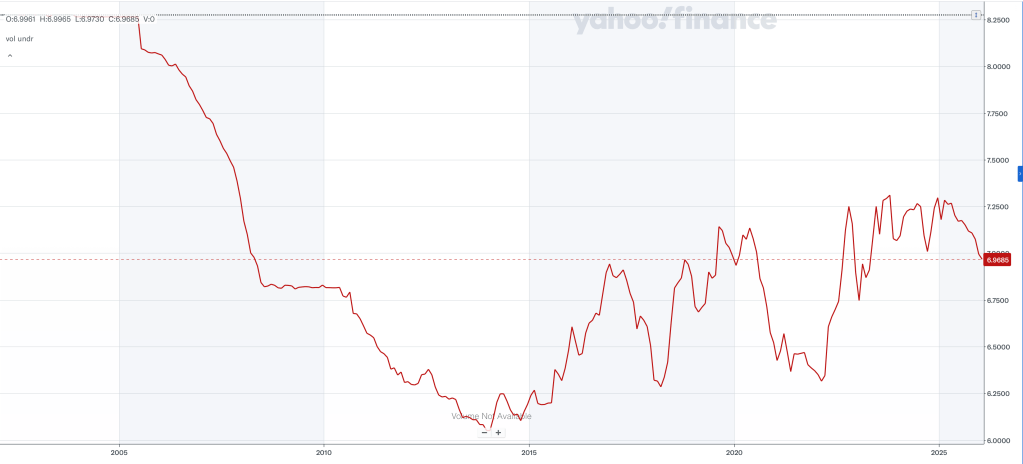

While overall, the dollar remains dull, an underreported story is the CNY (0.0% today) which has been appreciating steadily for the past year and is now at its strongest level since May 2023. In the beginning of the year my view was if Xi actually got Chinese consumers to raise their spending and back away from the mercantilism that has been the driver of the Chinese economy since the beginning, we would see CNY strength, calling for 6.50 by the end of the year. Well, a look at the chart below helps keep things in perspective as while CNY has appreciated about 5% in the past year, it remains far below (dollar higher) levels seen post pandemic. However, I need to see the data indicate Chinese domestic demand is growing before I become a true believer! Note, too, that the pace of this move is hardly remarkable.

Source: finance.yahoo.com

And that’s all I got today. Today’s data brings IP (exp 0.2%) and Capacity Utilization (76.0%) with a few more Fed speakers as well. Remarkably, despite the Fed trotting out virtually every member this week, nothing of note has been said given the current focus on defending Chairman Powell regarding the renovations at the Eccles Building.

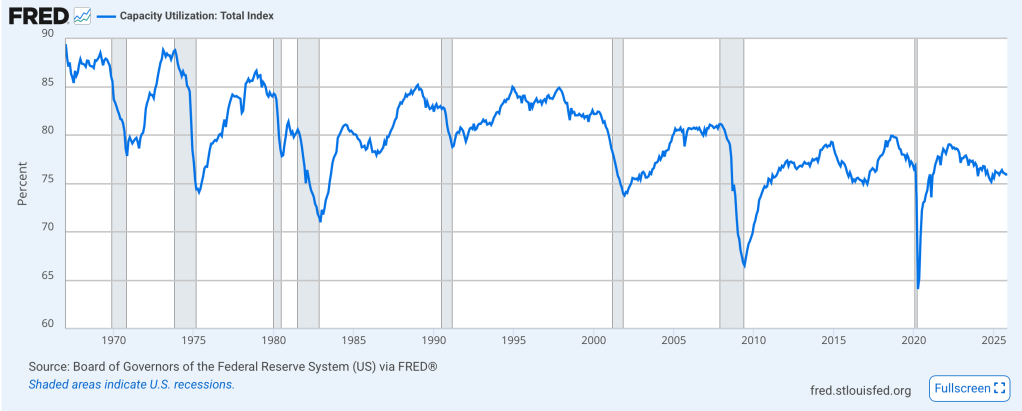

One other thing I have been wondering, and this has been for a long time, is the meaning of the Capacity Utilization reading. On its surface, it tells us that only three-quarters of the US currently available manufacturing, mining and drilling capacity is being utilized. But that seems like a low count based on the economy and the narrative. I wonder, how much of what is considered available capacity is actually obsolete? Undoubtedly, as you can see from the chart below from the FRED database, the trend is falling.

But do companies really build so much capacity they don’t use and it sits idle? Seems a tough way to make a living in a highly competitive world. I understand that globalization undermined US manufacturing ever since China entered the WTO in 2001. And maybe that is all this reflects. But given the dramatic buildout in AI infrastructure, as well as growth in LNG and power production of late, if nothing else, I have to believe this trend is set to reverse in the near future. After all, isn’t that Trump’s goal?

Meanwhile, I feel like we are all awaiting the next headline to determine the next move. The underlying trend in commodities remains in place, and mostly, bonds and the dollar have no reason to go anywhere.

Good luck and good long weekend

Adf