The art of the deal

Tokyo and Washington

Birds of a feather

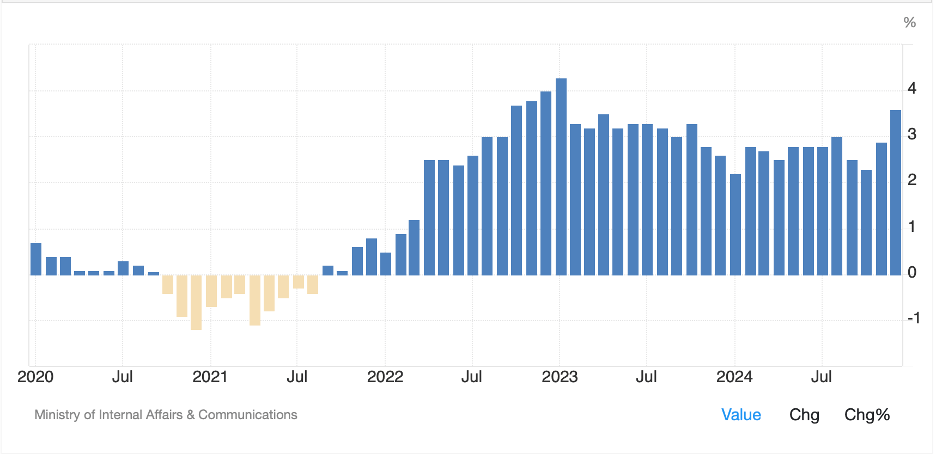

Seemingly, the biggest news story of the evening was the trade agreement between the US and Japan, where reciprocal tariffs have been set at 15%, including on Japanese autos, and Japan has pledged to invest $550 billion in the US, which I assume is from private corporations although that was not specified. However, they did explain that one of the investments would be Alaskan North Slope natural gas liquification, a project that has been on the boards for more than 20 years. Thus far, this seems like a big win and major milestone in President Trump’s trade strategy as it also opened Japanese markets to American products, including rice which had been a key sticking point.

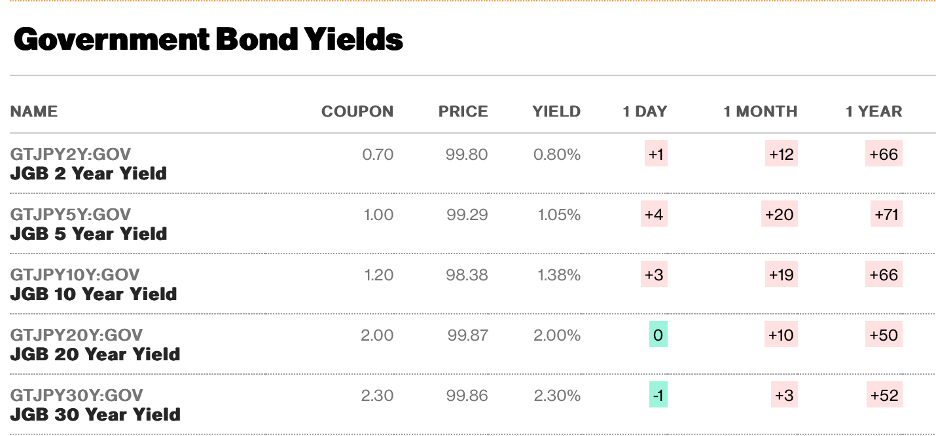

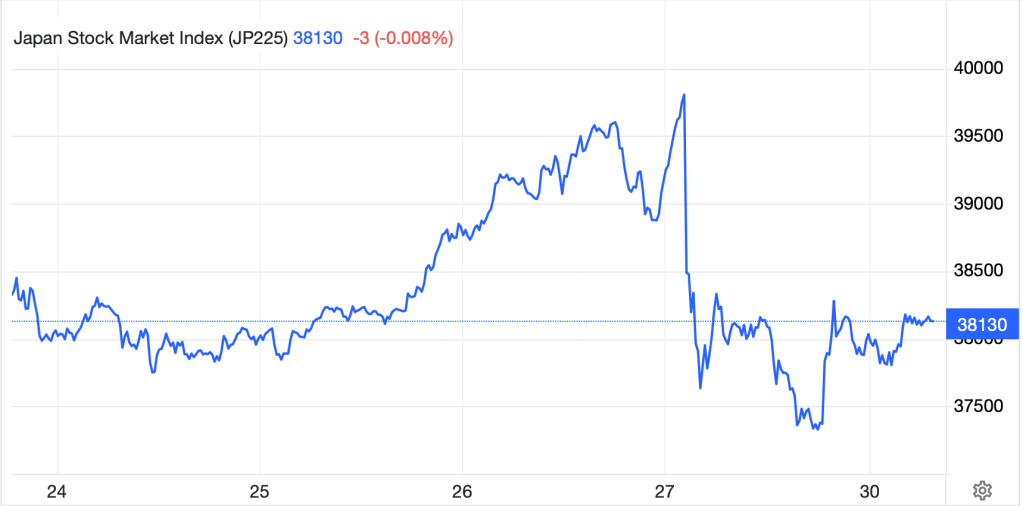

The market response was as might be expected with the Nikkei (+3.5%) rallying sharply and taking virtually every regional Asian market higher for the ride as the conclusion of a deal in the preferred timeline was seen as a precursor to others falling in line. It is quite interesting that this happened so shortly after PM Ishiba’s election disaster on Sunday, but perhaps that was his motivation. He needed a big win and conceding on some points to get a deal was much preferred to holding out and getting nothing. However, JGB markets saw things differently as a very weak 40-year JGB auction (lowest bid-to-cover ratio of 2.127 since 2011) led to long-dated yields rising between 8bps and 10bps last night, with the 10-year yield trading back to the highs seen in late March.

Source: tradingeconomics.com

While the stock market was giddy, apparently the only discussion in the bond market was whether Ishiba-san would be forced to resign, leaving Japan with a leadership vacuum. Meanwhile, the yen (+0.3%) did very little overnight although it has been creeping higher since the election results. My sense is Japanese investors are cautiously heading home, but I would not look for a major move lower in USDJPY, rather the current gradual pace makes sense.

A juxtaposition exists

Twixt Europe with all its sophists

And stolid Japan

Who finished their plan

On trade despite recent vote twists

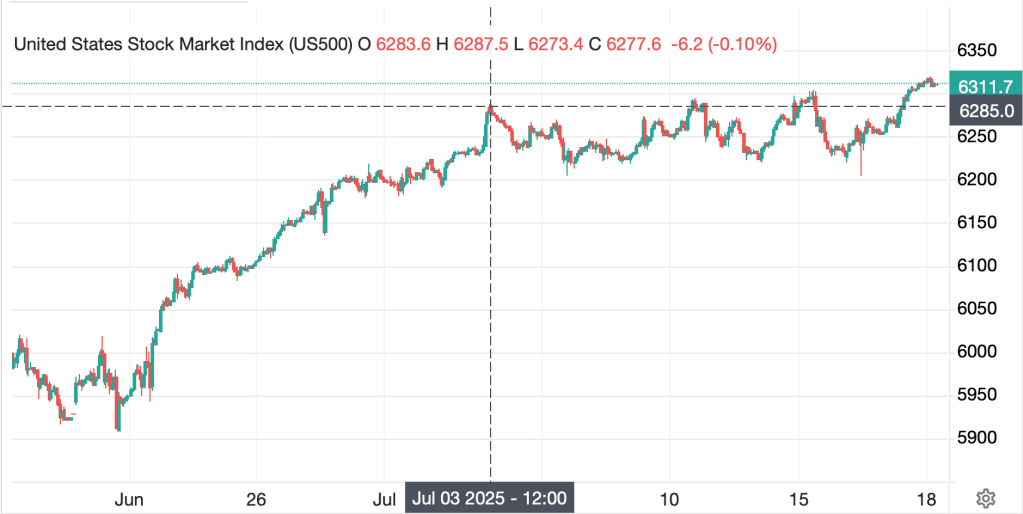

As trade continues to be the topic du jour, it is no surprise that the chatter out of European capitals is that they will fight to get the best trade deal possible. (I cannot help but laugh at Friedrich Merz saying, if they [the US] want war, we will give them a war). However, it is also no surprise that markets have looked at the Japanese deal and increased the pressure on EU negotiators to achieve a solution by the end of the month. First off, every European official wants to go on holiday in August, so they will want to have completed things. But secondly, equity investors have taken the fact that deals with major counterparties can be accomplished as a sign that the EU is next. And if they do not agree terms, it will be a double whammy of political and financial problems as you can be certain that the equity gains we are seeing today and have been steady so far this year (see below), will likely reverse on a failure to agree.

Today 1 Week 1 Month YTD

Source: tradingeconomics.com

But, away from the trade story, and various political stories in the US that are unlikely to have any immediate impact on markets, that’s kind of all there is to discuss. The Fed meets next week and there is no expectation of a rate move. The ECB meets tomorrow and there is no expectation of a rate move. Important data is scarce on the ground and the focus on crypto and meme stocks continues. In fact, this is likely the best descriptor of a market that has abundant liquidity and shoots down the case for cutting rates at all. In the meantime, let’s look at how other markets behaved overnight.

You will not be surprised that US equity futures are all pointing higher this morning, and we have already discussed the rest of the equity markets around the globe. In the bond markets, after declining yesterday, yields have stabilized this morning (Treasuries +1bp, Bunds +1bp, OATs +1bp) although UK Gilt yields (+5bps) have underperformed as there continue to be concerns over the fiscal picture in the UK as well as questions about PM Starmer’s ability to stay in his seat. In fact, UK 10-year yields are the highest in the developed world right now, and while they have been knocking back and forth for a few months, show no sign of falling regardless of the BOE’s future actions.

In the commodity space, oil (-0.7%) has been slipping back to the bottom of its post 12-day war range amid lackluster overall activity. Just as there didn’t seem to be an obvious driver when oil rallied to $68/bbl, too there is no clear driver of the recent decline. I continue to believe this is market internals rather than macro fundamentals. In the metals markets, after a major rally yesterday across the board, gold (-0.25%) is consolidating but silver (+0.1%) is pushing within spitting distance of a major milestone, $40/oz, while copper (+1.2%) sees the benefits of the trade deal and is rallying nicely.

Finally, the dollar is mixed this morning. While the yen is firming and the effects of the trade deal seem to be helping Aussie (+0.6) and Kiwi (+0.75%), the euro and pound are both little changed. in fact, the rest of the G10 is +/- 0.1% on the day, so nothing at all happening. In the EMG bloc, KRW (+0.3%) is the biggest mover with every other currency across regions +/- 0.15% or less and showing no signs of a trend right now. Broadly, the dollar appears to be in a downtrend, but short dollars is one of the most crowded trades in the hedge fund and CTA communities, and that gets expensive given US funding costs are higher than pretty much everybody else’s right now. Depending on how you draw your trend line (and I am no market technician), it appears that the dollar broke above that line and is now getting set to retest it. I would not be surprised to see a more substantial bounce on the next move.

Source: tradingeconomics.com

And that is really all there is today. This morning’s data consists of Existing Home Sales (exp 4.01M) and EIA oil inventories with a small draw expected. The Fed is in their quiet period so no speakers which means that all eyes will, once again, turn toward the White House to see who has the right squares on their bingo card.

Good luck

Adf